AIR Discussions (July 4th Week)

AIR SPOTLIGHT: Pradhan Mantri Mudra Yojana (PMMY) - boon to the entrepreneurs

CONTEXT: Over 11.29 crore loans worth Rs. 6.41 lakh crore disbursed under Pradhan Mantri Mudra Yojana (PMMY) across country during FYs 2019-21

ABOUT THE SCHEME:

- PMMY was launched in 2015 for providing loans up to Rs.10 Lakh to the non-corporate, non-farm small/micro enterprises.

Why MUDRA Yojana?

In order to provide a fertile ground for sowing the seeds of India’s development it is very important to harness this innovative zeal of young India which can provide new age solutions to existing gaps in the economic ecosystem of the country.

How does MUDRA Yojana work?

- Under PMMY collateral free loans are extended by Member Lending Institutions viz Scheduled Commercial Banks, Regional Rural Banks, Small Finance Banks, NBFCs, Micro Finance Institutions etc.

- To avail of the benefits of the PMMY Scheme, the person should be a citizen of India.

- The loans are basically for people having a business plan in a Non-Farming Sector with Income generating activities like the following:

- Manufacturing

- Processing

- Trade

- Service Sector

- Or any other fields whose credit demand is less than ₹10 lakhs.

Objectives:

- Funding the unfunded – To sanction loans to those who have a business plan to generate income from a non-farm activity but don’t have enough capital to invest

- Reducing jobless economic growth – To help generate sources of employment and increase the overall GDP by providing micro-enterprises with credit facilities.

- Monitoring and regulating the Microfinance institutions– With the help of MUDRA bank, the network of microfinance institutions will be monitored and new registration will also be done.

- Integration of Informal economy into Formal sector – It will help India also grow its tax base as incomes from the informal sector are non-taxed.

- Promoting financial inclusion – PMMY further adds to the vision of financial inclusion with the aim to reach the last mile credit delivery to micro-businesses and taking the help of technology solutions.

Funding Provision:

- MUDRA, which stands for Micro Units Development & Refinance Agency Ltd., is a financial institution set up by the Government.

- It provides funding to the non-corporate small business sector through various last-mile financial institutions like Banks, Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs).

- MUDRA does not lend directly to micro-entrepreneurs/individuals.

Categories:

- Mudra loans are offered in three categories namely, ‘Shishu’, ‘Kishore’and ‘Tarun’ which signifies the stage of growth or development and funding needs of the borrowers:-

- Shishu : covering loans upto 50,000/-

- Kishore : covering loans above 50,000/- and upto Rs. 5 lakh

- Tarun : covering loans above 5 lakh and upto Rs. 10 lakh

Achievements:

- Over 30 crore loans amounting to Rs.15.97 lakh crore have been sanctioned under PMMY since inception of the Scheme in April, 2015.

- PMMY helped in generation of 1.12 crore net additional employment during a period of approximately 3 years (i.e. from 2015 to 2018).

- At an overall level, Shishu category of loan has about 66% of share among additional employment generated by establishments owned by MUDRA beneficiaries followed by Kishore (19%) and Tarun (15%) categories respectively.

- Almost 24% of the loans have been given to new entrepreneurs

- About 68% of the loans have been given to women entrepreneurs

- About 51% of the loans loan have been given to SC/ST/OBC borrowers.

- About 11% of the loans have been given to Minority community borrowers.

WHY IS MUDRA BEING HAILED AS A GREAT SCHEME FOR MSMES?

- The MUDRA scheme has been a boon to the MSME sector by giving collateral free financing to these budding enterprises.

- Refinance support to banks and NBFCs to facilitate higher funds available for lending

- Onward lending to business entities involved in manufacturing, trading, services, tractor financing, agriculture and allied activities, and two-wheeler loans

- MUDRA also empowers MSME entities through financial literacy and other social support services in addition to financial assistance

- In the event of default, the government assumes responsibility for paying the loan.

- Women borrowers can get better benefits due to lesser interest rates.

- One can also apply for a MUDRA debit card that provides them with hassle-free instant access to funds.

CHALLENGES:

- NPAS: Public sector banks (PSBs) have seen a sharp surge in the amount of Mudra loans turning into non-performing assets (NPAs) over the last three years. NPAs in Mudra loans has spiked to Rs 18,835 crore in 2019-20, from Rs 11,483 crore in 2018-19 and Rs 7,277 in 2017-18, according to Finance Ministry data.

- A Forced Approach: There is a forced approach in dolling out Mudra loans. The targets have been given to every bank. In fact, there are also geographical targets to do loans in backward states.

- Full scale banks are not the right institutional vehicle to do Mudra loans: The small ticket size loans of less than Rs 10 lakh require a very different expertise in terms of managing the loans as well as making it a success.

- Refinancing Support: The refinancing budgets are not adequate to cover the loan size. The government has its own budget constraints and the banks have been asked to provide Mudra loans at affordable rates.

- Inadequate credit guarantee support: The credit guarantee is too low to cover large losses.

- Technology and Fin-tech: devising ways to do credit assessment of people who don't have a credit history.

WAY FORWARD:

- In order to achieve the vision of full financial inclusion and financial deepening in a manner that enhances systemic stability, there is a need to move away from a limited focus on any one model to an approach where multiple models and partnerships are allowed to emerge.

- Focus on enabling growth of specialist lenders: There is a need for strengthening existing and creating many more specialist institutions that focus on the provision of credit for different types of MSMEs.

- Evolving into a sector-focused provider of credit enhancements: strategic focus of MUDRA be shifted away from taking senior exposures in securitised paper to one where it plays the role of a guarantee institution for the lending institutions serving the MSME sector.

- Government interventions in credit must be restricted to ensuring allocational efficiency (across regions and sectors) without prescribing firm-level strategies.

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1737197

https://pib.gov.in/PressReleasePage.aspx?PRID=1709989

https://www.dvara.com/blog/wp-content/uploads/2020/02/PMMY_EPW_Feb20.pdf

NEWS IN BRIEF: PRELIMS SPECIAL

Historic Urban Landscape Project:

- Madhya Pradesh has launched UNESCO’s ‘Historic Urban Landscape’ project for Gwalior and Orchha cities of State.

- The development and management plan of these cities will be prepared by UNESCO.

- ‘Historic Urban Landscape’ Approach was adopted in 2011 at UNESCO’s General Conference.

- UNESCO defines HUL approach as an integrated approach towards managing heritage resources found within dynamic and evolving environments.

- The approach addresses the policy, governance and management concerns involving a variety of stakeholders, including local, national, regional, international, public and private actors in the urban development process.

H5N1 avian influenza:

- India has recorded first death due to H5N1 avian influenza this year.

- It is a disease caused by avian influenza Type A viruses found naturally in wild birds worldwide.

- The virus can infect domestic poultry and there have been reports of H5N1 infection among pigs, cats, and even tigers in Thailand zoos.

- Symptoms have ranged from mild to severe influenza-like illness.

- Avian Influenza type A viruses are classified based on two proteins on their surfaces – Hemagglutinin(HA) and Neuraminidase(NA).

- There are about 18 HA subtypes and 11 NA subtypes.

- Several combinations of these two proteins are possible e.g., H5N1, H7N2, H9N6, H17N10, etc.

https://newsonair.com/2021/07/21/12-year-old-boy-suffering-from-bird-flu-dies-at-aiims-in-delhi/

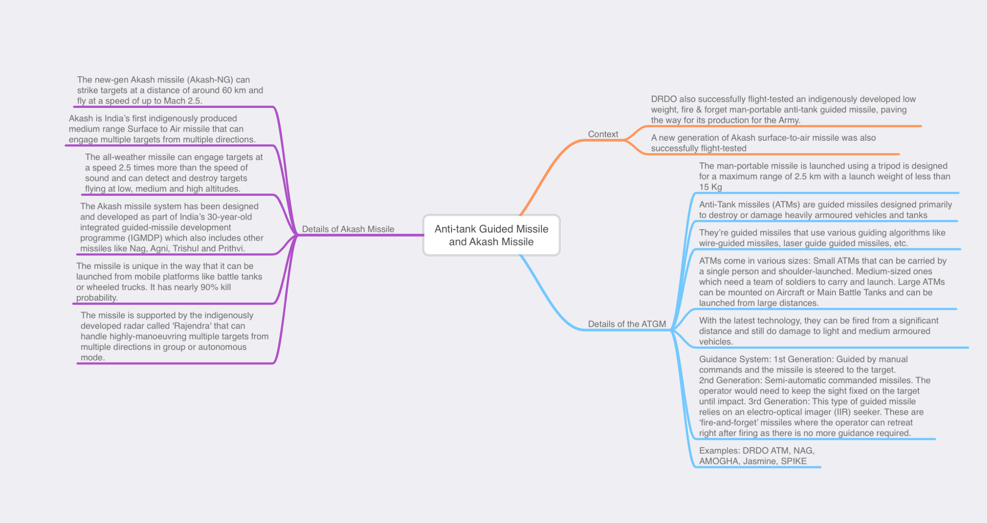

ATGM AND AKASH MISSILE:

https://newsonair.com/2021/07/21/123405/

Inland Vessels Bill:

- The government has introduced the Inland Vessels Bill, 2021, in Lok Sabha.

- It provides for a unified law for the entire country, instead of separate rules framed by the States.

- The certificate of registration granted under the proposed law will be deemed to be valid in all States and Union Territories, and there will be no need to seek separate permissions from the States.

- The Bill provides for a central data base for recording the details of vessel, vessel registration, crew on an electronic portal.

- It requires all mechanically propelled vessels to be mandatorily registered. All non-mechanically propelled vessels will also have to be enrolled at district, taluk or panchayat or village level.

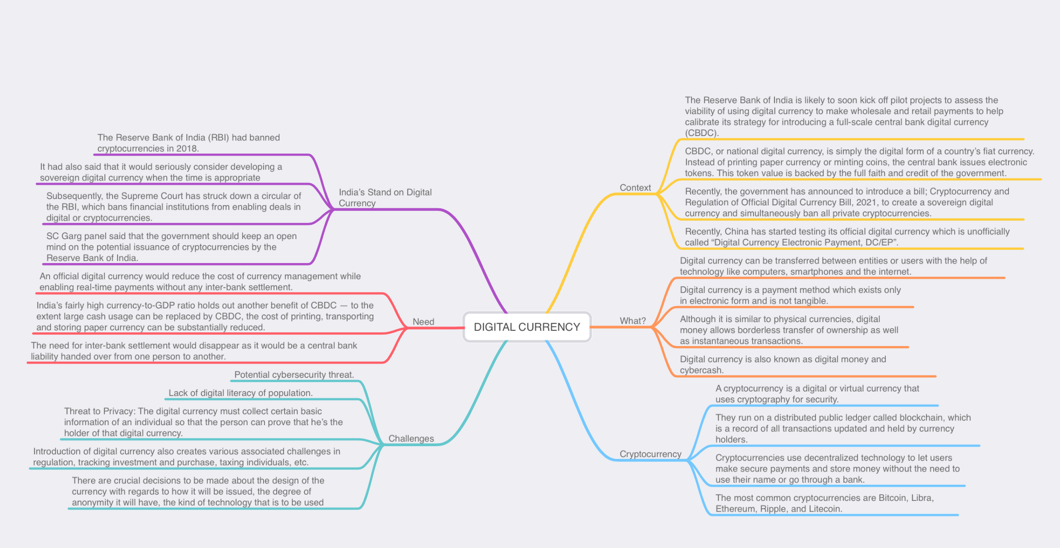

DIGITAL CURRENCY:

https://newsonair.com/2021/07/23/123837/

Essential Defence Services Bill:

- The Bill was recently introduced by the Parliament.

- It is aimed at preventing the staff of the government-owned ordnance factories from going on a strike.

- It is meant to “provide for the maintenance of essential defence services so as to secure the security of nation and the life and property of public at large and for matters connected therewith or incidental thereto”.

- The Bill empowers the government to declare services mentioned in it as essential defence services.

- It also prohibits strike and lockouts in “any industrial establishment or unit engaged in essential defence services”.

https://newsonair.com/2021/07/25/the-week-in-parliament-18/

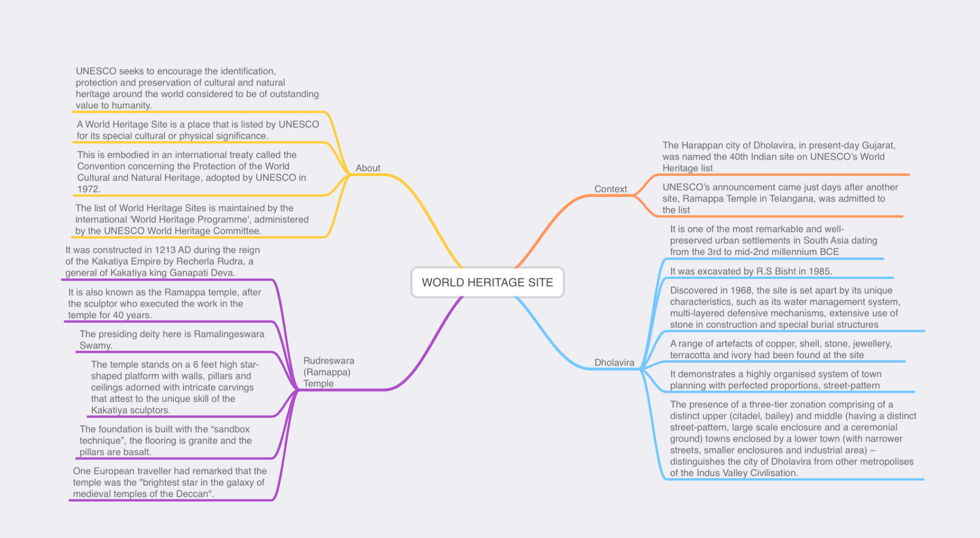

Kakatiya Rudreshwara (Ramappa) Temple:

- India gets its 39th World Heritage Site. The Kakatiya Rudreshwara (Ramappa) Temple, Telangana has been inscribed as a UNESCO World Heritage Site.

- Ramappa temple, a 13th century engineering marvel named after its architect, Ramappa, was proposed by the government as its only nomination for the UNESCO World Heritage site tag for the year 2019.

- The temple complexes of Kakatiyas have a distinct style, technology and decoration exhibiting the influence of the Kakatiyan sculptor.

- The temple stands on a six feet high star-shaped platform with walls, pillars and ceilings.

Kargil Vijay Diwas

- India observes Kargil Vijay Diwas on to mark the anniversary of the day we achieved victory over Pakistani infiltrators in the 1999 Kargil War.

- This day is also a day of remembrance for the hundreds of Indian soldiers who were martyred in this war initiated by Pakistan.

Dholavira:

https://newsonair.com/2021/07/27/harrapan-city-dholavira-inscribed-on-unesco-world-heritage-list/

Marine Aids to Navigation Bill:

- The Marine Aids to Navigation Bill is replacing an almost 90 year-old law named the Lighthouse Act, 1927.

- The Lighthouse Act, 1927 was providing for the regulation of lighthouses and other techniques which would allow ships to safely guide into a port.

- To aid the ships to reach the ports, some kind of guidance is required, which is known as the marine aids to navigation.

- The Bill proposes to update the legal framework for new technologies used in vehicle navigation like radar, radar beacons, vessel traffic service (equipment used to monitor vehicle locations), and Long Range Identification and Tracking systems also used for monitoring ship locations.

- The Bill provides for punishing those who knowingly damage a lighthouse as well as equipment in a lighthouse.

- The Bill also proposes to legally synchronize norms in India with the International Association of Marine Aids to Navigation and Lighthouse Authorities Maritime Buoyage System. India is a member of the association.

- Additionally, the Bill provides for the administration and safety of this equipment.

https://newsonair.com/2021/07/27/parliament-passes-the-marine-aids-to-navigation-bill-2021/

Juvenile Justice (Care and Protection of Children) Amendment Bill, 2021:

- Parliament Passes Juvenile Justice (Care and Protection of Children) Amendment Bill 2021.

- The Bill seeks to amend the Juvenile Justice Act, 2015.

- The amendments include authorizing District Magistrate including Additional District Magistrate to issue adoption orders under Section 61 of the JJ Act, in order to ensure speedy disposal of cases and enhance accountability.

- The District Magistrates have been further empowered to ensure its smooth implementation, as well as garner synergized efforts in favour of children in distress conditions.

- Any Child Care Institution shall be registered after considering the recommendations of the District Magistrate.

- The DM shall independently evaluate the functioning of District Child Protection Units, Child Welfare Committees, Juvenile Justice Boards, Specialized Juvenile Police Units, Child Care Institutions, etc.

- The eligibility parameters for appointment of Child Welfare Committee (CWC) members have been redefined. Disqualification criteria for the same have also been introduced.

- It has been decided that offences where the maximum sentence is more than 7 years imprisonment but no minimum sentence has been prescribed or minimum sentence of less than 7 years is provided, shall be treated as serious offences within this Act.

1.png)