Disclaimer: Copyright infringement not intended.

What is a PAN Card?

PAN is an abbreviation of Permanent Account Number. The Income Tax Department of India assigns an alphanumeric, 10-digit unique number to each taxpayer. Each PAN number is unique and different for each individual.

The PAN number keeps track of a person’s financial activities and is required for all forms of payment

A PAN card appears to be a physical plastic card with one’s PAN number, name, DOB, and a photograph printed on it.

The PAN number is valid for life because it is unaffected by changes in address or job profile and can thus be used as proof of identity.

Who Issues PAN Card?

PAN Card is issued by the Income Tax Department with help from authorised district-level PAN agencies, UTI ITSL (UTI Infrastructure Technology and Services Limited), and Protean e-Gov Technologies Limited (formerly National Securities Depository Limited-NSDL). There are several TIN-Facilitation Centres and PAN centres across the country, run by Protean eGov Technologies Limited that help citizens get their PAN Card.

The process of issuing of PAN works on the PPP (Public Private Partnership) model. This is done to maintain economy, efficiency, and effectiveness of managing, processing, and issuing PAN applications.

Structure of a PAN Card

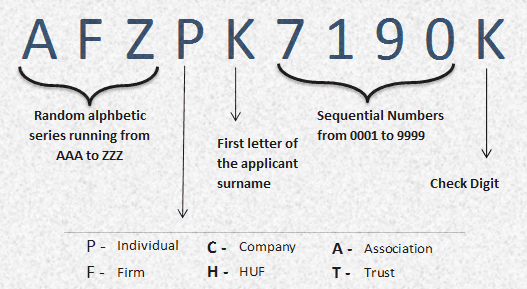

A PAN card is much more than just a card with the user’s basic information. It is designed in such a way that each special character, alphabet, and so on define various different things written on it. The following is an example of a PAN card structure:

_Card.jpg)

Each cardholder type is defined by the letter given below-

A- Association of persons (AOP)

B- Body of Individuals (BOI)

C- Company

F- Firm

G- Government

H- HUF (Hindu Undivided Family)

L- Local Authority

J- Artificial Juridical Person

P- Individual or Person

T- Trust (AOP)

the person’s surname or last name (in the case of a “Personal” PAN card)

Name of the trust, society, entity, or organisation (in the event that the fourth character is any of the letters “C”, “H”, “F”, “A”, “T”, “L”, “J”, “G”, or “A”)

Structure of PAN- AAA S A 1234 A

|

First Three Digit |

Alphabetic series running from AAA to ZZZ |

|

Fourth Digit |

Status (I.e. P For Personal, C for Corporate, F for Firm, H for Hindu Undivided Family Etc.) |

|

Fifth Digit |

First character of assessee’s Last Name/ Surname |

|

Next Digit |

Sequential Number running from 0001 to 9999 |

|

Last Digit |

Alphabetic Check digit |

What are the Types of PAN Cards?

There are several types of PAN cards available, each with a specific purpose, as explained below:

PAN Cards issued to individuals have the person's photograph, name, father's name, date of birth, signature, an authenticity hologram, QR Code, date of issue of the PAN, and the Permanent Account Number. PAN Cards issued to companies have the name of the company, its date of registration, the PAN number, hologram, QR Code, and date of issue of PAN. It will not have a photograph or signature.

History of PAN in India

Before the concept of PAN was introduced, there was a GIR number assigned to taxpayers. This was basically a manual system and was unique only within a ward or under a particular assessing officer. However, the number was not unique at the country level. Since GIR unique not unique, there could be higher chances of miscalculation and errors, or cases of mistaken identity during tax assessment.

The GIR number was allotted by the Assessing Officer to a tax payer and it included the Assessing Officer's information as well.

In the year 1972, the concept of PAN was rolled out by the Indian government and was made statutory under section 139A of the Income Tax Act, 1961. Initially a voluntary process, PAN was made mandatory for all tax paying individuals in 1976.

The initial PAN number allotments were made manually, and to avoid duplication, each ward/circle received a certain set of numbers. This series was abandoned in the year 1995.

Old PAN Series

In spite of these changes, the first avatar of the PAN card met with some difficulties, as mentioned below:

New PAN Series

In 1995, under an amended section 139A of the Income Tax Act, the new series of PAN was rolled out by the Income Tax Department. The new PAN series facilitated the following points which were earlier not included in the old series of PAN:

Who is Eligible for a PAN Card?

Jurisdiction:

The Permanent Account Number! Card does not by itself indicate jurisdiction, as jurisdiction gets changed frequently and is not a permanent information. However, in the database each PAN is linked to a 10 digit Assessing Officer code indicating the jurisdiction of the taxpayer. This AO code defines the Chief Commissioner Region, the Commissioner’s Charge, the Joint Commissioner Range, and the place and designation of the Assessing Officer(s). Any authorised user of the Income Tax Application systems can, by making a query on any PC on the Income Tax network find out the Assessing Officer for a given PAN.

Who is required to apply for Permanent Account Number: Under Section 139A(1) of the Income-tax Act, 1961 following categories of persons are expected to apply and obtain Permanent Account Number:

iii. Trusts;

The Assessing Officer can also allot Permanent Account Number to any other person by whom tax is payable. Any other person can also apply to the Assessing Officer for allotment of a Permanent Account Number. All assessees who had earlier been allotted a Permanent Account Number were expected to apply for Permanent Account Number under new series, so that a structured data base COULD be set up in respect of all persons having Permanent Account Number under new series.

Coverage of PAN

Permanent Account Number covers individuals, HUF, partnerships, firms, companies, body of individuals, trusts, and all other persons who are assessable to tax and /or come under the purview of Section 139A. PAN under the new series is allotted on the basis of Form 49A filled up by the applicants. Section 139A provides that no person can hold more than one PAN.

What happens if you don't have PAN Card?

If your income falls in the taxable bracket, not having a PAN card would result in:

New Design of PAN Cards

The Income Tax Department has prescribed a new format for PAN Cards issued after 1 January 2017. The changes made to the new PAN Card have been listed below:

PAN Card Forms

In order to apply for a PAN card, an application form has to be filled out. There are two types of application forms – Form 49A and Form 49AA. Both the forms can be availed through both online and offline platforms.

The forms have to duly filled up and sent in to the TIN-Protean eGov Technologies Limited's office.

The Cost of PAN Application

An individual can make an online application for his or her PAN card. This can be done through the Protean eGov Technologies Limited website (formerly NSDL) or the UTITSL portal. The cost of application for PAN can be summed as follows:

Concepts Similar to PAN Card

The concept of PAN, or a unique number assigned to every tax paying entity, is not a new concept. In fact, there are a number of similar such utilities that are used for tax purposes.

TAN (Tax Deduction and Collection Account Number) - This is a unique 10-digit number that is issued to individuals and entities who have to collect or deduct tax on payments made as part of tax Deducted at Source (TDS) under the Income Tax Act. TAN has to be quoted when applying for TDS or Tax Collected at Source (TCS) challans made to disburse the refund as well as on certificates. Failure to quote the TAN would result in a fine of Rs. 10, 000.

TIN (Taxpayer Identification Number) - TIN number is a unique 11-digit number that is used to identify dealers who are registered under Value Added Tax. Allotted by individual states, it is compulsory for all manufacturers, traders and dealers to register for a TIN number. This number is to be quoted when generating invoices, orders or quotations by both the issuing as well as the receiving company. It is also used to identify assesses under the Income tax Act of 1961.A

© 2024 iasgyan. All right reserved