Read about the entire process of Budget enactment from Lakshmikant and then go through these terminologies.

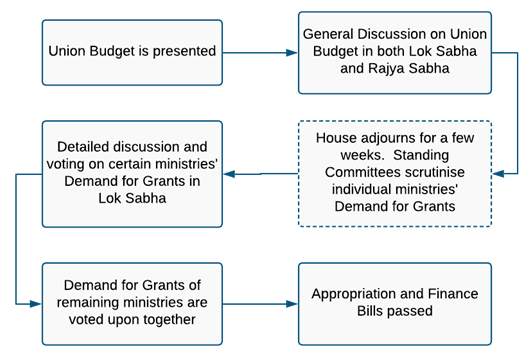

Refer to the following flow charts for ease of understanding:

Aggregate Economic Data: It explains total expenditures and total production of goods and services related to the entire economy.

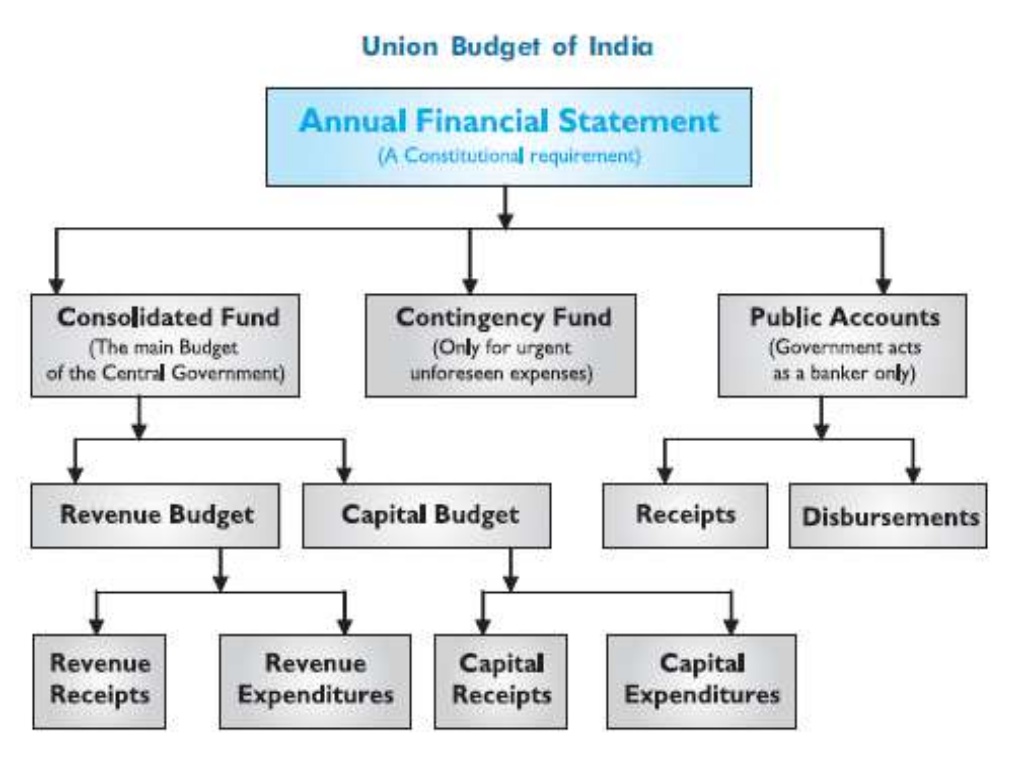

Annual Financial Statement (AFS): Article 112 of the Constitution requires the government to present to Parliament a statement of estimated receipts and expenditure in respect of every financial year, from April 1 to March 31. This statement is called the annual financial statement.

Description:It is divided into three parts, Consolidated Fund, Contingency Fund and Public Account. For each of these funds, the government has to present a statement of receipts and expenditure.

Appropriation Bill: An appropriation bill is a proposed law that authorises the expenditure of government funds. It is also known as a supply bill or spending bill. This Bill gives power to the government to withdraw funds to meet the expenditure during the financial year. The funds are withdrawn from the Consolidated Fund of India..

Balanced Budget: Budgets in which revenues are equal to expenditures are referred to as "balanced budget". It means there is neither a budget deficit nor a budget surplus.

Budget at a Glance: It is a document that shows in brief, receipts and disbursements along with broad details of tax revenues and other receipts.

Budget Cycle: It consists of the major events or stages in making decisions about the budget and implementing and assessing those decisions. The budget cycle usually has four stages: budget formulation, enactment, execution, and auditing and assessment.

Budgetary Deficit: It is the difference between all receipts and expenses in both revenue and capital account of the government. It means the government has spent more money that it earned in a financial year.

Balance of Payments: The term is used to denote the difference in total value between payments into and out of a country over a period.

Central Plan Outlay: It is the division of monetary resources among the different sectors in the economy and the ministries of the government.

Consolidated Budget: Or "unified budget", is the presentation of the budget in which revenues from all sources and spending for all activities are included.

Debt: Government debt is the outstanding amount that the government owes to private lenders at any given point in time.

Demands for Grants (DG): It is a kind of form that is submitted in pursuance of Article 113 of the Constitution.

Disinvestment: Disinvestment is the action of government selling or liquidating an asset or subsidiary.

Expenditure: The term refers to government spending (or outlays) made to fulfil a government obligation, generally by issuing a check or disbursing cash.

Expenditure Budget: It shows the revenue and capital disbursements of various ministries and departments and presents the estimates in respect of each under 'Plan' and 'Non-Plan'.

Expenditure Profile: Once the budget is approved, by allocating costs to the activities in a schedule, a profile of expenditure is produced.

Extra-governmental: Or "extra-budgetary", term refers to government transactions that are not included in the annual budget.

Finance Bill: It is presented at the time of presentation of the AFS in fulfilment of the requirement of Article 110 (1)(a) of the Constitution.

Fiscal Policy Strategy Statement: It outlines government's strategic priorities relating to taxation, expenditure, lending and investments, administered pricing, borrowings and guarantees.

Finance Bill: The proposals of the government for levy of new taxes, modification of the existing tax structure or continuance of the existing tax structure beyond the period approved by Parliament are submitted through the Finance Bill.

Fiscal Deficit: This is the gap between the government's total spending and the sum of its revenue receipts and non-debt capital receipts.

Fiscal Envelope: It refers to the aggregate level of expenditures and revenues (and the resulting deficit or surplus) in the budget.

Fiscal Policy: Government actions with respect to aggregate levels of revenue and spending. Fiscal policy is implemented through the budget and is the primary means by which the government can influence the economy.

Fiscal Year: It is the government's 12-month accounting period that frequently does not coincide with the calendar year. The fiscal year is named after the calendar year in which it ends.

Gross Domestic Product: This is the total value of final goods and services produced in a country during a calendar year. Economic growth is measured by the change in GDP from year to year.

Household Income: This is money received by people that may or may not be earned from productive activities and, after adjusting for taxes, is saved or spent on consumption of goods and services.

Income Tax: It refers to the tax that is levied directly on personal income.

Inflation: It is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.

Joint Account: It means that a bank account held in the names of two or more people.

Liquid asset: It is an asset that can be converted easily into cash.

Macro-Economic: This term refers to the part of economics that studies the economy as a whole and particularly topics such as gross production, unemployment, inflation, and business cycles.

Macro-Economic Framework Statement: It comprises an assessment of the overall growth prospects of the economy with specific underlying assumptions.

Medium Term Fiscal Policy Statement (MTFP): It is a statement that is presented in the Parliament under Section 3(2) of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003.

Memorandum Explaining the Provisions in the Finance Bill: It deals with information to facilitate understanding of the taxation proposals in the Finance Bill.

Micro-Economic: The term is related to the part of economics that studies topics such as individual markets, prices, industries, demand, and supply.

Non-plan expenditure: Non-plan revenue expenditure is accounted for interest payments, subsidies (mainly on food and fertilisers), wage and salary payments to government employees, grants to States and UTs governments, pensions, police, economic services in various sectors, other general services such as tax collection, social services, and grants to foreign governments.

Outcome Budget: It is a budgeting technique that entails ministries preparing their budget and submitting it to the Ministry of Finance before the Annual Budget is presented.

Opportunity Cost: The highest valued alternative foregone in the pursuit of an activity.

Output/Outcomes: The performance of government programs is assessed by examining whether they have delivered the desired outputs and outcomes.

Plan Expenditure: Plan expenditures are estimated after discussions between each of the ministries concerned and the Planning Commission. Plan expenditure forms a sizeable proportion of the total expenditure of the Central government.

Quarterly Report: It is a set of financial statements issued by a company every three-month providing details about the firm's financial health.

Receipts Budget: This provides an analysis of estimates of receipts included in the AFS.

Resources: This term is often used in a budgetary sense to mean the amount of funds available to the government to spend. Resources generally will come either from revenues or borrowing.

Revenue: The annual income collected from taxes by the government as a result of its sovereign powers.

Subvention: Government sometimes asks financial institutions to provide loans to farmers at below market rates. The loss is usually made good through subventions.

Tax Revenue: It gives a detailed report on revenue collected from different items. Taxes collected from both direct and indirect tax are considered in tax revenue.

Value-Added Tax (VAT): VAT helps avoid cascading of taxes as a product passes through different stages of production/value addition. The tax is based on the difference between the value of the output and inputs used to produce it. VAT brings in transparency to commodity taxation.

Zero-based budgeting: A budgeting technique that begins at zero and justifies every expenditure. See also incremental budgeting, performance-based budgeting and program budgeting.

Consolidated Fund

This is the most important of all government funds. All revenues raised by the government, money borrowed and receipts from loans given by the government flow into the consolidated fund of India. All government expenditure is made from this fund, except for exceptional items met from the Contingency Fund or the Public Account. Importantly, no money can be withdrawn from this fund without the Parliament's approval.

ContingencyFund

As the name suggests, any urgent or unforeseen expenditure is met from this fund. The Rs 500-crore fund is at the disposal of the President. Any expenditure incurred from this fund requires a subsequent approval from Parliament and the amount withdrawn is returned to the fund from the consolidated fund.

PublicAccount

This fund is to account for flows for those transactions where the government is merely acting as a banker. For instance, provident funds, small savings and so on. These funds do not belong to the government. They have to be paid back at some time to their rightful owners. Because of this nature of the fund, expenditure from it are not required to be approved by the Parliament.

For each of these funds the government has to present a statement of receipts and expenditure. It is important to note that all money flowing into these funds is called receipts, the funds received, and not revenue. Revenue in budget context has a specific meaning.

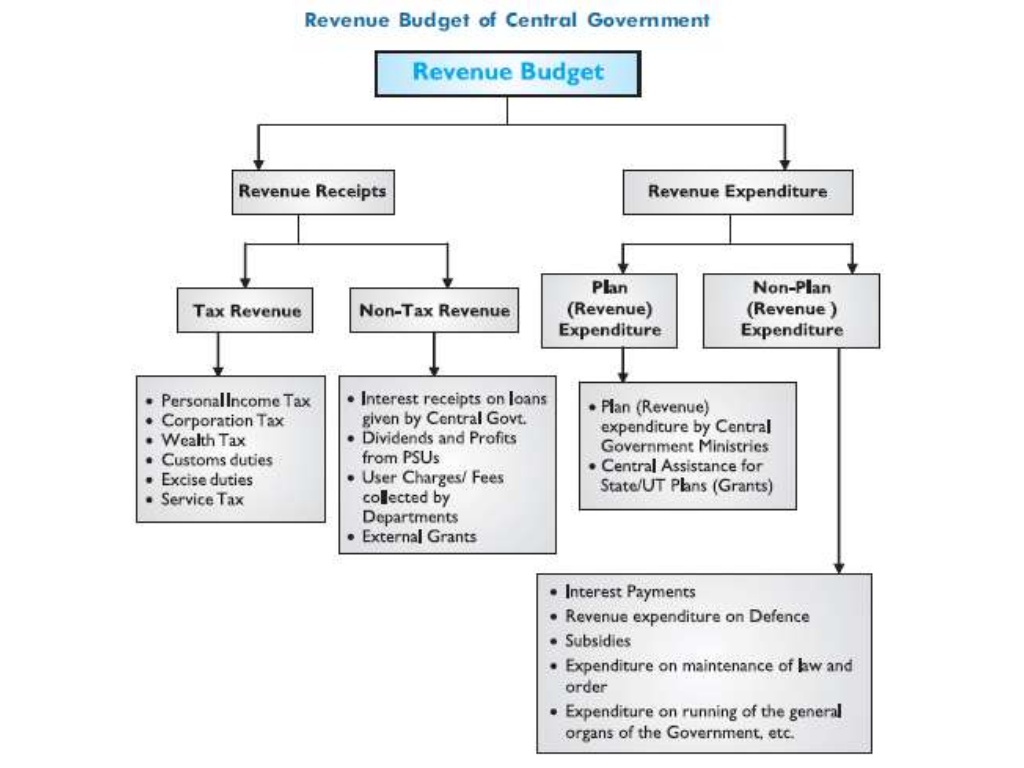

The Constitution requires that the budget has to distinguish between receipts and expenditure on revenue account from other expenditure. So all receipts in, say consolidated fund, are split into Revenue Budget (revenue account) and Capital Budget (capital account), which includes non-revenue receipts and expenditure. For understanding these budgets - Revenue and Capital - it is important to understand revenue receipts, revenue expenditure, capital receipts and capital expenditure.

RevenueReceipt/Expenditure

All receipts and expenditure that in general do not entail sale or creation of assets are included under the revenue account. On the receipts side, taxes would be the most important revenue receipt. On the expenditure side, anything that does not result in creation of assets is treated as revenue expenditure. Salaries, subsidies and interest payments are good examples of revenue expenditure.

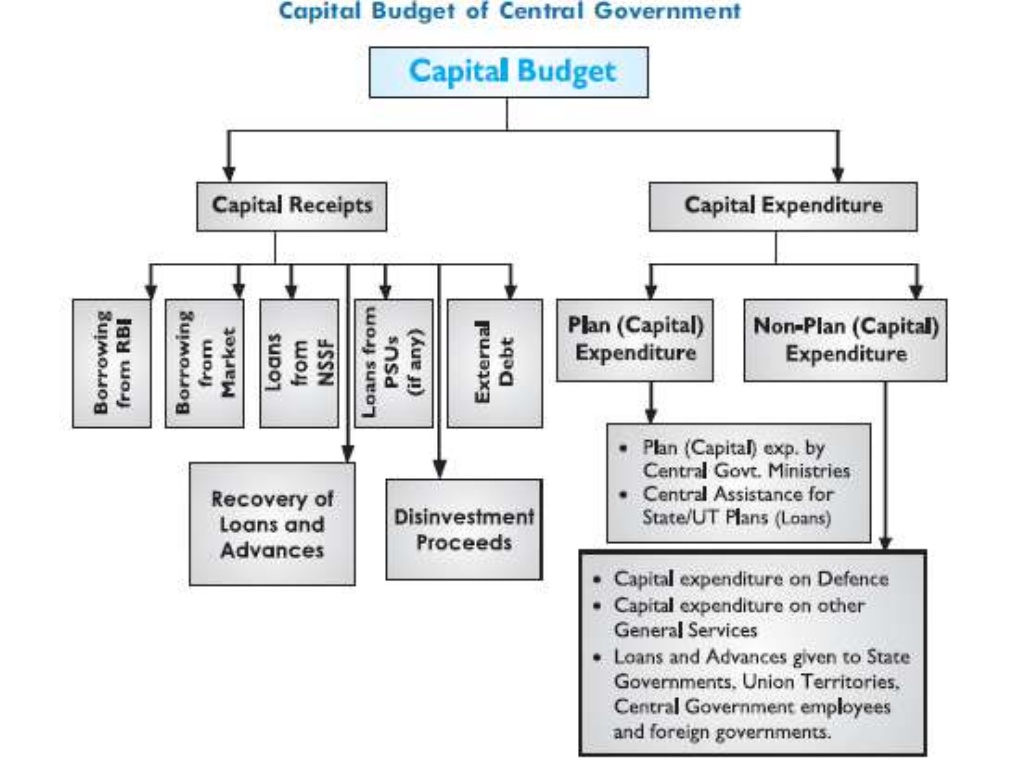

Capitalreceipt/Expenditure

All receipts and expenditure that liquidate or create an asset would in general be under capital account. For instance, if the government sells shares (disinvests) in public sector companies, like it did in the case of Maruti, it is in effect selling an asset. The receipts from the sale would go under capital account. On the other hand, if the government gives someone a loan from which it expects to receive interest, that expenditure would go under the capital account.

In respect of all the funds the government has to prepare a revenue budget (detailing revenue receipts and revenue expenditure) and a capital budget (capital receipts and capital expenditure). Contingency fund is clearly not that important. Public account is important in that it gives a view of select savings and how they are being used, but not that relevant from a budget perspective. The consolidated fund is the key to the budget. We will take that up in the next part.

As mentioned in the first part, the government has to present a revenue budget (revenue account) and capital budget (capital account) for all the three funds. The revenue account of the consolidated fund is split into two parts, receipts and disbursements - simply, income and expenditure. Receipts are broadly tax revenue, non-tax revenue and grants-in-aid and contributions. The important tax revenue items are listed below.

Corporation Tax: Tax on profits of companies.

Taxes on Income other than corporation tax: Income tax paid by non-corporate assesses, individuals, for instance.

Fringe benefit tax (FBT):

The taxation of perquisites - or fringe benefits - provided by an employer to his employees, in addition to the cash salary or wages paid, is fringe benefit tax. It was introduced in Budget 2005-06. The government felt many companies were disguising perquisites such as club facilities as ordinary business expenses, which escaped taxation altogether. Employers have to now pay FBT on a percentage of the expense incurred on such perquisites.

Securities transaction tax (STT):

Sale of any asset (shares, property) results in loss or profit. Depending on the time the asset is held, such profits and losses are categorised as long-term or short-term capital gain/loss. In Budget 2004-05, the government abolished long-term capital gains tax on shares (tax on profits made on sale of shares held for more than a year) and replaced it with STT. It is a kind of turnover tax where the investor has to pay a small tax on the total consideration paid / received in a share transaction.

Banking cash transaction tax (BCTT):

Introduced in Budget 2005-06, BCTT is a small tax on cash withdrawal from bank exceeding a particular amount in a single day. The basic idea is to curb the black economy and generate a record of big cash transactions.

Customs

Taxes imposed on imports. While revenue is an important consideration, Customs duties may also be levied to protect the domestic industry or sector (agriculture, for one), in retaliation against measures by other countries.

Union Excise Duty: Duties imposed on goods made in India.

Service Tax: It is a tax on services rendered. Telephone bill, for instance, attracts a service tax. While on taxes, let us take a look at an important classification: direct tax and indirect tax.

Direct Tax

Traditionally, these are taxes where the burden of tax falls on the person on whom it is levied. These are largely taxes on income or wealth. Income tax (on corporates and individuals), FBT, STT and BCTT are direct taxes.

Indirect Tax

In case of indirect taxes, the incidence of tax is usually not on the person who pays the tax. These are largely taxes on expenditure and include Customs, excise and service tax.

Indirect taxes are considered regressive, the burden on the rich and the poor is alike. That is why governments strive to raise a higher proportion of taxes through direct taxes. Moving on, we come to the next important receipt item in the revenue account, non-tax revenue.

Non-tax revenue

The most important receipts under this head are interest payments (received on loans given by the government to states, railways and others) and dividends and profits received from public sector companies.

Various services provided by the government - police and defence, social and community services such as medical services, and economic services such as power and railways - also yield revenue for the government.

Though Railways are a separate department, all its receipts and expenditure are routed through the consolidated fund.

Grants-in-aid and contributions

The third receipt item in the revenue account is relatively small grants-in-aid and contributions. These are in the nature of pure transfers to the government without any repayment obligation.

We now look at the disbursements section of the revenue account of the consolidated fund. It lists all the revenue expenditures of the government. These include expense incurred on organs of state such as Parliament, judiciary and elections. A substantial amount goes into administering fiscal services such as tax collection. The biggest item is interest payment on loans taken by the government. Defence and other services like police also get a sizeable share. Having looked at receipts and expenditure on revenue account we come to an important item, the difference between the two, the revenue deficit.

Revenue Deficit

The excess of disbursements over receipts on revenue account is called revenue deficit. This is an important control indicator. All expenditure on revenue account should ideally be met from receipts on revenue account; the revenue deficit should be zero.

When revenue disbursement exceeds receipts, the government would have to borrow. Such borrowing is considered regressive as it is for consumption and not for creating assets. It results in a greater proportion of revenue receipts going towards interest payment and eventually, a debt trap. The FRBM Act, which we will take up later, requires the government to reduce fiscal deficit to zero by 2008-09.

Receipts in the capital account of the consolidated fund are grouped under three broad heads - public debt, recoveries of loans and advances, and miscellaneous receipts.

Public debt: Public debt receipts and public debt disbursals are borrowings and repayments during the year, respectively. The difference is the net accretion to the public debt. Public debt can be split into internal (money borrowed within the country) and external (funds borrowed from non-Indian sources). Internal debt comprises treasury bills, market stabilisation schemes, ways and means advance, and securities against small savings.

Treasury bills (T-bills): These are bonds (debt securities) with maturity of less than a year. These are issued to meet short-term mismatches in receipts and expenditure. Bonds of longer maturity are called dated securities.

Market stabilisation scheme: The scheme was launched in April 2004 to strengthen RBI's ability to conduct exchange rate and monetary management. These securities are issued not to meet the government's expenditure but to provide RBI with a stock of securities with which it can intervene in the market for managing liquidity.

|

Ways and Means Advances The Reserve Bank of India (RBI) gives temporary loan facilities to the central and state governments. This loan facility is called Ways and Means Advances (WMA). The Ways and Means Advances scheme was introduced in 1997. Purpose of the WMA scheme The Ways and Means Advances scheme was introduced to meet mismatches in the receipts and payments of the government. How does it work? The government can avail of immediate cash from the RBI, if required. But it has to return the amount within 90 days. Interest is charged at the existing repo rate. If the WMA exceeds 90 days, it would be treated as an overdraft (interest rate on overdrafts is 2 percentage points more than the repo rate). What is WMA limit? The limits for Ways and Means Advances are decided by the government and RBI mutually and revised periodically. For the second half of the 2019-20 financial year, RBI set Rs 35,000 crore as limit for Ways and Means Advances. Types of WMA There are two types of Ways and Means Advances — normal and special. Special WMA or Special Drawing Facility is provided against the collateral of the government securities held by the state. After the state has exhausted the limit of SDF, it gets normal WMA. The interest rate for SDF is one percentage point less than the repo rate. |

Securities against small savings: The government meets a small part of its loan requirement by appropriating small savings collection by issuing securities to the fund.

Miscellaneous receipts: These are receipts from disinvestment in public sector undertakings. Capital account receipts of the consolidated fund - public debt, recoveries of loans and advances, and miscellaneous receipts and revenue receipts are receipts of the consolidated fund.

We now take up the disbursements on capital account from the consolidated fund. The first part deals with capital expenditure incurred on general, social and economic services. Some of the biggest expenditure items under these heads are defence services, investment in agricultural financial institutions and capital to railways. The second part takes up the public debt (repayments of loans) and various loans by the government.

The consolidated fund has certain disbursements 'charged' to the fund. These are obligations that have to be met in any case and, therefore, do not have to be voted by the Lok Sabha. These include interest payments and certain expenditure such as emoluments of the President, salary and allowances of speaker, deputy chairman of the Rajya Sabha, and allowances and pensions of Supreme Court judges, Parliament and so on.

Plan expenditure: This is essentially the budget support to the central plan and the central assistance to state and union territory plans. Like all budget heads, this is also split into revenue and capital components.

Non-plan expenditure: This is largely the revenue expenditure of the government. The biggest items of expenditure are interest payments, subsidies, salaries, defence and pension. The capital component of the non-plan expenditure is relatively small with the largest allocation going to defence. Defence expenditure is non-plan expenditure.

Fiscal Deficit:

When the government's non-borrowed receipts fall short of its entire expenditure, it has to borrow money from the public to meet the shortfall. The excess of total expenditure over total non-borrowed receipts is called the fiscal deficit.

Primary deficit:

The revenue expenditure includes interest payments on government's earlier borrowings. The primary deficit is the fiscal deficit less interest payments. A shrinking primary deficit indicates progress towards fiscal health. The Budget document also mentions deficit as a percentage of GDP. This is to facilitate comparison and also get a proper perspective. Prudent fiscal management requires that government does not borrow to consume in the normal course.

FRBM Act:

Enacted in 2003, Fiscal Responsibility and Budget Management Act require the elimination of revenue deficit by 2008-09. Hence, from 2008-09, the government will have to meet all its revenue expenditure from its revenue receipts. Any borrowing would only be to meet capital expenditure. The Act mandates a 3% limit on the fiscal deficit after 2008-09.

Value-Added Tax (VAT) and GST:

VAT helps avoid cascading of taxes as a product passes through different stages of production/value addition. The tax is based on the difference between the value of the output and inputs used to produce it. The aim is to tax a firm only for the value added by it to the inputs it is using for manufacturing its output and not the entire input cost. VAT brings in transparency to commodity taxation.

In this concluding part we take a look at some of the important terms that figure in the Budget

CESS:

This is an additional levy on the basic tax liability. Governments resort to cess for meeting specific expenditure. For instance, both corporate and individual income is at present subject to an education cess of 2%. In the last Budget, the government had imposed another 1% cess - secondary and higher education cess on income tax - to finance secondary and higher education.

COUNTERVAILING DUTIES (CVD):

Countervailing duty is a tax imposed on imports, over and above the basic import duty. CVD is at par with the excise duty paid by the domestic manufacturers of similar goods. This ensures a levelplaying field between imported goods and locally-produced ones. An exemption from CVD places the domestic industry at disadvantage and over long run discourages investments in affected sectors.

EXPORT DUTY:

This is a tax levied on exports. In most instances, the object is not revenue , but to discourage exports of certain items. In the last Budget, for instance , the government imposed an export duty of Rs 300 per metric tonne on export of iron ores and concentrates and Rs 2,000 per metric tonne on export of chrome ores and concentrates.

FINANCE BILL:

The proposals of government for levy of new taxes, modification of the existing tax structure or continuance of the existing tax structure beyond the period approved by Parliament are submitted to Parliament through this bill. It is the key document as far as taxes are concerned.

FINANCIAL INCLUSION:

Financial inclusion is universalising access to basic financial services (to have a bank account , timely and adequate credit) at an affordable cost. Exclusion from financial services imposes costs on those excluded ; these are typically the disadvantaged and low-income group. Exclusion forces them into informal arrangements such as borrowing from local money lenders at high rates. Financial inclusion remains a serious issue in India. The government has proposed a no-frills account to provide cheap banking.

MINIMUM ALTERNATE TAX (MAT):

This tax on corporate profits was introduced in 1996-97 and has been modified since. If the tax payable by a company is less than 10% of its book profits, after availing of all eligible deductions , then 10% of book profits is the minimum tax payable. Book profits are profits calculated as per the Companies Act, while profits as per the Income-Tax Act could be significantly lower, thanks to various exemptions and depreciation.

PASS-THROUGH STATUS:

A pass-through status helps avoid double taxation. Mutual funds, for instance , enjoy pass-through status. The income earned by the funds is tax free. Since mutual funds' income is distributed to unitholders, who are in turn taxed on their income from such investments , any taxation of mutual funds would amount to double taxation. Essentially , it means the income is merely passing through the mutual funds and, therefore, should not be taxed. The government allows venture funds in some sectors pass-through status to encourage investments in start-ups .

SUBVENTION:

The term subvention finds a mention in almost every Budget. It refers to a grant of money in aid or support, mostly by the government. In the Indian context, for instance, the government sometimes asks institutions to provide loans to farmers at below market rates. The loss is usually made good through subventions.

SURCHARGE:

As the name suggests, this is an additional charge or tax. A surcharge of 10% on a tax rate of 30% effectively raises the combined tax burden to 33%. In the case of individuals earning a taxable salary of more than Rs 10 lakh a surcharge of 10% is levied on income in excess of Rs 10 lakh. Corporate income is levied a flat surcharge of 10% in the case of domestic companies and 2.5% for foreign companies. Companies with revenue less than Rs 1 crore do not have to pay this surcharge.

Dividend Distribution Tax (DDT)

Dividend Distribution Tax (DDT) is a tax levied on dividends distributed by companies out of their profits among their shareholders.

The Dividend Distribution Tax is taxable at source and is deducted at the time of the distribution. According to the law, DDT is levied at the hands of the firm, and the shareholder. An exception is that when a shareholder receives more than Rs 10 lakh in dividend, they have to pay an additional tax.

Medium-term expenditure framework (MTEF)

The medium-term expenditure framework (MTEF) statement sets a three-year rolling target for expenditure indicators, along with specifications of underpinning assumptions and risks. This statement is presented in Parliament under Section 3 of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003.

The statement provides an estimate of expenditure for various sectors, including education, health, rural development, energy, subsidies and pension, and so on. Data such as expenditure commitments spread across the various central ministries on salaries and pensions, major programmes, grants-in-aid for creation of capital assets, defence expenditure, interest payment and major subsidies, etc, besides other commitments of the government are considered while formulating this statement.

Expenditure commitments for revenue and capital expenditure are shown separately. Also depicted as part of revenue expenditure are "grants-in-aid for creation of capital assets" and its projection.

The objective of MTEF is to facilitate a closer integration between FRBM statements and the Union Budget. This statement is presented in the session after the one in which the Budget is presented — usually, that is the monsoon session.

The first Medium Term Expenditure Framework was laid in the monsoon Session of Parliament in August 2013.

MTEF essentially contains the following:

Long Term Capital Gains Tax

Capital gains mean the profit earned by an individual on the sale of his investment in assets such as stocks, real estate, bonds, commodities, etc. Basically, it is the 'gain' made on 'capital investment'. In some tax jurisdictions — a country, state or city — capital gains are taxed if an individual sells an asset after holding it for a certain 'long' period. This period is often twelve months. However, it could also be defined differently for various assets.

In India, 'long-term' and 'short-term' are defined by the Income Tax Act, 1961. While a holding period of one year is considered 'long-term' for equities, the same is two years for real estate.

The Union Budget 2018 proposed to levy long-term capital gains tax (LTCG) of 10 per cent on gains exceeding Rs 100,000 from sale of equity shares. However, no change was made in the definition of short-term capital gains tax (STCG).

LTCG on sale of shares / stocks was removed in 2005, making India one of the most liberal stock market regimes. However, there were demands from a section of stakeholders that the LTCG tax on equities be brought back. The BSE had reportedly told the government that the revenue forgone on the LTCG tax exemption on listed securities could be as high as Rs 50,000 crore per year.

Another change that was made in the Union Budget 2018 was that an individual could get an exemption by investing long-term capital gains from the sale of house property in up to two house properties, against the earlier provision of investment in one house property with same conditions. However, the capital gains on the sale was restricted at Rs 2 crore for the exemption.

The LTCG and STCG tax rates also vary based on the asset class — they might be different for equities, real estate, bonds, mutual funds etc — and the income tax slab an individual falls under.

Monetised Deficit

Monetised deficit is the monetary support the Reserve Bank of India (RBI) extends to the Centre as part of the government's borrowing programme. In other words, the term refers to the purchase of government bonds by the central bank to finance the spending needs of the government.

Also known as debt monetisation, the exercise leads to an increase in total money supply in the system, and hence inflation, as RBI creates fresh money to purchase the bonds. The same bonds are later used to bring down inflation as they are sold in the open market. This helps RBI suck excess money out of the market and rein in rising prices.

Non-debt Capital Receipts (NDCR)

Taxes and duties levied by the government form the biggest source of its income or receipts. The government spends this money on both operational and developmental needs. Usually, there are two main sources of the government’s income — revenue receipts and capital receipts.

Revenue receipts comprise both tax and non-tax revenues, while capital receipts consist of capital receipts and non-debt capital receipts. Non-debt capital receipts (NDCR) account for just 3 per cent of the government’s total receipts.

The Union government usually lists non-debt capital receipts in two categories — recovery of loans, and other receipts. Other receipts basically mean disinvestment proceeds from the sale of the government’s share in public-sector companies.

At a detailed level, the government divides non-debt capital receipts into more than a dozen sub-heads.

There are two types of non-debt capital receipts, recoveries of loans and advances, and miscellaneous capital receipts.

The recoveries of loans and advances include recovery of loans and advances from state governments and Union Territories with legislature, recovery of loans given to foreign governments, recovery of loans and advances from PSUs and other autonomous bodies.

In miscellaneous capital receipts, proceeds from disinvestment in public-sector undertakings are included. The government classifies disinvestment proceeds into four sections:

Over the years, disinvestment has become the main source of the Union government’s non-debt capital receipts.

|

SIN TAX A sin tax is imposed on goods and services, which are perceived as harmful to society. Examples of products on which sin tax is imposed are: tobacco, gambling ventures, alcohol, cigarettes, etc. What is the main purpose of sin tax? Sin taxes seek to prevent people from participating in socially harmful activities. The aim is to reduce or eliminate the consumption of harmful products by making them more expensive to obtain. They also provide a source of revenue for governments. In March 2019, a committee headed by Arvind Subramanian recommended that in a unified GST regime, certain goods should attract a ‘Sin’ tax of 40 per cent. Sin tax a global trend In 1776, Adam Smith - Father of Economics - wrote that taxes on cigarettes, rum, and sugar are appropriate. Countries such as the UK, Sweden and Canada impose Sin Taxes on a series of products and services, from tobacco and alcohol to lotteries, gambling and fuel, which chip in with sizeable revenues. Mexico imposed a Soda Tax in 2013 and the UK is now debating a Sugar Tax, to tackle obesity, on all foods and drinks with high concentrations of the sweetener. Why is it necessary? Sin Taxes are intended to serve two objectives.

Excessive consumption of tobacco, alcohol or calories heightens health risks such as heart attack, cancer and obesity. Studies have shown that sin taxes have been successful in reducing consumption of harmful products and states have gained sufficient capital out of the excess tax. Criticisms against sin tax Critics argue that sin taxes can give the state unnecessary moral authority to dictate what citizens should and should not be doing. They are also of the opinion that while sin taxes may reduce purchases of a product for a few years, consumers who are really addicted to the habit may persist buying. Sin taxes are often termed regressive as they discriminate against the lower classes. The poor end up paying a greater share of their income as tax. |

Re-appropriations

Appropriation means keeping aside funds for a specific purpose – fund allocation by the Legislature to meet the expenditure of various government departments as Grants. Re-appropriation is to transfer money approved to one department (detailed head) to another.

Aggregate Demand

Aggregate Demand is the total demand for all goods and services in the entire economy. It includes every single thing purchased/produced within India and details the relationship between every goods/service and their respective prices.

Interim Budget

In India, an Interim Budget is presented only if the government does not have the time to present a full budget or because the General Lok Sabha elections may be close.

Blue Sheet

The blue colour secret sheet containing the key numbers and consists hundreds of pages of the budget document is called the Blue Sheet. It forms the backbone of the whole budget process and is kept as a secret even from the FM.

Halwa Ceremony

The print of budget starts roughly a week before presenting it in the Parliament with a customary 'Halwa Ceremony' in which halwa (a sweet dish) is served to the officers and support staff involved. Because India starts everything on a sweet note.

|

Short-term capital gain tax (STCG) Short-term capital gain tax (STCG) is a tax levied on capital gains from the sale of an asset held for a short period. What are capital gains? The gains or profits from sale of capital assets are classified as capital gains. The most common examples of capital assets are land, building, house property, gold, trademarks, equity shares, patents, leasehold rights, machinery, etc. If a capital asset is sold within government-defined short-term holding period, gains from it are known as short-term capital gains. The short-term holding period differs for various items. For security assets like shares listed on stock exchange, debentures, mutual funds, and government securities, the holding period is up to 12 months. For other immovable assets, such as land, property, the period is up to 24 months. |

To read the summary of 2021 Budget visit: https://www.iasgyan.in/blogs/summary-of-the-budget-2021-22

© 2024 iasgyan. All right reserved