ELECTRIC VEHICLE

Disclaimer: Copyright infringement not intended.

Introduction

An electric vehicle (EV) is one that operates on an electric motor, instead of an internal-combustion engine that generates power by burning a mix of fuel and gases. Therefore, such as vehicle is seen as a possible replacement for current-generation automobile, in order to address the issue of rising pollution, global warming, depleting natural resources, etc. EVs first came into existence in the late 19th century, when electricity was among the preferred methods for motor vehicle propulsion, providing a level of comfort and ease of operation that could not be achieved by the gasoline cars of the time. Though the concept of electric vehicles has been around for a long time, it has drawn a considerable amount of interest in the past decade amid a rising carbon footprint and other environmental impacts of fuel-based vehicles.

Types of Electric Vehicles

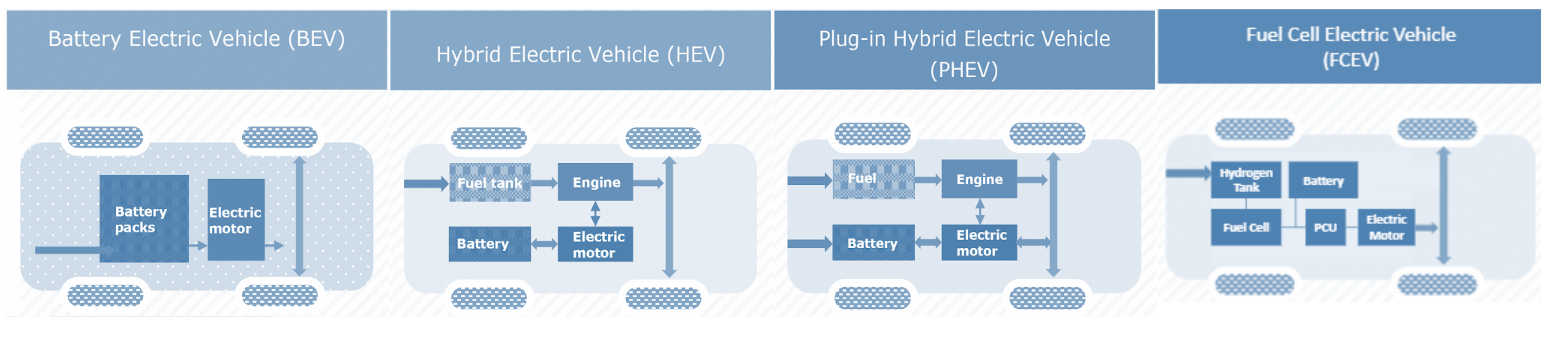

There are four types of electric vehicles available:

System Architecture of 4 types of electric cars is as follows:

Battery Electric Vehicles (BEVs)

BEVs are also known as All-Electric Vehicles (AEV). Electric Vehicles using BEV technology run entirely on a battery-powered electric drivetrain. The electricity used to drive the vehicle is stored in a large battery pack which can be charged by plugging into the electricity grid. The charged battery pack then provides power to one or more electric motors to run the electric car. To find out more about BEVs, click below.

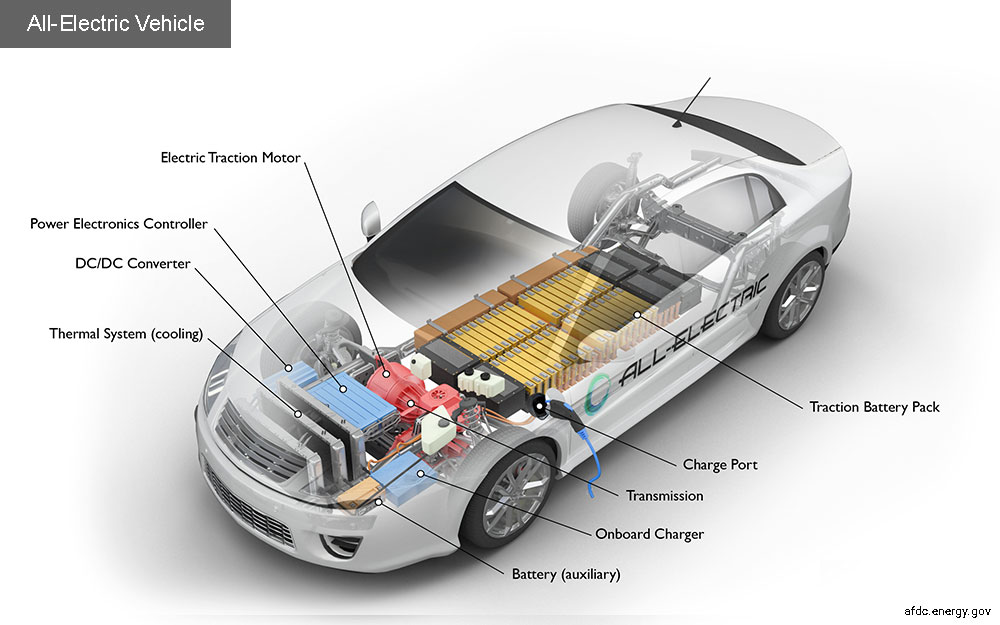

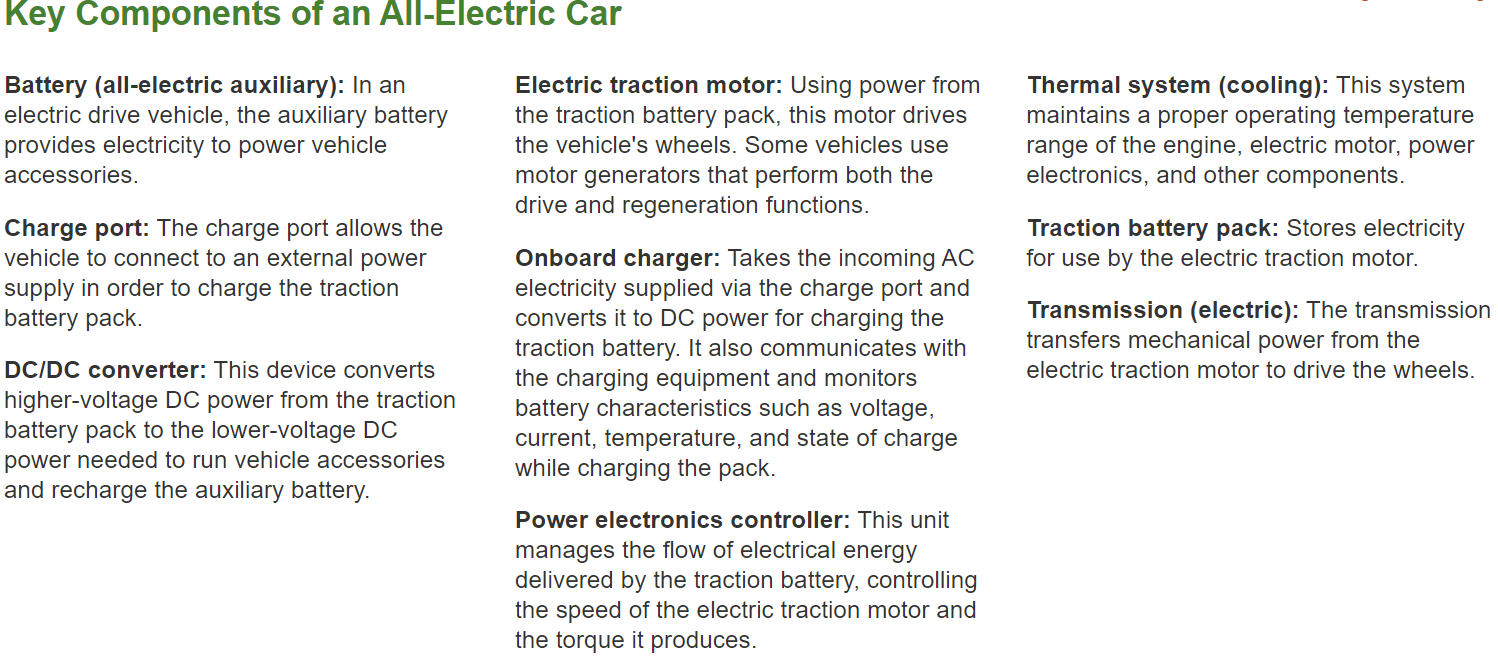

Main Components of BEV:

Electric motor, Inverter, Battery, Control Module, Drive train

Working Principles of BEV:

The power for the electric motor is converted from the DC Battery to AC. As the accelerator is pressed, a signal is sent to the controller. The controller adjusts the speed of the vehicle by changing the frequency of the AC power from the inverter to the motor. The motor then connects and leads to the turning of wheels through a cog. If the brakes are pressed, or the electric car is decelerating, the motor becomes an alternator and produces power, which is sent back to the battery.

Hybrid Electric Vehicle (HEV):

HEVs are also known as series hybrid or parallel hybrid. HEVs have both engine and electric motor. The engine gets energy from fuel, and the motor gets electricity from batteries. The transmission is rotated simultaneously by both engine and electric motor. This then drives the wheels. To find out more about HEVs, click below.

Main Components of HEV:

Engine, Electric motor, Battery pack with controller & inverter, Fuel tank, Control module

Working Principles of HEV:

The fuel tank supplies energy to the engine like a regular car. The batteries run on an electric motor. Both the engine and electric motor can turn the transmission at the same time.

Examples of HEV:

Engine, Electric motor, Battery pack with controller & inverter, Fuel tank, Control module

Plug-in Hybrid Electric Vehicle (PHEV):

The PHEVs are also known as series hybrids. They have both engine and a motor. You can choose among the fuels, conventional fuel (such as petrol) or alternative fuel (such as bio-diesel). It can also be powered by a rechargeable battery pack. The battery can be charged externally. To find out more about PHEVs, click below.

PHEVs can run in at least 2 modes:

All-electric Mode, in which the motor and battery provide all the car’s energy

Hybrid Mode, in which both electricity and petrol/diesel are employed

Main Components of PHEV:

Electric motor, Engine, Inverter, Battery, Fuel tank, Control module, Battery Charger (if onboard model)

Working Principles of PHEV:

PHEVs start-up in all-electric mode and make use of electricity until their battery pack is depleted. Once the battery gets drained, the engine takes over, and the vehicle operates as a conventional, non-plug-in hybrid. PHEVs can be charged by plugging into an outside electric power source, engine, or regenerative braking. When brakes are applied, the electric motor acts as a generator, using the energy to charge the battery. The engine’s power is supplemented by the electric motor; as a result, smaller engines can be used, increasing the car’s fuel efficiency without compromising performance.

Fuel Cell Electric Vehicle (FCEV):

FCEVs are also known as Zero-Emission Vehicles. They employ ‘fuel cell technology’ to generate the electricity required to run the vehicle. The chemical energy of the fuel is converted directly into electric energy. To find out more about FCEVs, click below.

Main Components of FCEV:

Electric motor, Fuel-cell stack, Hydrogen storage tank, battery with converter and controller

Working Principles of FCEV:

The FCEV generates the electricity required to run this vehicle on the vehicle itself.

Benefits of Electric Vehicles

Transport is a fundamental requirement of modern life, but the traditional combustion engine is quickly becoming outdated. Petrol or diesel vehicles are highly polluting and are being quickly replaced by fully electric vehicles. Benefits of electric vehicles are as follows:

Lower running costs

The running cost of an electric vehicle is much lower than an equivalent petrol or diesel vehicle. Electric vehicles use electricity to charge their batteries instead of using fossil fuels like petrol or diesel. Electric vehicles are more efficient, and that combined with the electricity cost means that charging an electric vehicle is cheaper than filling petrol or diesel. Using renewable energy sources can make the use of electric vehicles more eco-friendly. The electricity cost can be reduced further if charging is done with the help of renewable energy sources installed at home, such as solar panels.

Low maintenance cost

Electric vehicles have very low maintenance costs because they don’t have as many moving parts as an internal combustion vehicle. The servicing requirements for electric vehicles are lesser than the conventional petrol or diesel vehicles. Therefore, the yearly cost of running an electric vehicle is significantly low.

Zero Tailpipe Emissions

Driving an electric vehicle can help reduce carbon footprint because there will be zero tailpipe emissions.

Petrol and diesel use is destroying our planet

The availability of fossil fuels is limited, and their use is destroying our planet. Toxic emissions from petrol and diesel vehicles lead to long-term, adverse effects on public health. The emissions impact of electric vehicles is much lower than petrol or diesel vehicles. From an efficiency perspective, electric vehicles can covert around 60% of the electrical energy from the grid to power the wheels, but petrol or diesel cars can only convert 17%-21% of the energy stored in the fuel to the wheels. That is a waste of around 80%. Fully electric vehicles have zero tailpipe emissions, but even when electricity production is taken into account, petrol or diesel vehicles emit almost 3 times more carbon dioxide than the average EV. To reduce the impact of charging electric vehicles, India is ambitious to achieve about 40 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by the year 2030. Therefore, electric vehicles are the way forward for Indian transport, and we must switch to them now.

No fuel, no emissions

One of the most significant advantages of EVs is their impact on our environment. Pure EVs have zero tailpipe emissions, which reduces air pollution. Since the electric motor of the EV operates on a closed circuit, it does not emit any harmful gases. Pure electric cars do not require petrol or diesel, which is excellent for the environment.

Electric Vehicles are easy to drive and quiet

Electric vehicles don’t have gears and are very convenient to drive. There are no complicated controls, just accelerate, brake, and steer. When one wants to charge the vehicle, she has to just plug it in to a home or public charger. Electric vehicles are also quiet, so they reduce noise pollution that traditional vehicles contribute to.

No noise pollution

Electric vehicles have the silent functioning capability as there is no engine under the hood. No engine means no noise. The electric motor functions so silently that you need to peek into your instrument panel to check if it is ON. Electric vehicles are so silent that manufacturers have to add false sounds in order to make them safe for pedestrians.

Better performance

In the past, EVs were seen as impractical. However, that has changed over the years, with manufacturers offering well-designed and good-looking EVs. Even the performance of EVs has changed for the better. Electric Vehicles are lighter in weight, and their acceleration is impeccable compared to fuel-powered vehicles.

Safe to Drive

Electric cars undergo the same fitness and testing procedures test as other fuel-powered cars. An electric car is safer to use, given their lower center of gravity, which makes them much more stable on the road in case of a collision.

Battery Life & Cost

Batteries are an integral part of an electric vehicle. Most electric vehicle batteries are lithium ones, and their costs are improving every year.

The full capacity of a lithium-ion battery cell should be good for 300 to 500 cycles. A good battery could last you up to ten years. With the improving technologies, the cost of these batteries is expected to come down even more.

They are future proof

With several countries pledging to gradually reduce their dependence on petrol and diesel (fossil fuels), EVs are considered a sustainable alternative.

In a nutshell,

Electric vehicles have many benefits, including:

Cleaner environment

No congestion charges

Lower running costs

Renewable electricity tariffs

Better driving experience

Government funding

Reduced noise pollution

Increased resale value

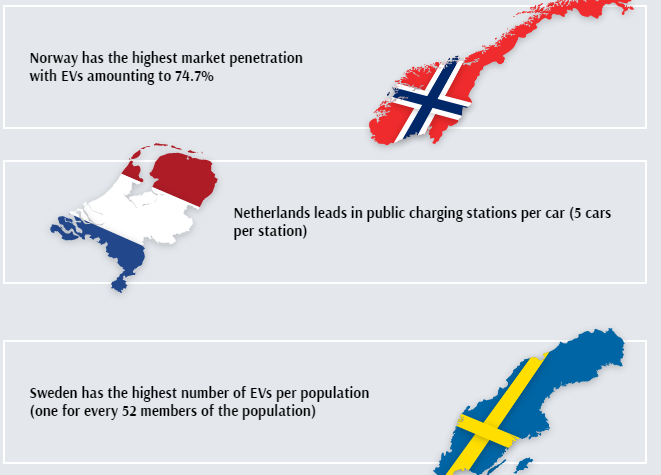

Global Electric Vehicle (EV) Market

The global electric vehicle (EV) market is developing at a rapid pace. According to EV volumes, overall electric vehicle reached a global share of 8.3% (including battery electric vehicles [BEVs] and Plug- in hybrid electric vehicles [PHEVs]) in 2021 from 4.2% in 2020 with 6.75 million vehicles on the road. This is an increase of 108% as of 2020. EVs are gaining attention across the globe as they help reduce emissions and depletion of natural resources.

EV in India

In India, the first concrete decision to incentivise electric vehicles was taken in 2010. According to a subsidy scheme approved by the Ministry of New and Renewable Energy (MNRE), the government announced a financial incentive for manufacturers for electric vehicles sold in India. The scheme, effective from November 2010, envisaged incentives of up to 20 per cent on ex-factory prices of vehicles, subject to a maximum limit. However, the subsidy scheme was later withdrawn by the MNRE in 2012.

In 2013, India unveiled the 'National Electric Mobility Mission Plan (NEMMP) 2020' to make a major shift to electric vehicles and to address the issues of national energy security, vehicular pollution and growth of domestic manufacturing capabilities. Though the scheme was to offer subsidies and create supporting infrastructure for e-vehicles, the plan mostly remained on papers. While presenting the Union Budget for 2015-16 in Parliament, then finance minister Arun Jaitley announced Faster Adoption and Manufacturing Of Electric Vehicles (FAME), with an initial outlay of Rs 75 crore. The scheme was announced with an aim to offer incentives for clean-fuel technology cars to boost their sales to up to 7 million vehicles by 2020.

In 2017, Transport Minister Nitin Gadkari made a statement showing India’s intent to move to 100 per cent electric cars by 2030. However, the automobile industry raised concerns over the execution of such a plan. The government subsequently diluted the plan from 100 per cent to 30 per cent.

In February 2019, the Union Cabinet cleared a Rs 10,000-crore programme under the FAME-II scheme. This scheme came into force from April 1, 2019. The main objective of the scheme is to encourage a faster adoption of electric and hybrid vehicles by offering upfront incentives on purchase of electric vehicles and also by establishing necessary charging infrastructure for EVs.

EV Market in India

The Indian EV market is evolving fast as close to 0.32 million vehicles were sold in 2021, up 168% YoY. Ongoing electric vehicle adoption in India is based on the Paris agreement to reduce carbon emissions, to improve the air quality in urban areas and reduce oil imports.

The Indian automobile industry is the fifth largest in the world and is expected to become the third largest by 2030. As per India Energy Storage Alliance (IESA), the Indian EV industry is expected to expand at a CAGR of 36%. As population rises and demand for vehicles grow, dependence on conventional energy resources is not a sustainable option as India imports close to 80% of its crude oil requirements. NITI Aayog aims to achieve EV sales penetration of 70% for all commercial cars, 30% for private cars, 40% for buses and 80% for two and three-wheelers by 2030. This is in line with the goal to achieve net zero carbon emission by 2070. Over the last three years, 0.52 million EVs were registered in India, according to the Ministry of Heavy Industries. EVs recorded robust growth in 2021, supported by the implementation of favourable policies and programmes by the government.

In India, Uttar Pradesh held the highest share in EV sales in 2021, with the number of units sold across all segments reaching 66,704, followed by Karnataka with 33,302 units and Tamil Nadu with 30,036 units. Uttar Pradesh dominated the three-wheeler segment, while Karnataka and Maharashtra led the two-wheeler segment and four-wheeler segment, respectively.

Challenges faced by EVs in India

The estimation of EV growth in India is also accompanied by concerns about specific challenges related to inadequate supply chains, certain government policies, consumer behaviour, infrastructure, etc.

Charging Infrastructure

Consumers and fleets considering all-electric vehicles need access to charging stations, also known as EVSE (electric vehicle supply equipment). For six lakh electric vehicles on the road today, we have roughly 2,000 public charging stations. This poor density of the charging stations is limiting the ease of EV usage. Lack of battery and charger standardization coupled with high capital intensity of setting up charging or swapping stations has emerged as a major infrastructural bottleneck.

This is rather a chicken and egg problem where setting up expansive CapEx heavy charging infrastructure would be financially viable for companies only when there is a critical mass of vehicles on the road. And unfortunately we do not have the required critical mass of vehicles in India today.

Range Anxiety:

For an EV user, range anxiety refers to the concern about the number of kilometres an EV will run i.e. how long the battery power will last. Many EV users like to travel long distances on a single charge, which is not feasible with the current battery technology installed in electric vehicles.

Time Anxiety:

Customers are keen to charge their EVs as quickly as possible; this too isn’t feasible with the current charging technologies that are available in the market.

Private Fleet Operators

Obtaining a reliable electric connection for a fleet-owned and operated EVSE still remains a concern.

Lack of Trained Personnel

In addition to the problem of inefficient infrastructure, the lack of skilled personnel in the electric vehicle markets is a significant challenge that foreign investors must deal with. The EV industry in India is still in its nascent stage, and almost every automobile organization will face a challenge in areas of EV talent acquisition and development.

Uncertain Consumer Behaviour

Uncertain consumer behaviour associated with the higher costs of EVs and the issues about inadequate charging infrastructure is major impediments to growth in this sector. The average starting price of an electric car in India is approximately USD 18000 (INR 13 lacs), whereas the average starting price of a regular fuel-powered vehicle is approximately USD 6000 (INR 4.5 lacs). This nearly 3X price is a severe market entry barrier and requires an adequate India market entry strategy that will help to identify the right consumer segment and their needs and preferences to achieve a sustainable profit in a short span.

Supply-chain Problems

EV battery manufacturing in India is still largely dependent on imports due to the lack of Lithium, and this poses a major hurdle for companies willing to invest in India’s EV industry. Companies in India are trying to prospect for stakes in overseas resources and are transferring more raw material production chains to India; there is very little synergy as the battery manufacturing capacity still demands adequate planning.

This has also created the need for joint ventures to acquire adequate lithium-ion battery resources. Foreign organizations, therefore, are increasingly turning to consulting firms to help them to assess technology and market trends and offer comprehensive business opportunities in India to achieve profitable long-term growth.

Impact of FAME II Policy

In the year 2019, the Indian government approved the FAME II scheme, by which the government has proposed to invest about USD 1.4 billion to incentivize the production of electric vehicles in the country. However, FAME II policy also requires 50% localization in vehicle production is required to avail of the incentive. This is a significant India market entry strategy barrier for most organizations as the Indian component suppliers are not yet ready to manufacture components in the face of the present low value of electric vehicles in the market. Therefore, most firms will not be able to enjoy the benefits of the FAME II incentive, which consequently impacts the growth of business opportunities.

No Universal charger and Ecosystem (Lack of standardization):

Lack of standardization is a curse to the Indian electric vehicle industry; it’s damaging the present and future of the EV market. Every second electric scooter has its own different charging port, which affects the charging station infrastructure because no specific charging station can be built that can charge all types of electric vehicles. Also, the lack of standardization reduces the EV adoption rate in society-based communities.

Just like electric cars get a specific charging port (CCS-2), electric two and three-wheelers should maintain a similar standard to achieve the mass adoption of electric vehicles.

Temperature Issues:

Temperature can affect the performance of an EV battery at a large extent which makes EV’s inappropriate for too cold (Uttarakhand, Meghalaya) or too hot regions like (Rajasthan, Kerala). The battery can give its ideal performance when it’s in use under the temperature range of 15-40 degrees.

Lower mileage:

Since the industry is young, there is immense scope for R&D. As of today, EVs in India are not cost competitive to an average customer as internal combustion engine (ICE) vehicles prove to be more cost effective.

Environmental concerns:

The EV revolution is necessary for the most populated and polluted parts of India like Delhi, Mumbai, etc. but in such cities the major chunk of electricity is generated through burning fossil fuels which are equivalent to spreading the pollution through the ICE vehicle smoke, even most of the charging stations are reportedly operating upon diesel-driven electricity generator.

So, the only solution to the emission problem is to use renewable energy sources. (Like Solar power, wind energy, tidal power, etc).

Shifting to renewable energy sources is equally important as shifting to electric mobility.

Lack of policy for the protection of EV:

Profit determination in purchasing an EV is not very stable. It could be due to high production costs and uncertain policies developed around electric vehicles. It leads to discouragement in the industry to invest. Policies like Faster Adoption and Manufacturing of Electric Vehicle are extended constantly. Instead of pushing the deadlines, the focus should be on implementing them in a better way.

Resources:

The battery used in an Electric Vehicle runs on Lithium and Cobalt. India is dependent on countries like Japan and China for the import of lithium-ion batteries. The depreciating value of rupee has thus discouraged the production.

Lack of Product Innovation

One of the key reasons for limited adoption of electric vehicles can be attributed to the lack of innovation on the product front. So far, companies failed to spotlight the practicality of an electric vehicle for the value-conscious Indian consumers. Sustainable performance was not built into the product and EVs failed to provide a satisfactory range suitable for intercity travel. Lack of charging infrastructure is popularly believed to be the number one reason for low EV adoption. However, while it is one of the reasons, it is not the primary reason limiting the success of EVs. Instead, it is the dearth of customer-first and appealing products despite the premium being charged for EVs.

Possible Disruption in the Automobile Sector

The biggest problem that the automobile sector will face would be the possible disruption of the market. Since many automobile companies like Kia, MG Morris Garages, Jeep, etc. have recently entered India and have invested heavily, electric vehicles would lead to a complete disruption in the Indian automobile market. We need a slow and steady transition to electric vehicles so that existing automobile companies will also be able to transition to EVs.

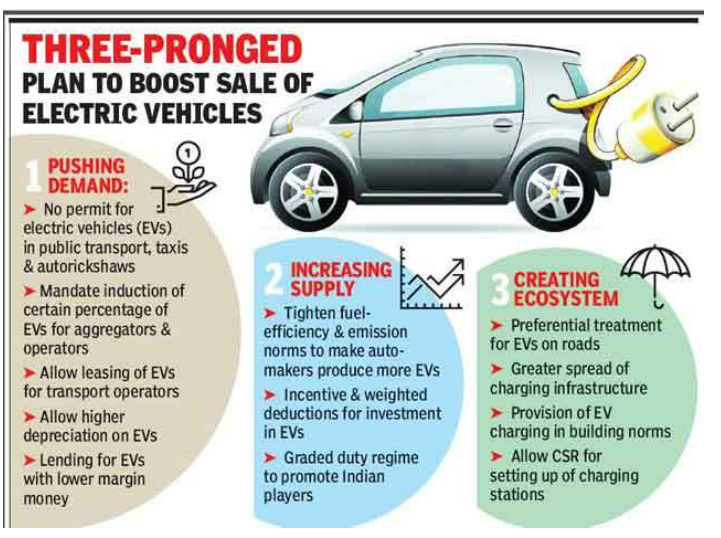

Key Policy Initiatives – Growth Levers

In a thrust towards incentivising new age technologies and fulfil the pledged taken at COP26 to reduce its carbon emissions to net-zero by the year 2070, India is aggressively promoting the adoption of Electric Vehicles (EVs). India aims of switch 30 per cent of private cars, 70 per cent of commercial vehicles, and 80 per cent of two and three-wheelers to EV by the year 2030. For this, both Central and state governments are offering various incentives to buyers and manufacturers. The Government has been framing policies related to EV adoption in the country. Few of the programmes launched by the government to increase EV adoption are shown below:

FAME India Scheme:

FAME INDIA

In the year 2015, Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India was first started. Its second phase has already been started. With this, the government is focussing on four major aspects of EV, such as

FAME-II scheme was launched in India with a budget outlay of US$ 1.3 billion (Rs. 10,000 crore) to support 1 million e-two-wheelers, 0.5 million e-three -wheelers, 55,000 e-passenger vehicles and 7,000 e-buses. The government extended the scheme until 2024, as announced in Union Budget 2022-23.

PLI Scheme:

The government introduced Production Linked Incentive for Advanced Chemistry Cell Battery Storage (PLI-ACC) scheme. The scheme is expected to boost India’s battery infrastructure. As per the Union Budget, the total outlay for the scheme is US$ 2.45 billion (Rs 18,100 crore), which would be disbursed to beneficiaries over five years once the manufacturing facility is set up.

Battery Swapping Policy:

A wide-spread charging infrastructure is essential for EV adoption. In this regard, on April 22, 2022, NITI Aayog released a draft battery swapping policy which will be valid until March 31, 2025. The policy will be implemented over a period of 1-2 years from the date of launch of the policy and will cover all metropolitan cities with a population greater than four million. The second phase will be implemented over 2-3 years from date of launch of the policy and will cover all UT’s and major cities with a population greater than 5,00,000.

Centre’s Scrappage Policy

Prime Minister Narendra Modi, launched the Vehicle Scrappage Policy virtually at the Gujarat Investor Summit. The policy aims to phase out unfit and polluting vehicles in an environment-friendly manner. Under the policy, vehicles will not just be scrapped by their age but also if they are found to be unfit in automated testing. The vehicle scrappage policy for private vehicles is set to be implemented in 2024. The policy is said to offer a much-needed boost for the Indian auto sector and bring investments of around Rs 10,000 crore by improving new vehicle sales.

Provisions are broadly arranged into these three groups:

a) Registration and fitness tests:

Criteria for vehicle fitness will primarily be emission tests, braking, and safety equipment, per Central Motor Vehicle rules

Rules for fitness tests and scrapping centers to be applicable from October 1, 2021

Scrapping of government and PSU vehicles older than 15 years to start from April 2022

The mandatory fitness testing for heavy commercial vehicles to start from April 2023 and for other vehicles from June 2024

Increased fees for fitness certificate and test for commercial vehicles older than 15 years and non applying/issuance of fitness certificate will lead to de-registration

Increased re-registration fees for private vehicles older than 15 years and de-registration after 20 years if found unfit or registration not renewed

A vehicle failing the fitness test or failing to get a renewal of its registration certificate to be declared as ‘End of Life Vehicle’

b) Financial incentives:

Scrap value for the old vehicle given by the scrapping center up to 4–6% of the ex-showroom price of a new vehicle

OEMs to give 5% discount on the purchase of a new vehicle against the scrapping certificate

State governments to offer road tax rebate of up to 25% for personal vehicles and up to 15% for commercial vehicles

No registration fee for new vehicles if scrapping certificate for old vehicle is available

c) Scrapping centers:

Encourage public and private participation (PPP) in opening Registered Vehicle Scrapping Facility (RVSF)

Encourage setting up of Automated Fitness Centers on a PPP model by the state government, private sector, automobile companies, etc.

The policy will be a major demand driver, with implementation focused on discounts for eligible users, infrastructure development for fitness testing of old vehicles, and a well-connected network of scrapping centers. Tata Motors has already planned the establishment of four scrapping centers in Howrah, Karnal, Hyderabad, and Greater Mumbai.

The above policies, combined with improved infrastructure and a shift in market acceptance of EVs, will enable India to make a dramatic leap in EV adoption and environmental sustainability.

Changes in State EV Policies

To increase penetration and adoption of battery electric vehicles (BEVs), governments of around 20 states in India, including Delhi, Gujarat, Goa, Maharashtra and Rajasthan have already come up with either a draft or final state level EV policies. The objectives of each state level policy will vary but some common objectives include– solving air quality issues, help in climate change mitigation, reduce dependence on oil imports and promote development of EV industry.

Ministry of Power:

It has clarified that charging EVs is considered a service, which means that operating EV charging stations will not require a license. It has also issued a policy on charging infrastructure to enable faster adoption of EVs. The revised consolidated Guidelines & Standards for Charging Infrastructure for Electric Vehicles was promulgated on January 14, 2022. Exhaustive in scope, these guidelines include provisions for a) individual owners of EVs and b) for public charging stations (PCS) infrastructure. It covers land use and access, power tariffs, state and central government roles, timelines for providing connectivity for installation of PCS, among other concerns.

Department of Science and Technology:

It has launched a grand challenge for developing the Indian Standards for Electric Vehicle Charging Infrastructure.

Niti Aayog

The National Mission on Transformative Mobility and Battery Storage has been approved by the cabinet. The Mission aims to create a Phased Manufacturing Program (PMP) for five years till 2024, to support setting up large-scale, export-competitive integrated batteries and cell-manufacturing giga plants in India, as well as localizing production across the entire electric vehicle value chain. The Mission focuses on the research and development of battery technology to decrease the dependence on China. With this, the government is also inviting foreign players to explore the Indian market, such as Tesla, etc.

These steps are competitive, but to make a fruitful transition to EV, there’s an urge to focus on the following Focus Areas

Other Initiatives-

Overcoming barriers to EV adoption in India

Technology cost:

In a few segments, the high upfront cost of EVs is slowing adoption despite the potential for lower total cost of ownership (TCO). There is an ongoing need to further reduce the upfront cost and TCO in many use cases through various instruments.

Policy implementation:

National-level policy can be complemented with added fiscal incentives at the state level. Non-fiscal incentives will also be important in developing a favourable operating environment and customer confidence for EVs.

Manufacturing and supply:

Despite growing product diversity, there is still a need for greater customised product and model availability, and more fit-for-purpose models. Further, more domestic manufacturing of advanced batteries and cells, battery management systems, electric motors, motor controllers, and other components is needed. Original equipment manufacturer (OEM) capital has recently focused on the migration of internal combustion engine vehicles to Bharat Stage VI (BSVI) standards, while the industry is experiencing lower sales due to COVID-19. This is hampering supply-side investment in EVs.

Infrastructure buildout:

The introduction of advanced batteries and longer-range vehicle modes can address customer concerns about range. Alongside these developments, electricity distribution companies (discoms), charging service providers, and other actors can focus on building robust charging infrastructure networks. Using smart technology that communicates with the electric grid will unlock additional value from demand-side management.

Consumer behaviour:

Demand for more affordable EV products is expected, as consumers reduce spending in the short term due to COVID-19. This potential shift in consumer preferences may affect manufacturers’ investment and production decisions.

In addition to these commonly discussed barriers, access to low-cost finance is still a formidable barrier that warrants multi-stakeholder attention and innovative solutions.

Improving access to attractive financing products can be key to drive EV demand.

Infrastructure Technology

Enabling convenient charging for everyone means more EVs on the road which will require a more extensive charging infrastructure. Charging infrastructure still has a long way to go in India. To meet the charging requirement for 20 Lakh electric cars, India needs to have about 4 Lakh charging stations installed by 2026.

EV players need to make sure that people can easily adapt to this charging habit. For this, they have to increase the number of public charging stations. The common charging infrastructure in public places needs to be prepared to deal with this workload. Adoption of modern technologies can help achieve this.

Most public charging stations today are comprised of normal chargers that require several hours to charge an average EV. The fast and ultra-fast chargers for electric vehicles are easily available in the market but are not used in these charging stations. Furthermore, the harmonisation of payment systems in charging stations can go a long way in improving the charging experience.

Load balancing

Load balancing is a growing technology trend that helps distribute the available capacity over all active charging stations. It also helps ensure that optimal charging is provided to all-electric vehicles at a specific location, within the limits of the charging stations’ capacity.

With this technology, charge point owners will be able to balance the load and distribute the current between units. This is dynamic, cost-efficient, and a much more sustainable way to send energy to every single station.

Conclusion

The Indian EV Industry is slowly gathering momentum, supported by government initiatives and rise in crude oil prices, as people look for alternative sources to reduce their monthly bills. However, a mass shift from internal combustion engine (ICE) vehicles to EVs requires expansion of infrastructure facilities, including charging stations, and vehicles that could provide a higher range (KM range with a single charge). Several initiatives taken by the government to support the manufacturing and adoption of electric vehicles in the country should help in achieving the target of a 100% EV adoption by 2030.

Ultimately, the scope of India’s EV market growth rests on availability of capital for original equipment manufacturers, battery manufacturers, and charge point operators as well as improvements to infrastructure and diversified options for consumers.

Realizing India’s EV ambition will also require an estimated annual battery capacity of 158 GWh by FY 2030, which provides huge investment opportunities for investors. Enabling policy support measures are a critical need at this juncture.

© 2024 iasgyan. All right reserved