When it comes to Indian Economy, many aspirants who do not come from Economy background find it difficult to understand terminologies and concepts which appear in Newspaper Editorials recurrently. And it is often perplexing for aspirants to figure out where to begin! In one of the previous articles we have explained all the basic concepts like GDP, Monetary Policy etc. In this article we shall try to decode some other concepts and terminologies that are important from UPSC perspective.

So, without any further ado, let’s begin.

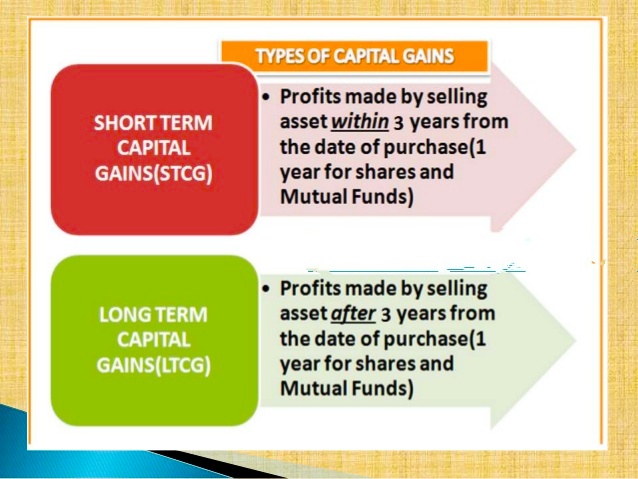

Simply put, any profit or gain that arises from the sale of a ‘capital asset’ is a capital gain. This gain or profit is comes under the category ‘income’, and hence you will need to pay tax for that amount in the year in which the transfer of the capital asset takes place. This is called capital gains tax.

Note: Capital gains are not applicable to an inherited property as there is no sale, only a transfer of ownership. The Income Tax Act has specifically exempted assets received as gifts by way of an inheritance or will. However, if the person who inherited the asset decides to sell it, capital gains tax will be applicable.

Dumping refers to the situation when a country sells exports very cheaply to another country.

For example, the European Union had a large surplus of food items, due to the Common Agricultural Policy. These goods were then sold very cheaply – ‘dumped’ on other world markets. This causes big problems for farmers in these countries because they are undercut, prices fall and they lose income. Therefore, governments are keen to take measures against the dumping of goods.

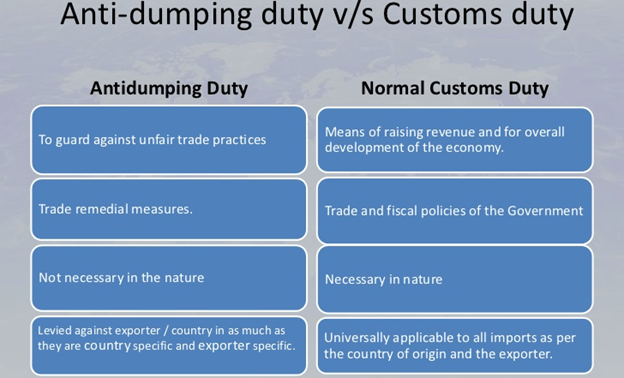

Anti Dumping Duties are tariffs imposed by importer country on exporter country when such dumped goods are exported below market price. It is a way of increasing the price of goods which are too cheap.

The break-even price is the price necessary to make normal profit. It is a price which includes all costs, including variable and fixed costs.

At the break-even price, the firm neither makes a loss or profit.

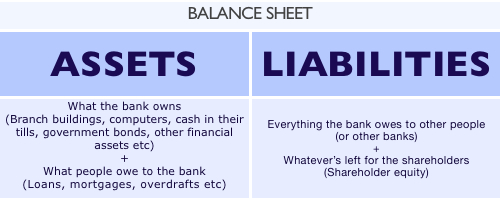

It is the ratio of cash to total liabilities a bank will hold. For example, suppose that a bank has deposit of Rs 1000. If it has a cash ratio of 1%, it will need to hold Rs 10 on cash reserves. Cash Ratio or liquidity ratio measures a bank’s/ firm’s ability to pay off its current liabilities with only cash and cash equivalents.

A cash ratio determines how much credit can be created from deposits. It also determines the profitability of a bank. If cash ratios are higher then banks will be less profitable. However, higher cash ratios do enable greater security.

A cartel occurs when two or more firms enter into agreements to restrict the supply or fix the price of a good in a particular industry.

A cartel is a formal type of collusion.

Cartels are considered to be against the public interest. This is because cartels aim to:

When government conducts an expansionary fiscal policy (i.e. increases in government spending or decreases in tax rate, it may run afoul of the crowding out effect.

Expansionary fiscal policy means an increase in the budget deficit. The government is spending more money than it has in income. Where does government obtain the necessary funds to cover it’s increased deficit?

The answer is - Borrowing from financial markets.

Now the supply of funds in financial markets is the sum of private saving, government saving, and net investment by foreigners into domestic financial markets.

If private saving and net foreign investment remain the same, then less financial capital will be available for private investment.

When government borrowing soaks up available financial capital and leaves less for private investment in physical capital the result is crowding out of private players.

The dependency ratio measures the % of dependent people (not of working age) / number of people of working age (economically active)

Dependency Ratio=

Number of Children + Number of Pensioners

——————————————————————–

Number of Working age

A dependency ratio of 1.2 means that for every 10 workers there are 12 people not of working age.

An economic stimulus package is an attempt by the government to boost economic growth and lead the economy out of a recession or economic slowdown.

The two main ways for stimulating the economy are expansionary monetary policy and expansionary fiscal policy.

Fiscal policy

This involves a change in spending or taxation in order to influence aggregate demand. A Fiscal stimulus could involve:

Externalities occur when producing or consuming a good cause an impact on third parties not directly related to the transaction.

Externalities can either be positive or negative. They can also occur from production or consumption.

For example, just driving into a city centre, will cause external costs of more pollution and congestion to those living in the city.

A Pigovian tax is a tax placed on any good which creates negative externalities. The aim of a Pigovian tax is to make the price of the good equal to the social marginal cost and create a more socially efficient allocation of resources.

It is named after the economist Arthur Pigou who developed the concept of externalities in the 1920s.

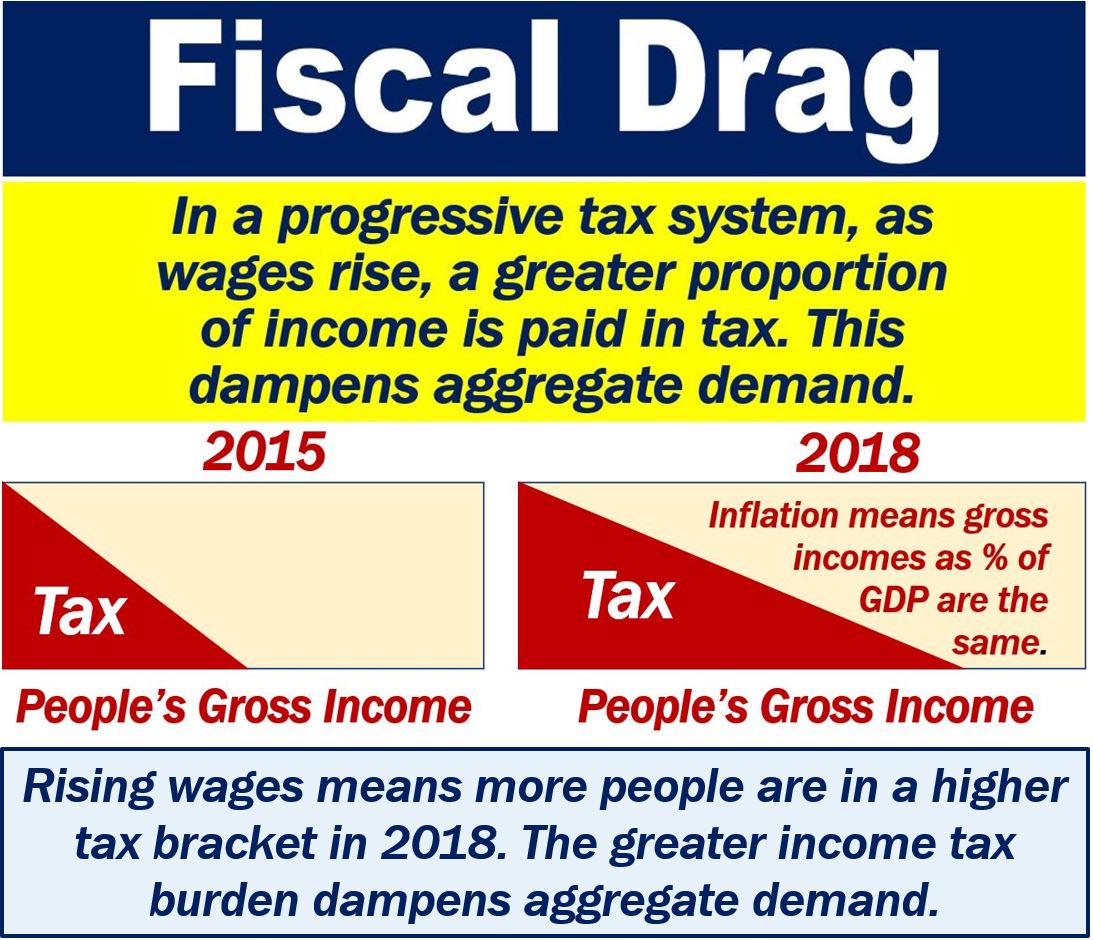

Fiscal drag is a concept where inflation and earnings growth may push more taxpayers into higher tax brackets. Therefore fiscal drag has the effect of raising government tax revenue without explicitly raising tax rates.

A tax haven is a country where individuals and firms are able to save money on paying tax through low or zero rates of tax. Tax havens may also provide customers with the ability to hide their true identity – helping their activities to remain hidden from the government in questions

Countries considered to be tax havens include:

Tax havens have been criticized because

The wage-price spiral refers to the strong mutual link and between wage growth and inflation.

Thus, a wage-price spiral can lead to a prolonged period of inflation.

Trade barriers are government policies which place restrictions on international trade. Trade barriers can either make trade more difficult and expensive (tariff barriers) or prevent trade completely (e.g. trade embargo)

Examples of Trade Barriers

The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. There are different leverage ratios such as

Leverage ratios give an indication of the financial health of a bank and how over-extended they may be.

Core inflation denotes the rate of increase in consumer prices on commodities other than food and energy whose prices are often beyond the control of the authorities as well as the effects of changes in indirect taxes.

Derived demand occurs when there is a demand for a good or factor of production resulting from demand for an intermediate good or service.

Example – mobile phones and lithium batteries

The rise in demand for mobile phones and other mobile devices has led to a strong rise in demand for lithium. Lithium is used in the batteries.

Predatory pricing occurs when a firm sells a good or service at a price below cost (or very cheaply) with the intention of forcing rival firms out of business.

_.png)

Rules of origin refer to finding the source of a product. For example, if the UK import bananas from Spain, were the bananas originally from Spain or were they imported from Costa Rica. If the bananas come originally from Costa Rica, that has importance for:

Why rules of origin can be important

Anti-dumping: Suppose Africa imposes limits on the dumping of surplus agricultural products from the EU. It means there will be quotas on EU exports. However, if EU farmers export food to Turkey, who then export the same goods to Africa – it is effectively a way to get around the anti-dumping legislation. Knowing the origin of agricultural products is important.

Carbon Trading is a scheme where firms (or countries) buy and sell carbon permits as part of a programme to reduce carbon emissions.

Usually firms are given a certain quote to pollute a certain amount. If they wish to pollute more than their allowance then they have to buy more permits.

If they pollute less than their quota they can sell their spare permits on the market. Thus there is an incentive to reduce pollution and find the most efficient way of dealing with pollution.

Over time governments can reduce pollution quotas to encourage greater efficiency.

A credit default swap is a financial derivative that guarantees against bond risk. Swaps work like insurance policies. They allow purchasers to buy protection against an unlikely but devastating event. Like an insurance policy, the buyer makes periodic payments to the seller.

Most of these swaps protect against default of high-risk municipal bonds, sovereign debt, and corporate debt, mortgage-backed securities etc.

Hit and run competition occurs when a firm temporarily enters a market and then leaves when supernormal profits are exhausted.

Hit and run competition is considered to be a feature of a contestable market. A contestable market has low barriers to entry and exit. Therefore, if firms in the industry are making supernormal profits, there is an incentive for a new firm to enter and take advantage of the high profits.

If the industry no longer makes supernormal profits, it is easy for the firm to exit and leave without excessive costs.

The threat of hit and run competition may be sufficient to keep prices and profits low.

A mixed economy means that part of the economy is left to the free market, and part of it is managed by the government.

Marginal revenue (MR) is the additional revenue gained from selling one extra unit of product in a period of time.

While marginal revenue can remain constant over a certain level of output, it follows from the law of diminishing returns and will eventually slow down as the output level increases.

Pareto efficiency, or Pareto optimality, is an economic state where resources cannot be reallocated to make one individual better off without making at least one individual worse off. Pareto efficiency implies that resources are allocated in the most economically efficient manner, but does not imply equality or fairness.

Hot money is capital that investors regularly move between economies and financial markets to profit from highest short-term interest rates. Basically, it refers to capital flows moving to countries with higher interest rates and/or expected changes in exchange rates.

© 2024 iasgyan. All right reserved