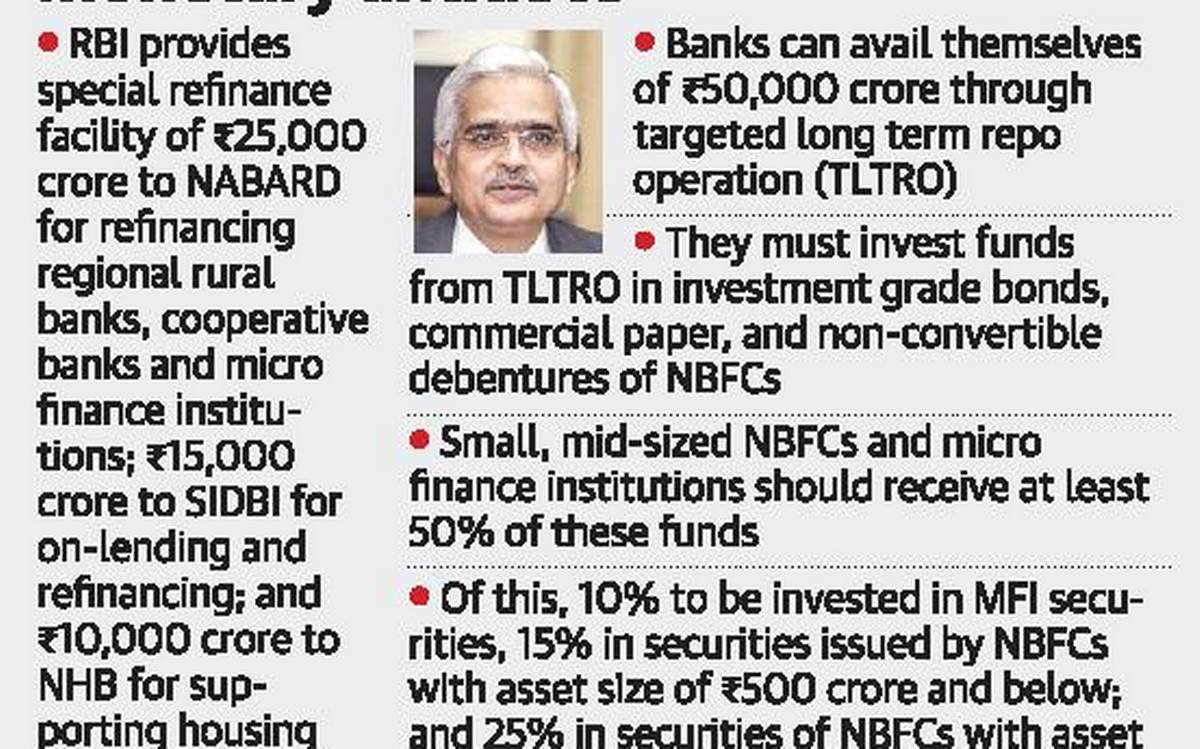

The main objective has been to make sure that the Market has enough liquid money supply for the businesses to sustain this tough time.

Checks and control measures in order to ensure safety in the investment market have been key.

Image Source: The Hindu

It is almost impossible to discuss all the steps taken by RBI in one blog. So Macroeconomic parameters are described in this one. In our future blog, I am going to discuss the important aspects of RBI’s initiative in Micro Economic perspective.

Just remember the keyword, the main two objectives of RBI’s initiatives have been

© 2024 iasgyan. All right reserved