A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer. Governments, corporations and municipalities issue bonds when they need capital. An investor who buys a government bond is lending money to the government. If an investor buys a corporate bond, the investor is lending money to the corporation. Like a loan, a bond pays interest periodically and repays the principal at a stated time, known as maturity.

Bonds can be bought and sold in the “secondary market” after they are issued. While some bonds are traded publicly through exchanges, most trade over-the-counter between large broker-dealers acting on their clients’ or their own behalf.

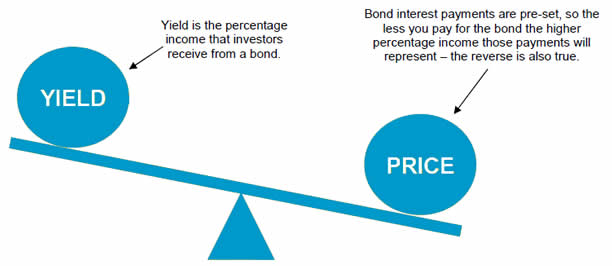

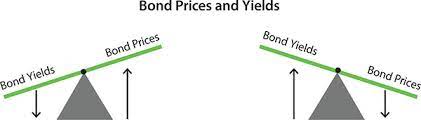

A bond’s price and yield determine its value in the secondary market.

| The primary market is where securities are created. Here securities are issued by companies for the first time. New stocks and bonds are offered to the public via an initial public offering (IPO). The secondary market, on the contrary, refers to exchanges such as BSE or New York Stock Exchange or Nasdaq where stocks are traded. |

Bond yield is the amount of return an investor realizes on a bond. Required yield refers to the amount of yield a bond issuer must offer to attract investors.

When investors buy Bonds, they essentially lend bond issuers money. In return, bond issuers agree to pay investors interest on bonds throughout their lifetime and to repay the face value of bonds upon maturity. The money that investors earn is called yield. Investors do not have to hold bonds to maturity. Instead, they may sell them for a higher or lower price to other investors, and if an investor makes money on the sale of a bond, that is also part of its yield.

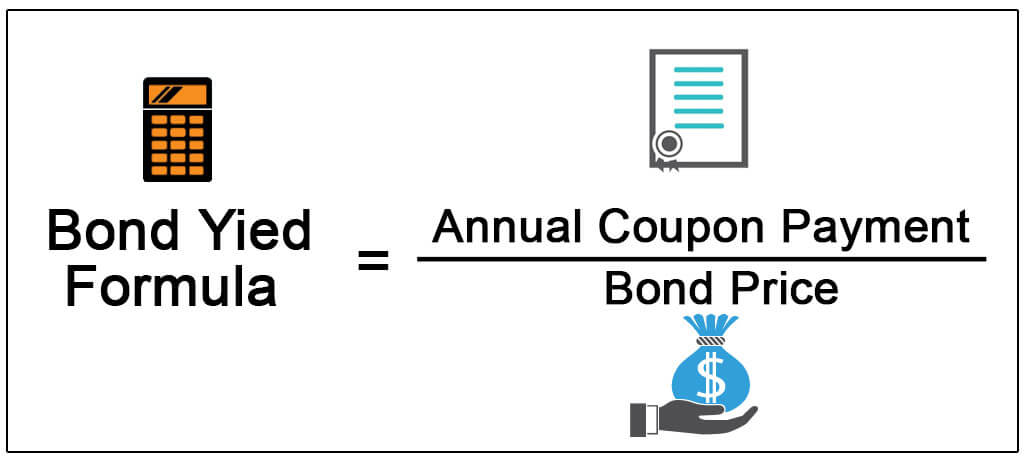

As bond prices increase, bond yields fall. For example, assume an investor purchases a bond with a 10% annual coupon rate and a par value of Rs. 1,000. Each year, the bond pays 10%, or Rs. 100, in interest. Its annual yield is the interest divided by its Par value. As Rs. 100 divided by Rs. 1,000 is 10%, the bond's nominal yield is 10%, the same as its coupon rate.

Eventually, the investor decides to sell the bond for Rs. 900. The new owner of the bond receives interest based on the face value of the bond, so he continues to receive Rs. 100 per year until the bond matures. However, because he only paid Rs. 900 for the bond, his rate of return is Rs. 100/ Rs. 900 or 11.1%. If he sells the bond for a lower price, its yield increases again. If he sells for a higher price, its yield falls.

|

Example from Market Perspective Let’s say a bond’s face value is Rs 1,000 on which an investor can earn 5%. This means that the coupon is 5% and an investor who buys the bond and holds it till maturity will get Rs 50 every year over the tenure of the bond. Now the price of the bond drops in the market to Rs 980. That means the current yield is Rs 50 divided by Rs 980 = 5.10%. Later, the price of the bond rises to Rs 1,030. That means the current yield is Rs 50 divided by Rs 1,030 = 4.85%. As the price of the bond fell, its yield increased. Because yield is a function of price, changes in price result in bond yields moving in the opposite direction. There are two ways of looking at bond yields - current yield and yield to maturity. |

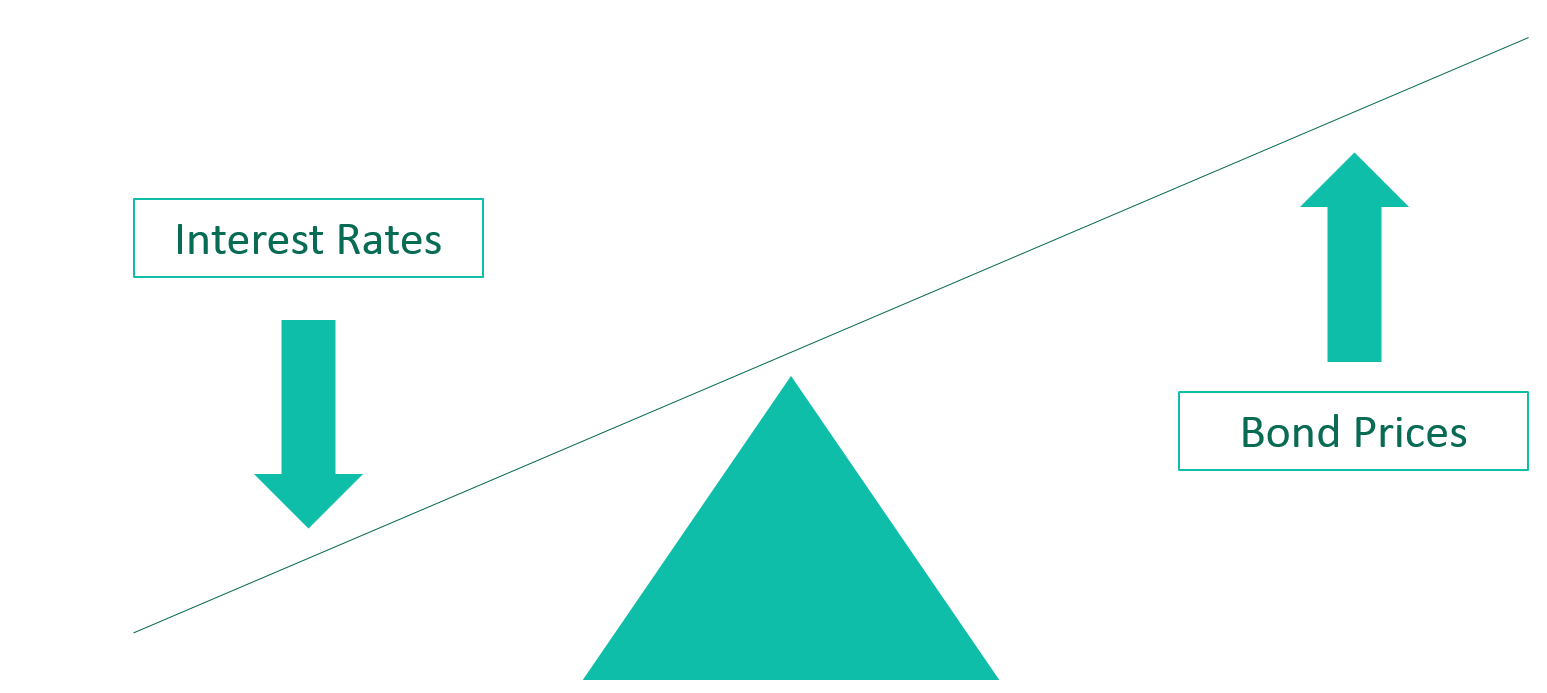

Generally, investors see bond yields fall when Economic Conditions push markets toward safer investments. Economic conditions that might decrease bond yields include high rates of unemployment and slow Economic Growth or Recession. As interest rates increase, bond prices also tend to fall.

In a nutshell,

A bond's yield is based on the bond's coupon payments divided by its market price;

To examine the relationship between interest rates and bond prices, imagine an investor buys a bond from XYZ Company with a 4% coupon rate and a Rs. 1,000 face value. Another investor waits a few weeks before buying a bond, and during that time, the issuer raises interest rates to 6%. At this point, the second investor can buy a Rs. 1,000 bond from XYZ Company and receive Rs. 60 in interest per year.

Meanwhile, upset that he is only earning Rs. 40 per year, the original investor decides to sell, but to entice others to buy his bond instead of bonds directly from XYZ Company, he lowers his price. For example, he lowers it to Rs. 650, making its effective annual yield Rs. 40/Rs. 650 or 6.15%. If the bond issuer had not increased its rates, the investor might not have had to sell his bond for less than its face value.

© 2025 iasgyan. All right reserved