CORPORATES AS BANKERS: BOON OR BANE?

CONTEXT: A recent report by an Internal Working Group of the Reserve Bank of India has attracted a lot of attention as well as criticism. The IWG was constituted to “review extant ownership guidelines and corporate structure for Indian private sector banks”. The IWG submitted several recommendations, but one, in particular, has raised a lot of concern. This had to do with allowing large corporate/industrial houses to be promoters of private banks.

WHY WAS THE WORKING GROUP SET UP?

- Banking sector contributes significantly to the welfare in an economy by providing intermediation through maturity and risk transformations to balance the utility preferences of the economic agents, it is tightly regulated considering the social externalities of the negative spillovers.

- One of the channels through which regulations ensure that the incentives of the banking companies align with that of the larger society is through having a say in the market structure and organisation of banking business.

- Licensing regimes, which aim to ensure that only those participants with the right amount of ability and willingness to do banking business in line with the social and economic preferences of a financial system are permitted to organise such businesses, have been a key component of the regulatory arsenal of prudential regulators, including Reserve Bank of India.

- Prior to nationalisation of banks, Indian banking sector had been organised in the private sector. The sector was opened up again post liberalisation with the first round of licensing of private banks that was done in 1993.

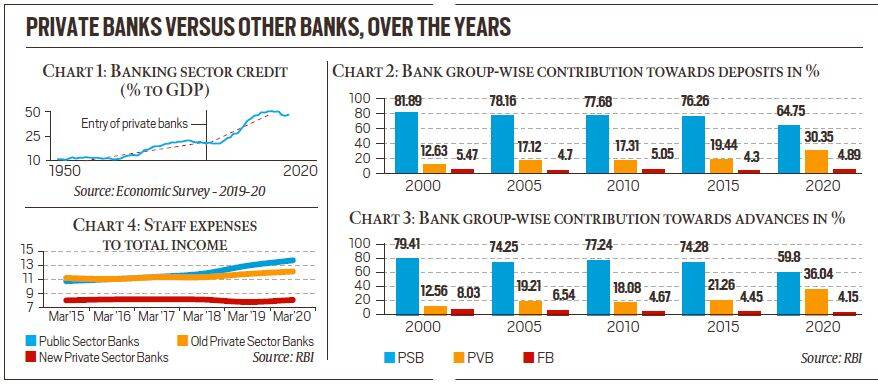

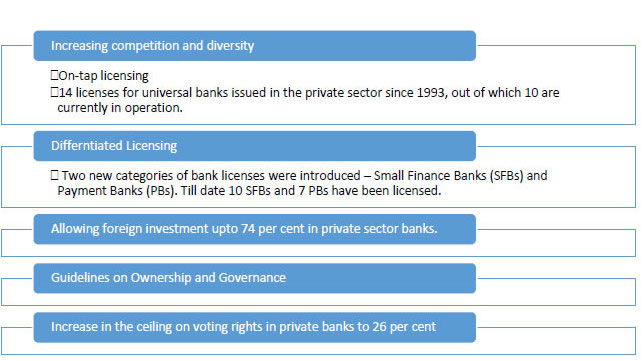

- Since then there have been two more rounds of licensing of banks in the private sector – in 2001 and 2013 – culminating with the on-tap licensing regime of universal banks since 2016.

- The provisions and requirements of the various rounds of licensing have not been uniform; in fact, it reflected the regulatory preference and the generally accepted prudential principles as existed at each time.

- As a result, presently, India has a number of banks working under differing regulatory regimes when it comes to organisation of business.

- This has the potential to raise concerns about uneven playing field as well as scope for regulatory arbitrage.

- Moreover, various structural changes have occurred over the years both in the Indian economy as well as the body of banking regulation.

- Further, the aspirations of the Indian economy for the future also requires a strong and vibrant banking sector to be in place to adequately support the investment demands of such growth, which may require a fundamental rethink of current regulatory stance towards the question of how a banking business should be organised.

KEY REFORMS REGARDING OWNERSHIP AND GOVERNANCE OF PRIVATE SECTOR BANKS:

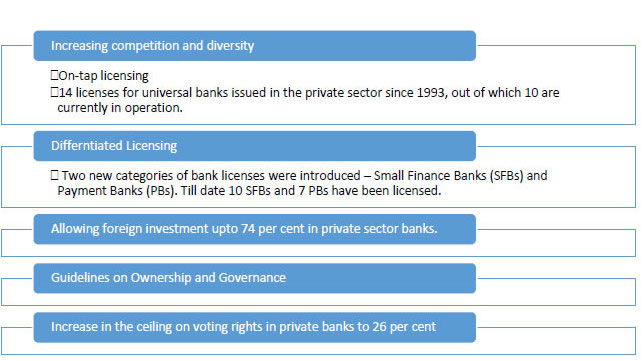

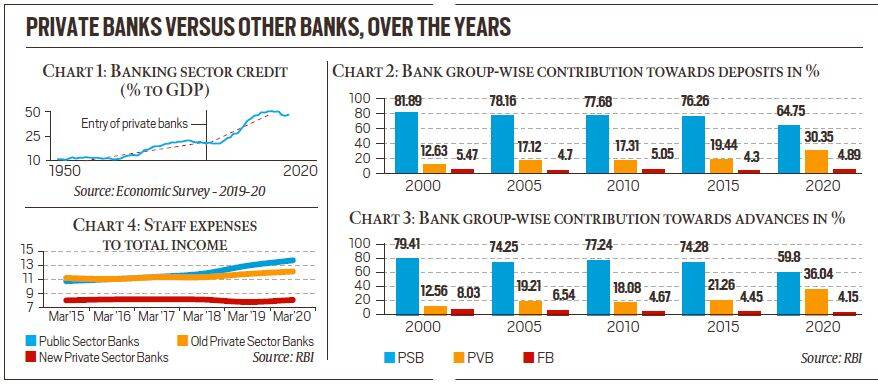

- With economic liberalisation in the early 1990s, the economy’s credit needs grew and private banks re-entered the picture. As Chart 1 shows, this had a salutary impact on credit growth.

- However, even after three decades of rapid growth, “the total balance sheet of banks in India still constitutes less than 70 per cent of the GDP, which is much less compared to global peers” such as China, where this ratio is closer to 175%.

- Moreover, domestic bank credit to the private sector is just 50% of GDP when in economies such as China, Japan, the US and Korea it is upwards of 150 per cent. In other words, India’s banking system has been struggling to meet the credit demands of a growing economy. There is only one Indian bank in the top 100 banks globally by size. Further, Indian banks are also one of the least cost-efficient.

- Clearly, India needs to bolster its banking system if it wants to grow at a fast clip. In this regard, it is crucial to note that public sector banks have been steadily losing ground to private banks as Charts 2, 3 and 4 show. Private banks are not only more efficient and profitable but also have more risk appetite.

With the above backdrop, the Internal Working Group (‘the IWG’), under the leadership of Dr. P.K.Mohanty, was constituted by RBI in June 2020 to examine and review the extant licensing and regulatory guidelines relating to ownership and control, corporate structure and other related issues.

The Terms of Reference (TOR) of the IWG were as under:

- To review the extant licensing guidelines and regulations relating to ownership and control in Indian private sector banks and suggest appropriate norms, keeping in mind the issue of excessive concentration of ownership and control, and having regard to international practices as well as domestic requirements;

- To examine and review the eligibility criteria for individuals/ entities to apply for banking licence and make recommendations on all related issues;

- To study the current regulations on holding of financial subsidiaries through non-operative financial holding company (NOFHC) and suggest the manner of migrating all banks to a uniform regulation in the matter, including providing a transition path;

- To examine and review the norms for promoter shareholding at the initial/licensing stage and subsequently, along with the timelines for dilution of the shareholding; and,

- To identify any other issue germane to the subject matter and make recommendations thereon.

IWG has made the following major recommendations on the various issues that were considered for deliberations:

1. Lock-in period for promoters’ initial shareholding, limits on shareholding in long run, dilution requirement and voting rights

- No change may be required in the extant instructions related to initial lock-in requirements, which may continue as minimum 40 per cent of the paid-up voting equity share capital of the bank for first five years.

- The cap on promoters’ stake in long run of 15 years may be raised from the current levels of 15 per cent to 26 per cent of the paid-up voting equity share capital of the bank.

- No intermediate sub-targets between 5-15 years may be required.

- As regards non-promoter shareholding, current long-run shareholding guidelines may be replaced by a simple cap of 15 per cent of the paid-up voting equity share capital of the bank, for all types of shareholders.

2. Pledge of Shares

- Pledge of shares by promoters during the lock-in period, which amounts to bringing the unencumbered promoters’ shares below the prescribed minimum threshold, should be disallowed.

- In case invoking the pledge results in purchase/transfer of shares of such bank beyond 5 per cent of the total shareholding of the bank, without prior approval of Reserve Bank, it may restrict the voting rights of such pledgee till the pledgee applies to Reserve Bank for regularisation of acquisition of these shares.

- The Reserve Bank may introduce a reporting mechanism for pledging of shares by promoters of private sector banks.

3. ADR/GDR issued by banks

The Reserve Bank may legally examine the issue and make suitable regulations so that this conduit is not used by dominant shareholders to indirectly enhance their voting power. The options may include prior approval of the Reserve Bank before entering into agreements with depositories, with a provision to modify the Depository Agreement to assign no voting rights to depositories; and a mechanism for disclosure of the details of ultimate depository receipt holders so that indirect holding may be reckoned along with direct holding.

4. Eligibility of Promoters

- Large corporate/industrial houses may be allowed as promoters of banks only after necessary amendments to the Banking Regulations Act, 1949 to deal with connected lending and exposures between the banks and other financial and non-financial group entities; and strengthening of the supervisory mechanism for large conglomerates, including consolidated supervision.

- Well run large Non-banking Financial Companies (NBFCs, with an asset size of ₹50,000 crore and above, including those which are owned by a corporate house, may be considered for conversion into banks provided they have completed 10 years of operations and meet the due diligence criteria and satisfy the additional conditions specified in this regard.

- With regard to individuals and entities/groups, the provisions of the extant on-tap licensing on universal banks and SFBs are appropriate and do not warrant any change. However, for Payments Banks intending to convert to a Small Finance Bank, track record of 3 years of experience as Payments Bank may be sufficient.

5. Initial Capital

- The minimum initial capital requirement for licensing new banks should be enhanced as below:

- For Universal banks: The initial paid-up voting equity share capital/ net worth required to set up a new universal bank, may be increased to ₹1000 crore.

- For Small Finance Banks: The initial paid-up voting equity share capital/ net worth required to set up a new SFB, may be increased to ₹300 crore.

- For UCBs transiting to SFBs: The initial paid-up voting equity share capital/ net worth should be ₹150 crore which has to be increased to ₹300 crore in five years.

- As the licensing guidelines are now on continuing basis (on-tap), the Reserve Bank may put a system to review the initial paid up voting equity share capital/net-worth requirement for each category of banks, once in five years.

6. Corporate Structure – Non-operative Financial Holding Company (NOFHC)

- NOFHCs should continue to be the preferred structure for all new licenses to be issued for Universal Banks. However, NOFHC may be mandatory only in cases where the individual promoters / promoting entities / converting entities have other group entities.

- Banks currently under NOFHC structure may be allowed to exit from such a structure if they do not have other group entities in their fold.

- While banks licensed before 2013 may move to an NOFHC structure at their discretion, once the NOFHC structure attains a tax-neutral status, all banks licensed before 2013 shall move to the NOFHC structure within 5 years from announcement of tax-neutrality.

- The Reserve Bank should engage with the Government to ensure that the tax provisions treat the NOFHC as a pass-through structure.

- The concerns with regard to banks undertaking different activities through subsidiaries/Joint Ventures (JVs)/associates need to be addressed through suitable regulations till the NOFHC structure is made feasible and operational. The Reserve Bank may frame suitable regulations in this regard inter alia incorporating the following and the banks must be required to fully comply with these regulations within a period of two years.

- The bank and its existing subsidiaries/JVs/associates should not be allowed to engage in similar activity that a bank is permitted to undertake departmentally. The term ‘similar activity’ to be defined clearly.

- If a group entity desires to continue undertaking any lending activity, the same shall not be undertaken by the bank departmentally and the group entity shall be subject to the prudential norms as applicable to banks for the respective business activity.

- Banks should not be permitted to form/acquire/associate with any new entity [subsidiary, JV or Associate (>20% stake – signifying significant influence or control)] or make fresh investments in existing subsidiary/JV/associate for any financial activity. Investments in ARCs may be as per extant norms.

- However, banks may be permitted to make total investments in financial or non-financial services company which is not a subsidiary/JV/associate upto 20 per cent of the bank’s paid up share capital and reserves.

7. Listing Requirements

- SFBs to be set up in future: Such banks should be listed within ‘six years from the date of reaching net worth equivalent to prevalent entry capital requirement prescribed for universal banks’ or ‘ten years from the date of commencement of operations’, whichever is earlier.

- For existing small finance banks and payments banks: Such banks should be listed ‘within six years from the date of reaching net worth of ₹500 crore’ or ‘ten years from the date of commencement of operations’, whichever is earlier.

- Universal banks: Such banks shall continue to be listed within six years of commencement of operations.

8. Harmonisation of Various Licensing Guidelines

- Whenever a new licensing guideline is issued, if new rules are more relaxed, benefit should be given to existing banks, immediately. If new rules are tougher, legacy banks should also confirm to new tighter regulations, but transition path may be finalised in consultation with affected banks to ensure compliance with new norms in a non-disruptive manner.

- As and when the changes in certain norms, as recommended by the Group in this report are accepted by Reserve Bank, these should be made applicable to existing banks also, in the manner as prescribed in previous paragraph.

- As the licensing is now on-tap, Reserve Bank may prepare a comprehensive document encompassing all licensing and ownership guidelines at one place, with as much as possible harmonisation and uniformity, providing clear definition of all major terms. These guidelines may be equally applicable on legacy or new banks. This may be updated from time to time depending on emerging requirements.

INDIAN BACKGROUND WITH REGARD TO CORPORATES AS BANKERS:

- Various industrial consortiums aiming to enter the commercial banking zone since 1993 ever since private players were permitted into banking.

- In 2008, the Committee on Financial Sector Reforms led by Raghuram Rajan strongly rejected the admission of corporate businesses into banking and observed that exclusion is necessary like in the US. The committee also declared that up until private governance and governing capability progress, the prohibition is needed.

- In 2012, many NBFCs supported by outsized industrial establishments showed interest for banking permits. Bajaj Finserv, M&M Finance, Tata Capital, L&T Financial Holdings, Aditya Birla Capital, Shriram Transport, Cholamandalam Investments and Finance, Muthoot Finance are the few NBFCs who demonstrated high level interest for banking licenses.

- For the first time in 2013 the Reserve Bank, in its Guidelines for Licensing of New Banks in the Private Sector, had prescribed several structural requirements of promoting a bank under an NOFHC which permitted industrial and business houses to set up banks with certain conditions. Certain large corporate houses applied for a licence under this new policy of which few entities withdrew their application. Eventually only IDFC Bank and Bandhan Bank, both from the financial services sector, were given permission to set up banks. The Reserve Bank, in its in-principle approval of these two banks in 2014, stated the following about its decision to only issue these two licences: “At a time when there is public concern about governance, and when it comes to licences for entities that are intimately trusted by the Indian public, this may well be the most appropriate stance.”

- The apex bank reinstated the time-honored ban on the entry of corporate establishments into banking in 2014 and the RBI’s viewpoint on the theme remained same since then.

VIEWS OF IWG ON CORPORATES AS BANKERS:

- IWG acknowledged the arguments in favour of allowing such entities:

- that they can be an important source of capital and can bring in their experience, management expertise, and strategic direction to banking.

- It is also a fact that many of such corporate/industrial houses have been successfully operating in other financial segments.

- The IWG also noted that internationally, there are very few jurisdictions which explicitly disallow large corporate houses, and even in these jurisdictions, it is not a settled issued.

- On balance, the IWG was of the view that what may be more important in taking a conclusive view on this critical question would be the robustness of the institutional and legal setting.

- Notwithstanding the merits of permitting large corporate/industrial houses to own banks, certain prerequisites may be necessary before considering the same in view of valid concerns. These would include:

- a strong legal framework for addressing connected lending and an enabling framework for consolidated supervision.

- These mechanisms would be imperative to deal with intra-group transactions and exposures that may be detrimental to the banking entity. For instance, though the US does not allow commercial firms to own banks, there are specific provisions in the Federal Reserve Act on regulating relations with affiliates and even putting restrictions on transactions with affiliates.

- In India too, the need for such an enabling legal provision was flagged by two Committees in the past - Working Group on Consolidated Accounting and Other Quantitative Methods to Facilitate Consolidated Supervision (2001) and Inter-Regulatory Working Group on Monitoring of Financial Conglomerates (2004).

- While the Reserve Bank has issued guidelines in 2014 on Management of Intra-Group Transactions and Exposures, without appropriate legal backing the concerns in this regard will not be fully addressed.

- The IWG also noted that tracking of money trail is basically an investigative function and not a supervisory function.

- Companies (Significant Beneficial Owners) Rules have been notified in 2018 and still evolving. Till these rules get clarity and settle down, the haze before ultimate beneficiary may continue, making it difficult to track the inter-linkages.

- Given the various ramifications, the IWG agreed that a cautious approach needs to be adopted in this regard.

- As such the IWG recommends that large corporate/industrial houses may be permitted to promote banks only after necessary amendments to the Banking Regulations Act, 1949 to deal with connected lending and exposures between the banks and other financial and non-financial group entities akin to the US Federal Reserve Act in this regard; and strengthening of the supervisory mechanism for large conglomerates, including consolidated supervision. RBI may examine the necessary legal provisions that may be required to deal with all concerns in this regard.

WHY THE RECOMMENDATIONS TO ALLOW CORPORATES TO FLOAT THEIR OWN BANKS IS BEING CRITICISED?

- The propositions of the IWG of the RBI have created tremor amongst brainy banking leaders and wizards like former RBI governor and deputy governor Raghuram Rajan and Viral Acharya, have labeled it as a ‘bombshell’.

- Moreover, countless credible voices have upheld their opinion. Primarily many problematic issues like inherited distrust in the banking sector and irrepressible weaknesses of the regulator’s ability and autonomy made them to act so.

- The foremost disagreement towards the proposal is that business firms obviously stage-manage the system and stakeholders’ wealth since these firms could get finance effortlessly and without any interrogations if they have in house bank. Of late, the banking sector has witnessed plentiful incidences of failure of public and private sector banks due to the greediness and untruthfulness of persons controlling the banks, with dangerous upshots to shareholders and depositors. Adjoining a bank to corporate entity definitely augment the intensity of economic power just like how politicians have utilized banks to promote their political interests. By owning bank corporate houses will tantalized to misuse the funds by diverting them to their buddies, cronies, customers or suppliers. Although many firms have power to run banks but they do not stimulate assurance when it comes to governance.

- Business establishments may transmit funds domestically and globally through large network of firms. Because of this feature, supervising the financial transactions of the business firms, locating interrelated lending will be difficult. This situation will necessitate the support of numerous law prosecution bureaus and business entities may use their political influence to prevent such cooperation. Even though the group suggested that the RBI should be armed with necessary legal power to deal with interconnected lending and procedure, with reference to Indian setting, it is foolish to assume that any legal outline and administrative system will be sufficient to deal with the intrinsic threats of interrelated lending. The reaction of the RBI to interconnected lending after significant exposure to the firms of the business houses has ensued, will not be able to check such exposure and it will be like post-mortem.

- Hostility between RBI and the corporate entities will damage the image of the regulator. Moreover, the regulator may have to face massive pressure to compromise on rules and regulations. As a result it may lose the reliability and its prominence will be in danger.

- Public sector banks are in dire need of capital that the government is incapable to give and the entry of corporate players probably to be a prologue to privatization. Also the valuations of the public sector banks have tattered in current years and this is the real attraction for business firms to acquire them. Considering what we know of governance in the Indian corporate sector, purchase of public sectors by corporate houses will jeopardize the financial solidity.

- The group contends that terms pertaining to the entry of corporate players who owns NBFCs into banking should be eased because the RBI knows well about the NBFCs owned by corporate entities and controlled them professionally. This is clearly misleading and hypocritical because there is a big gap between corporate owning a NBFC and one possessing a bank. Bank possession offers access to public protection net whereas NBFC possession not. The reach and power that bank ownership offers are widely excellent to that of a NBFC. Therefore, the restrictions that apply to a corporate firm with no presence in banking industry should similarly applicable to corporate firms that own NBFCs.

- The banking sector in India has been in trouble for the last few years, keeping that in mind the RBI is 2016 had created new guidelines on limit of lending to a single company. If a bank lends too much to one company only then it risks losing that money if the company sinks. Compare that rule with the new proposal, which only large companies will be able to fulfill. With the new rule, the RBI will create large capital, large entrepreneurship and large lending capacity, which, all in one hand is not healthy.

- This will lead to the creation of money into the hands of some, which could corrupt politics even more.

- Public sector banks in the country have become “blind wells” in which the government keeps throwing money with no returns. In order to revive taxpayers’ and depositors’ money, the government will have to either sell these banks to private players or find other public sector undertakings to return the amount.

- Indian banking regulators are not strong enough to prevent connected lending and the move to bring private players was too risky. Indian banking system does not have the desired supervisory capacity. Had it existed, self-destruction of banks like the Yes Bank could have been prevented.

- Mixing industry and finance will set us on a road that is dangerous for growth, public finance and the future of the country itself.

- Slippery-slope analogy: Once you start going down that gradient, it becomes difficult to control the descent. It has been the experience in India that once a small relaxation is allowed, it affords powerful lobbies space to keep driving wedges that finally change the original complexion of the regulation or legislation. The telecom regulatory landscape offers numerous examples of policy flip-flops–across ministers and governments–that fittingly demonstrate how policy structure is inherently unstable and malleable to external influences.

WHAT IS CONNECTED LENDING?

- Connected lending refers to a situation where the promoter of a bank is also a borrower and, as such, it is possible for a promoter to channel the depositors’ money into their own ventures.

- Connected lending has been happening for a long time and the RBI has been always behind the curve in spotting it.

- The recent episodes in ICICI Bank, Yes Bank, DHFL etc. were all examples of connected lending.

- The so-called ever-greening of loans (where one loan after another is extended to enable the borrower to pay back the previous one) is often the starting point of such lending.

- Unlike a non-bank finance company or NBFC (many of which are backed by large corporates), a bank accepts deposits from common Indians and that is what makes this riskier.

- Simply put, it is prudent to keep the class of borrowers (big companies) apart from the class of lenders (banks).

- Past examples of such mingling — such as Japan’s Keiretsu and Korea’s Chaebol — came unstuck during the 1998 crisis with disastrous consequences for the broader economy. Connected lending was the key factor behind 1997 Asian Financial crisis.

- In the past, RBI has always frowned upon this suggestion.

- There are challenges while dealing with interconnected lending: Multi sector cooperation required, Crony capitalism, No prevention possible, Complex process, Regulator credibility at stake.

Then why recommend it?

- The Indian economy, especially the private sector, needs credit to grow. Far from being able to extend credit, the government-owned banks are struggling to contain their non-performing assets.

- Government finances were already strained before the Covid crisis. With growth faltering, revenues have plummeted and the government has limited ability to push for growth through the public sector banks.

- Large corporates, with deep pockets, are the ones with the financial resources to fund India’s future growth.

Of course, choosing this option is not without serious risks.

RBI VIEW ON IWG PROPOSAL:

- RBI has distanced itself from proposal of corporate entry into banking.

- The recommendation should not be construed as the central bank’s point of view on the issue, according to Governor Shaktikanta Das.

- According to the RBI governor, the regulator’s decision-making process is consultative. For now, the working group’s report has been put in the public domain for comments. Once the regulator receives comments from various stakeholders, it will review the proposal and take a final decision.

THE OTHER SIDE OF THE COIN:

Further, it is important to understand that the need of corporates as bankers is motivated by the desire to have greater competition by allowing for more banks. A chronic feature of the Indian banking sector has been lazy banking, and the sector dominated by Public-Sector Banks will surely benefit from having greater competition. The issue here pertains to allowing existing businesses houses to set up their banks, as many believe the model is ‘risky’ and would lead to greater concentration of economic power. It has, thus, been argued that a bank owned by the borrower may undertake poor lending decisions and information on loan performance will not be timely or accurate. However, the assumption that a bank will be willing to lend to an unviable project using depositor’s money ignores the effect of such decisions on the viability of the bank itself. A business group — if it owns a bank — will be geared towards ensuring that the company is viable, and maximizes shareholder wealth by generating a healthy steam of profits. While there are concerns of banks funding other entities owned by business-houses, including evergreening of loans — a practice which was mastered by India’s public sector undertakings — however, we must realise regulations and mandatory disclosures can mitigate a major part of the risk associated with the same.

FINAL WORD:

RBI’s Internal Working Group’s recommendation to sanction corporate business units to establish banks and amendment of the Banking Regulation Act is a step in harmful way. This will surely give birth to crony capitalism and fiscal uncertainty. The RBI should learn lessons from East Asian’s bad loans crisis which was one of the biggest financial crashes in the world that started in Thailand in 1997 due to connected lending. Thus, corporate entities possessing banks barely meet the benchmark of strong restructurings and their entry into banking is the avenue to hell.

The Apex bank needs to shrewd and should design power-packed reforms urgently needed for the Indian banking sector. It should reveal its smartness through action, not reaction. An arrangement of accurate and strict safeguards will need to be put in place before the central bank allows billionaires to start banks in its wonderland. Steps that should be taken involve improving private governance and regulatory capacity, regulator has to enhance the credibility of the system by ensuring every deposit is safe especially with better governance, RBI should ensure the checks and balances before allowing corporates to become promoters.