Customs Duty refers to the tax that is imposed on the transportation of goods across international borders. It is a kind of indirect tax that is levied by the government on the imports and exports of goods. Companies that are into the export-import business need to abide by these regulations and pay the customs duty as required.

Put differently, the customs duty is a kind of fee that are collected by the customs authorities for the movement of goods and services to and from that country. The tax that is levied for the import of products is referred to as import duty, while the tax levied on the goods that are exported to some other country is known as an export duty.

The primary purpose of customs duty is to raise revenue, safeguard the domestic business, jobs, environment and industries etc. from predatory competitors of other countries. Moreover, it helps reduce fraudulent activities and the circulation of black money.

The customs duty is calculated based on various factors such as the following:

Moreover, if one is bringing a good for the first time in India, she/he must declare it as per the customs rule.

India has a well-developed taxation structure. The tax system in India is mainly a three-tier system that is based between the Central, State Governments and the local government organizations. Customs duty in India falls under the Customs Act 1962 and Customs Tariff Act of 1975.

India's tariff system is based on the Harmonised System of Nomenclature (HSN) of the Customs Co-operation Council.

It also follows the Directorate-General of Commercial Intelligence and Statistics (DGCI&S) that uses eight-digit codes for statistical purposes, and the Directorate General of Foreign Trade (DGFT) that has broadly extended the eight-digit DGCI&S codes up to 10 digits.

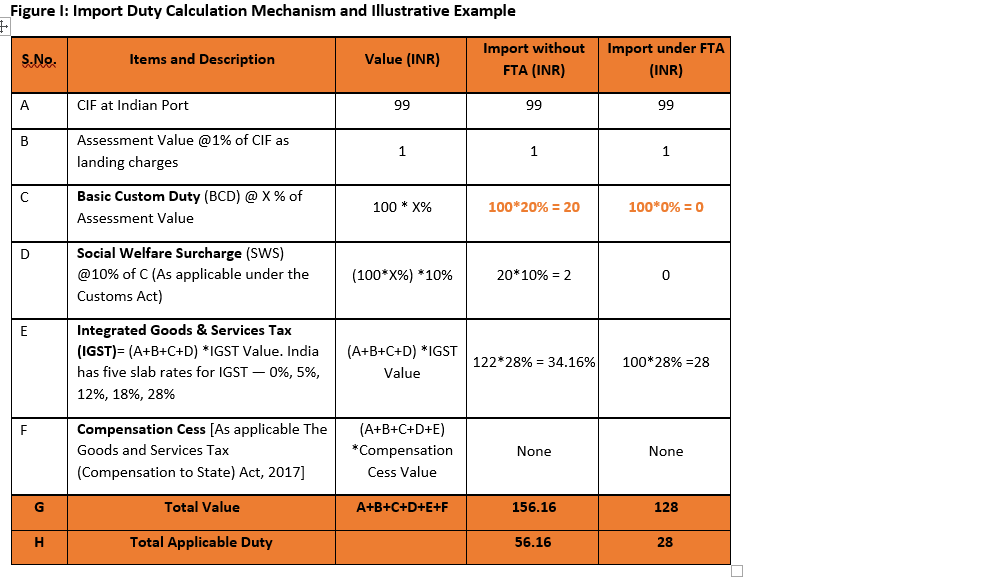

The sample calculation for identifying import duties on equipment, raw material and other inputs is displayed in the following Figure. The calculation has four variable values, where the rate of tax depends upon the HSN Codes of the products. These four variables are points c,d,e,f :

|

Harmonized Commodity Description and Coding Systems (HS) The Harmonized System is an international nomenclature for the classification of products. It allows participating countries to classify traded goods on a common basis for customs purposes. At the international level, the Harmonized System (HS) for classifying goods is a six-digit code system. The Harmonized System was introduced in 1988 and has been adopted by most of the countries worldwide. |

Usually, the goods that are imported to the country are charged customs duty along with educational cess. The customs duty is evaluated on the value of the transaction of the goods.

The basic structure of import and export tariffs in India includes:

The additional duty is applied to all imports except for wine, spirits and alcoholic beverages. Furthermore, the special additional duty is calculated on top of the basics duty and additional duty.

Customs duties are levied on almost all goods that are imported into the country. On the other hand, export duties are levied on a few items as mentioned in the Second Schedule. Customs duties are not levied on life-saving drugs, fertilizers, and food grains. Customs duties are divided into different taxes, such as:

This is levied on imported items that are part of Section 12 of the Customs Act, 1962. The tax rate is levied as per First Schedule to Customs Tariff Act, 1975.

It is levied on goods that are stated under Section 3 of the Customs Tariff Act, 1975. The tax rate is more or less similar to the Central Excise Duty charged on goods produced within India. This tax is subsumed under GST now.

This is levied for the purpose of protecting indigenous businesses and domestic products against overseas imports. The rate is decided by the Tariff Commissioner.

This is charged at 2%, with an additional higher education cess 1%, as included in the customs duty.

This is levied if a particular good is being imported is below fair market price.

This is levied of the customs authorities feel that the exports of a particular good can damage the economy of the country.

|

Countervailing Duties' Duties that are imposed in order to counter the negative impact of import subsidies to protect domestic producers are called countervailing duties. In cases foreign producers attempt to subsidize the goods being exported by them so that it causes domestic production to suffer because of a shift in domestic demand towards cheaper imported goods, the government makes mandatory the payment of a countervailing duty on the import of such goods to the domestic economy. This raises the price of these goods leading to domestic goods again being equally competitive and attractive. Thus, domestic businesses are cushioned. These duties can be imposed under the specifications given by the WTO (World Trade Organization) after the investigation finds that exporters are engaged in dumping. These are also known as anti-dumping duties.

Anti-Dumping Duty Anti-dumping duty is a tariff imposed on imports manufactured in foreign countries that are priced below the fair market value of similar goods in the domestic market. The government imposes anti-dumping duty on foreign imports when it believes that the goods are being “dumped” – through the low pricing – in the domestic market. Anti-dumping duty is imposed to protect local businesses and markets from unfair competition by foreign imports.

The duty is priced in an amount that equals the difference between the normal costs of the products in the importing country and the market value of similar goods in the exporting country or other countries that produce similar products. Calculating the Anti-Dumping Duty The WTO Anti-Dumping Agreement allows governments to act in a way that does not discriminate between trading partners and honors the DATT 1994 principle when calculating the duty. The GATT 1994 principle provides a number of guidelines to govern trade between members of the WTO. It requires that imported goods not to be subjected to internal taxes in excess of the costs imposed on domestic goods.

Also, it requires that imported goods be treated the same way as domestic goods under domestic laws and regulations. However, it allows the government to impose a duty on foreign imports if they exceed the bound rates and threaten to cause injury to the domestic market. |

It is a tax imposed on the value of goods including the BCD value. It is generally 10% unless the good is exempted from this tax. Social Welfare Surcharge was introduced in the Budget 2018 is levied in place of education Cess

Introduced on 1 July 2017, GST subsumed most indirect taxes such as excise duties and a special additional customs duty that was applied previously. A concept note on GST can be accessed at this Link on website of GST Council. IGST is imposed on the imported goods to provide a level playing field for domestic manufacturers, who also pay an equivalent tax (Central GST + State GST or IGST) on sale of goods. IGST on imported goods can be set-off against any other GST liability in India. There are five slabs of IGST 0%, 5%, 12%, 18%, 28%.

Value of imported Goods + Basic Customs Duty + Social Welfare Surcharge = Value on which IGST is calculated

Value x IGST Rate = IGST Payable

This is an additional tax that is imposed along with GST on both imported items as well as domestically manufactured items on products that are classified as notified (mostly belonging to the luxury and demerit category) E.g. Special Utility Vehicles, Cigarettes, Tobacco, Aerated Water, etc.

The Indian government assesses a 1% customs handling fee on all imports in addition to the applied customs duty.

Tariff rates, excise duties, regulatory duties, and countervailing duties are revised in each annual budget in February and are published in various sources.

There are five mechanisms that can be used to reduce the applicable BCD. Exemption or waiver of IGST is not permitted as per law:

Units operating in SEZ are exempted from BCD and IGST on Capital Goods, Raw Material and other Fixtures. If these units, do any sales in the domestic market of India then they pay applicable BCD + IGST on the product or service.

Bonded Warehouse can be used for the storage of goods as well as for manufacturing. Unitholders can defer BCD on imported Capital Goods, Raw materials, and other Fixtures. This duty can be deferred until clearance in the domestic tariff area and can be exempted if the products are exported/re-exported. There is no time limit for duty deferment.

Governed by SEZ Act 2005 and SEZ Rules. Predominately for EXIM trade & storage. Duty deferment permitted on imported goods and also permits trade transactions in foreign currency.

Import policy is published by Directorate General of Foreign Trade (DGFT), Ministry of Commerce & Industry. Foreign Trade Policy schemes that can help reduce BCD liability are:

Most Favoured Nation (MFN) or arrangements under FTA /PTA can help reduced BCD rates.

Note: India has signed several FTAs and PTAs with countries in East Asia (Japan, Korea, Malaysia, Thailand, Singapore) and ASEAN Bloc, among others. Details of these agreements can be accessed at this Link on website of the Ministry of Commerce & Industry.

India Trade Portal is portal developed and maintained by the Federation of Indian Export Organisations (FIEO), Ministry of Commerce & Industry. The portal can be leveraged to identify BCD rates as per arrangements under Most-Favoured Nation (MFN), Free Trade Agreements (FTAs) and Preferential Trade Agreements (PTAs).

© 2025 iasgyan. All right reserved