Pareto's efficiency is defined as the economic situation when the circumstances of one individual cannot be made better without making the situation worse for another individual. Pareto's efficiency takes place when the resources are most optimally used. Pareto's efficiency was theorized by the Italian economist and engineer Vilfredo Pareto.

Description: It is a purely economic concept and has no relationship with the concept of equal or fair utilization of resources. It has wide applications in the field of economics and engineering.

It is the final optimum solution beyond which any change would directly lead to loss in the allocation of resources. Pareto's efficiency is, thus, the complete solution in itself. However, it is almost impossible to achieve.

Catch up effect, alternatively called the theory of convergence, states that poor or developing economies grow faster compared to economies with a higher per capita income and gradually reach similar high levels of per capita income. Thus, all economies, over time, may converge in terms of income per head.

Deadweight loss can be stated as the loss of total welfare or the social surplus due to reasons like taxes or subsidies, price ceilings or floors, externalities and monopoly pricing. It is the excess burden created due to loss of benefit to the participants in trade which are individuals as consumers, producers or the government.

Seigniorage is the difference between the value of currency/money and the cost of producing it. It is essentially the profit earned by the government by printing currency.

Tulip mania is used as a metaphor to describe an economic bubble. Tulip mania was a period when tulips were recently introduced and bought in large quantities by many people. This caused tulip prices to shoot up. They were sold at prices higher than skilled workers' income. After reaching a peak, tulip prices crashed, leaving tulip holders bankrupt. It was the first major economic bubble.

Present analogy: People start investing in a particular asset in large quantities because of positive sentiments about it. This pushes the prices of that asset to very high levels. After reaching a peak, prices suffer a sharp fall due to an extensive sell off, leaving the asset holders bankrupt. These assets are metaphorically called tulips.

Windfall gain (or windfall profit) is an unexpected gain in income which could be due to winning a lottery, unforeseen inheritance or shortage of supply. Windfall gains are transitory in nature.

For instance, when real estate property prices rise dramatically, the owner can make a substantial amount of profit by selling property. This sudden and unexpected rise in income is called windfall profit. Many countries define proper laws to tax windfall profits.

True cost economics is an economic model that includes the cost of negative externalities associated with goods and services.

If the prices of goods and services do not include the cost of negative externalities or the cost of harmful effects they have on the environment, people might misuse them and use them in large quantities without thinking about their ill effects on the environment. Therefore, environmentalists support true cost economics to counter the impact of negative externalities.

This commonly-used phrase stands for 'all other things being unchanged or constant'. It is used in economics to rule out the possibility of 'other' factors changing, i.e. the specific causal relation between two variables is focused.

It is particularly crucial in the study of cause and effect relationship between two specific variables such that other relevant factors influencing these are assumed to be constant by the assumption of Ceteris Paribus.

The opposite for this is the phrase 'mutatis mutandis', which states changing some factors that need to be changed. Ceteris paribus is often a fundamental assumption to the predictive purpose of scrutiny.

In economics and finance, a contagion can be explained as a situation where a shock in a particular economy or region spreads out and affects others by way of, say, price movements.

Paradox of thrift was popularized by the renowned economist John Maynard Keynes.

It states that individuals try to save more during an economic recession, which essentially leads to a fall in aggregate demand and hence in economic growth. Such a situation is harmful for everybody as investments give lower returns than normal.

When a firm uses its resources to procure an unwarranted monetary gain from external elements, be it directly or indirectly, without giving anything in return to them or the society, it is termed as rent-seeking.

A popular example for rent-seeking is political lobbying by companies. These are primarily done by companies in order to make economic gains through government action.

This might be done by a company to get subsidy from the government for the product which it produces or increasing tariff rates by the government for its services, etc. Such a practice neither leads to creation of new wealth, nor does it benefit the society.

The principle agent problem arises when one party (agent) agrees to work in favor of another party (principle) in return for some incentives. Such an agreement may incur huge costs for the agent, thereby leading to the problems of moral hazard and conflict of interest. Owing to the costs incurred, the agent might begin to pursue his own agenda and ignore the best interest of the principle, thereby causing the principal agent problem to occur.

For example: Shareholders of a company appoint managers to look after the proceedings of the company and earn profits on their behalf. The shareholders expect the managers to distribute all the profits to the shareholders. But the managers sensing their own growth and salary expectation try to retain the profits for future as a safe side. This can lead to principle agent problem. It is one of the most noticed problems in the current situation when most companies are not being managed by the owners themselves.

The Interest Coverage Ratio (ICR) is a financial ratio that is used to determine how well a company can pay the interest on its outstanding debts. The ICR is commonly used by lenders, creditors, and investors to determine the riskiness of lending capital to a company. The interest coverage ratio is also called the “times interest earned” ratio.

Off-price retailers are retailers who provide high quality goods at cheap prices. They usually sell second-hand goods, off-the-season items etc.

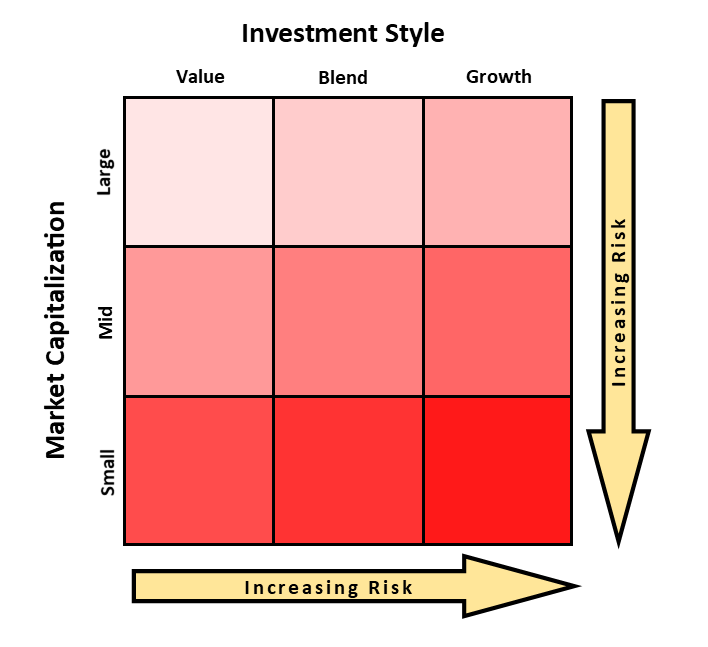

An equity style box is a visual representation of the key investment characteristics of stocks and stock mutual funds. The style box is a valuable tool for investors to use to determine the risk-return structures of their stocks/stock portfolios and/or how these investments fit into their investing criteria.

The Sharpe ratio and the Sortino ratio are both risk-adjusted evaluations of return on investment. The Sharpe ratio indicates how well an equity investment is performing compared to a risk-free investment, taking into consideration the additional risk level involved with holding the equity investment. The Sortino ratio is a variation of the Sharpe ratio that only factors in downside risk. Before selecting an investment vehicle, investors should seek the risk-adjusted return and not just the simple return.

‘Dead Cat Bounce’ is a market jargon for a situation where a security (stock) or an index experiences a short-lived burst of upward movement in a largely downward trend. It is a temporary rally in the price of a security or an index after a major correction or downward trend.

It is a pricing pattern used by stock analysts to determine whether a spurt in the price of a stock after a major correction is a reversal of the downward trend or just a dead cat bounce.

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. It is used to limit loss or gain in a trade. The concept can be used for short-term as well as long-term trading. This is an automatic order that an investor places with the broker/agent by paying a certain amount of brokerage. Stop-loss is also known as ‘stop order’ or ‘stop-market order’. By placing a stop-loss order, the investor instructs the broker/agent to sell a security when it reaches a pre-set price limit.

In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to.

A contra fund is defined by its against-the-wind kind of investing style. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. This is done with the belief that the herd mentality followed by investors on the Street will lead to mispricing of assets, which will pick up steam in the long run, creating opportunities for investors to generate superlative returns.

Floating stock can be defined as the total number of shares of a stock that are available for trading in an open market. It can be calculated by subtracting the sum of closely-held shares (shares that are not publicly traded) plus restricted stock (non- transferable stock of a company) from the company’s total outstanding shares.

© 2025 iasgyan. All right reserved