Introduction

Political finance has long served as the wellspring of corruption in India. As the costs of elections have soared, politico- bureaucratic-corporate nexus has been used to skillfully manipulate the regulatory and policy levers at their disposal in exchange for easy campaign cash. Campaign spending is an investment—one that pays back with interest once the person is in office. While these realities are well known, the dark currents of political funding largely flow out of public view.

Amidst this depressing backdrop, in 2017 the government created a new political funding mechanism, known as electoral bonds. It was called as a harbinger of a new era of transparency and accountability. Experts are however divided on the efficacy of this instrument. Before we analyze by delving deeper let us learn about the basics of Electoral Bonds.

What are electoral bonds?

The central government had on January 29, 2018, notified the electoral bond scheme. It is like a promissory note that can be bought by any Indian citizen or company incorporated in India from select branches of the State Bank of India. The citizen can then donate the same to any eligible political party of his/her choice. These are issued by Scheduled Commercial banks upon authorization from the Central Government to intending donors, but only against cheque and digital payments (it cannot be purchased by paying cash).

Who can receive electoral bonds?

Issued in multiple values of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1 crore, these bonds can only be encashed by political parties, which had secured at least 1 percent of the votes polled in the most recent Lok Sabha or state election.

Money received from electoral bonds will be deposited in a bank account verified by the Election Commission. All the transactions for electoral bonds can be done only through that account.

Key Features of Electoral Bond

- It is an interest-free banking instrument issued on a non-refundable basis and is not available for trading.

- Further, no loan would be provided against these bonds. A citizen of India or a body incorporated in India will be eligible to purchase the bond.

- It would be issued/purchased for any value, in multiples of 1,000, Rs.10,000, Rs.1,00,000, Rs.10,00,000 and Rs.1,00,00,000 from the Specified Branches of the State Bank of India (SBI).

- The purchaser would be allowed to buy Electoral Bonds either singly or jointly with other individuals, only on due fulfillment of all the extant KYC norms and by making payment from a bank account either using a cheque or electronically.

- It will not carry the name of payee.

- Electoral Bonds would have a life of only 15 days during which it can be used for making a donation only to the political parties registered under section 29A of the Representation of the Peoples Act, 1951 and which secured not less than one percent of the votes polled in the last general election to the House of the People or a Legislative Assembly.

- Further, the Electoral Bonds under the Scheme shall be available for purchase for a period of 10 days each in the months of January, April, July and October, as may be specified by the Central Government.

- An additional period of 30 days shall be specified by the Central Government in the year of the General election to the House of People.

- The Electoral Bonds shall be encashed by an eligible political party only through a designated bank account with the authorized bank.

- No payment shall be made to any payee political party if the bond is deposited after the expiry of the validity period and the bond deposited by any political party to its account shall be credited on the same day.

- The information furnished by the buyer shall be treated confidentially by the authorized bank and shall not be disclosed to any authority for any purposes, except when demanded by a competent court or upon registration of criminal case by any law enforcement agency.

- No commission, brokerage or any other charges for the issue of the bond shall be payable by the buyer against the purchase of the bond.

- Previously, as per Section 29C (1) of The Representation of People Act, 1951, the political party needed to disclose the details of non-governmental corporations and persons who donate more than Rs. 20,000 to it in a financial year.

- However now, vide the Finance Bill 2017, it has been specified that no report needs to be prepared in respect of the contributions received by way of an electoral bond.

Are electoral bonds taxable?

- In February 2017, it was asserted that the donations would be tax-deductible. Hence, a donor will get a deduction and the recipient, or the political party, will get tax exemption, provided returns are filed by the political party.

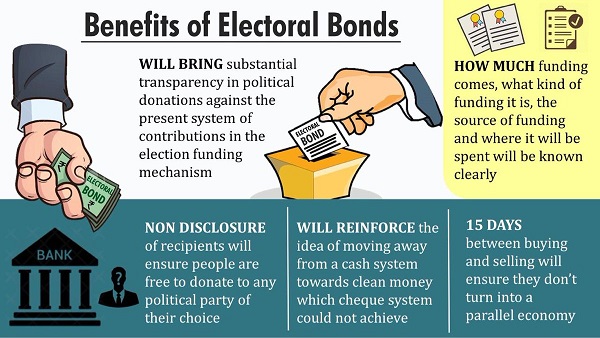

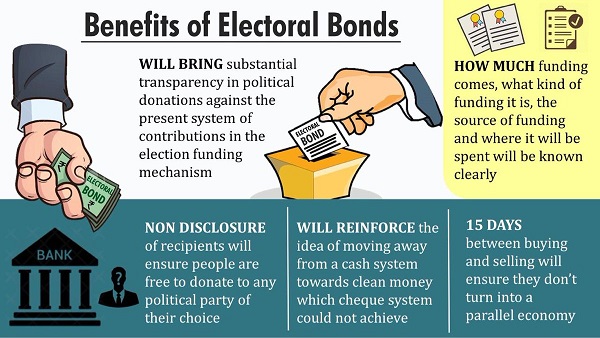

Benefits of Electoral Bonds

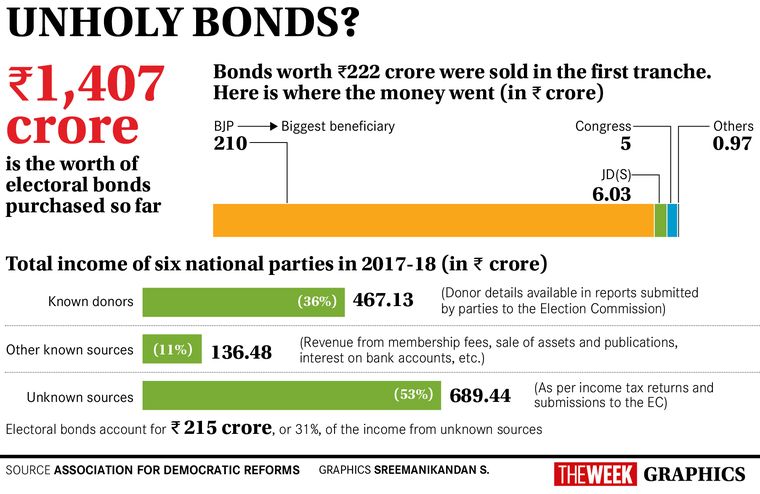

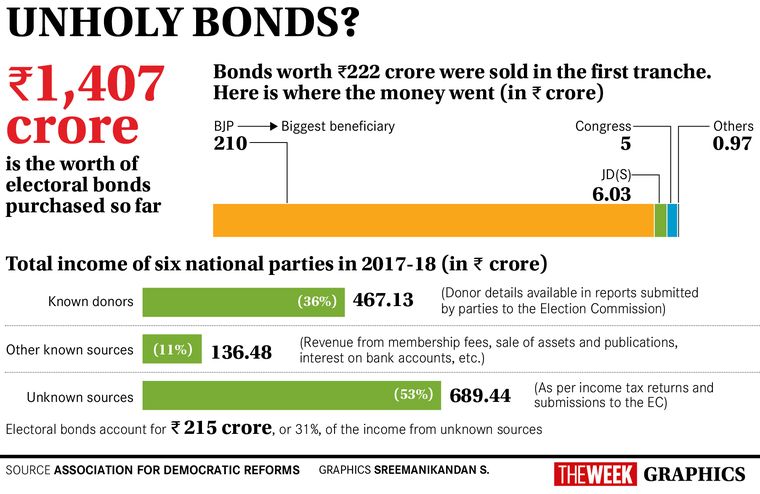

- Transparency: The ADR (Association for Democratic Rights) study shows that 69% of political funding in India comes from unknown sources. In this situation, Electoral bonds give an alternative and transparent route for parties to collect funds and meet election expenditures.

- Secure: Since the donor purchases electoral bonds after submitting KYC details to the bank, it is a more transparent tool than cash.

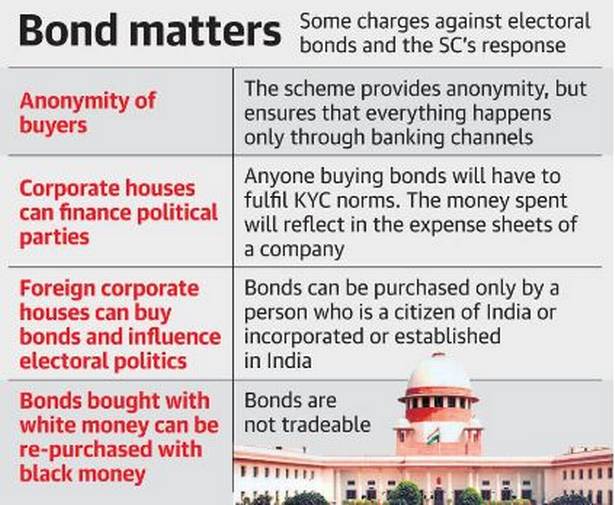

- Anonymity: Further, it also provides anonymity to donors which is essential since they need to be protected against any post-poll intimidation or harassment by political opponents.

- Combats counterfeiting: The life of these bonds is only 15 days which prevents the scope for misuse.

- Cleans up electoral finance: Also, the political parties are required to submit the details about contributions received through electoral bonds to the Election Commission. Hence the bonds help in cleaning up the system of electoral finance in India.

- Attracts political donation: The bonds also provide tax exemption to donors = making them an attractive route for providing political donations.

Criticism of Electoral Bonds

- RBI’s autonomy: The government had to amend the RBI act in order to issue bonds since the bearer bonds have the features of currency notes which are issued solely by the RBI. Hence the amendment amounts to dilution of the notes issuing the power of the RBI.

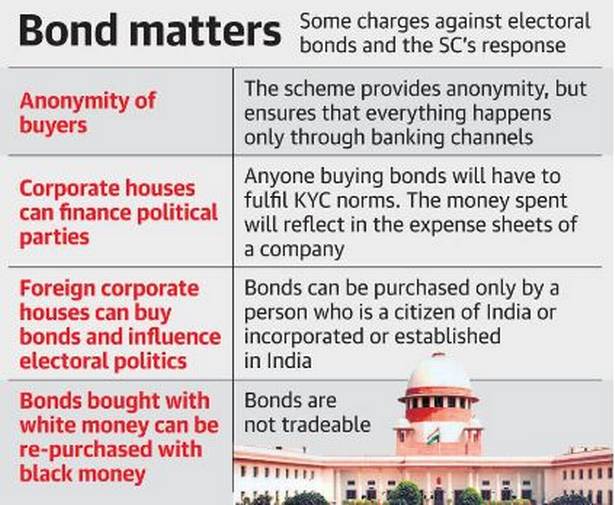

- Lack of transparency: The bonds are not registered in the name of the concerned person = donations via electoral bonds continue to provide anonymity to donors.

- Lack of enough secrecy: Another concern raised by political parties against the electoral bonds is that the ruling government can easily ascertain donor information using KYC details submitted in the banks.

- Black Money: The bonds could be used as a conduit for money laundering and hoarding black money. Since these bonds continue to provide anonymity to donors, they can be misused similar to the Indira Vikas Patras which were issued as development bonds in 1987 but were discredited due to similar reasons.

- Round-tripping/Tax evasion: These bonds will also facilitate round-tripping i.e., rerouting illegal money that originates in India, back into the country through a tax haven. Electoral bonds provide secrecy and will encourage such tax evasion. Note — Tax haven is a country or independent region where taxes are low.

- Lobbying: The secrecy and anonymity encourage lobbying and capture of governments by big donors which will result in the government of the few. The Scheme was to entice big corporate houses into making political donations without being identified - Experts.

- Non-disclosure to Election Commission: While RoPA, 1951 mandates that the funds received by political parties in sums greater than Rs 20,000 be disclosed to the tax authorities, the Finance Act 2017 explicitly provides an exemption to this clause to electoral bonds. This affects the very purpose of cleaning up electoral finance.

- Undemocratic: As the scheme was introduced through a money bill route = not debated in the upper house (Rajya Sabha) = undemocratic.

- Foreign funding: The Election Commission observed that with the removal of the cap on foreign funding, electoral bonds invite foreign corporate powers to impact Indian politics.

- Economic impacts: As electoral bonds eliminate the 7.5% cap on company donations, even loss-making companies can make unlimited donations = not good for the economy.

|

Restrictions that were done away with after the introduction of the electoral bond scheme

- Earlier, no foreign company could donate to any political party under the Companies Act

- A firm could donate a maximum of 7.5 percent of its average three-year net profit as political donations according to Section 182 of the Companies Act

- As per the same section of the Act, companies had to disclose details of their political donations in their annual statement of accounts.

The government moved an amendment in the Finance Bill to ensure that this proviso would not be applicable to companies in the case of electoral bonds.

|

- Affect Shareholders: As companies no longer need to declare the names of the parties, shareholders of the companies won’t know where their money has gone.

Supreme Court on Electoral Bond Scheme

On April 12, 2019 the Supreme Court asked all the political parties to submit details of donations received through electoral bonds to the ECI. It also asked the Finance Ministry to reduce the window of purchasing electoral bonds from 10 days to five days.

Election Commission of India's view on electoral bonds

The Election Commission on April 10, 2019, told the Supreme Court of India that while it was not against the Electoral Bonds Scheme, but it did not approve of anonymous donations made to political parties.

Reserve Bank of India on electoral bonds scheme

RBI was critical of the scheme. The central bank had warned the government that the bonds would "undermine the faith in Indian banknotes and encourage money laundering opacity, and could lead to potential abuse"

Reforms needed in Indian electoral funding

- Cash donations: The cap of Rs 2000 for cash donations offers an opportunity for the flow of black money into elections. This should be eliminated altogether. Election Commission has suggested that parties should be made to disclose funds received in cash for smaller sums in case they exceed 20 percent of total funds raised. This suggestion can be considered.

- Intensive scrutiny: of election expenditure incurred by parties and candidates is needed in order to ensure detection of black money in the system.

- Higher expenditure limit: In order to prevent parties from violating expenditure norms, the Election Commission should allow higher expenditure limit for candidates.

- Simultaneous elections: This should be considered since a shorter campaign period will limit expenses incurred by parties.

- National Electoral Fund: as suggested by the former Chief Election Commissioner S.Y.Quraishi shall also be explored, to which all donors can contribute and the funds are distributed among the parties. Funds could be allocated based on the votes they get. It will also protect the donors’ identity and wipe out black money with an annual audit by CAG.

- State funding of elections: shall be explored for bringing all parties on a level playing field and to make private donations less relevant.

Conclusion

Electoral bonds are much-needed instruments introduced to clean up the electoral finance in the country. Even though they raise some concerns, they are better than cash for bringing more transparency in electoral finance. The need of the hour is to implement the scheme with other reforms to completely eliminate the role of money power in Indian politics and strengthen Indian democracy.