Inflation is a general rise in the price level of most goods and services in an economy over a period of time, resulting in a sustained drop in the purchasing power of currency.

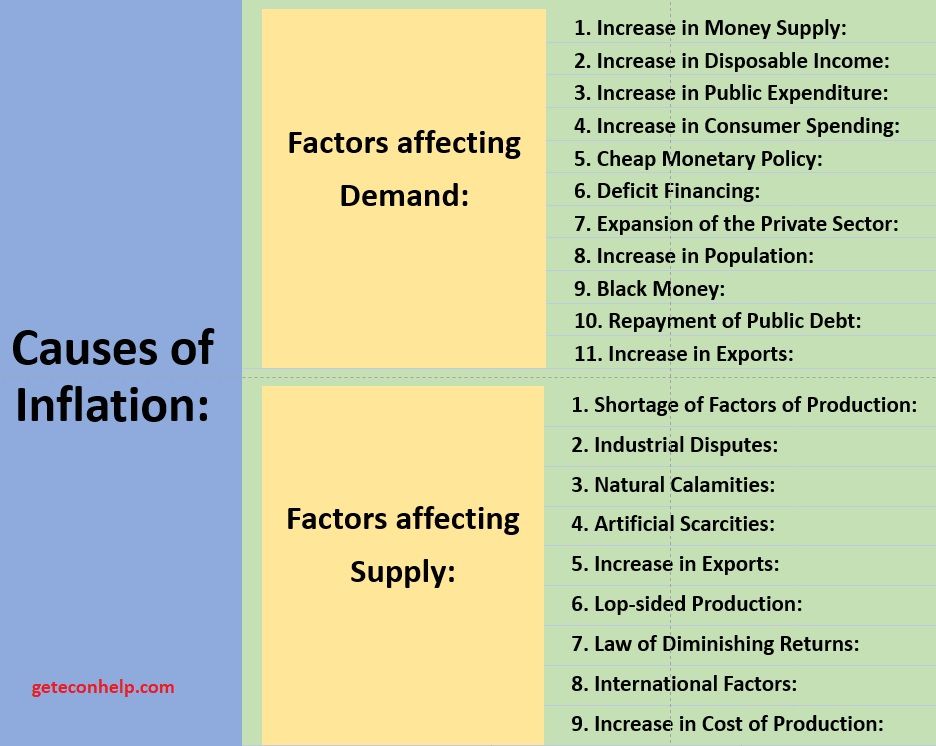

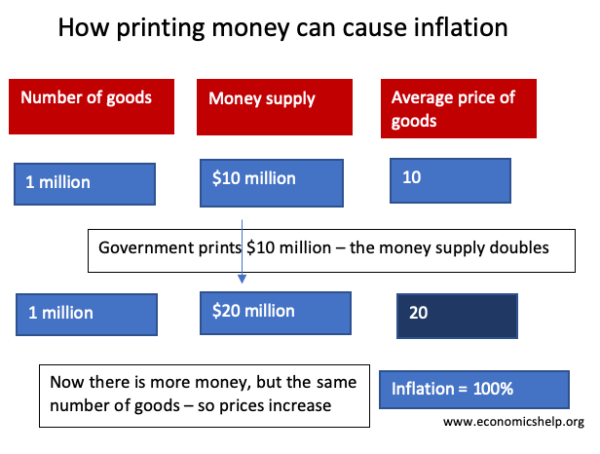

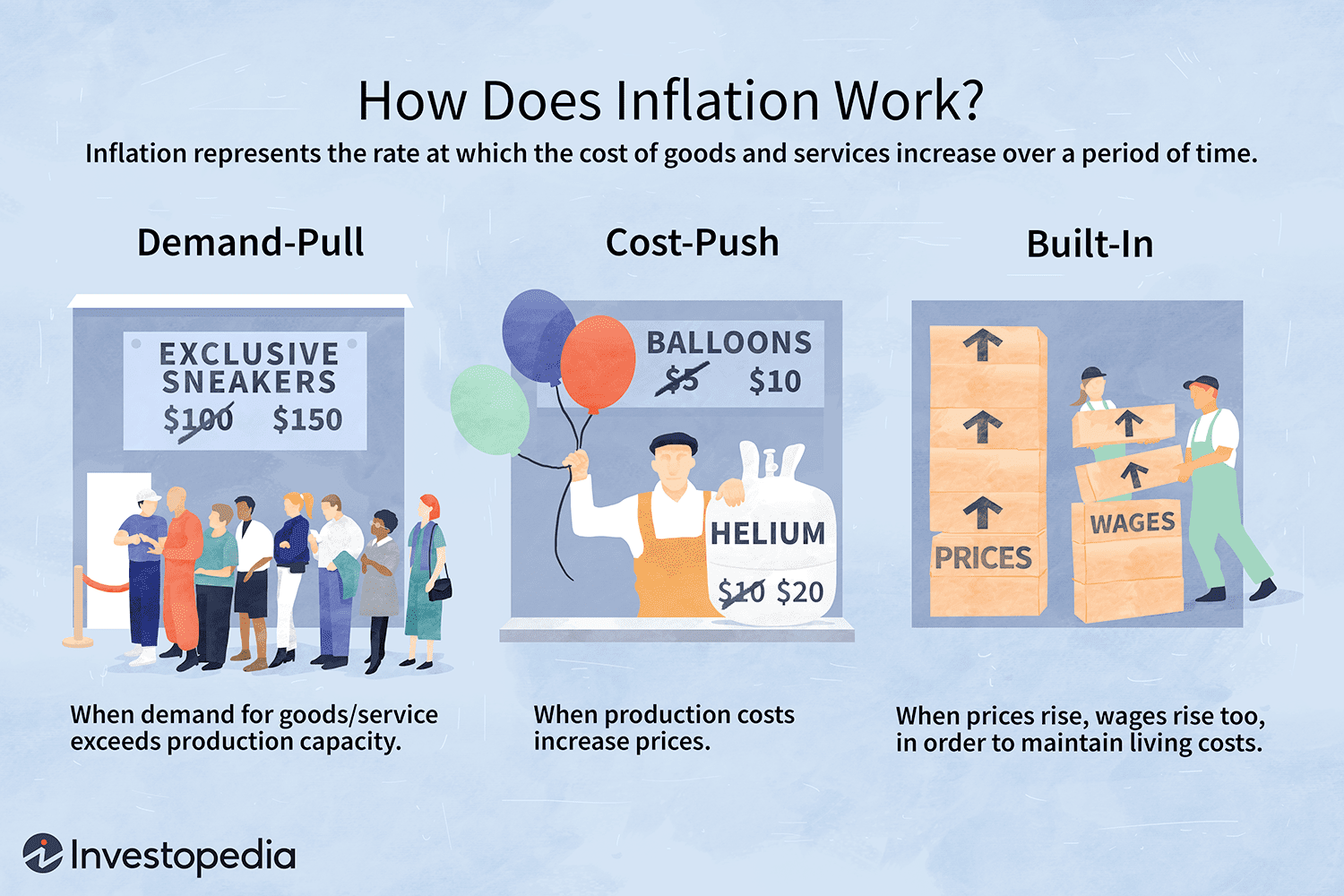

Following are some of the chief reasons for the increase in prices:

A too high or a too low inflation is harmful to the economy. However, a moderate value is actually good for the economy.

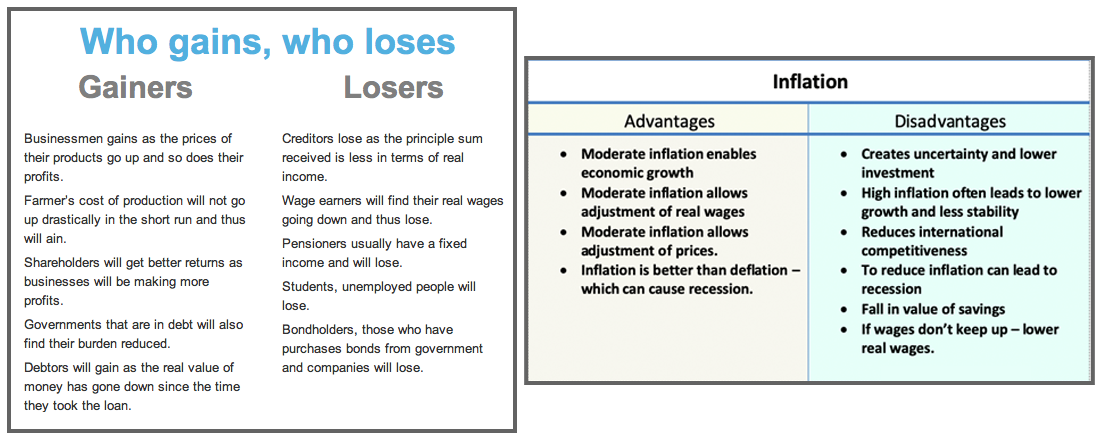

In general, Inflation is perceived differently by everyone depending upon the kind of assets they possess. For someone with investments in real estate or stocked commodity, inflation means that the prices of their assets are set for a hike. For those who possess cash, they may be adversely affected by inflation as the value of their cash erodes.

This acts as a stimulant for the economy by providing it with some momentum.

When we start expecting sustained price rise, we increase our spendings in order to beat inflation and as such this stimulates the growth of the economy. As we start spending more, it would increase the profit of the businesses who then start hiring more people or raise the salary of the existing employees or expand. All these, in turn, will help in the growth of the economy. Thus, this acts as an incentive for consumers to spend more, businesses to invest, wages to rise and employment to expand thereby helping the economy to grow.

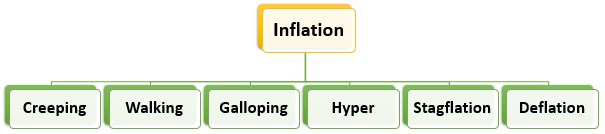

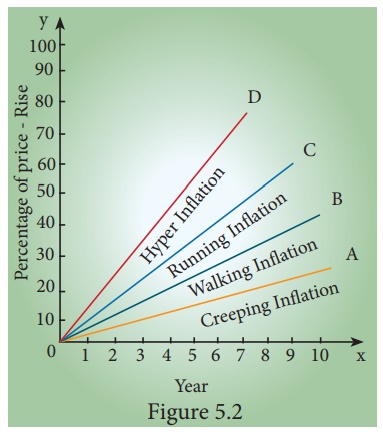

When the rise in prices is very slow (less than 3% per annum) like that of a snail or creeper, it is called creeping inflation. Such an increase in prices is regarded safe and essential for economic growth. This is also known as mild inflation or moderate inflation.

When prices rise moderately and the annual inflation rate is a single digit (3% - 10%), it is called walking or trotting inflation.

It is harmful to the economy because it heats-up economic growth too fast. People start to buy more than they need to avoid tomorrow's much higher prices. This increased buying drives demand even further so that suppliers can't keep up. As a result, common goods and services are priced out of the reach of most people.

Inflation at this rate is a warning signal for the government to control it before it turns into running inflation.

When prices rise rapidly like the running of a horse at a rate of speed of 10% - 20% per annum, it is called running inflation. Its control requires strong monetary and fiscal measures, otherwise it leads to Galloping or hyperinflation.

Inflation in the double or triple digit range of 20, 100 or 200 percent a year is called galloping inflation.

Galloping wreaks absolute havoc on the economy. Money loses value so fast that business and employee income can't keep up with costs and prices. Foreign investors avoid the country, depriving it of needed capital. The economy becomes unstable, and government leaders lose credibility. Galloping inflation must be prevented at all costs. Many Latin American countries such as Argentina, Brazil had inflation rates of 50 to 700 percent per year in the 1970s and 1980s.

Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. Hyperinflation is when prices skyrocket more than 50% a month.

It is very rare. In fact, most examples of hyperinflation occur when governments print money to pay for wars. Examples of hyperinflation include Germany in the 1920s, Zimbabwe in the 2000s, and Venezuela in the 2010s.2 The last time America experienced hyperinflation was during its civil war.

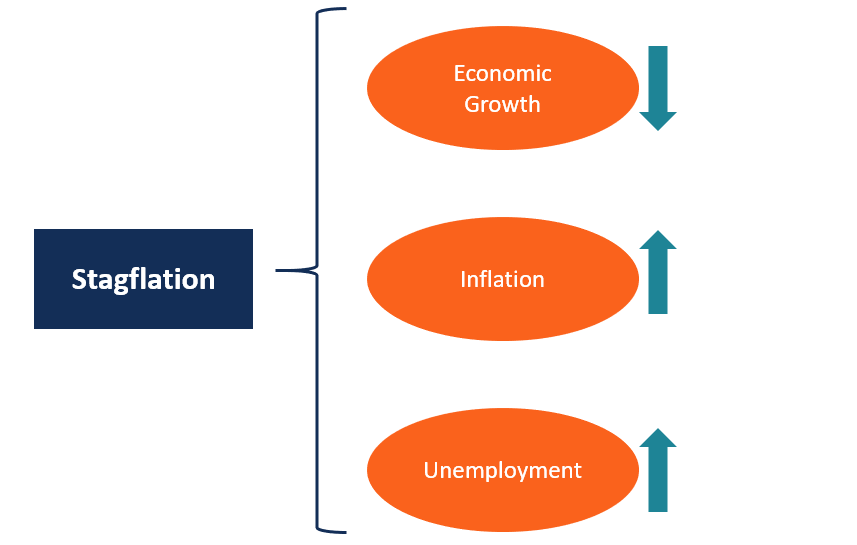

Stagflation is a combination of stagnant economic growth, high unemployment, and high inflation.

Causes of stagflation

Oil price rise: Stagflation is often caused by a supply-side shock. For example, rising commodity prices, such as oil prices, will cause a rise in business costs (transport more expensive) and short-run aggregate supply will shift to the left. This causes a higher inflation rate and lower GDP.

Powerful trade unions: If trade unions have strong bargaining power – they may be able to bargain for higher wages, even in periods of lower economic growth. Higher wages are a significant cause of inflation.

Falling productivity: If an economy experiences falling productivity – workers becoming more inefficient; costs will rise and output fall.

Rise in structural unemployment: If there is a decline in traditional industries, we may get more structural unemployment and lower output. Thus we can get higher unemployment – even if inflation is also increasing.

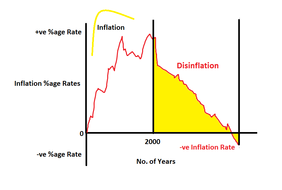

Disinflation is a fall in the inflation rate. It means that the general price level is increasing at a slower rate.

When people talk of disinflation, they often mean a period of low inflation. For example, inflation falling below the inflation target of 4%.

If the inflation rate is already very low, then disinflation could lead to deflation. Deflation is where there is actually a fall in the price level.

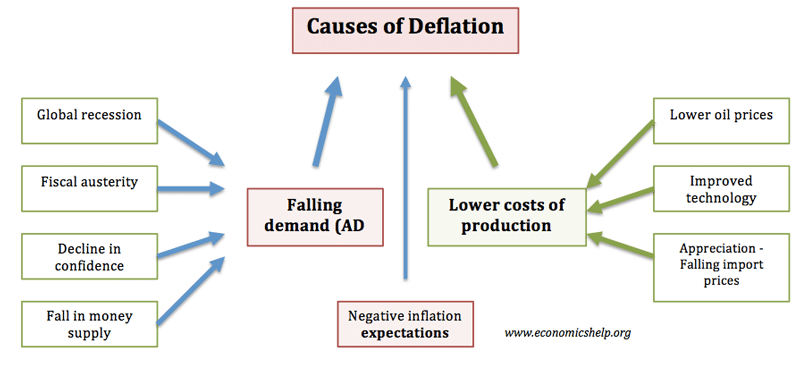

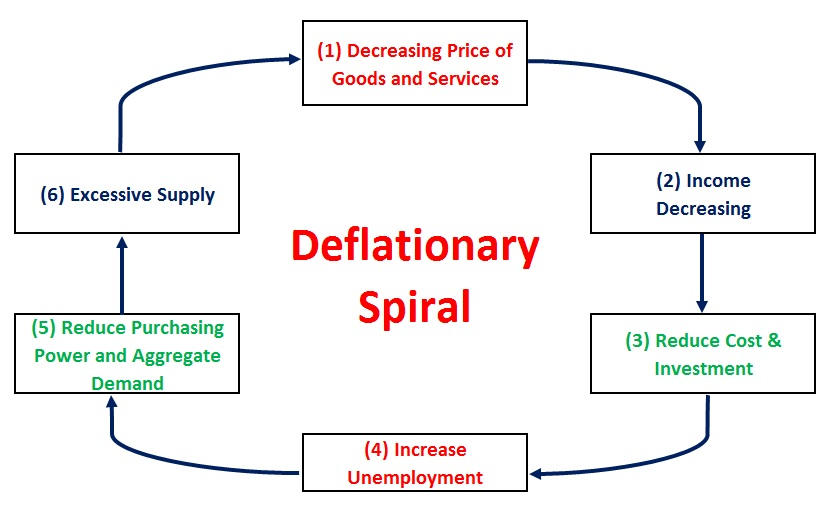

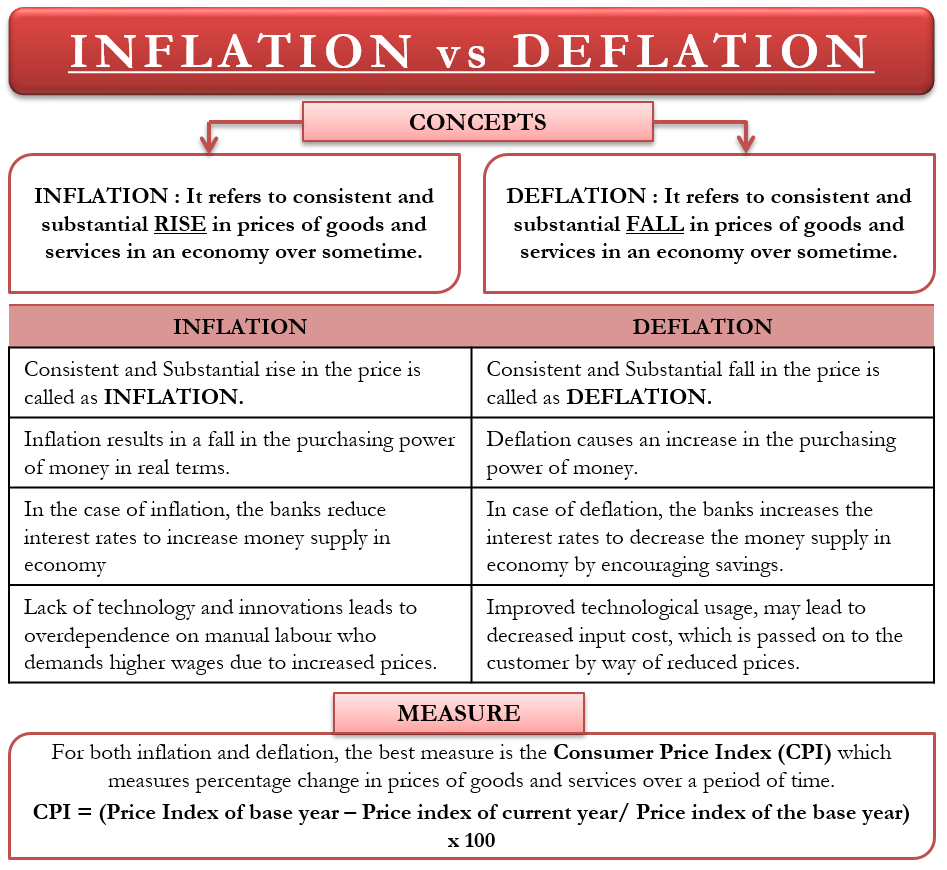

Deflation is the reverse of inflation. It refers to a sustained decline in the price level of goods and services. It occurs when the annual inflation rate falls below zero percent (a negative inflation rate), resulting in an increase in the real value of money. Japan suffered from deflation for almost a decade in 1990s.

In India, the Ministry of Statistics and Programme Implementation measures inflation.

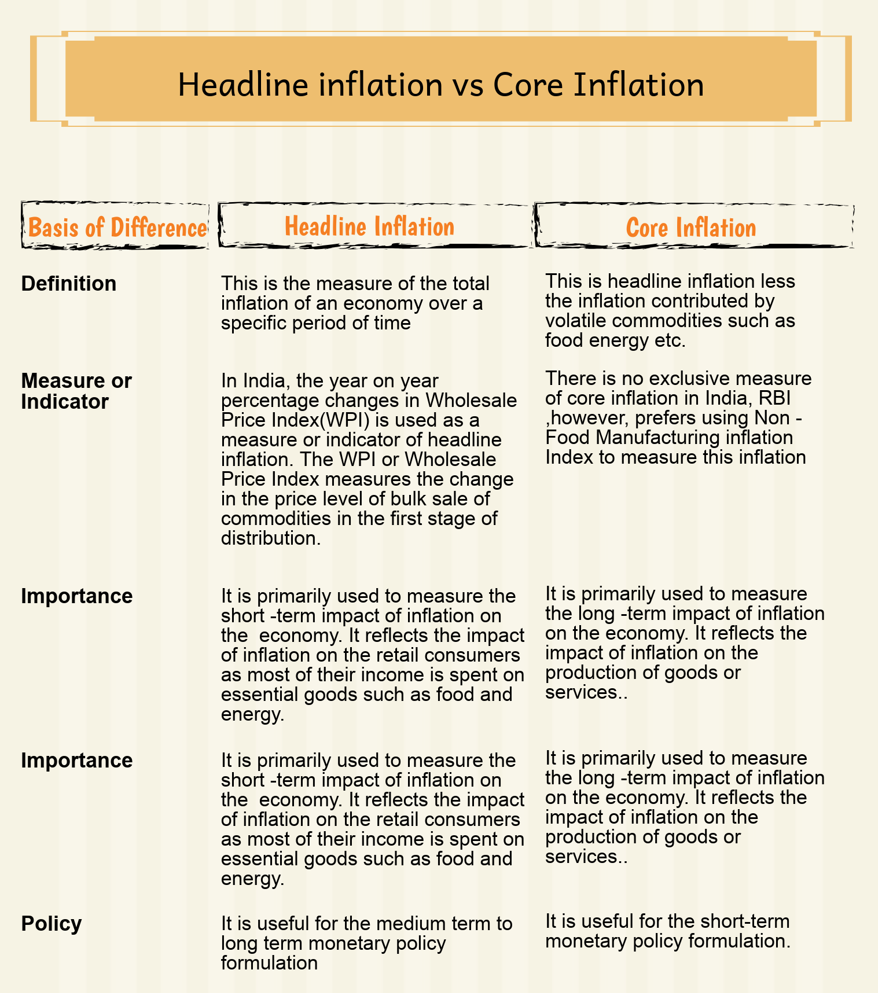

There are two main set of inflation indices for measuring price level changes in India – the Wholesale Price Index (WPI) and the Consumer Price Index (CPI). GDP deflator is also used to measure inflation.

Consumer Price Index or CPI is an index measuring retail inflation in the economy by collecting the change in prices of most common goods and services used by consumers. CPI is calculated for a fixed list of items including food, housing, apparel, transportation, electronics, medical care, education, etc. The price data is collected periodically, and thus, the CPI is used to calculate the inflation levels in an economy.

In India, there are four consumer price index numbers, which are calculated, and these are as follows:

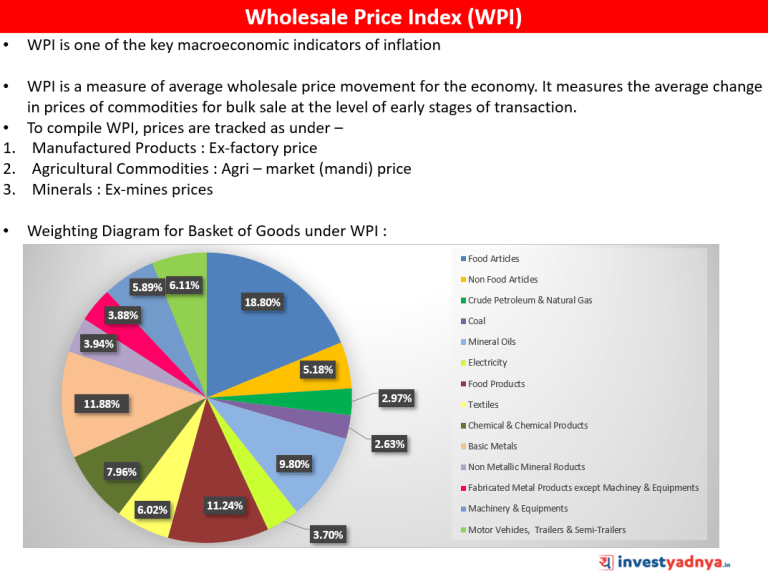

Wholesale Price Index, or WPI, measures the changes in the prices of goods sold and traded in bulk by wholesale businesses to other businesses.

Who publishes WPI in India and what does it show?

The numbers are released by the Economic Advisor in the Ministry of Commerce and Industry. An upward surge in the WPI print indicates inflationary pressure in the economy and vice versa. The quantum of rise in the WPI month-after-month is used to measure the level of wholesale inflation in the economy. Base year: 2011-12.

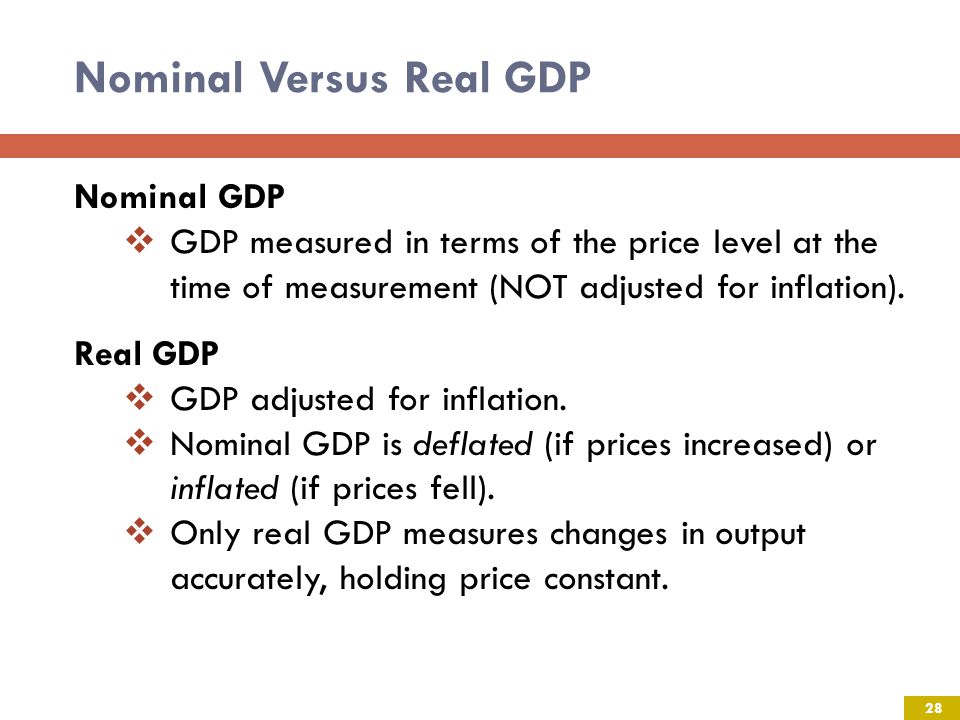

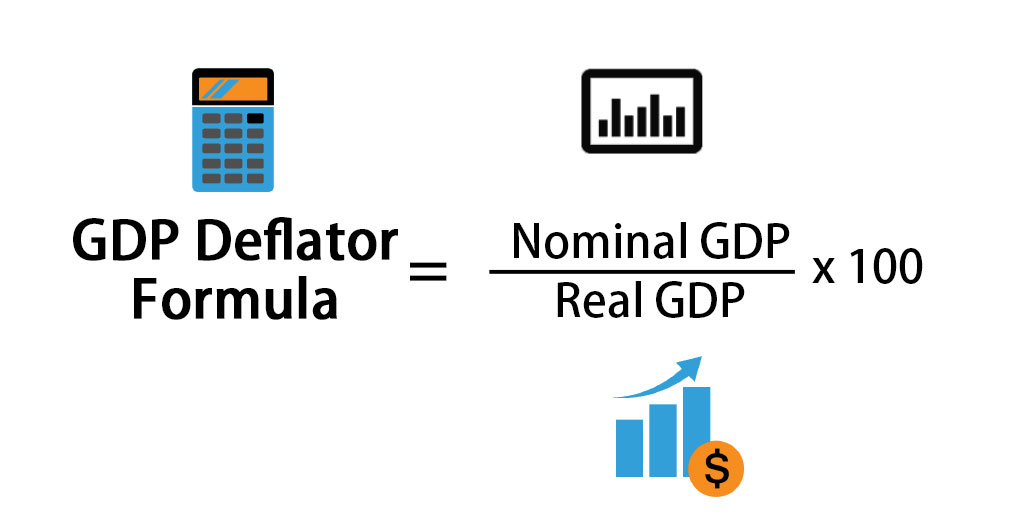

The GDP deflator, also called implicit price deflator, is a measure of inflation. It is the ratio of the value of goods and services an economy produces in a particular year at current prices to that of prices that prevailed during the base year.

This ratio helps show the extent to which the increase in GDP has happened on account of just rise in prices rather than increase in output.

Since the deflator covers the entire range of goods and services produced in the economy — as against the limited commodity baskets for the wholesale or consumer price indices — it is seen as a more comprehensive measure of inflation.

© 2025 iasgyan. All right reserved