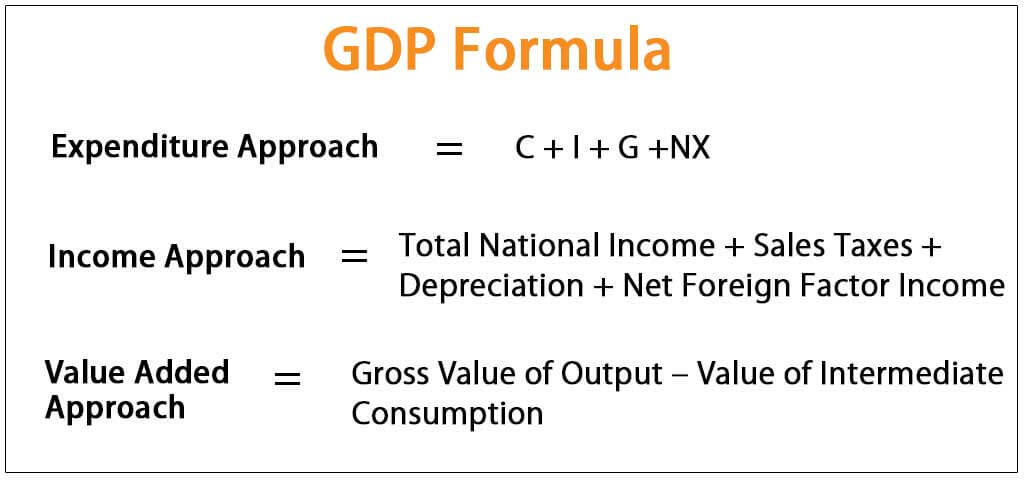

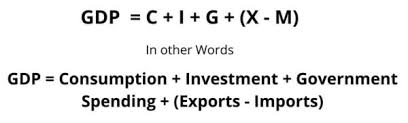

Gross Domestic Product (GDP) is the total value of goods and services produced in a country in one year. GDP refers to the value of goods produced within the geographical territory of a country irrespective of whether they are produced by citizens or foreigners.

Gross National Product (GNP) is the total value of the goods and services produced by a country’s citizens or companies in one year irrespective of their geographic location.

.jpg)

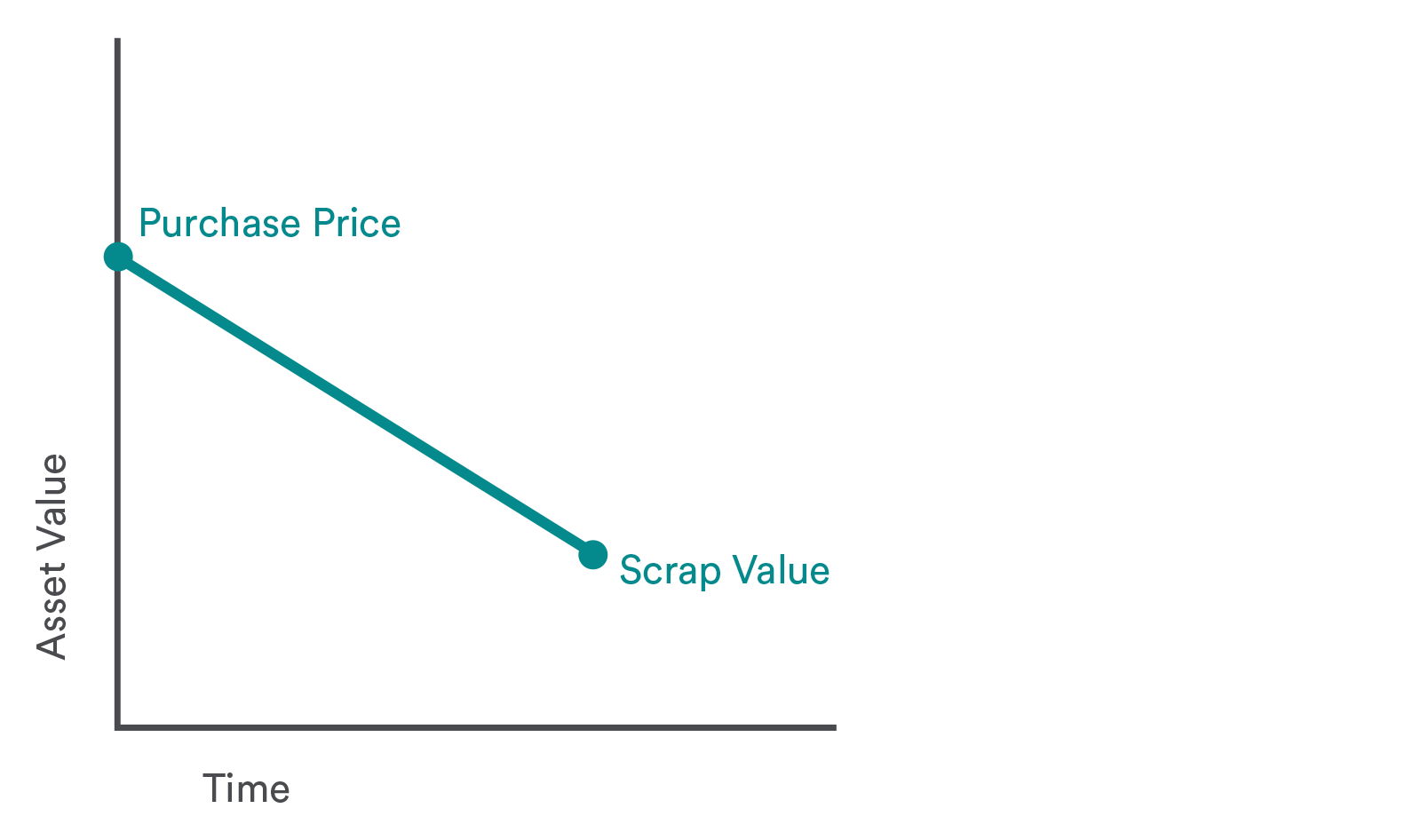

Net domestic product (NDP) is an annual measure of the economic output of a nation that is adjusted to account for depreciation and is calculated by subtracting depreciation from the gross domestic product (GDP).

Net Domestic Product: NDP = GDP – Depreciation

The monetary value of an asset decreases over time due to use, wear and tear or obsolescence. This decrease is measured as depreciation.

Net national product (NNP) is calculated by taking GNP and then subtracting the value of how much physical capital is worn out, or reduced in value because of aging, over the course of a year.

KEY TAKEAWAYS

Net national product (NNP) is gross national product (GNP), the total value of finished goods and services produced by a country's citizens overseas and domestically, minus depreciation.

NNP is often examined on an annual basis as a way to measure a nation's success in continuing minimum production standards.

Gross Domestic Product (GDP) is the most popular method to measure national income and economic prosperity, although NNP is prominently used in environmental economics.

Net National Product: NNP = GNP – Depreciation

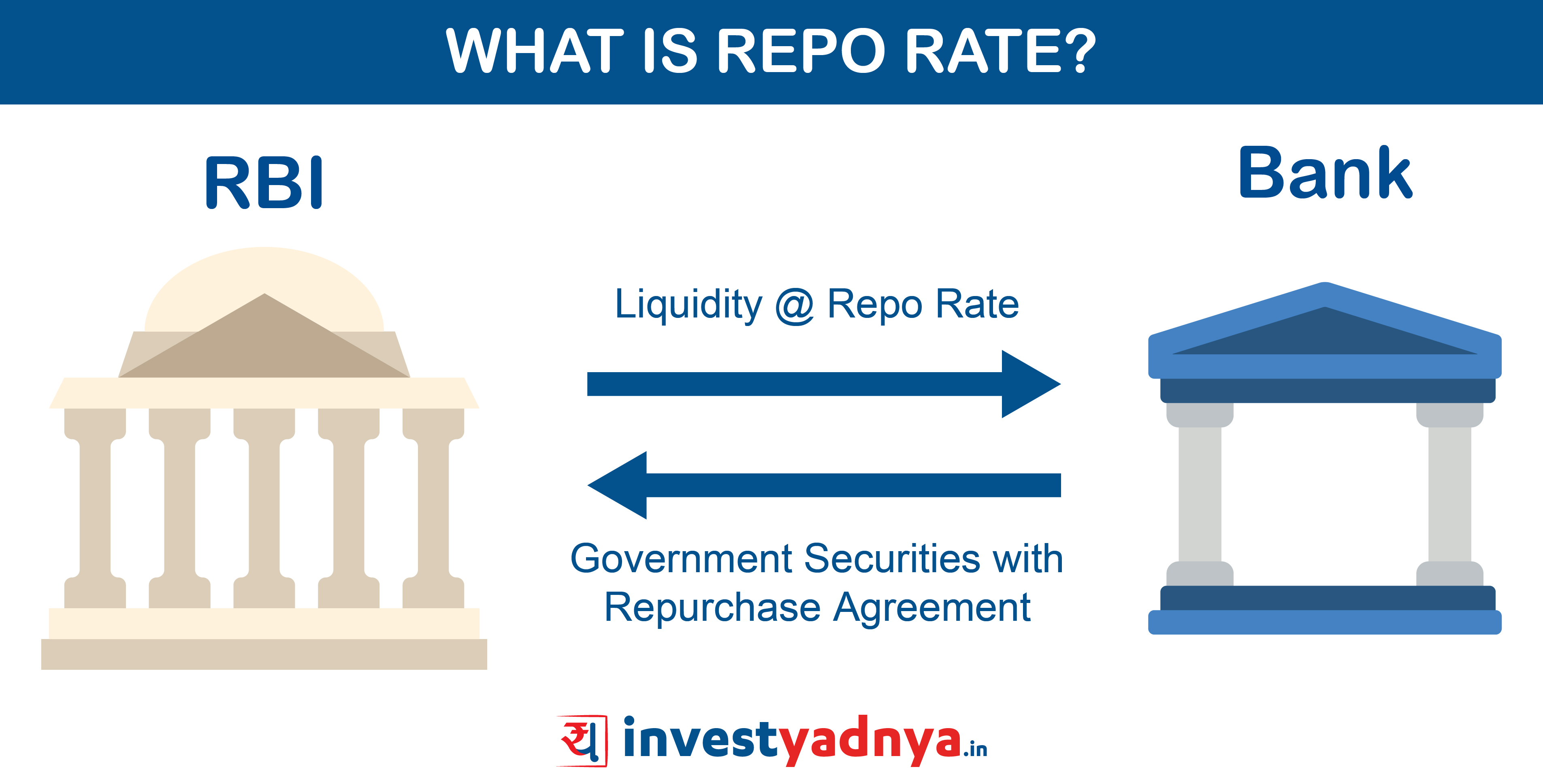

Monetary policy is the macroeconomic policy laid down by the central bank(RBI). It involves management of money supply and interest rate and is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

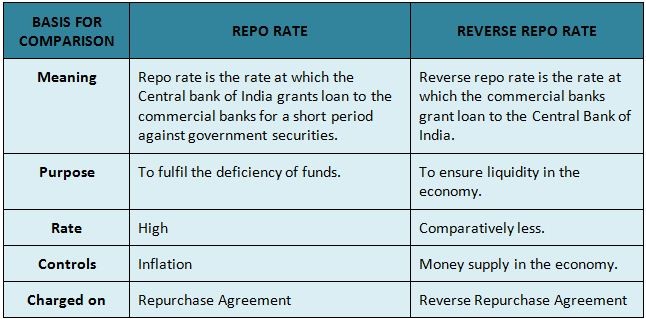

Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

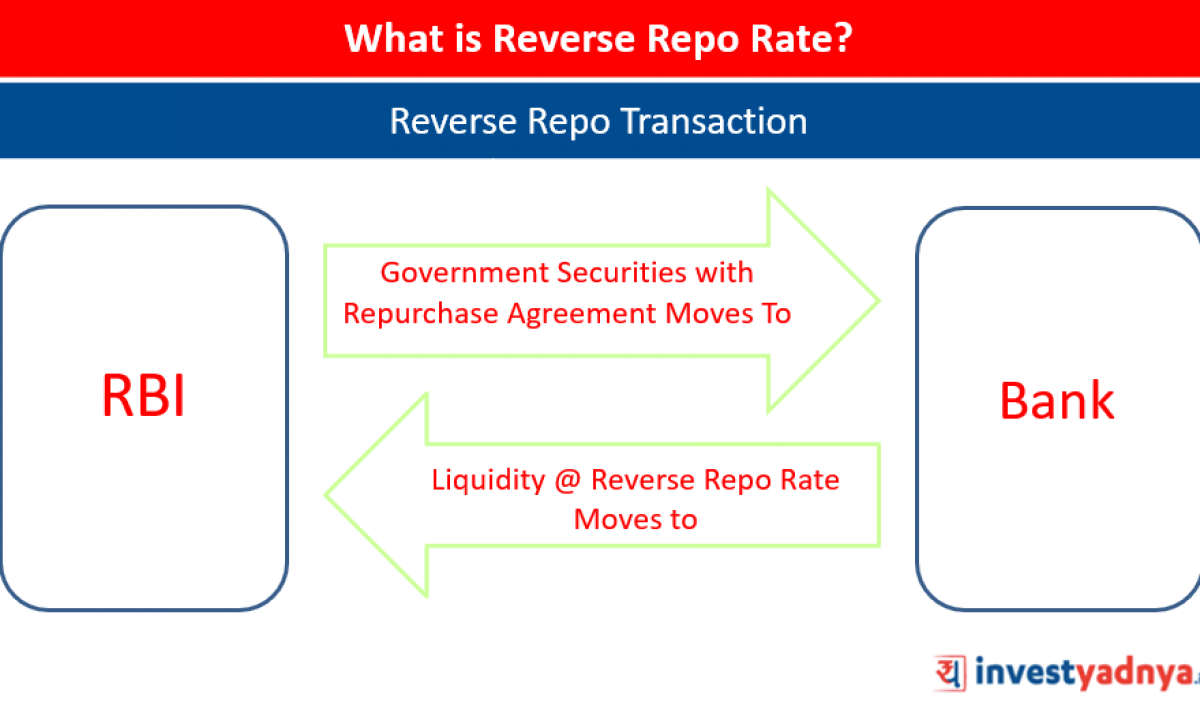

Reverse Repo rate is the rate at which the Reserve Bank of India borrows funds from the commercial banks in the country. In other words, it is the rate at which commercial banks in India park their excess money with Reserve Bank of India usually for a short-term.

It is lower than the REPO rate.

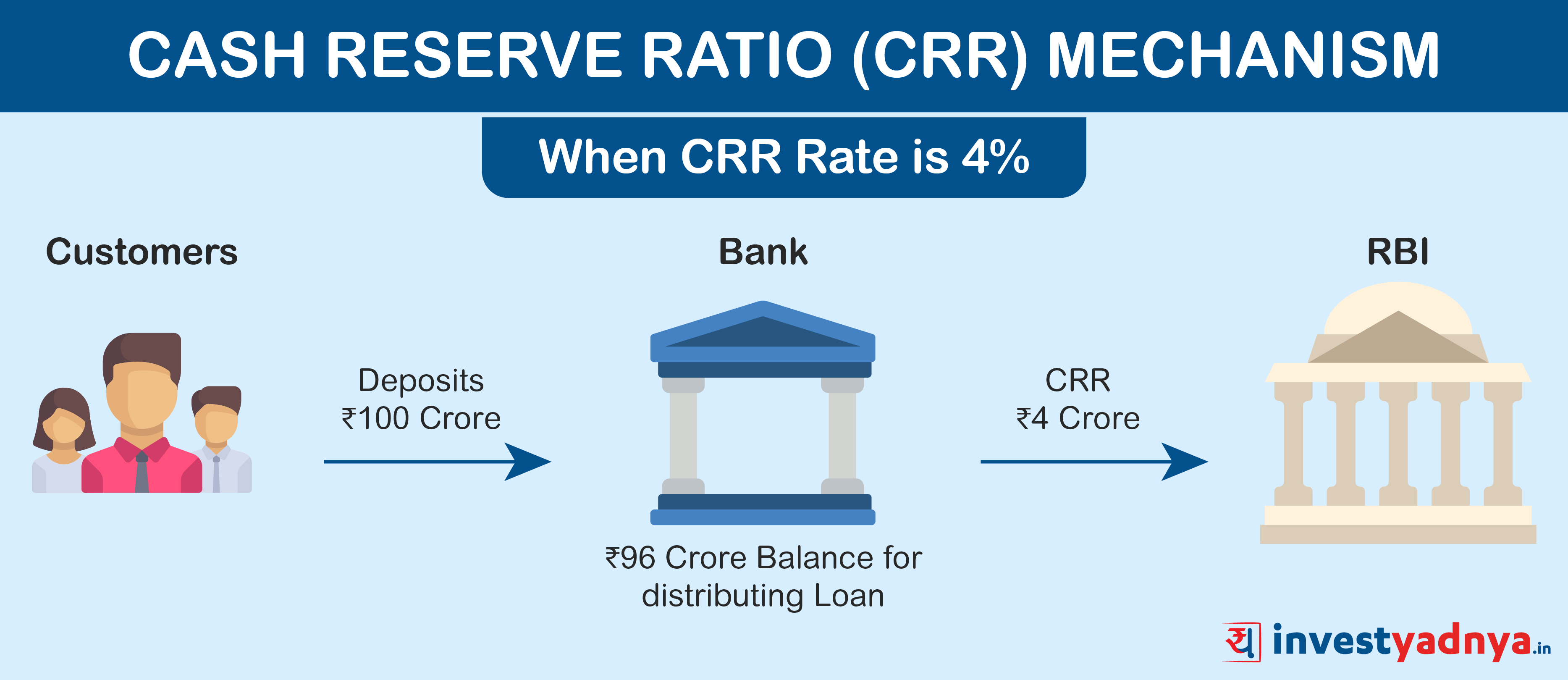

The Reserve Bank of India or RBI mandates that banks store a proportion of their deposits in the form of cash so that the same can be given to the bank’s customers if the need arises. The percentage of cash required to be kept in reserves, vis-a-vis a bank’s total deposits, is called the Cash Reserve Ratio. The cash reserve is either stored in the bank’s vault or is sent to the RBI. Banks do not get any interest on the money that is with the RBI under the CRR requirements.

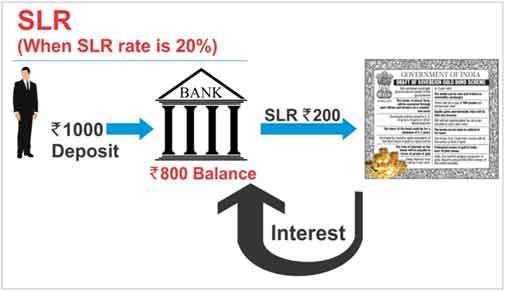

Every bank must have a particular portion of their Net Demand and Time Liabilities (NDTL) in the form of cash, gold, or other liquid assets by the end of the day. The ratio of these liquid assets to the demand and time liabilities is called the Statutory Liquidity Ratio (SLR). The Reserve Bank of India (RBI) has the authority to increase this ratio by up to 40%. An increase in the ratio constricts the ability of the bank to inject money into the economy.

RBI is also responsible for regulating the flow of money and stability of prices to run the Indian economy. Statutory Liquidity Ratio is one of its many monetary policies for the same. SLR (among other tools) is instrumental in ensuring the solvency of the banks and cash flow in the economy.

|

NDTL refers to the total demand and time liabilities (deposits) of the public that are held by the banks with other banks. Demand deposits consist of all liabilities, which the bank needs to pay on demand. They include current deposits, demand drafts, balances in overdue fixed deposits, and demand liabilities portion of savings bank deposits. Time deposits consist of deposits that will be repaid on maturity, where the depositor will not be able to withdraw his/her deposits immediately. Instead, he/she will have to wait until the lock-in tenure is over to access the funds. Fixed deposits, time liabilities portion of savings bank deposits, and staff security deposits are some examples. The liabilities of a bank include call money market borrowings, certificate of deposits, and investment deposits in other banks. |

Marginal standing facility (MSF) is a window for banks to borrow from the Reserve Bank of India in an emergency situation when inter-bank liquidity dries up completely.

Description: Banks borrow from the central bank by pledging government securities at a rate higher than the repo rate under liquidity adjustment facility or LAF in short. The MSF rate is pegged 100 basis points or a percentage point above the repo rate. Under MSF, banks can borrow funds up to 2 to 3 % of their net demand and time liabilities (NDTL).

Bank rate is the rate charged by the central bank for lending funds to commercial banks.

Bank rates influence lending rates of commercial banks. Higher bank rate will translate to higher lending rates by the banks. In order to curb liquidity, the central bank can resort to raising the bank rate and vice versa.

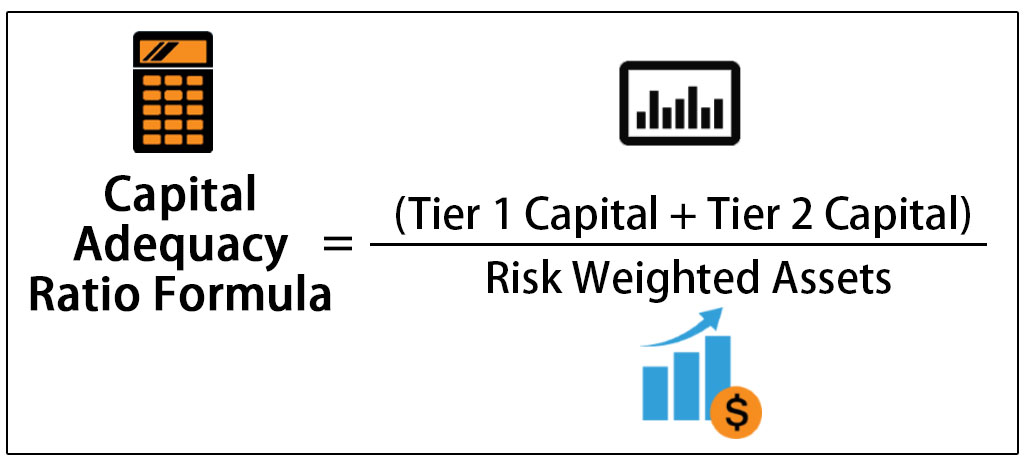

Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities. It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

It is measured as

Capital Adequacy Ratio = (Tier I + Tier II + Tier III (Capital funds)) /Risk weighted assets

The risk weighted assets take into account credit risk, market risk and operational risk.

The Basel III norms stipulated a capital to risk weighted assets of 8%. However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9% while Indian public sector banks are emphasized to maintain a CAR of 12%.

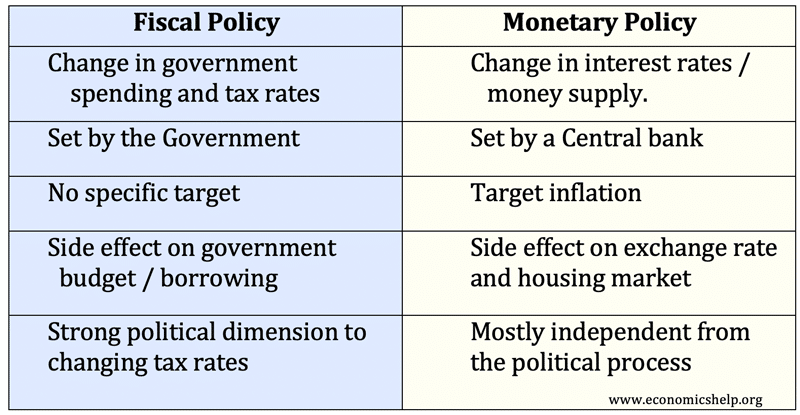

Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation's economy. It is the sister strategy to monetary policy through which a central bank influences a nation's money supply. These two policies are used in various combinations to direct a country's economic goals.

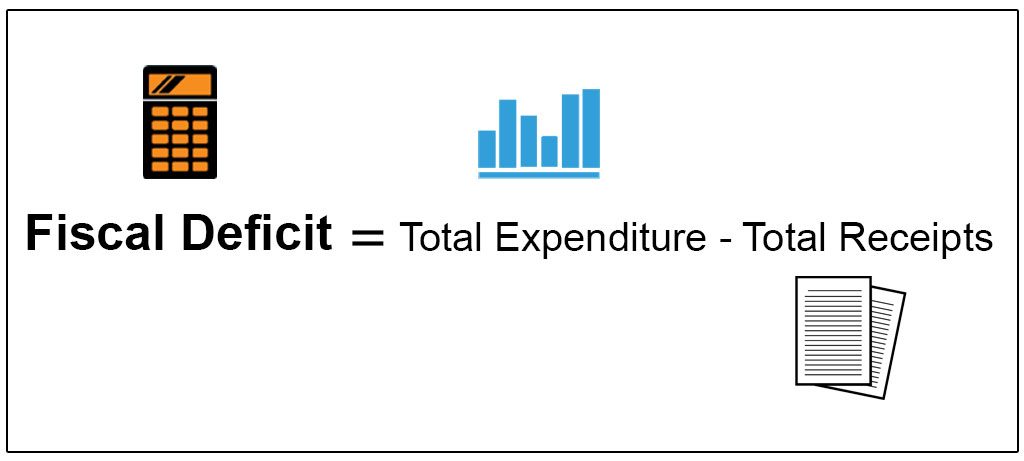

It is the difference between the government’s total expenditure and its total receipts (excluding borrowing). A fiscal deficit occurs when this expenditure exceeds the revenue generated.

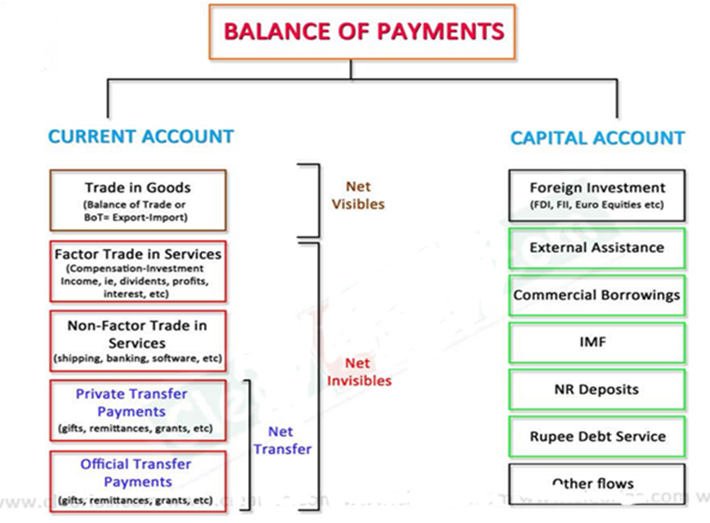

The Balance of Payments is a record of a country’s transactions with the rest of the world. It shows the receipts from trade. It consists of the current and financial account

KEY TAKEAWAYS

Inflation means a sustained increase in the general price level. It is simply the rate at which the prices of goods and services rise in a country. Thus, it causes a fall in the purchasing power of the currency.

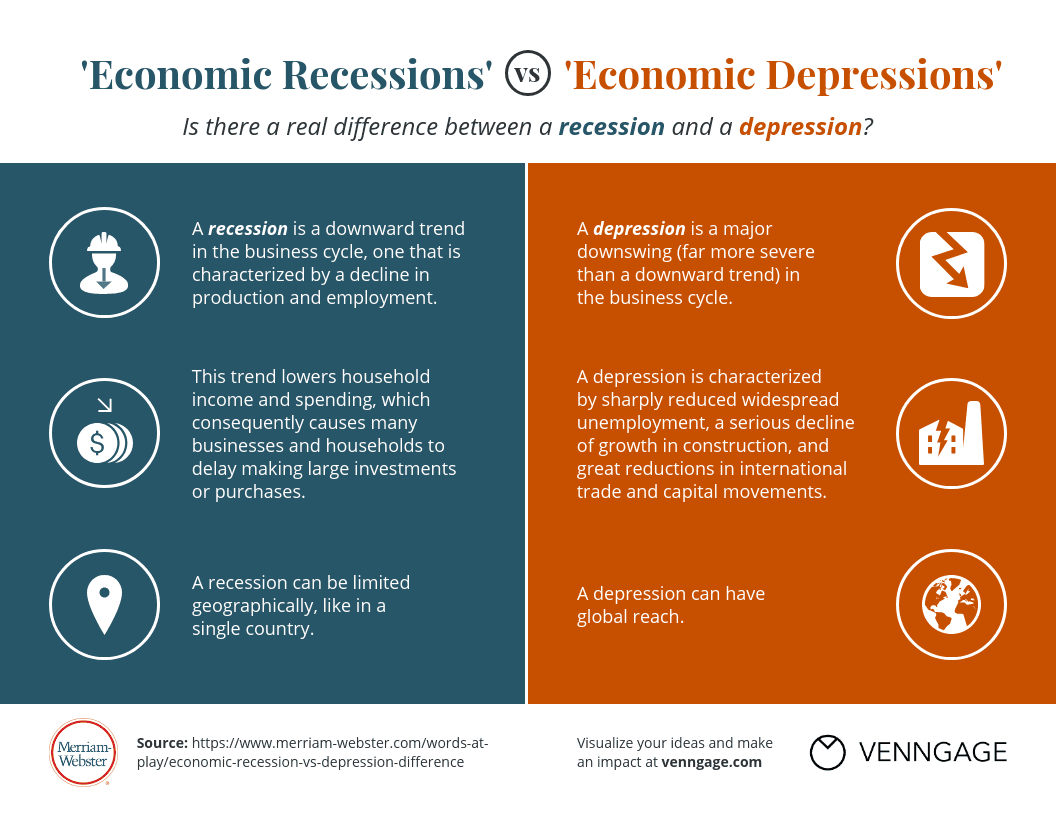

It is a prolonged and severe downturn in the economic activity of a country. It is more severe than a recession.

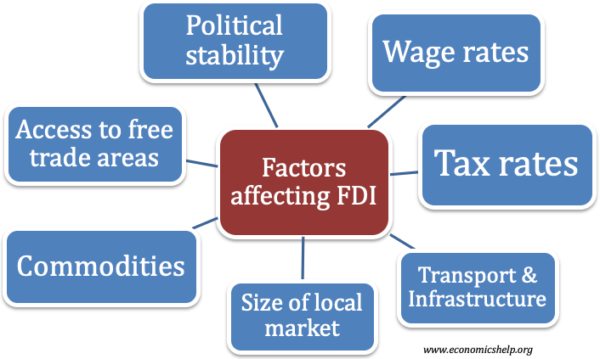

Foreign direct investment (FDI) is an investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest. Lasting interest differentiates FDI from foreign portfolio investments, where investors passively hold securities from a foreign country. A foreign direct investment can be made by expanding one’s business into a foreign country.

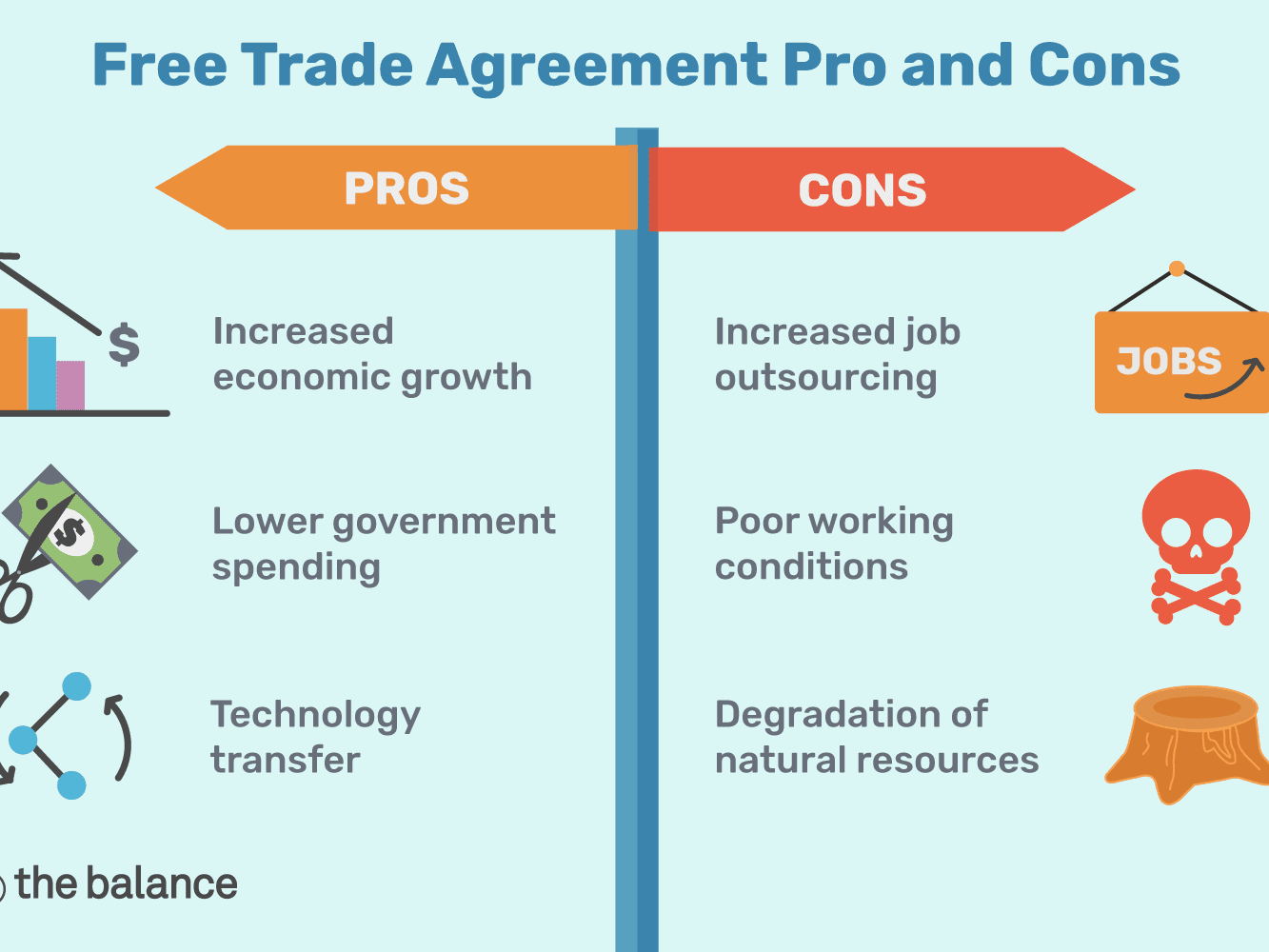

A free trade agreement is a pact between two or more nations to reduce barriers to imports and exports among them. Under a free trade policy, goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies, or prohibitions to inhibit their exchange.

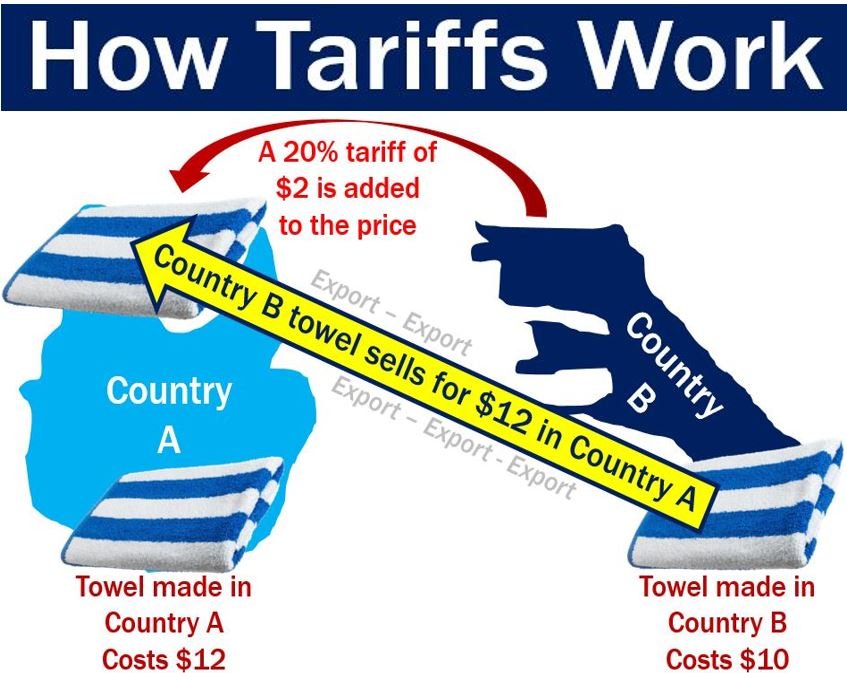

A tariff is a tax imposed by a government on goods and services imported from other countries that serves to increase the price and make imports less desirable, or at least less competitive, versus domestic goods and services. Tariffs are generally introduced as a means of restricting trade from particular countries or reducing the importation of specific types of goods and services.

Special Economic Zone (SEZ) is a specifically delineated duty-free enclave and shall be deemed to be foreign territory for the purposes of trade operations and duties and tariffs. In order words, SEZ is a geographical region that has economic laws different from a country's typical economic laws. Usually the goal is to increase foreign investment and generate employment.

© 2025 iasgyan. All right reserved