Copyright infringement not intended

In News:

Background:

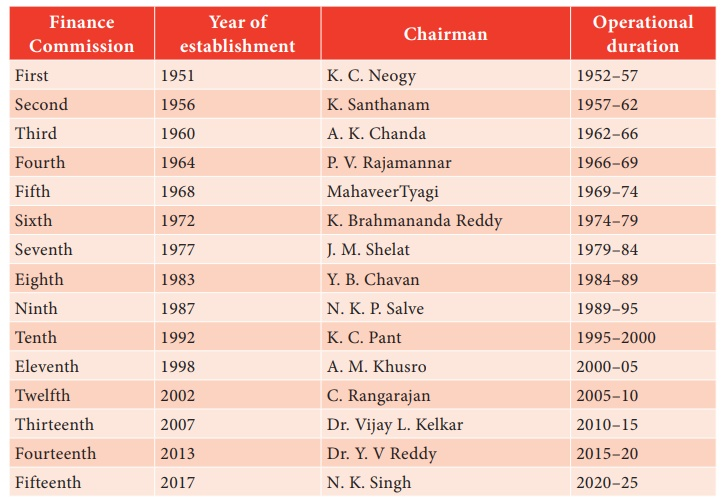

Finance Commission:

Must Read: https://www.iasgyan.in/blogs/abc

© 2025 iasgyan. All right reserved