Description

Disclaimer: Copyright infringement of intended.

Context

- This year Governments across Asia implemented export curbs on various agricultural and energy products to ensure sufficient supplies and cap a rise in prices due to the Russia-Ukraine war. However, these measures have disrupted global trade.

Highlights

Coal

- World’s top thermal coal exporter, Indonesia imposed a month-long export ban on January 1 due to concerns over low supplies for domestic power plants.

- The move hit Indonesia’s exports, snared shipments to top buyers such as Japan and caused prices to surge.

Palm oil

- World’s top palm oil exporter Indonesia imposed a three-week export ban on edible oil and related products in April to check soaring local prices and improve domestic cooking oil supplies after the Ukraine conflict disrupted sunflower oil exports from Kyiv (Ukraine).

Wheat

- India banned wheat exports on May 14. This was after the government maintained a target export volume of 10 million tonnes to compensate for Ukraine’s reduced supply. But the scorching heat wave in India curtailed output and domestic prices hit a record high. Next came the ban in exports.

Sugar

- India imposed restrictions on sugar exports for the first time in six years by capping this season’s exports at 10 million tonnes. This is to prevent a surge in domestic prices after mills sold a record volume on the world market.

Chicken

- Malaysia halted exports of live chickens starting June 1 in an effort to stabilise output and domestic prices. This was after a global feed shortage triggered by the war in Ukraine disrupted production.

Rice

- India banned exports of broken rice and imposed a 20% duty on exports of various grades of rice. India is the world’s biggest exporter of the grain and it is trying to augment supplies and calm local prices after below-average monsoon rainfall curtailed planting.

Food trade protectionism since the invasion of Ukraine

- Data collected by the World Bank and the Global Trade Alert show that from the beginning of 2022, 135 policy measures have been announced or implemented affecting trade in food and fertilizers.

- 86 nations were responsible for the increase in trade related policies imposed in food products and fertilizers since the beginning of the year, especially in the Europe and Central Asia region.

- Out of these, a total of 34 countries have imposed restrictive export measures on food and fertilizers. This number is approaching the levels of the 2008-2012 food crisis, where a total of 36 countries-imposed export restrictions contributing to price surges of key staples like wheat and rice by well over 30 percent.

How do export restrictions affect food price inflation?

- The ban reduces the supply of the product in global markets. This measure results in an increase in the world price of the good.

- The impact on the world price is affected by factors such as the change in world food supply (i.e. how important a country is in the global export supply of the product) and how elastic imports are with respect to trade costs (i.e. how rigid demand is in the face of shocks).

- Other factors matter as well, namely price surges can be higher as a result of increases in demand driven by temporary import liberalization or given declines in supply due to export restrictions other than export bans (e.g. export licensing requirements or export quotas).

Impact of Russia-Ukraine war

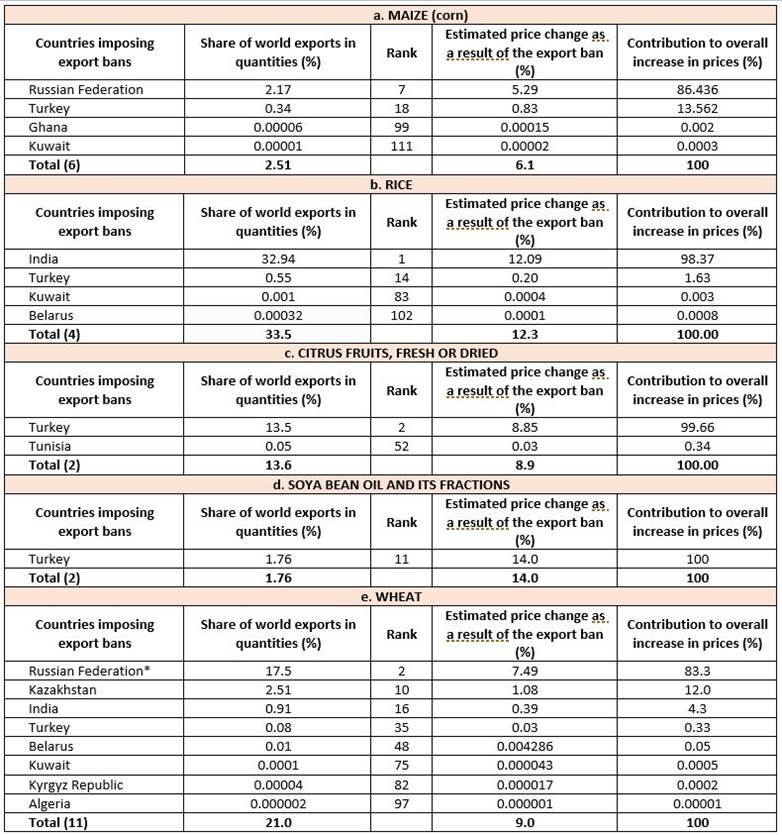

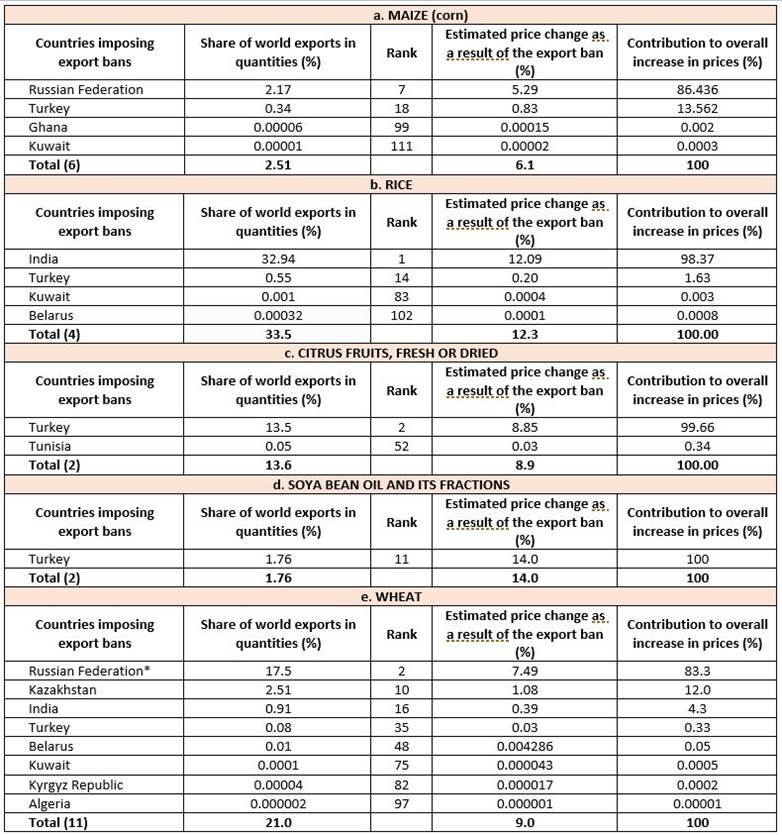

- The estimated impact of export bans imposed since the beginning of the Ukraine war has led to increases in prices higher than 5 percent: maize, rice, citrus fruit, soya beans oils and its fractions and wheat.

- Export bans in products such as rice, wheat and citrus fruits have led to increases in prices estimated at respectively 12.3 percent, 9 percent and 8.9 percent. Also in this case, the increase in price is driven by the reduction in supply of top exporters: India for rice, with a share of exports of 33 percent; Russia for wheat, with a share of exports of 17.5 percent; and Turkey for citrus fruits, with a share of exports of 13.5 percent.

- For products such as soya bean oil and maize (corn), the exporters imposing restrictions are not among the top 5 world exporters. However, the demand of these products tends to be more inelastic and therefore the impact on prices is still significant. Specifically, existing export bans are estimated to have increased prices by 14 percent in the case of soya bean oil and by 6.1 percent in the case of maize.

All these show the direct effect of the export bans on food price inflation. But these measures can also ignite a multiplier. Other exporters may impose restrictions shifting in the global supply of food and importers may further reduce import protection shifting out global demand. Both actions would magnify the initial price shock.

Conclusion

- Trade ministers meeting in Geneva for the World Trade Organization’s 12th Ministerial Conference expressed their concern that trade disruptions could undermine global food security. The Ministerial Declaration on the Emergency Response to Food Security could not make countries commit to avoid or limit export restrictions on food.

https://indianexpress.com/article/explained/explained-economics/asian-economies-2022-agri-export-curbs-explained-8147137/