Disclaimer: Copyright infringement not intended.

Context

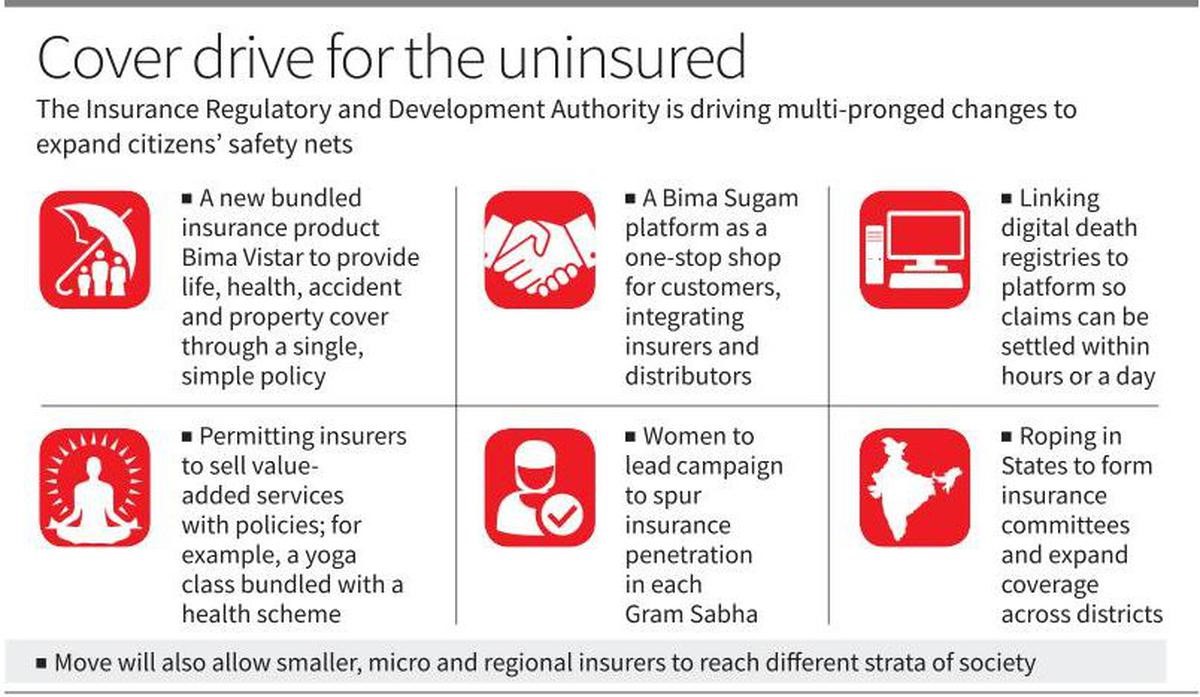

About

Aim

Features

Mechanism

ALL ABOUT IRDA: https://www.iasgyan.in/daily-current-affairs/insurance-regulatory-and-development-authority-of-india

|

PRACTICE QUESTION Q. Consider the following statements: 1. The Insurance Regulatory and Development Authority of India (IRDAI) is an independent statutory body that was set up under the IRDA Act,1999 and it is under the jurisdiction of the Ministry of Finance. 2. IRDAI is a 25-member body including the chairman, five full-time and four part-time members appointed by the government of India.. Which of the above statements is/are true? (a) Only 1 (b) Only 2 (c) Both 1 and 2 (d) Neither 1 nor 2 Correct Answer: (a) Only 1 |

© 2025 iasgyan. All right reserved