Description

Disclaimer: Copyright infringement not intended.

Context

- The 'angel tax' provision in the Finance Bill will not impact startups in India, a senior government official said.

- As per a motion made in the Finance Bill, 2023, Indian start-ups that offer their shares to foreign investors, may have to pay ‘angel tax’. Earlier, it was only supposed to be paid for investments raised by resident Indian investors.

- To bring this into effect, Finance Bill, 2023, has proposed to amend Section 56(2) VII B of the Income Tax.

Background

Angel Investors

- An angel investor is an individual who provides capital for a start-up, in exchange for convertible debt or ownership equity.

- Angel Investors are Wealthy Individuals or High Net worth Individuals having huge wealth. These investors generally provide seeding capital or initial capital to a start-up entity to earn healthy profit or capital appreciation of investment once start-ups come into operations and exist from the start-ups.

Tax benefits available to an Eligible Start-Up

- Exemption from levy of angel tax under section 56(2)(viib);

- Deductions under section 80-IAC of the income tax Act.

.jpeg)

What is Angel Tax? Decoded

Definition

- Angel tax is levied on start-ups when they receive investments in excess of their ‘fair market value’. The perceived profit is considered as income from other sources—it’s taxed at 30% and termed as angel tax.

Note that angel tax (as of now) is not applicable in the case of investments made by venture capital firms or foreign investors. It’s limited to investments made only by Indian investors.

Description

- Referred to colloquially as Angel Tax, this rule is described in Section 56(2)(viib) of the Income Tax Act, 1961.

- This clause was inserted into the act in 2012 to prevent-laundering of black money, and roundtripping via investments with a large premium into unlisted companies. Essentially it’s a tax on capital receipts, unique to India in the global context.

- The tax covers investment in any private business entity, but only in 2016 was it applied to startups.

- As more and more new-age tech startups started raising Venture Capital Funding, they came under the IT department scrutiny. These funding deals often saw investors paying a premium above the face value or the fair market value of securities, and therefore were taxed as income for the startup.

- The Angel Tax is being levied on startups at 30.9%on net investments in excess of the fair market value. And many startups were retrospectively assessed for this tax, years after their fundraising.

Implications

- Between 2016 and 2019, startups urged the government to add exceptions that would allow them to be exempt from the Angel Tax.

Government’s step

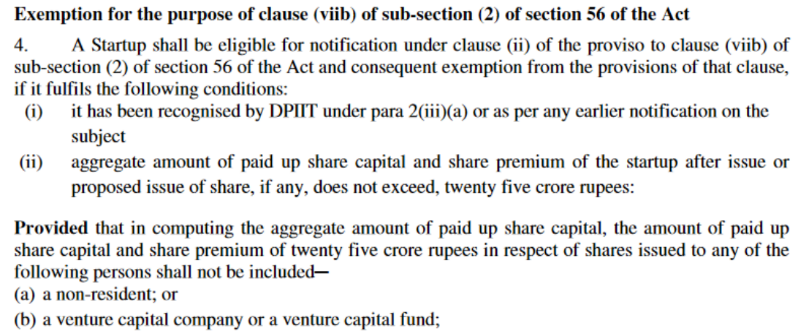

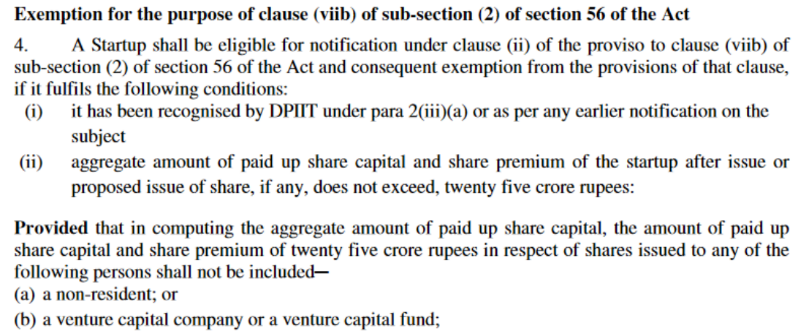

- In March 2019, an exemption was provided to startups under certain conditions, which are specified here and reproduced below:

- Note: This exemption does not need validation by the Inter-Ministerial Board of Certification, which was set up by the Department of Promotion of Industry & Internal Trade.

- However, the key condition for exemption is that the aggregate amount of paid-up share capital and share premium of the startup after the issue or proposed issue of shares does not exceed INR 25 Cr.

- This meant resident angel investors who typically invest a small amount of seed money were spared the Angel Tax.

- Besides this, there was a further exemption for SEBI-registered alternative investment funds (AIFs) and capital raised from overseas investors, since the primary target was roundtripping of funds from and to India.

So, Have These Exemptions Changed In 2023?

- Not all of them, startups are still exempt from angel tax when the total aggregate amount for the deal is under INR 25 Cr, and domestic non-Alternate Investment Funds investing in Indian startups still need to pay a tax on their deals.

- What’s being amended in the Finance Bill, 2023 is the exemption for overseas investors. This means when a start-up raises funding from a foreign investor, that too will now be counted as income and be taxable.

The rationale behind the move

- By removing the exception for overseas funds, the new proposed Angel Tax is further looking to track such transactions, where Indian individuals are Limited Partners (LPs) in blind pool foreign funds.

- The Indian government does not always have visibility into the LPs that make up foreign funds.

Plausible Implications

- This will have far-reaching implications for the Indian startup ecosystem as a majority of the funds are raised from overseas investors, whose investments will now be subject to Angel Tax. This move may push many startups to redomicile overseas.

- Rather than launching India-based AIFs, global investors might pressure Indian entrepreneurs and startups to move overseas and invest in those entities.

- Despite the government’s bluster about improving the ease of doing business in India, entrepreneurs and investors are concerned that applying strict taxes on capital receipts without adequate exceptions will lead to startups moving overseas.

- This might put an impact on the FDI inflows and hamper the Ease of Doing Business.

Moving ahead

- Given the massive downside for FDI under the current clauses, there’s hope among the investor class for more clarifications.

- It’s possible that the Finance Ministry further clarifies the exceptions under this new, avatar of ‘Angel Tax’.

https://www.ndtv.com/business/angel-tax-provisions-in-finance-bill-wont-affect-startups-official-3801622