Description

Disclaimer: Copyright infringement not intended.

Context

- India's Securities and Exchange Board is calling for asset management companies to set up surveillance and internal control systems as part of measures against market abuse and fraudulent transactions.

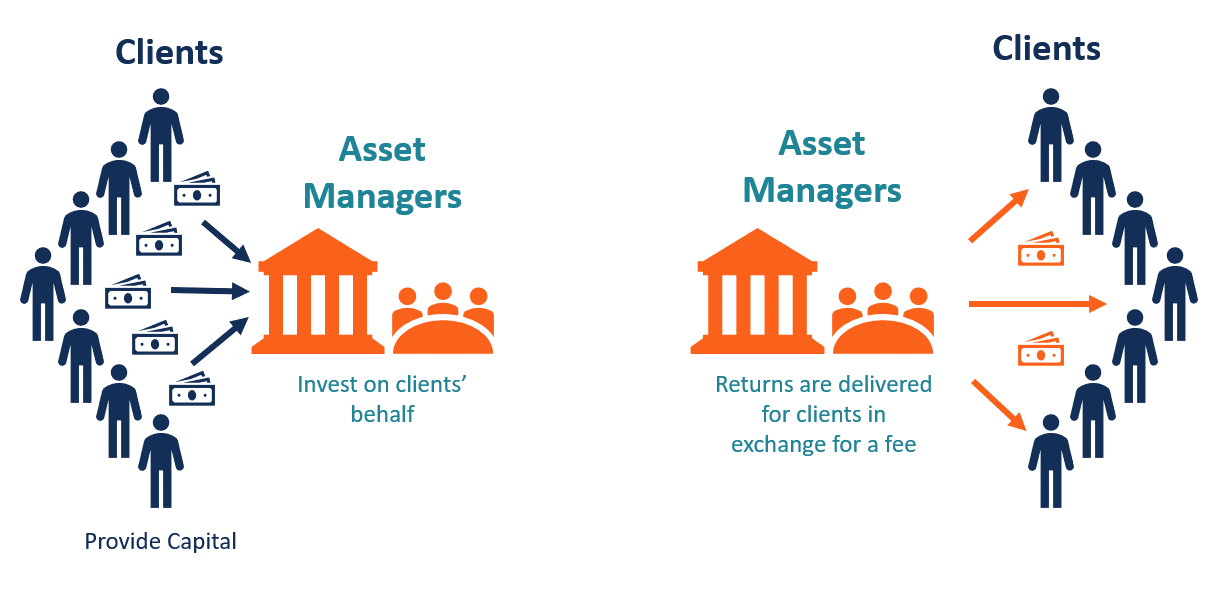

What is an Asset Management Company?

- An Asset Management Company (AMC) is a firm that invests the funds pooled from individual investors in securities with the objective of optimal return for investors in exchange for a fee.

- AMC maintains the diversity of its portfolio by investing in both high-risk and low-risk securities such as stock, debt, real- estate, shares, bonds, pension funds, etc.

- Factors such as industry risk, market risk, return risk, and political risk are considered before selecting any security to meet the return on investment targets. For example, a debt fund invests in bonds and risk-free Government bonds to maintain the minimum risk.

- On the other side, an equity-oriented fund will invest in shares and stocks with high risk and high return.

How are the funds managed by an AMC?

- Basically, when you invest with an AMC, you invest in a portfolio that AMC maintains for you. It is the responsibility of AMC to ensure an investor’s financial objective is met. AMC ensures this by the following means:

Market Research and Analysis

- To build a portfolio for an investor the asset manager needs to do a lot of research on the market trends, macro-economic and micro-economic factors, and political aspects. On the basis of this research, the appropriate securities are selected which will outperform the return expectations of the investors.

Asset Allocation

- On the basis of market research and the investor’s financial objective, the asset manager allocates the funds to different assets. For example, a debt-oriented would invest just 20% in equity-oriented funds to keep the risk levels low. However, an equity-oriented fund would invest more than 70% in equity and rest in debt. A balanced fund would end up with just 60% in equity and 40% in debt to balance out return and risk.

Creating a Portfolio

- After research and analysis by analysts and a decision on asset allocation are done, the asset manager on the basis of market findings creates a portfolio. Here the asset manager will take decisions like which security to sell, buy or hold for a period. The entire creation of a portfolio is solely based on the market expertise of professionals, research and study, and investment goals of the investor.

Review of Performance

- Since the fund of an investor is at stake, the performance measurement of the portfolio becomes very important.

- At every point, the asset manager has to justify a buy, sell or hold securities to investors and trustees.

- Every asset manager generally provide regular updates investor regarding sales, repurchases, NAV, Return on risk, portfolio changes and factors which might affect their portfolio.

How do Asset Management Company functions?

- An AMC collects funds from different investors having different financial objectives. Now it invests such a large pool of funds in a very diversified portfolio and enjoys economies of scale, getting discounts on purchases. The return earned by the portfolio is then distributed among all the small retail investors.

- The services provided by an AMC is charged either on a fixed basis or commission-based. Fixed Fee is nothing but a monthly or quarterly amount for maintaining the fund.

Bodies Governing AMC’s Operations

- AMC performs under the supervision of the board of trustees. All the Asset Management Companies are governed by SEBI and AMFI.

- Securities and Exchange Board of India (SEBI) is the Indian Capital Market Regulator which governs and controls every AMC in India.

- The Association of Mutual Funds in India (AMFI) is a statutory body formed by mutual fund companies.

- AMFI was formed with the vision of a transparent and ethic-driven financial industry. Every AMC must comply with the regulations led by AMFI.

- Banks being sponsors are governed by RBI as well along with SEBI and AMFI.

- Lastly, all the regulatory bodies SEBI, AMFI, and RBI are governed by RBI.

Guidelines laid by SEBI, AMFI, and RBI for an AMC

Some of the mandatory practices and guidelines laid down by SEBI, AMFI, and RBI for a mutual fund company to follow:

-

- The Chairman of an AMC cannot hold the position of Trustee of any mutual fund.

- Key personnel of every AMC should not have indulged or been convicted for any fraudulent or offensive acts.

- AMC should not act as a Trustee of a mutual fund.

- The net worth of an AMC must be not less than Rs. 10 crores.

- Before making an investment in any of its schemes the company must disclose its intention to invest in the offer documents.

- A quarterly report on activities and compliance with regulations must be submitted to the trustees.

Recent direction of SEBI for AMCs

- SEBI recently proposed that asset management companies (AMCs) set up surveillance and internal control systems for the deterrence of possible market abuse and fraudulent transactions.

- It further suggested that senior management of AMCs should be responsible to ensure that an institutional mechanism is put in place to detect and report possible misconduct by its employees, dealers, stock brokers or any other connected entities.

- Further, AMCs should have appropriate escalation and reporting mechanisms for possible market abuse and fraudulent transactions in securities related to the AMCs' transactions.

Reason behind SEBI’s concern

- In the Axis AMC case, broker-dealers, certain employees and connected entities were found to have front-run the trades of the AMC and in the case of LIC, an employee of a listed insurance company was observed to be front-running the trades of the company.

SEBI’s remarks and Recommendations

- SEBI proposed that AMCs should put in place robust surveillance systems and internal control procedures, to deter possible misconduct by employees or other entities which may have information relating to fund management and/or investments of mutual fund schemes

- AMCs should customize their surveillance systems and internal control procedures including alert types, parameters and thresholds based on backtesting of historical data to ensure their effectiveness.

- In order to determine the likelihood of misconduct, AMCs shall process system-driven alerts in conjunction with soft alerts such as lifestyle checks, recording of communication such as recorded emails, chats and CCTV footage etc.

- With regard to taking action in case of possible misconduct, SEBI suggested that AMCs should have a documented policy on types of actions to be taken based on the likelihood of wrongdoing and other relevant factors.

|

PRACTICE QUESTION

Q. Consider the following statements:

1. All the Asset Management Companies are governed by SEBI and Association of Mutual Funds in India (AMFI).

2. The net worth of an AMC must be not less than Rs. 10 crores.

Which of the above statements are correct?

(a) Only 1

(b) Only 2

(c) Both 1 and 2

(d) Neither 1 nor 2

Correct Answer: c -Both 1 and 2

|

https://legal.economictimes.indiatimes.com/news/regulators/sebi-proposes-institutional-mechanism-for-amcs/100395375#:~:text=India's%20Securities%20and%20Exchange%20Board,market%20abuse%20and%20fraudulent%20transactions.