Description

Context: As the problem of non-performing assets persists in a sector stressed by the pandemic, the RBI Governor has agreed to look at a proposal for creating a bad bank.

What is NPA’s?

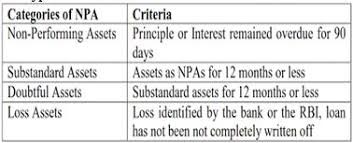

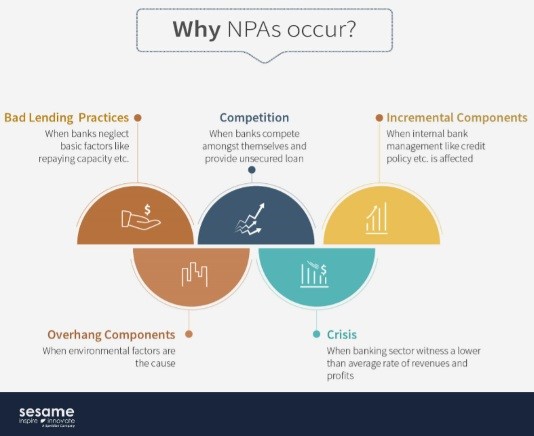

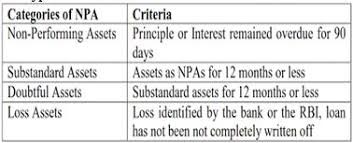

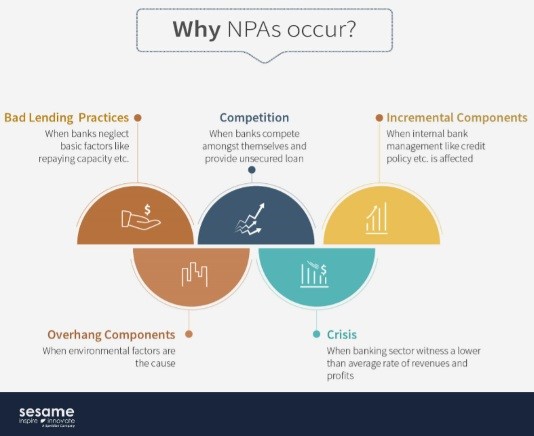

- Loans in which the borrower fails to pay principal and/or interest charges within 90 days are classified as NPAs.

What’s a bad bank and how does it work?

- A bad bank conveys the impression that it will function as a bank but has bad assets to start with.

- Technically, a bad bank is an asset reconstruction company (ARC) or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

- Former RBI Governor Raghuram Rajan had opposed the idea of setting up a bad bank in which banks hold a majority stake.

- He saw this idea as shifting loans from one government pocket (the public sector banks) to another (the bad bank) and did not see how it would improve matters.

- Indeed, if the bad bank were in the public sector, the reluctance to act would merely be shifted to the bad bank.

- US-based Mellon Bank created the first bad bank in 1988, after which the concept has been implemented in other countries including Sweden, Finland, France and Germany.

- However, resolution agencies or ARCs set up as banks, which originate or guarantee lending, have ended up turning into reckless lenders in some countries.

Do we need a bad bank?

- The idea gained currency during Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- ARCs have not made any impact in resolving bad loans due to many procedural issues.

- Now, with the pandemic hitting the banking sector, the RBI fears a spike in bad loans in the wake of a six-month moratorium it has announced to tackle the economic slowdown.

What is the stand of the RBI and government on a bad bank?

- While the RBI did not show much enthusiasm about a bad bank all these years, there are signs that it can look at the idea now.

- RBI can consider the idea of a bad bank to tackle bad loans.

- In recent months, the Finance Ministry too has been receptive to the idea.

- It would be better to limit the objective of these asset management companies to the orderly resolution of stressed assets, followed by a graceful exit.

- Two models under consideration to solve the problem of stressed assets.

- The first is a private asset management company (PAMC), which is said to be suitable for stressed sectors where the assets are likely to have an economic value in the short run, with moderate levels of debt forgiveness.

- The second model is the National Asset Management Company (NAMC), which would be necessary for sectors where the problem is not just one of excess capacity but possibly also of economically unviable assets in the short to medium terms.

Will a bad bank solve the problem of NPAs?

- Despite a series of measures by the RBI for better recognition and provisioning against NPAs, as well as massive doses of capitalisation of public sector banks by the government, the problem of NPAs continues in the banking sector, especially among the weaker banks.

- As the Covid-related stress pans out in the coming months, proponents of the concept feel that a professionally-run bad bank, funded by the private lenders and supported the government, can be an effective mechanism to deal with NPAs.

- The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course.

- The presence of the government is seen as a means to speed up the clean-up process.

- Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system.

Has the banking system made any proposal?

- The banking sector, led by the Indian Banks’ Association, had submitted a proposal last May for setting up a bad bank to resolve the NPA problem, proposing equity contribution from the government and banks.

- The proposal was also discussed at the Financial Stability and Development Council (FSDC) meeting, but it did not find favour with the government which preferred a market-led resolution process.

- The banking industry’s proposal was based on an idea proposed by a panel on faster resolution of stressed assets in public sector banks headed by former Punjab National Bank Chairman Sunil Mehta.

- This panel had proposed a company, Sashakt India Asset Management, for resolving large bad loans two years ago.

How serious is the NPA issue in the wake of the pandemic?

- The RBI noted in its recent Financial Stability Report that the gross NPAs of the banking sector are expected to shoot up to 13.5% of advances by September 2021, from 7.5% in September 2020, under the baseline scenario, as “a multi-speed recovery is struggling to gain traction” amidst the pandemic.

- The K V Kamath Committee, which helped the RBI with designing a one-time restructuring scheme, also noted that corporate sector debt worth Rs 15.52 lakh crore has come under stress after Covid-19 hit India.

- The panel has said companies in sectors such as retail trade, wholesale trade, roads and textiles are facing stress.

- Sectors that have been under stress pre-Covid include NBFCs, power, steel, real estate and construction. Setting up a bad bank is seen as crucial against this backdrop.

https://indianexpress.com/article/explained/npa-bad-bank-balance-sheet-loan-rbi-shaktikanta-das-7151841/