Description

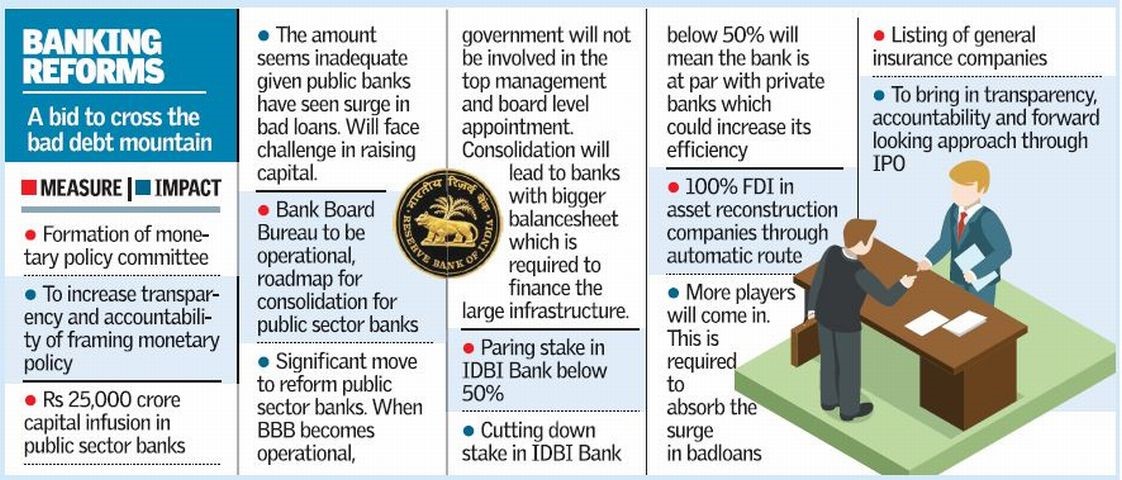

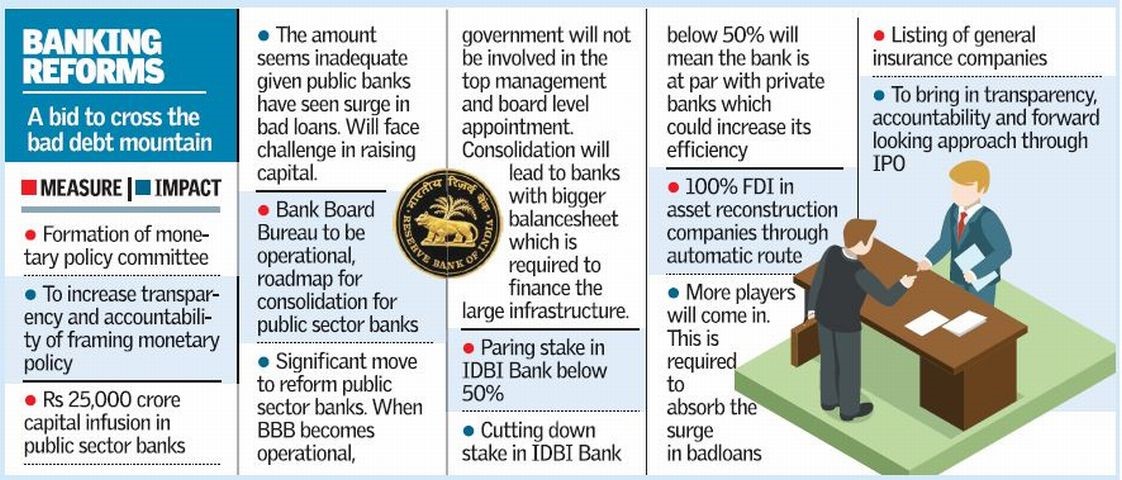

Context: Centre mulls BIC model for bank recap

- With the RBI raising concerns over the issuance of zero-coupon bonds for recapitalisation of public sector banks (PSBs), the Finance Ministry is examining other avenues for affordable capital infusion, including setting up of a Bank Investment Company (BIC).

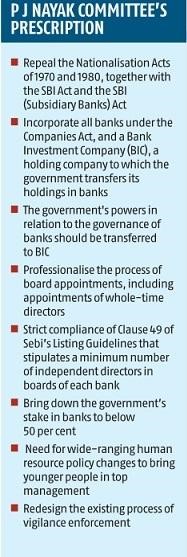

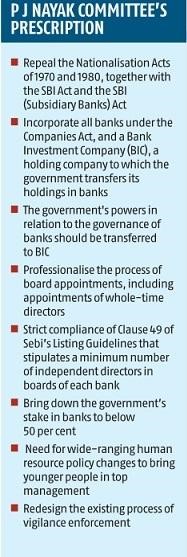

- Setting up a BIC as a holding company or a core investment company was suggested by the J. Nayak Committee in its report on ‘Governance of Boards of Banks in India

The report recommended transferring shares of the government in the banks to the BIC, which would become the parent holding company of all these banks; as a result of this, all the PSBs would become ‘limited’ banks.

Zero-coupon bonds

- A zero-coupon bond is a debt security instrument that does not pay interest.

- Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity.

- The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

https://www.thehindu.com/business/Economy/centre-mulls-bic-model-for-bank-recap/article33589572.ece