Disclaimer: Copyright infringement not intended.

Context

- The income tax department raised tax demands amounting to Rs 13,566 crore during the last four financial years under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 to deal with undisclosed foreign income and assets.

Important Definitions

- “Undisclosed asset located outside India” means an asset (including financial interest in any entity) located outside India, heldby an assessee in his name or of which he is a beneficial owner AND he has NO explanation about the source of Investment in such asset OR explanation given by him is in the opinion of AO unsatisfactory.

- “Undisclosed foreign income and asset” means the total amount of undisclosed income of an assessee from a source outside India& the value of an undisclosed asset located outside India.

.jpeg)

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

About:

- Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015is an Act of the Parliament of India. The Act came into effect on 1 July 2015.

Aim:

- It aims to curb black money, or undisclosed foreign assets and income, and imposes tax and penalty on such income.

Broader Objective:

- The goal of this law is to bring back the income and assets held abroad back to the country. As a result, only an Indian resident gets the opportunity to declare undisclosed assets.

2019 Amendment:

- An amendment was made in 2019 in the Act retrospectively, to cover even persons who are non-residents but were residents when the asset was acquired or income was earned outside India.

- The government gives a time frame so that someone can disclose assets. If the resident holding undisclosed assets declares the assets in the given time frame, they are not subject to prosecution.

Coverage: This Act covers only 2 issues:

-

- Undisclosed foreign income or

- Undisclosed foreign assets.

- A base tax of 30% is leviable on any undisclosed foreign income or foreign asset.

- Besides the tax so leviable, penalty at the rate of 90% (three times the amount of tax computed). There are other penalties also leviable on account of non-disclosure of required information etc and there are prosecution provisions also within the Act.

Penalty

Related to undisclosed foreign income and assets:

- The taxpayer holding undisclosed foreign income and assets is liable to pay a penalty that is three times the tax computed under section 10 of the article.

Related to default in payment of tax arrear:

- If the taxpayer is in default, he/she is liable to pay a penalty that equals the amount of tax arrears.

Related to other defaults:

- If the taxpayer does not comply with the rules and officers and is subject to defaults then he/she is liable to pay a sum ranging from 50,000- 2,00,000 INR.

Related to failure in filing return:

- If a person fails to file return before the end of that assessment year then he/she is subject to a 10,00,000 INR penalty.

- There will be no penalty if the aggregate balance in one or more foreign bank accounts is less than 5,00,000 INR.

Related to failure to provide information or provide inaccurate particulars while filing:

- If a person provides inaccurate information or does not provide information, in general, is subject to a penalty of 10,00,000 INR.

- There will be no penalty if the aggregate balance in one or more foreign bank accounts is less than 5,00,000 INR.

Analysis on Black Money

What is black money?

- There is no official definition of black money in economic theory, with several different terms such as parallel economy, black money, black incomes, unaccounted economy, illegal economy and irregular economy all being used more or less synonymously.

- The simplest definition of black money could possibly be money that is hidden from tax authorities. That is, black money can come from two broad categories: illegal activity and legal but unreported activity.

Through illegal activities:

- Money that is earned through illegal activity is not reported to the tax authorities, and so is black.

Tax avoidance

- The second category comprises income from a legal activity that is not reported to the tax authorities. For example, let us assume that a piece of land is sold, with the payment made in the proportion of 60% by cheque or electronic transfer, and 40% in cash. If that 40% cash component is not reported to the Income Tax Department, then it is black money. A large number of small shops around the country almost exclusively do business in cash without receipts. All of this could potentially be black money.

Tax evasion

- Another major source of black money is income earned by companies that is routed through shell companies abroad, thereby evading tax authorities.

Sources of Black Money in India

Bullion and Jewellery market

- The option of converting black money to gold ingots or jewellery is very widespread in practice.

Out of book transactions

- By not providing bills and receipts for the sales, they are basically adding to their unaccounted sum of money on which they will not pay taxes.

Hawala

- This is an informal and inexpensive method of transferring money without the use of the bank. It works on codes and contacts and does not require disclosure of any kind of information.

Non-profit organizations

- Some NGOs exist only on paper. Their model is collecting legitimate amounts from citizens, misrepresenting the number of orphan children or needy persons they work for, thereby creating a source of black money for the promoter.

Tax havens

- There are some small countries with liberal tax laws where foreigners don’t have to pay taxes. By setting up shell companies in these countries, people redirect their funds and reduce their tax liabilities.

Real estate

- Since the prices of real estate are on the rise, many people undervalue their property to save on property taxes.

Manipulation of income by Tax payers

- Taxpayers may manipulate income by inflating expenses, and obtaining fake invoices. There are operators providing entries by accepting cash in lieu of cheques, thereby laundering large sums of money for commissions.

- Due to frequent migration such operators escape prosecution under the Income Tax Act.

Trade-based money laundering

- Trade-based money laundering is a process used to disguise the proceeds of crime by transferring money through trade transactions and legitimising their illegal origins.

- It includes over-invoicing, under-invoicing or multiple invoicing of goods and services, misrepresenting the quality and type of a good or service, forgery of export promotion scheme.

Use of Cooperative Banks

- Co-operative banks are also used to generate black money. Some have accepted deposits from individuals and lent that money to founders and directors.

- The process is illegal and escapes the law because it is not regulated by the RBI but by politicians who are directors in such banks.

Other Institutions

- Schools, colleges and institutions use management quota to garner students’ money into black money pools for the founders.

Crime

- Smuggling of goods and contraband items, drug trafficking, arms deals and other illegal activities are facilitated by the use of black money and in turn generates more black money.

Why is it difficult to quantify Black Money?

- The whole concept that Black Money is the money that is unaccounted for makes it impossible for the government to identify the exact amount of black money that is in the economy and how much of it is converted into white.

- According to the Standing Committee’s report, the sectors that see the highest incidence of black money include real estate, mining, pharmaceuticals, pan masala, the gutkha and tobacco industry, bullion and commodity markets, the film industry, and educational institutes and professionals.

- As the report also notes, there is no accurate well-accepted methodology to make such an estimation. So far there is no uniformity in the assumptions made by the various agencies tasked with measuring the black economy.

- The estimates of the black money in the system provided by the Standing Committee vary from 7% of GDP to 120% of GDP, highlighting the wide variance in the methods of estimation.

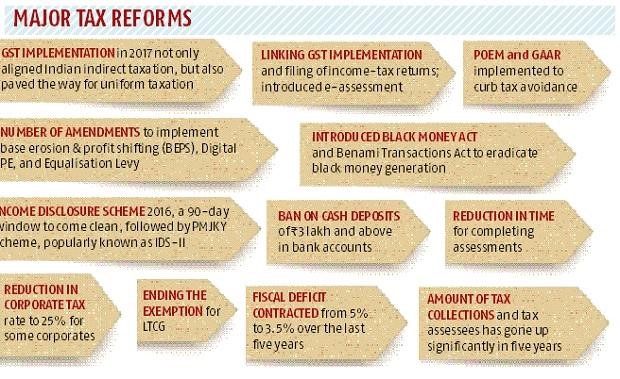

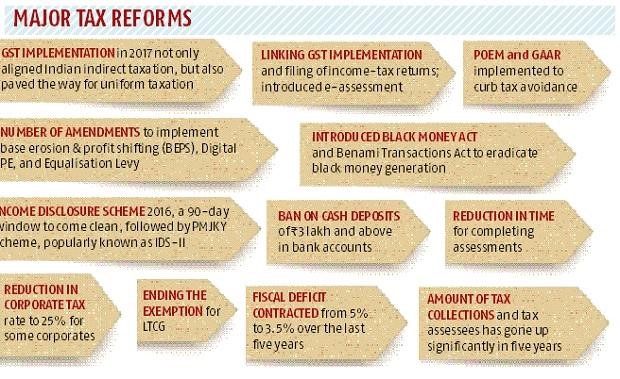

How does the government try to curb black money?

- There are several ways and the first is through legislative action. The government has already enacted several laws that seek to formalize the economy and make it necessary to report economic transactions. These include the

- Central Goods and Services Tax Act,

- Various GST Acts at the State levels,

- Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015,

- Benami Transactions (Prohibition) Amendment Act, and the Fugitive Economic Offenders Act.

- For the investigation of Panama Paper leaks, the government brought in Constitution of Multi-Agency Group (MAG) with officers of the Central Board of Direct Taxes (CBDT), Reserve Bank of India (RBI), Enforcement Directorate (ED) and Financial Intelligence Unit (FIU).

- India has been collaborating with foreign governments to facilitate and expand the exchange of information. For this, the Double Taxation Avoidance Agreements (DTAAs). has been signed with tax havens like Mauritius and Cyprus.

- Global efforts to combat tax evasion and black money were taken by joining the Multilateral Competent Authority Agreement in respect of Automatic Exchange of Information (AEOI) and having an information sharing arrangement with the US under its Foreign Account Tax Compliance Act (FATCA).

- An information technology-based ‘Project Insight’ was introduced by the Income Tax Department to strengthen the non-intrusive information-driven approach for improving tax compliance and effective utilization of available information.

- The Income Declaration Scheme, 2016 was announced, which is like a one-time amnesty-like compliance window for citizens to declare their undisclosed income. Under the scheme, persons can declare their undisclosed income and pay tax, surcharge and penalty amounting to 45% of the total undisclosed income. Here, the income declared is taxed at 30% plus a 'Krishi Kalyan Cess' of 25% on the taxes payable and a penalty at the rate of 25% of the taxes payable, amounting to 45% of the income declared under the scheme.

- Another method employed by the government to make it harder for transactions to be hidden is to mandate the reporting of PAN for transactions of more than ₹2.5 lakh, and the prohibition of cash receipts of ₹2 lakh or more and a penalty equal to the amount of such receipts if a person contravenes the provision.

- The Income Tax Department has also started monitoring non-filers of income tax returns using third-party information to identify persons who have undertaken high value financial transactions but not filed their returns.

- Operation Clean Money : Operation Clean Money was launched in 2017 for the collection, colla,tion and analysis of information on cash transactions, extensive use of information technology and data analytics, tools for identification of high-risk cases, expeditious e-verification of suspect cases and enforcement actions in appropriate cases, including searches, surveys, inquiries, assessment of income, levy of taxes, penalties etc. and filing of prosecution complaints in criminal courts wherever applicable.

Reforms Suggested to curb Black Money: The Way Forward

- Black money clean-up is underway on many fronts. Many of the pieces of the puzzle have been put in place.

- Prevention and control of black money is a pre-requisite for establishing an equitable, transparent and efficient economy.

- In addition to the measures adopted, set out below are some recommendations for regulating and eventual eradication of black money.

Digitization

- Mandatory digitization of all land and property records linked to PAN/Aadhaar numbers.

Tax on agricultural income

- Tax on agricultural income based on farm holding, leaving small and marginal farmer untouched and unaffected.

Plastic money

- Plastic money should be encouraged. A charge has already been introduced for cash withdrawal beyond a limit.

Cash transaction fee

- Cash transaction fee must be introduced. At present, many business establishments display a sign that credit card payment will be charged extra. A cash transaction levy must instead be introduced and they must come to the central government to recover the cost of currency management.

Reduce Settlement Cycle

- To encourage credit/debit card payments, the settlement cycle must be reduced from monthly to fortnightly on a mandatory basis, otherwise it will give rise to unhealthy competition.

Funding to political parties should come under the purview of RTI

- Lastly, the funding to political parties should come under the purview of RTI and income-tax authorities.

- The political party funding needs to be disclosed to the IT department and matched with the spending in various election campaigns.

- The ruling party, as well as the Opposition parties should ensure that nobody, including them, is excluded to be put under the scanner. And, eventually the country should move towards state funding of elections.

Vigorous Prosecution

- The Wanchoo Committee also recommended that the department should completely reorient itself to a more vigorous prosecution policy in order to instill a wholesome respect for the tax-laws in the minds of the taxpayers.

Rationalization of Controls

- Since ill-devised controls are major causes of black money, it is essential to rationalize the control system.

- Government has taken some steps in this direction by easing the licensing policy etc. But still there are many cumbersome rules and formalities and unnecessary control in many areas, which need to be effectively rationalized.

Arousing Public Conscience

- A special drive should be undertaken to arouse public conscience by enhancing the co-operation of the leaders in various walks of life.

Ethical, socio-economic and administrative levels

- The fight against the menace of black money needs to be fought simultaneously at ethical, socio-economic and administrative levels. At the ethical level, we require reinforcing value/moral education in school and highlighting the evils of tax evasion and black money.

- At socio-economic level, the thrust of public policy should be to encourage savings, simplicity and reduce the gap between the rich and the poor.

Technical upgradation

- All agencies require continuous technological upgradation and exposure to global best practices to effectively tackle the hazard of black money.

Fast Track Investigation

- A common platform for sharing intelligence/information between Central and State agencies should be established for expeditious and fast-track investigation process of unearthing black money transactions and effective law enforcement.

Keeping Citizens in loop

- It is imperative that citizens are kept in the loop about government strategies and made to understand the merits of tax compliance and the perils of black money and how it can be possibly controlled.

Tax Compliance

- One of the most important factors in ensuring tax compliance is reducing tax rates.This can increase tax revenue in two ways, first by increasing tax base and second by increasing compliance with IT Rules.

Broad-based information and intelligence gathering mechanism

- The information and intelligence gathering mechanism of various economic agencies must be broader based so that the entire scope of economic activity is seized in an electronic manner, mined and analysed.

Conclusion

- A comprehensive analysis of the factors leading to the generation of black money in India along with various measures attempted to counter it to date makes it apparent that there is no single magic bullet that can rid society of this menace.

- The fight against the generation and accumulation of black money is likely to be far more complex and prolonged requiring a comprehensive mix of well-defined strategies to be pursued with patience and perseverance by the central and state governments and put into practice by all agencies in a coordinated manner.

|

MAINS PRACTICE QUESTION

Q. The fight against the generation and accumulation of black money is likely to be far more complex and prolonged requiring a comprehensive mix of well-defined strategies simultaneously at ethical, socioeconomic, and administrative levels. Comment.

|

https://economictimes.indiatimes.com/news/economy/finance/tax-demands-of-rs-13566-crore-raised-in-four-fiscals-under-black-money-law-mos-finance/articleshow/98813764.cm