Disclaimer: Copyright infringement not intended.

Context

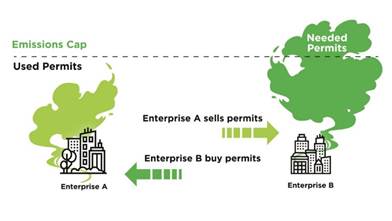

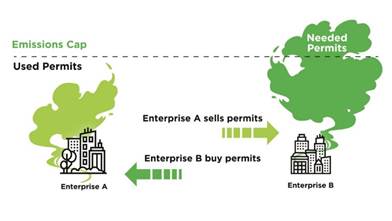

Carbon Credits

|

Clean Development Mechanism The CDM allows emission-reduction projects in developing countries to earn certified emission reduction (CER) credits, each equivalent to one tonne of CO2. These CERs can be traded and sold, and used by industrialized countries to a meet a part of their emission reduction targets under the Kyoto Protocol.

The mechanism stimulates sustainable development and emission reductions, while giving industrialized countries some flexibility in how they meet their emission reduction limitation targets. The CDM is the main source of income for the UNFCCC Adaptation Fund. The Fund was established to finance adaptation projects and programmes in developing country Parties to the Kyoto Protocol that are particularly vulnerable to the adverse effects of climate change. The Adaptation Fund is financed by a 2% levy on CERs issued by the CDM. Kyoto Protocol The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions. The Kyoto Protocol was adopted in Kyoto, Japan, on 11 December 1997 and entered into force on 16 February 2005. The Kyoto Protocol implemented the objective of the UNFCCC to reduce the onset of global warming by reducing greenhouse gas concentrations in the atmosphere to "a level that would prevent dangerous anthropogenic interference with the climate system".

The Kyoto Protocol applied to the seven greenhouse gases listed in Annex A: carbon dioxide (CO2), Methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), nitrogen trifluoride (NF3). Nitrogen trifluoride was added for the second compliance period during the Doha Round. The Protocol was based on the principle of common but differentiated responsibilities: it acknowledged that individual countries have different capabilities in combating climate change, owing to economic development, and therefore placed the obligation to reduce current emissions on developed countries on the basis that they are historically responsible for the current levels of greenhouse gases in the atmosphere. The Protocol's first commitment period started in 2008 and ended in 2012. A second commitment period was agreed to in 2012 to extend the agreement to 2020, known as the Doha Amendment to the Kyoto Protocol. The Doha negotiations failed due to lack of consensus among countries. |

Importance

Need to develop Carbon Credit Market in India

Significance

|

PAT SCHEME In India, the clean development mechanism under the Kyoto Protocol provided a primary carbon market for the players. The secondary carbon market is covered by the perform-achieve-trade scheme (which falls under the energy efficiency category) and the renewable energy certificate. The insight gained from each of the schemes will prove to be instrumental in the creation of a national carbon market.

The Perform, Achieve and Trade (PAT) Scheme is a programme launched by the Bureau of Energy Efficiency (BEE) to reduce energy consumption and promote enhanced energy efficiency among specific energy intensive industries in the country.

Under this scheme, reductions in specific energy saving targets are assigned to Designated Consumers (DCs) for a three-year cycle. The target reduction for each DC is based on their current levels of energy efficiency, so that energy efficient DCs will have lower target of percentage reduction, as compared to less energy efficient DCs which will have higher targets. While calculating the specific energy consumption “gate-to-gate” approach is adopted, thereby including all energy consumption against the total production. |

Paris Agreement

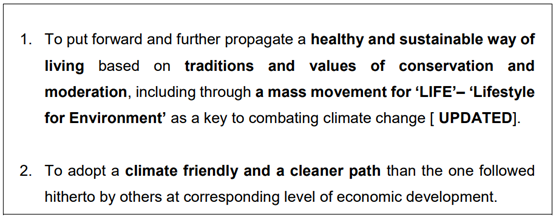

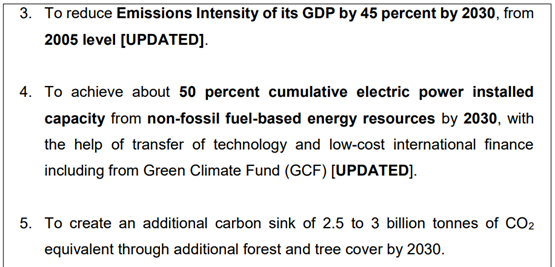

Nationally Determined Contribution (NDCs)

India’s Updated NDCs

© 2025 iasgyan. All right reserved