Description

Disclaimer: Copyright infringement not intended.

Context

- The Reserve Bank of India (RBI) is in the process of implementing the Central Bank Digital Currency (CBDC) in a phased manner for wholesale and retail segments

Details

- The introduction of CBDC was announced in the Union Budget 2022-23. Necessary amendments to the relevant section of the RBI Act, 1934 have been made with the passage of the Finance Bill 2022.

What Is a Central Bank Digital Currency (CBDC)?

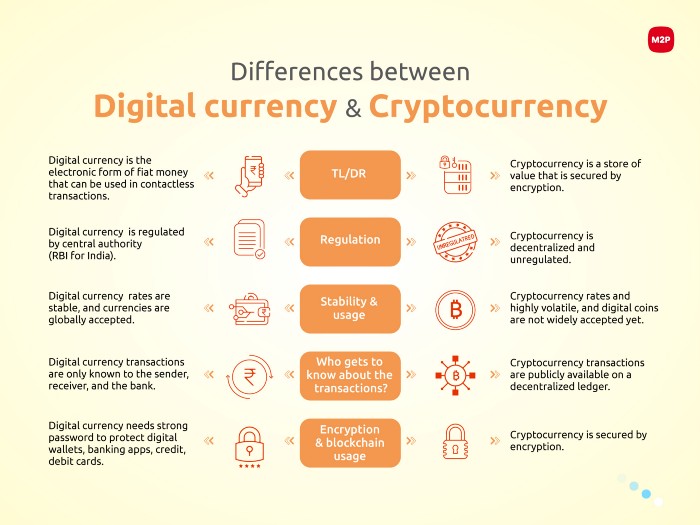

- Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency.

- Many countries are developing CBDCs, and some have even implemented them.

- Businesses, households, and financial institutions can use CBDCs to manage payments and savings. A nation’s monetary policies, central bank, and trade surpluses determine the supply and value of CBDC. The use of distributed ledger or blockchain technologies in CBDC is based on the requirement.

- CBDCs are neither cryptocurrencies nor equivalent to electronic cash. Instead, they exhibit features of both fiat currencies and cryptocurrencies.

Types of CBDTs

Benefits of CBDT

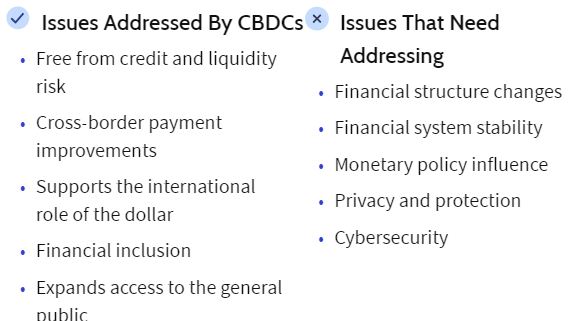

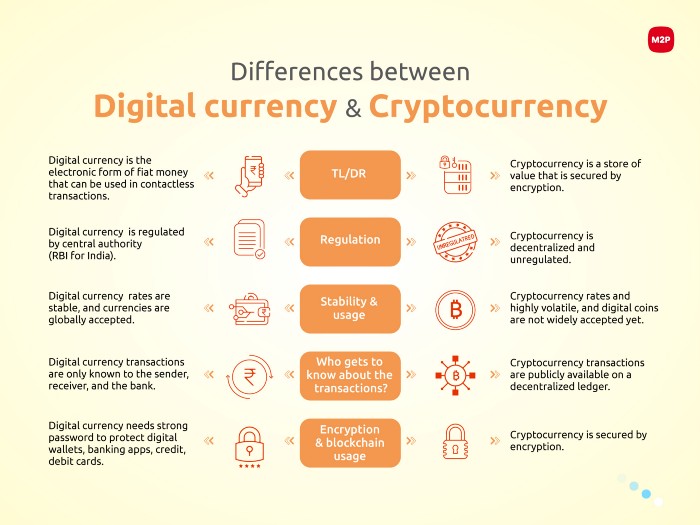

At present, central banks of various nations are currently examining the positive implications that a digital currency contributes to financial inclusion, economic growth, technology, innovation and increased transaction efficiencies.

Real-time money transfer

- Money transfers and payments can be made in real-time from the payer to payee without relying on intermediaries such as banks.

Easy tracking of currency

- With the introduction of CBDC in a nation, its central bank would be able to keep a track of the exact location of every unit of the currency.

Income Tax

- Tax avoidance and tax evasion will be near to impossible as methods such as offshore banking and unreported employment cannot be practised to hide financial activities from the central bank.

Curbing Crime:

- Criminal activities can be easily spotted and ended such as terror funding, money laundering, and so forth.

Alternative to physical cash

- Digital currencies issued by central banks would provide for a modern alternative to physical cash.

Seigniorage income

- Issuance of digital currency would avoid a reduction of seigniorage income for governments in the event of the disappearance of physical cash.

Seigniorage income refers to the difference between the value of money and the cost to produce and distribute it.

Volatility

- CBDCs will be pegged to assets such as gold and thereby will not witness any volatility as in the case of cryptocurrencies.

Need for CBDCs in India

In May 2020, China started testing its Digital Yuan-- Digital Renminbi (RMB). Several other nations have also started research and pilot projects related to CBDC such as Canada, USA and Singapore. Also, China and USA are battling to gain the supremacy across markets with the introduction of new-age financial products and India may get caught up in this digital proxy war.

Furthermore, there's a wide disconnect between the number of bank accounts and mobile phone connections in India, and CBDC can possibly bridge this gap.

- The Digital Rupee provides India with the opportunity to establish the dominance of Digital Rupee as a superior currency for trade with its strategic partners, thereby reducing its dependency on the dollar.

- It will also help India in addressing the malpractices such as tax evasion, terror funding, money laundering, etc., as the central bank can keep a check on every unit of the digital currency.

- CBDC will empower RBI to control monetary policies. These effects of monetary policies can be immediately reflected instead of relying on commercial banks to make changes when they deem fit.

- It will also empower RBI to monitor transactions and credit flow across the Indian economy, weeding out scams, frauds instantly, thereby protecting depositors' money.

- CBDC will also help in distracting the investors from investing in the current crypto assets that are highly risky.

- It will also turn every large technology company in a fintech company nullifying the need for permission or partnership with a bank. It will create incentives for the companies and provide financial assistance to those who have been at the mercy of banks.

- It will also make loans, insurance, stocks and other financial products a natural extension using programmable smart contracts.

Digital Proxy War

- The Dollar has been unchallenged as the world's reserve currency, giving the US an advantage over the world's financial system, enabling it to impose sanctions against other nations. In view of the recent trade war with the US, China is pushing for a more advanced financial system using Digital Renminbi (RMB).

- The Digital Rupee will help RBI in achieving financial inclusion, shift to a cashless society, reducing the cost of printing and handling cash. Thus, there's a need for the introduction of a Digital Rupee as it will not only empower the citizens but will also enable them in expanding digital economy, putting an end to the current banking system.

Final Thoughts

- The Digitized Money will help RBI in achieving financial inclusion, shift to a cashless society, reducing the cost of printing and handling cash. Thus, there's a need for the introduction of a Digital Rupee as it will not only empower the citizens but will also enable them in expanding digital economy, putting an end to the current banking system.

- Digitized money will spur global trade since it will be more convenient and better risk mitigation due to the verifiable nature of transactions in block chain. This will lead to emergence of a new universal currency and newer markets. A new segment of investment sources will arise such as game finance and decentralized finance.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GQ4A2ARIA.1&imageview=0

1.png)