Description

Disclaimer: Copyright infringement not intended.

Context

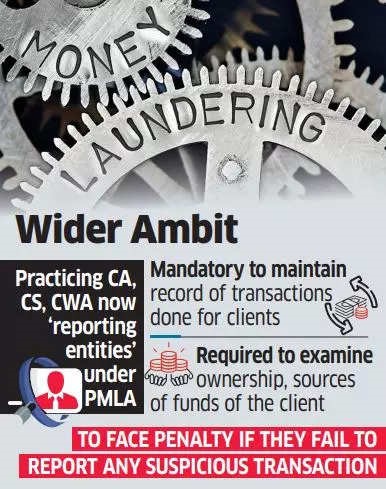

- The Finance Ministry has notified changes to the Prevention of Money Laundering Act.

- It has brought in practicing chartered accountants, company secretaries, and cost and works accountants carrying out financial transactions on behalf of their clients into the ambit of the money laundering law.

Note: Lawyers and legal professionals, however, seem to have been kept out in the new definition of entities covered under the PMLA.

Highlights

- An activity will be recognised under the Prevention of Money Laundering Act if these professionals carry out financial transactions on behalf of their client such as ---

- Buying and selling of any immovable property;

- Managing of client money,

- Securities or other assets;

- Management of bank,

- Savings or securities accounts;

- Organisation of contributions for the creation, operation or management of companies;

- Creation, operation or management of companies, limited liability partnerships or trusts, and

- Buying and selling of business entities.

- The reporting entities shall be expected to maintain the record of all transactions and would be required to furnish these to the Director (Financial Intelligence Unit).

- The reporting entities would also be expected to conduct KYC before commencement of each specified transaction and will have to examine the ownership and financial position including sources of funds of the client and to record the purpose behind conducting the specified transaction.

- Failure to meet these requirements could invite imposition of penalty by the Director, FIU and even more action by other investigative agencies such as the Enforcement Directorate.

Significance

- The notification aims to prevent money laundering and terrorist financing by ensuring that practicing professionals in these fields comply with the PMLA when executing financial transactions on behalf of clients.

- The amendments are expected to aid investigative agencies further in their probe against dubious transactions involving shell companies and money laundering.

- The change in PMLA law also assumes significance ahead of the proposed assessment of India under the Financial Action Task Force (FATF) expected to be undertaken later this year. The FATF is the global money laundering and terrorist financing watchdog.

Conclusion

- In conclusion, the inclusion of practicing professionals in the field of Chartered Accountancy, Company Secretaries, and Cost and Works Accountants under the ambit of the Prevention of Money Laundering Act is a significant step in the fight against money laundering and terrorist financing.

- It will help ensure that these professionals comply with the PMLA and take necessary precautions to prevent such activities.

READ ABOUT PMLA: https://www.iasgyan.in/daily-current-affairs/prevention-of-money-laundering-act#:~:text=Punishment%20%2D%20The%20Act%20prescribes%20that,10%20years%2C%20along%20with%20fine.

https://www.iasgyan.in/daily-current-affairs/pmla

|

PRACTICE QUESTION

Q. The inclusion of practicing professionals in the field of Chartered Accountancy, Company Secretaries, and Cost and Works Accountants under the ambit of the Prevention of Money Laundering Act is a significant step in the fight against money laundering and terrorist financing. Substantiate.

|

-min.jpg)

https://indianexpress.com/article/business/banking-and-finance/pmla-finance-ministry-ca-cs-accountants-financial-transactions-clients-money-laundering-law-8590871/