Disclaimer: Copyright infringement not intended

Context

Measures announced

Considering the importance of cooperative banks in promoting inclusive growth, RBI has announced three measures for the cooperative banking sector.

What are cooperative banks?

Characteristics of Cooperative Bank

Some of the main features or characteristics of cooperative banks are:

Customer-owned entities

The members of cooperative banks are both the owners and the customers of the bank. Thus, the aim of the cooperative bank is not to maximize profits but to provide the best possible services to its members. Some of the cooperative banks also admit non-members so as to provide them with banking services.

Democratic member control

Cooperative banks are owned and controlled by members, who democratically elect the board of directors. The basic principle of co-operatives “one man one vote” is followed, irrespective of the number of shares held by a member, which ensures that no member enjoys any arbitrary power over other members.

Profit allocation

A specified portion of the profits are transferred to Statutory Reserve and other reserves, and then a fair rate of interest is paid on the capital subscribed by the members. A part of this profit can also be distributed to the co-operative members, with legal and statutory limitations in most cases.

Inclusion of rural masses

It plays a significant role in the financial inclusion of unbanked rural masses.

Functions of Cooperative Banks

Objectives of Cooperative Banks

Structure of Cooperative Banks in India

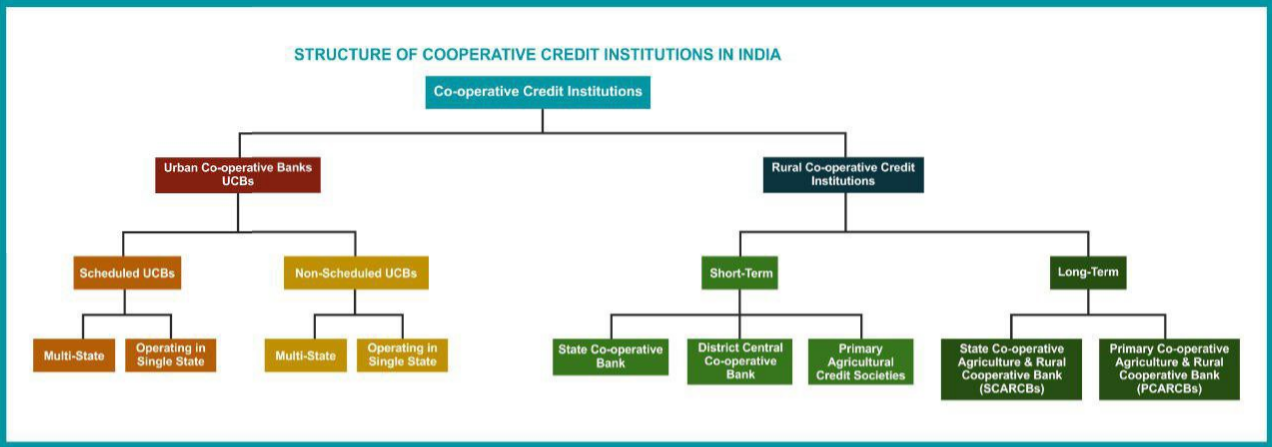

The co-operative banking structure in India is divided into Short term structure and Long-term structure.

Short term structure has three levels

Long term structure has two levels

Broadly, co-operative banks in India are divided into two categories - urban and rural.

Rural cooperative credit institutions could either be short-term or long-term in nature. Further, short-term cooperative credit institutions are further sub-divided into State Co-operative Banks, District Central Co-operative Banks, Primary Agricultural Credit Societies.

Meanwhile, the long-term institutions are either State Cooperative Agriculture and Rural Development Banks (SCARDBs) or Primary Cooperative Agriculture and Rural Development Banks (PCARDBs).

On the other hand, Urban Co-operative Banks (UBBs) are either scheduled or non-scheduled. Scheduled and non-scheduled UCBs are again of two kinds- multi-state and those operating in single state.

Types of Cooperative Banks in India

The co-operative banking structure in India is divided into the following 5 categories:

Cooperative banks in India fund rural areas under:

Cooperative banks in India finance urban areas by virtue of:

Importance of Cooperative Banks

Advantages of Cooperative Banks

Easy to form

Registration and legal requirements are comparatively easy compared to traditional banks. It takes a group of ten adults to form a cooperative bank. It needs a base capital of 25 lakhs only as compared to 100 crores of Small Finance Banks.

Alternative credit source

One of the objectives of the cooperative system is to provide easy accessibility to the rural section of the country so as to protect them from the clutches of greedy money lenders. These money lenders exploit the needy by providing credit facilities at higher rates and by manipulating their accounts. It acts as an effective alternative to this traditional money lending system.

Cheap credit

It provides cheap credit to rural masses. It provides a high-interest rate to members for their investments and low lending interest rate. This also protects the rural masses from the exorbitant interest rate at which money lender provides credit, thus breaking their monopoly.

Encouragement of savings and investments

It has encouraged the habit of thrift among the masses. Instead of hoarding money or spending unnecessarily, masses tend to invest and save their money.

Advancement in farming

Cooperative societies provide credit to agriculturalists at cheaper rates to buy inputs, warehousing facilities, marketing assistance and other facilities. These banks often provide assistance for buying cheap products and services and help them by introducing them to modern technology and better farming methods to improve their output.

Problems faced in the Indian Cooperative Banking System

Small capital base

Cooperative banks have a small capital base as it can start with a capital base of 25 lakhs, making it difficult for them to account a portion of such capital as their working capital and raising working capital has been a major hurdle for almost all cooperative banks.

Political interference

Politicians use them to increase their vote bank and usually get their representatives elected over the board of directors in order to gain undue advantages like sanctioning of loans which later gets written off.

RBI Supervision

The supervision of RBI is not as stringent on cooperative banks as compared to commercial banks. RBI inspects the books of these banks only once a year.

Dual control

Cooperative banks are controlled under the dual system, i.e. by RBI and by their respective State government which poses a problem in coordination and management.

Professional management and technological advancement

Cooperative banks are often reluctant to adopt new technologies like computerised data management. Professional management in the banks is often missing due to lack of training of personnel because of lack of funds.

Dependence of finance

Cooperative banks depend heavily on RBI, NABARD and the government for refinancing facilities. It depends on the government for capital rather than on its members.

Overdue loans

Overdue loans of cooperative banks are increasing yearly, restricting the recycling of funds which in turn affects the lending and borrowing capacity of the bank.

|

Case of Punjab and Maharashtra Cooperative Bank (PMC Bank) The PMC Bank had Rs 11,617 crore in deposits as on March 31, 2019. It had violated Reserve Bank of India (RBI) norms by lending heavily to one client-real-estate firm Housing Development and Infrastructure Limited (HDIL), which itself is facing bankruptcy proceedings. PMC Bank has extended 73 per cent of their assets to HDIL. The former chiefs of the bank and the promoters of HDIL have been booked for cheating, and lookout notices have also been issued against them. The PMC Bank crisis shows how the watchdogs -the bank’s auditors, the RBI and the government were lousy in doing their jobs and taking responsibility. An action was taken by RBI under sub-section (1) of Section 35A of the Banking Regulation Act,1949 read with Section 56 of the Act which deals with the power of RBI to give directions. PMC Bank cannot grant or renew any loans or advances or to make any investments or accept any new deposits without the prior approval of RBI for the next six months. |

Measures to be taken

PMC Bank is not the first case of failure of the cooperative banking system in India. The Madhavpura Cooperative Bank scam in 2001-02 was a clear signal to bring certain changes in the regulatory and supervisory structure of cooperative banks. But no heed was given at that time. Since then, urban cooperative banks are failing with alarming regularity. Their numbers fell from 1,926 in 2004 to 1,551 in 2018, as per RBI data. These issues need to be addressed and remedied if the Government wants the public to place their trust in the country’s banking system.

In 2015, an RBI panel under R. Gandhi, a former deputy governor at the Central bank, had proposed several governance reforms for the cooperative banking sector, some of which are as follows:

Conclusion

https://www.livemint.com/economy/rbi-raises-co-operative-banks-housing-loan-limits-by-100-11654664316123.html

© 2025 iasgyan. All right reserved