Disclaimer: Copyright infringement not intended

Context

- The Reserve Bank of India (RBI) has decided to adopt a simple four-tiered regulatory framework with differentiated regulatory system for UCBs. The RBI decision is based on the report submitted by NS Viswanathan Committee on UCBs..

- It is aimed at strengthening the financial soundness of the existing urban cooperative banks (UCBs).

Changes made

- The RBI has stipulated a minimum net worth of Rs 2 crore for Tier 1 UCBs operating in single district and Rs 5 crore for all other UCBs (of all tiers). This is expected to strengthen the financial resilience of the banks and enhance their ability to fund their growth..

- Most of the banks already comply with the requirement. The UCBs which do not meet the requirement will be provided a glide path of five years with intermediate milestones to facilitate smooth transition to revised norms.

- The minimum CRAR requirement for Tier 1 banks is retained at the present prescription of 9% under current capital adequacy framework based on Basel-1 rules. For Tier 2, Tier 3 and Tier 4 UCBs, while retaining the current capital adequacy framework, it has been decided to revise the minimum CRAR to 12% so as to strengthen their capital structure.

- The increase in CRAR requirement is reasonable as these UCBs do not have full capital charge for market risk and currently maintain no capital charge for operational risk. As per the data reported by the banks as on March 31, 2021, most of UCBs have CRAR more than 12% (1274 banks out of 1534).

- Further, the banks that do not meet the revised CRAR will be provided with a glide path of three years for achieving the same in a phased manner. Accordingly, these banks will have to achieve a CRAR of 10% by the financial year ended March 31, 2024, 11% by March 31, 2025 and 12% by March 31, 2026.

- In order to boost growth opportunities in the sector, the RBI has decided to introduce automatic route for branch expansion to UCBs which meet the revised Financially Sound and Well Managed (FSWM) criteria and permit them to open new branches up to 10% of the number of branches as at the end of the previous financial year. While the branch expansion proposals under the prior approval route will also continue to be examined as hitherto, the process will be simplified to reduce the time taken for granting approvals for opening new branches.

- In respect of housing loans, it has decided to assign the risk weights on the basis of loan-to-value (LTV) ratio alone which would result in capital savings. This will be applicable to all Tiers of UCBs. Revaluation Reserves will be considered for inclusion in Tier-I capital subject to applicable discount on the lines of scheduled commercial banks.

- In order to examine the issues concerning recommendation for capital augmentation under the provisions of Section 12 of the Banking Regulation Act, 1949 (as amended) — applicable to co-operative societies — a Working Group comprising the representatives from the RBI, SEBI and Ministry of Co-operation, Government of India has been constituted.

- The committee has also made certain recommendations regarding Umbrella Organization for the UCB sector which will be examined once the entity is fully operational.

What are cooperative banks?

- A co-operative bank is a financial entity which belongs to its members, who are at the same time the owners and the customers of their bank. It is often established by people belonging to the same local or professional community having a common interest.

- It is formed to promote the upliftment of financially weaker sections of the society and to protect them from the clutches of money lenders who provide loans at an unreasonably high-interest rate to the needy. The co-operative structure is designed on the principles of cooperation, mutual help, democratic decision making and open membership. It follows the principle of ‘one shareholder, one vote’ and ‘no profit, no loss’.

- Cooperatives Banks are registered under the Cooperative Societies Act, 1912. These are regulated by the Reserve Bank of India and National Bank for Agriculture and Rural Development (NABARD) under the Banking Regulation Act, 1949 and Banking Laws (Application to Cooperative Societies) Act, 1965.

- Cooperative banks differ from commercial banks on the grounds of organisation, governance, interest rates, and the scope of functioning, objectives and values.

Characteristics of Cooperative Bank

Some of the main features or characteristics of cooperative banks are:

Customer-owned entities

The members of cooperative banks are both the owners and the customers of the bank. Thus, the aim of the cooperative bank is not to maximize profits but to provide the best possible services to its members. Some of the cooperative banks also admit non-members so as to provide them with banking services.

Democratic member control

Cooperative banks are owned and controlled by members, who democratically elect the board of directors. The basic principle of co-operatives “one man one vote” is followed, irrespective of the number of shares held by a member, which ensures that no member enjoys any arbitrary power over other members.

Profit allocation

A specified portion of the profits are transferred to Statutory Reserve and other reserves, and then a fair rate of interest is paid on the capital subscribed by the members. A part of this profit can also be distributed to the co-operative members, with legal and statutory limitations in most cases.

Inclusion of rural masses

It plays a significant role in the financial inclusion of unbanked rural masses.

Functions of Cooperative Banks

- It provides financial assistance to people with small means and protects them from the latches of money lenders providing loans and other services at a higher rate at the expense of the needy.

- It supervises and guides affiliated societies.

- Rural financing- It provides financing to rural sectors like cattle farming, crop farming, hatching, etc. at comparatively lower rates.

- Urban financing- it provides financing for small scale industries, personal finance, home finance, etc.

- It mobilizes funds from its members and provides interest on the invested capital.

Objectives of Cooperative Banks

- To provide rural financing and micro-financing.

- To remove the dominance of money lenders and middleman.

- To provide credit services to agriculturalists and weaker sections of the society at comparatively lower rates.

- To provide financial support and personal financial services to small scale industries, housing financial assistance, etc.

- To provide basic banking services to its members.

- To promote the overall development of rural areas.

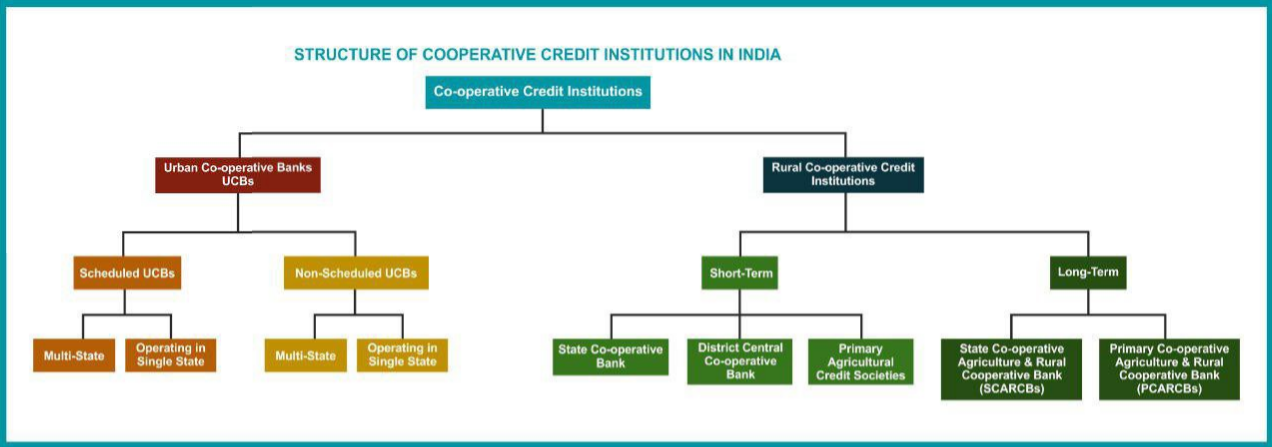

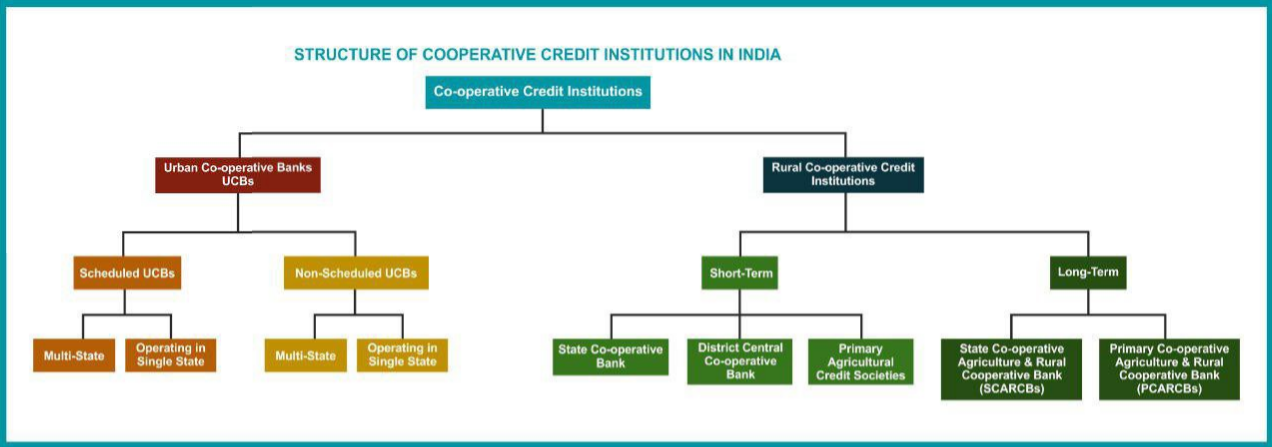

Structure of Cooperative Banks in India

The co-operative banking structure in India is divided into Short term structure and Long-term structure.

Short term structure has three levels

- A State Co-operative Bank works at the apex level (i.e. works at the state level).

- The Central Co-operative Bank works at the Intermediate Level (i.e. works at district level).

- Primary Co-operative Credit Societies at a base level (i.e. works at village level).

Long term structure has two levels

- State Co-operative Agriculture and Rural Development Banks (SCARDBs) at the apex level.

- Primary Co-operative Agriculture and Rural Development Banks (PCARDBs) at the district level or block level.

Broadly, co-operative banks in India are divided into two categories - urban and rural.

Rural cooperative credit institutions could either be short-term or long-term in nature. Further, short-term cooperative credit institutions are further sub-divided into State Co-operative Banks, District Central Co-operative Banks, Primary Agricultural Credit Societies.

Meanwhile, the long-term institutions are either State Cooperative Agriculture and Rural Development Banks (SCARDBs) or Primary Cooperative Agriculture and Rural Development Banks (PCARDBs).

On the other hand, Urban Co-operative Banks (UBBs) are either scheduled or non-scheduled. Scheduled and non-scheduled UCBs are again of two kinds- multi-state and those operating in single state.

Types of Cooperative Banks in India

The co-operative banking structure in India is divided into the following 5 categories:

- Primary Co-operative Credit Society

- The Primary Co-operative Credit Society is an association of borrowers and non-borrowers residing in a particular locality.

- The funds of the society are derived from the share capital and deposits of members and loans from central co-operative banks.

- Borrowing constitutes the most important element of their working capital.

- The borrowing powers of the members as well as of the society are fixed but may differ from state to state.

- The loans are given to members for the purchase of cattle, fodder, fertilizers and pesticides.

- Central Co-operative Banks

- These are the federations of primary credit societies in a district and are of two types:

- Those having a membership of primary societies only.

- Those are having a membership of societies as well as individuals.

- The funds of the bank consist of share capital, deposits, loans and overdrafts from state co-operative banks and joint stocks.

- These banks provide finance to member societies within the limits of the borrowing capacity of societies.

- They also conduct all the business of a joint-stock bank.

- State Co-operative Banks

- The state co-operative bank is a federation of central co-operative bank and acts as a watchdog of the co-operative banking structure in the state.

- It procures funds from share capital, deposits, loans and overdrafts from the Reserve Bank of India.

- The state co-operative banks lend money to central co-operative banks and primary societies and not directly to the farmers.

- Land Development Banks

- These are organized in 3 tiers, namely; state, central, and primary level with the objective to meet the long term credit requirements of the farmers for developmental purposes.

- National Bank for Agriculture and Rural Development (NABARD) supervises Land development banks.

- The sources of funds for these banks are the debentures subscribed by both Central and State government as these banks do not accept deposits from the general public.

- Urban Co-operative Banks

- It refers to primary cooperative banks located in urban and semi-urban areas.

- Earlier the scope of these banks was restricted, which now has been considerably widened.

- They provide funds and services to small borrowers and small business.

Cooperative banks in India fund rural areas under:

- Agriculture

- Livestock

- Milk

- Nursery

- Personal finance

Cooperative banks in India finance urban areas by virtue of:

- Self-employment

- Industries

- Small-scale units

- Home finance

- Consumer finance

- Personal finance

Importance of Cooperative Banks

- It has an extensive branch network all over the country, making credit easily available even to rural areas. It accounts for 67 per cent of total rural credit.

- It is an integral source for credit to agriculturalists.

- It confirms to the requirements of democratic planning and economic progress.

- It provides support to small and marginal farmers for buying inputs, storage and marketing assistance.

Advantages of Cooperative Banks

Easy to form

Registration and legal requirements are comparatively easy compared to traditional banks. It takes a group of ten adults to form a cooperative bank. It needs a base capital of 25 lakhs only as compared to 100 crores of Small Finance Banks.

Alternative credit source

One of the objectives of the cooperative system is to provide easy accessibility to the rural section of the country so as to protect them from the clutches of greedy money lenders. These money lenders exploit the needy by providing credit facilities at higher rates and by manipulating their accounts. It acts as an effective alternative to this traditional money lending system.

Cheap credit

It provides cheap credit to rural masses. It provides a high-interest rate to members for their investments and low lending interest rate. This also protects the rural masses from the exorbitant interest rate at which money lender provides credit, thus breaking their monopoly.

Encouragement of savings and investments

It has encouraged the habit of thrift among the masses. Instead of hoarding money or spending unnecessarily, masses tend to invest and save their money.

Advancement in farming

Cooperative societies provide credit to agriculturalists at cheaper rates to buy inputs, warehousing facilities, marketing assistance and other facilities. These banks often provide assistance for buying cheap products and services and help them by introducing them to modern technology and better farming methods to improve their output.

Problems faced in the Indian Cooperative Banking System

Small capital base

Cooperative banks have a small capital base as it can start with a capital base of 25 lakhs, making it difficult for them to account a portion of such capital as their working capital and raising working capital has been a major hurdle for almost all cooperative banks.

Political interference

Politicians use them to increase their vote bank and usually get their representatives elected over the board of directors in order to gain undue advantages like sanctioning of loans which later gets written off.

RBI Supervision

The supervision of RBI is not as stringent on cooperative banks as compared to commercial banks. RBI inspects the books of these banks only once a year.

Dual control

Cooperative banks are controlled under the dual system, i.e. by RBI and by their respective State government which poses a problem in coordination and management.

Professional management and technological advancement

Cooperative banks are often reluctant to adopt new technologies like computerised data management. Professional management in the banks is often missing due to lack of training of personnel because of lack of funds.

Dependence of finance

Cooperative banks depend heavily on RBI, NABARD and the government for refinancing facilities. It depends on the government for capital rather than on its members.

Overdue loans

Overdue loans of cooperative banks are increasing yearly, restricting the recycling of funds which in turn affects the lending and borrowing capacity of the bank.

|

Case of Punjab and Maharashtra Cooperative Bank (PMC Bank)

The PMC Bank had Rs 11,617 crore in deposits as on March 31, 2019. It had violated Reserve Bank of India (RBI) norms by lending heavily to one client-real-estate firm Housing Development and Infrastructure Limited (HDIL), which itself is facing bankruptcy proceedings. PMC Bank has extended 73 per cent of their assets to HDIL.

The former chiefs of the bank and the promoters of HDIL have been booked for cheating, and lookout notices have also been issued against them.

The PMC Bank crisis shows how the watchdogs -the bank’s auditors, the RBI and the government were lousy in doing their jobs and taking responsibility.

An action was taken by RBI under sub-section (1) of Section 35A of the Banking Regulation Act,1949 read with Section 56 of the Act which deals with the power of RBI to give directions.

PMC Bank cannot grant or renew any loans or advances or to make any investments or accept any new deposits without the prior approval of RBI for the next six months.

|

Measures to be taken

PMC Bank is not the first case of failure of the cooperative banking system in India. The Madhavpura Cooperative Bank scam in 2001-02 was a clear signal to bring certain changes in the regulatory and supervisory structure of cooperative banks. But no heed was given at that time. Since then, urban cooperative banks are failing with alarming regularity. Their numbers fell from 1,926 in 2004 to 1,551 in 2018, as per RBI data. These issues need to be addressed and remedied if the Government wants the public to place their trust in the country’s banking system.

In 2015, an RBI panel under R. Gandhi, a former deputy governor at the Central bank, had proposed several governance reforms for the cooperative banking sector, some of which are as follows:

- Greater control and supervision of RBI upon the cooperative banks.

- These banks and other financial institutions should be professionally managed, which means that the board of directors should be delegated power similar to those delegated under commercial banks. Board of directors should be able to conduct an independent assessment and supervise the bank’s functioning. They should be able to question the shareholder’s representation.

- The committee also recommended certain changes in Banking Regulation Act,1949, so as to increase the ambit of power of RBI to wind up and liquidate banks without involving other regulators under the cooperative societies’ laws.

- Conversion of UCBs into small finance banks by RBI should be allowed subject to fulfilment of certain conditions.

- Creation of umbrella organisation for supervising and coordinating the activities of all cooperatives. Such an organisation should be over and above the board of directors and should be reporting directly to RBI so as to bring it under better control.

Conclusion

- Cooperative banks play an integral part in the implementation of development plans and are important for the effective functioning of the banking system in India.

- India is termed as an under-banked country, and after so many scams, it is need of the hour to take necessary measures to remedy the lacunae and to boost the confidence and trust of the public in the banking system.

https://indianexpress.com/article/business/banking-and-finance/for-urban-cooperative-banks-rbi-chalks-out-4-tier-regulatory-framework-8040008/

1.png)