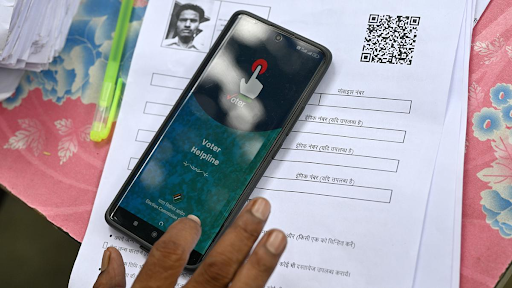

Description

Copyright infringement not intended

Picture Courtesy: https://indianexpress.com/article/india/tax-crackdown-draws-links-between-ngos-in-cause-and-funding-pattern-9600786/

Context:

The Income Tax (IT) Department has recently investigated several major non-governmental organizations (NGOs) in charge of the violation of the provisions of the Foreign Contribution Regulation Act (FCRA).

Details

The IT Department claims these NGOs did not report their foreign currency transactions correctly in their annual returns. There are claims that these organizations misused funds received from abroad for purposes not aligned with their stated goals. As a result of these findings, the IT Department cancelled the FCRA licenses of these NGOs.

Charges Against NGOs

- The investigation claims Oxfam India supported international efforts to stop mining by the Adani Group. It alleges that Oxfam India’s activities serve foreign interests rather than local needs and questions its charitable status.

- The I-T Department asserts that the Centre for Policy Research (CPR) funded local movements against coal mining and received foreign donations with a focus on litigation rather than research or education.

- Environics Trust is accused of using funds to fuel protests against industrial projects, such as the JSW Utkal Steel Plant in Odisha. The I-T letter states that the trust received money to support community agitation against these projects.

- The allegations suggest that the Legal Initiative for Forest and Environment (LIFE) collaborates with a U.S.-based NGO, EarthJustice, to impede coal mining projects in India. The I-T Department claims LIFE has engaged in illegal activities with this external support.

Response from NGOs

The founders strongly rejected the allegations and challenged the IT department's action in the Delhi High Court.

About Foreign Contribution Regulation Act (FCRA)

It was passed by the Parliament to regulate the acceptance and utilization of foreign donations by individuals, associations, or companies.

Key Provisions

- Organizations and individuals must register with the Ministry of Home Affairs to receive foreign contributions. They can seek prior permission for specific contributions.

- Foreign contributions must be used only for the purpose for which they were received. The funds should not be used for speculative activities or purposes other than those specified.

- Registered entities must submit annual returns detailing the amount of foreign contributions received, the sources, and how the funds were utilized. The Act mandates transparency and accountability in the use of foreign funds.

- Organizations registered under FCRA cannot transfer foreign contributions to another organization unless the latter is also registered under FCRA.

- Non-compliance with FCRA provisions can lead to penalties, including cancellation of registration, fines, and imprisonment.

- The Ministry of Home Affairs scrutinises the compliance of registered bodies and can conduct inspections and audits.

|

The Act has been amended several times, with significant changes introduced in 2020.

|

Highlights of the Foreign Contribution (Regulation) Amendment Act 2020

- The Act regulates who can accept foreign donations. Certain individuals and groups, such as election candidates, newspaper editors, judges, government workers, members of legislatures, and political parties, cannot accept foreign contributions. The 2020 amendment also includes public servants in this list. A public servant is anyone paid by the government or performing public duties.

- Anyone wanting to register or renew their registration for receiving foreign contributions must provide the Aadhar numbers of their key members, such as office bearers and directors. Foreigners must submit a copy of their passport or Overseas Citizen of India (OCI) card as identification.

- Foreign contributions must be deposited in a designated “FCRA account” at a specified branch of the State Bank of India in New Delhi. No other funds should be mixed with foreign contributions in this account. However, organizations can open another FCRA account in any scheduled bank to use the funds.

- The government can limit how unspent foreign contributions can be used, especially for those who received prior permission to accept these funds. Organizations can now use only up to 20% of foreign contributions for administrative costs. Previously, this limit was 50%.

- Organizations must renew their registration within six months of its expiration. The government may investigate before granting renewal.

- The government can suspend an organization’s registration for up to 180 days. This suspension can be extended for another 180 days if needed. The government can cancel the registration of an NGO if it violates the FCRA. If cancelled, the NGO cannot re-register for three years.

- Organizations can challenge government decisions in the High Court.

Role of NGOs

- NGOs work on various social issues such as poverty alleviation, education, healthcare, women’s empowerment, and child welfare. They provide essential services and support to marginalized and disadvantaged communities.

- Many NGOs advocate for the rights of marginalized groups, including Dalits, tribal communities, women, and children. They work to protect human rights and promote social justice.

- NGOs play a vital role in environmental conservation efforts, including wildlife protection, forest conservation, and combating climate change. They engage in awareness campaigns, policy advocacy, and grassroots initiatives.

- In times of natural disasters, NGOs are often at the forefront of relief and rehabilitation efforts. They provide immediate assistance, such as food, shelter, and medical aid, and help in the long-term recovery of affected communities.

- NGOs work on community development projects that aim to improve the quality of life in rural and urban areas. This includes infrastructure development, livelihood programs, and capacity building.

|

CRACKDOWN ON NGOS

The crackdown on NGOs in India has been a significant and controversial issue, involving various government actions aimed at regulating and scrutinizing the activities of non-governmental organizations.

The Union government has intensified its scrutiny of NGOs, particularly those receiving foreign funding. This scrutiny is conducted under the Foreign Contribution Regulation Act (FCRA), which regulates the acceptance and utilization of foreign contributions by NGOs.

Potential Reasons

- The government has highlighted their concerns over the foreign funding that could be used to influence domestic policies and activities in ways that might not align with national interests. Intelligence Bureau reported that certain NGOs were reducing India’s GDP by stalling development projects.

- There have been allegations that some NGOs misuse foreign funds for purposes other than those planned. The government has highlighted the need for greater transparency and accountability in how these funds are utilized.

- Some NGOs have been found to be non-compliant with the Foreign Contribution Regulation Act (FCRA) requirements; including failing to submit annual returns, not maintaining proper accounts, and not sticking to the prescribed guidelines for the use of foreign contributions.

Challenges

- The strict regulations and compliance requirements under the FCRA have increased the administrative burden on NGOs. The requirement for all foreign contributions to be received in a designated FCRA account at the State Bank of India, New Delhi, has created logistical challenges, especially for smaller NGOs based in remote areas.

- The crackdown has resulted in many NGOs scaling back or shutting down their operations, affecting the communities they serve, this affected healthcare, education, and social welfare programs. The reduction in NGO activities has impacted the livelihoods of individuals employed by these organizations and those who rely on their services.

- The restrictions on foreign funding have resulted in financial stress for many NGOs. With limited access to foreign contributions, NGOs have struggled to maintain their programs and initiatives. The increased compliance costs and administrative burdens have diverted resources away from programmatic activities, reducing the overall effectiveness of NGOs.

- Critics argue that the crackdown is aimed at quieting disagreement and reducing the influence of organizations that are critical of government policies, this raised concerns about the erosion of democratic freedoms and the ability of civil society to hold the government accountable.

- The crackdown has drawn international criticism, concerns raised about the impact on human rights and the ability of NGOs to operate freely in India. The actions against NGOs have also led to diplomatic tensions, particularly with countries that provide significant funding to Indian NGOs.

Way Forward

- There is a need to establish regular communication channels between NGOs and government agencies to strengthen the understanding of each other’s perspectives and work towards common goals.

- Simplifying the regulatory framework for NGOs can reduce administrative burdens and encourage compliance. There should be clear guidelines and simplified processes for registration, reporting, and fund utilization that could help NGOs operate more effectively.

- The government can provide capacity-building support to NGOs through training programs, technical assistance, and funding for infrastructure development to enhance the operational efficiency and impact of NGOs.

- NGOs and the government need to prioritize transparency and accountability. NGOs should maintain transparent financial approaches and routine reporting, and the government should ensure fair and constant enforcement of regulations.

- Encouraging public-private partnerships can leverage the strengths of NGOs, the government, and the private sector. Collaborative projects can handle complicated social issues more effectively and sustainably.

- NGOs should remain engaged in constructive policy advocacy to influence government policies and programs. Regular conversations and consultations with policymakers can ensure that the voices of civil society are heard and considered in decision-making processes.

Conclusion

NGOs need to ensure compliance with the Foreign Contribution Regulation Act (FCRA) and other relevant laws, increasing transparency in operations and financial dealings will help to build trust with both the government and donors. Forming partnerships with government agencies can help NGOs to align their projects with national priorities and gain support.

Must Read Articles:

FOREIGN CONTRIBUTION REGULATION ACT (FCRA)

Source:

INDIAN EXPRESS

HINDUSTAN TIMES

SCROLL

THE CONVERSATION

|

PRACTICE QUESTION

Q.What are the most significant challenges faced by NGOs in India today, and how can they overcome these challenges to enhance their impact? (250 words)

|