Description

Disclaimer: Copyright infringement not intended.

Context:

- United States announced a ban on all crude oil and natural gas imports from Russia into the US even as the Ukraine conflict intensified.

- UK also announced that it would phase out imports of Russian oil by the end of the year.

How does the war in Ukraine affect oil prices?

- The Ukraine-Russia conflict pushed U.S. oil prices to their highest level since 2008.

- High energy prices contribute to increased cost of virtually all goods and services further fuelling inflation expectations.

- The recent ban by the US and UK on Russia will further increase crude oil prices, which in turn will stoke inflation across the world — particularly in Europe.

Note: Russia is the world’s second-largest producer of oil as well as the second-largest exporter.

How important is Russia as a global oil supplier?

- Russia produces close to 11 million barrels per day of crude oil. It exports 5 million to 6 million barrels per day.

- Today Russia is the second-largest crude oil producer in the world, behind the U.S. and ahead of Saudi Arabia.

- Russia accounts for 12% of all global exports of oil.

- About half of Russia's exported oil is shipped to European countries, including Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania and Bulgaria.

- Nearly one-third of it arrives in Europe via the Druzhba Pipeline through Belarus.

Europe highly dependent on Russia

- The US imports less than 10% of its energy requirement from Russia but European countries are much more heavily dependent on Russia.

- For example Russia accounts for over 40% of Germany’s oil needs.

- Germany gets 25% from natural gas — again hugely imported from Russia.

High prices are being passed over to consumers at the pump, in their gas, heating and electricity bills. And high energy prices contribute to increased cost of virtually all goods and services further fuelling inflation expectations.

Rising questions:

- As mentioned earlier Unlike the US, Europe is heavily dependent on oil and natural gas imports from Russia.

- Can a US ban drive a wedge between its own foreign policy goals and those of its allies in Europe?

Addressing the issue with Strategic Reserves:

- Strategic reserves are good enough only for emergencies. The top three countries in terms of such reserves are the US, China and Japan. Between them, they have 1500 million barrels. At an average daily global consumption of 95 million barrels a day, that’s roughly 20-odd days of oil.

Alternative countries:

Venezuela

- Venezuela has the world’s largest oil reserves but producing oil requires more than just reserves.

- The country’s oil-producing apparatus is in disrepair partly due to the government’s mismanagement and also because of harsh US sanctions.

- Oil-producing companies are in debt and most don’t even have good quality drilling equipment.

Iran and other countries

- Iran will not increase output unless it gets the nuclear deal with the US.

- Production can be scaled up but it will take time, money and effort.

- Moreover, since individual production levels are quite low, several countries will have to come together and still they may not come anywhere close to matching the levels that Russia produces.

Impact on India:

- India gets most of its energy from coal (75%) and oil (10%) and very little from natural gas.

- India imports 85% of its oil from more than 40 countries.

- The bulk of supplies come from the Middle East and the US. (India imports only 2% of its supplies from Russia.)

- But the rise in global crude oil will affect India indirectly.

|

India exports petroleum products - accounting for more than 13% of its total exports - to more than 100 countries.

|

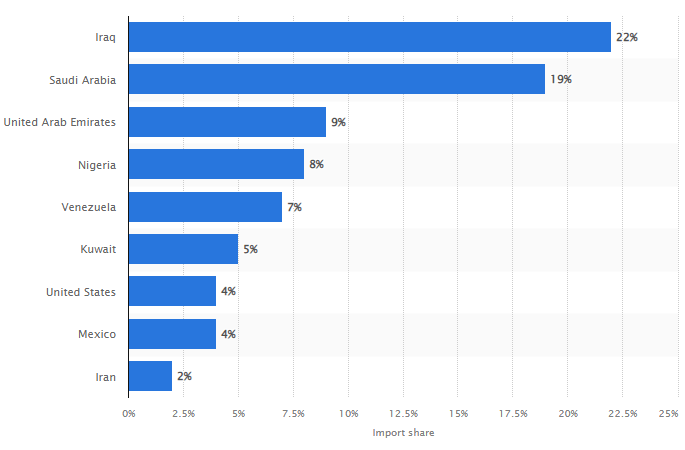

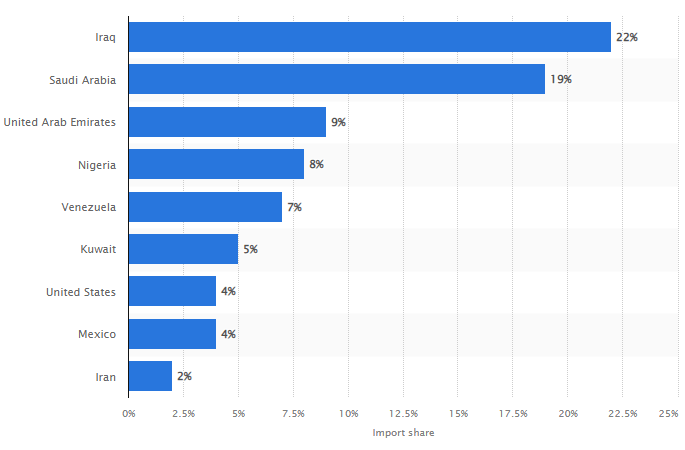

Distribution of crude oil imported into India in 2019:

Impact of Global Crude Oil Price rise on India:

- Current Account Deficit: The increase in oil prices will increase the country's import bill, and further disturb its current account deficit (excess of imports of goods and services over exports).

- Inflation: The increase in crude prices could also further increase inflationary pressures.

- Fiscal Health: If oil prices continue to increase, the government shall be forced to cut taxes on petroleum and diesel which may cause loss of revenue and deteriorate its fiscal balance. The revenue lost will erode the government's ability to spend or meet its fiscal commitments in the form of budgetary transfers to states.

- Economic Recovery: Any increase in global prices can affect its import bill, stoke inflation and increase its trade deficit, which in turn will slow its economic recovery.

- Natural Gas Price: The increase in gas prices has put upward pressure on the price of both Compressed Natural Gas (CNG) used as a transport fuel and Piped Natural Gas (PNG) used as a cooking fuel.

- Subsidies: The rise in crude oil prices is also expected to increase the subsidy on LPG and kerosene, pushing up the subsidy bill.

As Recent Example

- In India Investor sentiment has been hurt over the last few days in line with rising crude prices. Foreign portfolio investors have pulled out a net of Rs 51,703 crore from Indian equities leading to decline and volatility in equity markets.The rupee has fallen over 1.7% against the dollar from $73.8 per barrel on Jan 12 to hit $75.09.

Final Thoughts and way ahead:

- The whole world including Europe needs to rethink its reliance on imported fuels.

- There needs to be a renaissance of nuclear and locally mined coal along with further accelerated renewable investments in an effort to substitute gas and coal imported.

- The key to the energy transition is in our hands. The huge change required needs to be led by policymakers, consumers, individuals and industry.

- For example, if EU citizens adjusted car driving patterns to average levels observed in Hungary, the entire imports of oil from Russia would not be needed at all.

- High oil prices improve the economics of alternatives like electric or hydrogen vehicles.

- Need of the hour: Combined with the need to decrease import dependence a serious policy push followed by a strong consumer response to deploy electric vehicles and other solutions quicker and at a greater scale.

- Achieving a substantial change however would take years if not decades. For example, in Norway, where 65% of all vehicles sold in 2021 were electric, oil demand has fallen less than 10% since 2013.

- Transitioning to alternatives quickly would not only improve energy security, it will significantly cut CO2 emissions and eliminate our dependencies in such war like situations.

Read: https://www.iasgyan.in/daily-current-affairs/crude-oil-prices

https://indianexpress.com/article/explained/russia-ukraine-war-looming-oil-crisis-what-now-7807596/