Description

Disclaimer: Copyright infringement not intended.

Context

- In intra-day trade, Brent crude was trading around 112 dollars per barrel while WTI crude prices were at 110 dollars.

- Crude Oil prices are rising due to Russia-Ukraine conflict.

Details

- Oil prices are rising on fears that Western sanctions over the Ukraine conflict will disrupt shipments from Russia, the world's biggest exporter of crude and oil products combined.

- Oil prices have spiked despite member countries of the International Energy Agency agreeing to release 60 million barrels from strategic reserves to offset the supply shortfall resulting from Russia's invasion of Ukraine.

- Investors are focusing on the revival of the Iran nuclear deal, which is expected to boost Iranian oil exports and ease tight supplies.

Crude Oil

- Crude Oil or Black Gold (mixture of hydrocarbons) is a non renewable raw natural resource formed over millions of years when large quantities of dead organisms, mostly zooplankton and algae, are buried underneath sedimentary rock and subjected to both intense heat and pressure.

- Crude oil is refined to produce usable products including gasoline, diesel, and various other forms of petrochemicals.

- Today, the world's economy is largely dependent on fossil fuels such as crude oil, and the demand for these resources often sparks political unrest, as a small number of countries control the largest reservoirs.

History of Crude Oil prices

- In the late 19th and early 20th centuries, the United States was one of the world's leading oil producers.

- S. companies developed the technology to make oil into useful products like gasoline.

- In 1950s a consortium of U.S. oil companies gained control of Iran's crude production after a Western-backed coup.

- Thus, oil prices were set by the USA’s internationally dominant oil companies and backed by import quotas.

- US was clearly the world's largest consumer and producer of crude oil.

The rise of OPEC

- In 1960 the Organization of the Petroleum Exporting Countries (OPEC) was created to protect the interests of Mideast crude exporters in a market dominated--and fixed--by the U.S.

- During this time, U.S. oil production fell dramatically, and the U.S. became an energy importer. And its major supplier was the Organization of the Petroleum Exporting Countries (OPEC) - which consists of the world's largest (by volume) holders of crude oil and natural gas reserves.

OPEC

- The Organization of the Petroleum Exporting Countries (OPEC) was formed in 1960 in Baghdad by developing country exporters to assert control over their domestic production and global supply.

- The five founding members were Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela.

- Following subsequent additions and a few departures, OPEC currently has these 13 members:

- Algeria

- Angola

- Congo

- Equatorial Guinea

- Gabon

- Iran

- Iraq

- Kuwait

- Libya

- Nigeria

- Saudi Arabia

- United Arab Emirates

- Venezuela

- Each member of the organization has one vote and all OPEC decisions on oil production require unanimous consent.

- HQ- It has since 1965 been headquartered in Vienna, Austria, although Austria is not an OPEC member state.

- The 13 member countries of OPEC account for an estimated 44 percent of global oil production and 81.5 percent of the world's "proven" oil reserves.

- This gives OPEC a major influence on global oil prices.

- Mission of OPEC: To coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets, in order to secure an efficient, economic and regular supply of petroleum to consumers.

|

The price of a barrel of crude oil has for decades been as much a geopolitical metric as an economic one. It continues to be calculated based on a unit of measurement dating from the 19th century, i.e. the barrel (corresponding to about 159 liters).

|

- OPEC is led by Saudi Arabia, which is the largest exporter of crude oil in the world (single-handedly exporting 10% of the global demand).

- In 2021, Saudi Arabia accounted for 34% of OPEC's crude oil output, more than twice as much as Iraq, the second-largest producer in the organization.

- OPEC crude oil accounted for 28% of global petroleum liquids production in January 2022.

Expansion to OPEC Plus

- In 2016, OPEC allied with other top non-OPEC oil-exporting nations to form an even more powerful entity named OPEC+ or OPEC Plus.

- The Organization of the Petroleum Exporting Countries Plus (OPEC+) is a loosely affiliated entity consisting of the 13 OPEC members and 10 of the world’s major non-OPEC oil-exporting nations.

- OPEC plus countries include Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- OPEC+ came into existence, in part, to counteract other nations' capacity to produce oil, which could limit OPEC's ability to control supply and price.

- OPEC+ aims to regulate the supply of oil in order to set the price on the world market.

- OPEC+ controls over 50% of global oil supplies and about 90% of proven oil reserves.

Oil Price and Supply

- As a cartel, the OPEC+ member countries collectively agree on how much oil to produce, which directly impacts the ready supply of crude oil in the global market at any given time.

- OPEC+ subsequently exerts considerable influence over the global market price of oil and, understandably, tends to keep it relatively high in order to maximize profitability.

- A pledge by OPEC+ to cut supply causes an immediate spike in the price of oil.

- Conversely, OPEC+ can decide to boost supply. For instance, on June 22, 2018, the cartel met in Vienna and announced that they would be increasing supply.

- In the end, the forces of supply and demand determine the price equilibrium, although OPEC+ announcements can temporarily affect the price of oil by altering expectations.

Crude oil Benchmarks

- Crude Oil Benchmarks are used because there are many different varieties and grades of crude oil.

- A benchmark crude or marker crude is a crude oil that serves as a reference price for buyers and sellers of crude oil. There are three primary benchmarks, West Texas Intermediate (WTI), Brent Blend, and Dubai Crude.

- Other well-known blends include the OPEC Reference Basket used by OPEC, Tapis Crude which is traded in Singapore, Bonny Light used in Nigeria, Urals oil used in Russia and Mexico's Isthmus.

- Using benchmarks makes referencing types of oil easier for sellers and buyers.

- There is always a spread between WTI, Brent and other blends due to the relative volatility (high API gravity is more valuable), sweetness/sourness (low sulfur is more valuable) and transportation cost.

- This is the price that controls world oil market price.

High and Low Sulfur Oils

- Sweet and sour are the industry terms for fuels that are low and high in sulfur content.

- The names sweet oil and sour oil come from the fact that oil which is low in sulfur has a sweet taste and high sulfur oil is bitter.

- High-sulfur crude oil is lower quality. They produce greater emissions, particularly those emissions that are toxic and have a high global warming potential.

- High-sulfur oils cause oxidation and corrosion. Higher the sulfur count, the lower the hydrocarbon count —that combusts and generates energy.

- Carbon and hydrogen make up around 98 percent of the content of a typical crude oil type. The rest is made up of sulfur (1-3 percent), nitrogen, oxygen, metal and salts (less than 1 percent each).

Heavy vs Light Crude Oil

- American Petroleum Institute (API) gravity is the measure of the weight of crude oil.

- API gravity is a measure of the weight of a crude oil in relation to water.

- If an oil’s API Gravity is greater than 10, it is lighter than water and will float on it.

- If an oil’s API Gravity is less than 10, it is heavier than water and will sink.

- There are four classifications of API gravity: light crude oils, medium oils, heavy, and extra heavy.

- Light crude oils have an API of greater than 31.1 degrees; medium oils have an API of between 22.3 and 31.1 degrees; heavy crude has an API of fewer than 22.3 degrees, and extra heavy has an API less than 10.0 degrees.

- The lighter a crude oil, the more expensive it is.

- Light Crude oil is liquid petroleum that has low density and that flows freely at room temperature.

- It has low viscosity, low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions.

- The reason light crude oil is more expensive than heavier crude is because it produces the most gasoline and the most diesel, the two most sought-after elements of crude oil.

- Total acid content is an important measure of quality because TAN directly affects the price of a barrel of crude oil. Crude oil with a high TAN is considerably less expensive than other crude oil types is that it is highly corrosive.

|

Benchmark prices: Brent crude price is the international benchmark price used by OPEC while WTI crude price is a benchmark for US oil prices.

Brent crude oil originates from oil fields in the North Sea between the Shetland Islands and Norway.

West Texas Intermediate (WTI) is sourced from US oil fields, primarily in Texas, Louisiana, and North Dakota.

Light and Sweet: Both oils are relatively light, but Brent has a slightly higher API gravity, making WTI the lighter of the two.

Since India imports primarily from OPEC countries, Brent is the benchmark for oil prices in India.

|

Today, the top five oil-producing nations are the U.S., Saudi Arabia, Russia, Canada, and China.

[More than 70% of U.S. output comes from shale production. The “Shale Revolution” enabled the United States to significantly increase its production of oil and natural gas. Shale oil extraction is an industrial process for unconventional oil production. This process converts kerogen in oil shale into shale oil by pyrolysis, hydrogenation, or thermal dissolution. Kerogen is solid, insoluble organic matter in sedimentary rocks.]

How important is Russia as a global oil supplier?

- Russia produces close to 11 million barrels per day of crude oil. It exports 5 million to 6 million barrels per day.

- Today Russia is the second-largest crude oil producer in the world, behind the U.S. and ahead of Saudi Arabia, but sometimes that order shifts.

- About half of Russia’s exported oil is shipped to European countries, including Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania and Bulgaria.

- Nearly one-third of it arrives in Europe via the Druzhba Pipeline through Belarus.

How does the war in Ukraine affect oil prices?

- The Ukraine-Russia conflict pushed U.S. oil prices to their highest level since 2008.

- High energy prices contribute to increased cost of virtually all goods and services further ueling inflation expectations.

- In relation to oil, high prices naturally improve the economics of alternatives like electric or hydrogen vehicles.

Impact of Global Crude Oil Price rise on India

- Current Account Deficit: The increase in oil prices will increase the country’s import bill, and further disturb its current account deficit (excess of imports of goods and services over exports).

- Inflation: The increase in crude prices could also further increase inflationary pressures.

- Fiscal Health: If oil prices continue to increase, the government shall be forced to cut taxes on petroleum and diesel which may cause loss of revenue and deteriorate its fiscal balance.

- The revenue lost will erode the government’s ability to spend or meet its fiscal commitments in the form of budgetary transfers to states, payment of dues and compensation for revenue shortfalls to state governments under the Goods and Services Tax (GST} framework.

- Economic Recovery: Any increase in global prices can affect its import bill, stoke inflation and increase its trade deficit, which in turn will slow its economic recovery.

- Natural Gas Price: The increase in gas prices has put upward pressure on the price of both Compressed Natural Gas (CNG) used as a transport fuel and Piped Natural Gas (PNG) used as a cooking fuel.

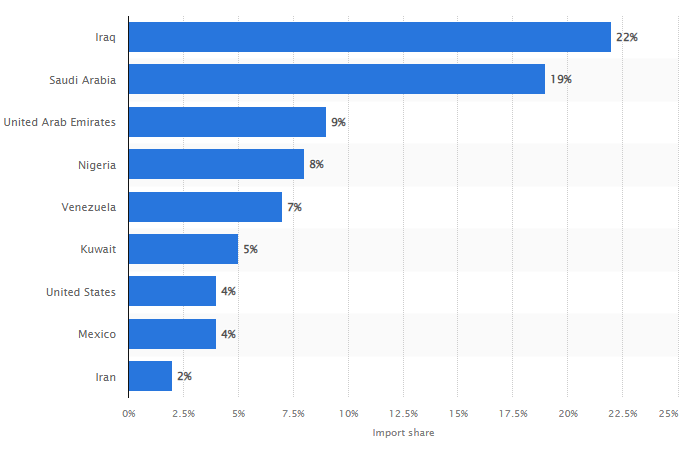

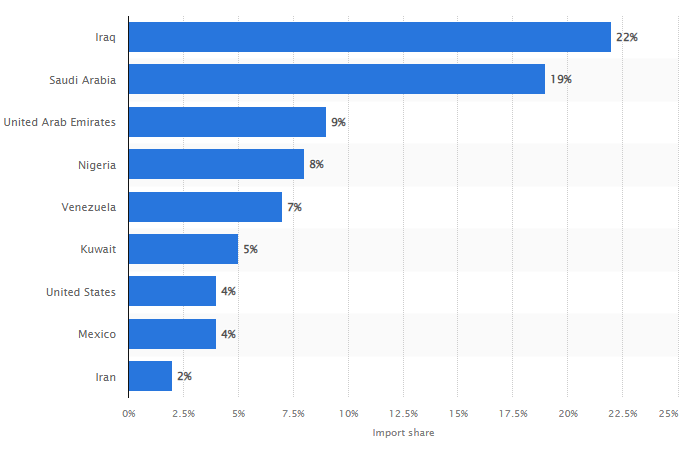

India’s crude oil imports

- India imports 85% of its oil from more than 40 countries.

- The bulk of supplies come from the Middle East and the US. (India imports only 2% of its supplies from Russia.)

- Imports include oil which it converts to petroleum products after refining.

- India exports petroleum products – accounting for more than 13% of its total exports – to more than 100 countries.

Distribution of crude oil imported into India in 2019

https://www.businesstoday.in/latest/world/story/oil-rises-above-112-a-barrel-as-russia-ukraine-conflict-offsets-iranian-supply-324781-2022-03-04