Description

Disclaimer: Copyright infringement not intended.

Context

- Currency with the public rose by Rs 38,196 crore to an all-time high of Rs 30.18 lakh crore according to the latest Reserve Bank of India (RBI) data. During the financial year so far, currency with the public has gone up by 9.7 per cent than in March 2021.

Currency in Circulation

- The currency in circulation in a country is the value of currency or cash (banknotes and coins) that has ever been issued by the country’s monetary authority (RBI in this case) minus the amount that has been removed from the system.

- Currency in circulation includes currency notes circulated in the economy for transaction purposes, deposits with commercial banks in the form of current and savings accounts.

- CiC refers to currency notes and coins issued by the central bank within a country that is physically used to conduct transactions between consumers and businesses.

- Money in circulation includes currency and also some types of bank deposits, such as deposits at call.

- Currency in circulation can also be thought of as currency in hand because it is the money used throughout a country's economy to buy goods and services.

What causes this excess money in circulation?

- Mostly, it is the result of government bond auctions and fiscal packages that are intended to boost economic recovery.

- While the measures have helped the economy--businesses and and people--it has increased the money in circulation.

- Fall in bank deposits: The decline in bank deposits is also a pandemic-induced syndrome. Due to increased uncertainty, investors and consumers feel safe in keeping cash with themselves. Another event that has triggered the lack of deposits is the lockdown. During periods of restricted travel and lack of easily accessible technology across India, bank deposits have taken a hit.

What is wrong with too much of cash in circulation?

- If there is too much money in circulation, both in terms of cash and credit, then the value of currency decreases. This leads to "too much money chasing too few goods", causing demand-pull inflation.

- Given the current uncertainty amid the pandemic-induced induced supply shock inflation, an added demand-triggered inflation will only make matters worse.

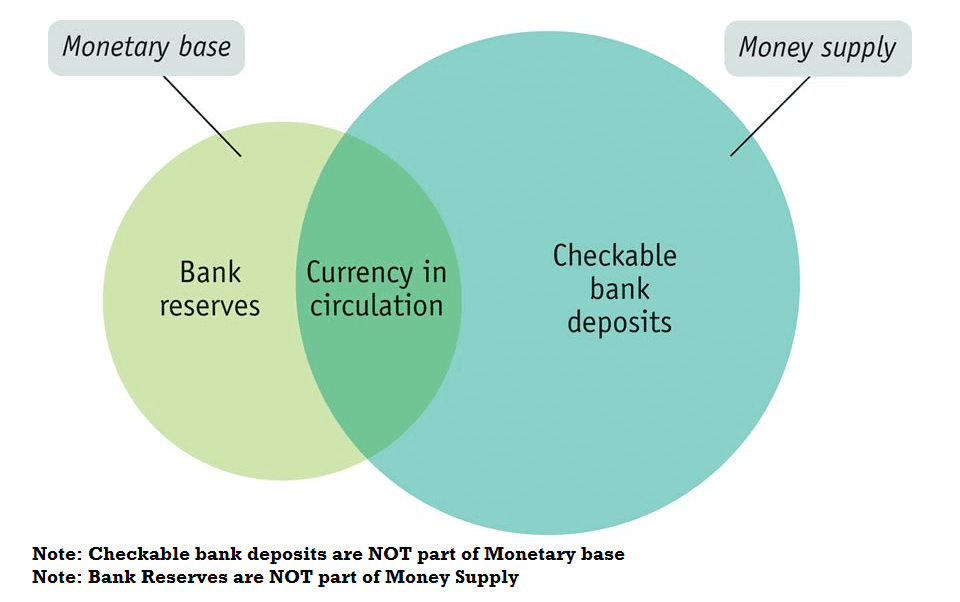

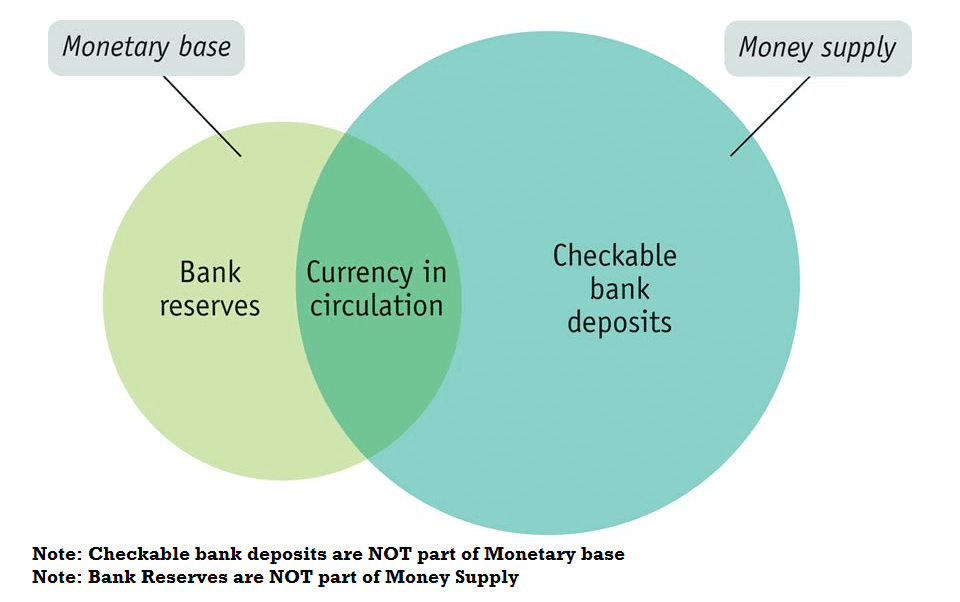

Money Supply

- The total stock of money circulating in an economy is the money supply. The circulating money involves the currency, printed notes, money in the deposit accounts and in the form of other liquid assets.

- Thus, it is Currency in Circulation plus Deposits in Commercial Banks.

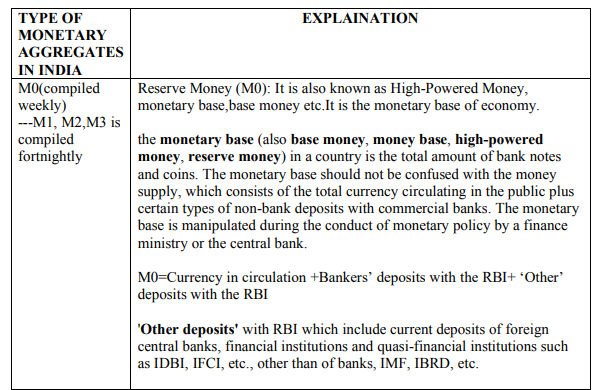

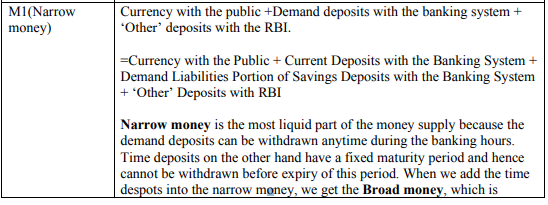

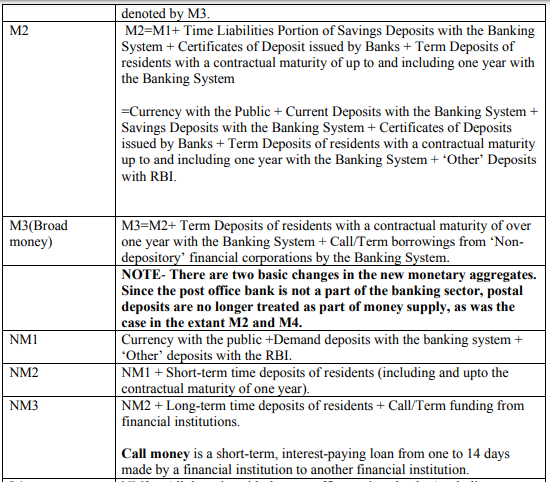

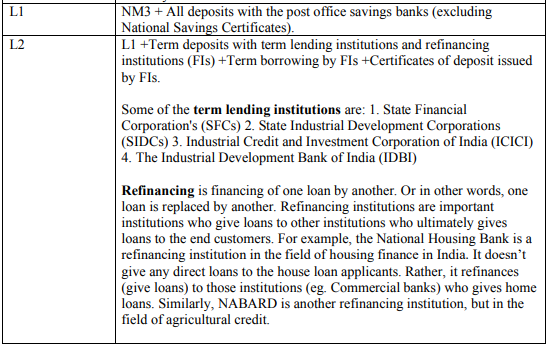

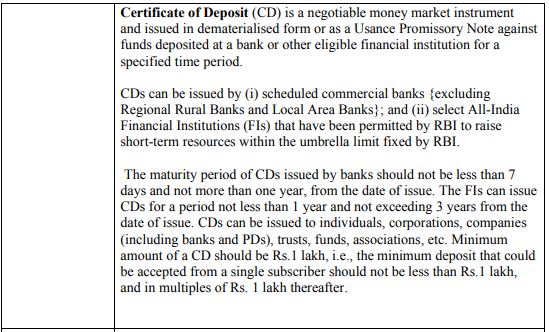

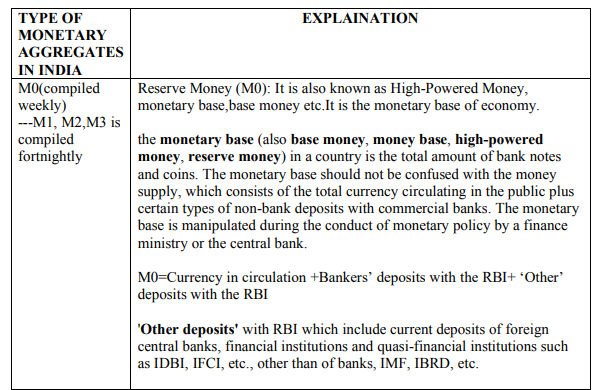

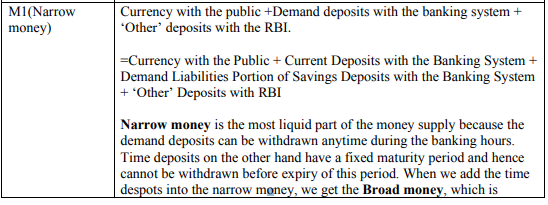

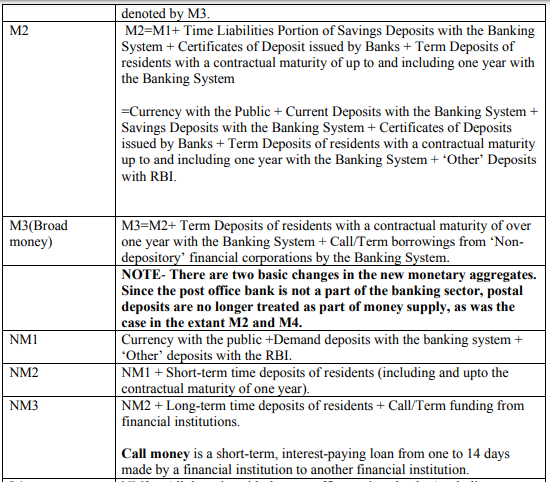

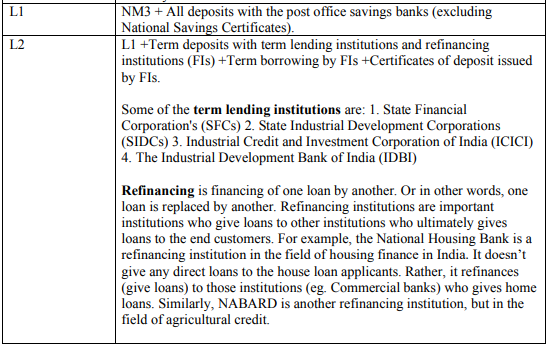

- Periodically, every country's central bank publishes the money supply data based on the monetary aggregates set by them. In India, the Reserve Bank of India follows M0, M1, M2, M3 and M4 monetary aggregates.

Monetary Aggregates

- Modern money has several components. Apart from just cash and coins, money also consists of deposits with the banking system, both interest-free demand deposits and interest-bearing time deposits, such as fixed deposits.

- The various components of money can be aggregated together in order of liquidity. Monetary aggregates are compiled by Central Banks(in Indian case its RESERVE BANK OF INDIA) on the basis of surveys of monetary and financial institutions; they measure the amount of money circulating in an economy, and usually presented as end-of-month national currency stock series.

https://indianexpress.com/article/business/banking-and-finance/cash-with-public-at-new-high-this-fiscal-even-as-digital-payments-rise-by-a-third-7839414/