Description

GS PAPER II: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Context: Bangladesh’s central bank has approved a $200 million currency swap facility to Sri Lanka.

- Last July, the Reserve Bank of India extended a $400 million credit swap facility to Sri Lanka, which Central Bank of Sri Lanka settled in February. The arrangement was not extended.

SAARC currency swap facility

- RBI has a framework under which it can offer credit swap facilities to SAARC countries within an overall corpus of $2 billion.

- SAARC currency swap facility came into operation in November 2012 with the aim of providing to smaller countries in the region “a backstop line of funding for short-term foreign exchange liquidity requirements or balance of payment crisis till longer term arrangements are made”.

What is a Currency Swap?

- A currency swap is a transaction in which two parties exchange an equivalent amount of money with each other but in different currencies.

- The parties are essentially loaning each other money and will repay the amounts at a specified date and exchange rate.

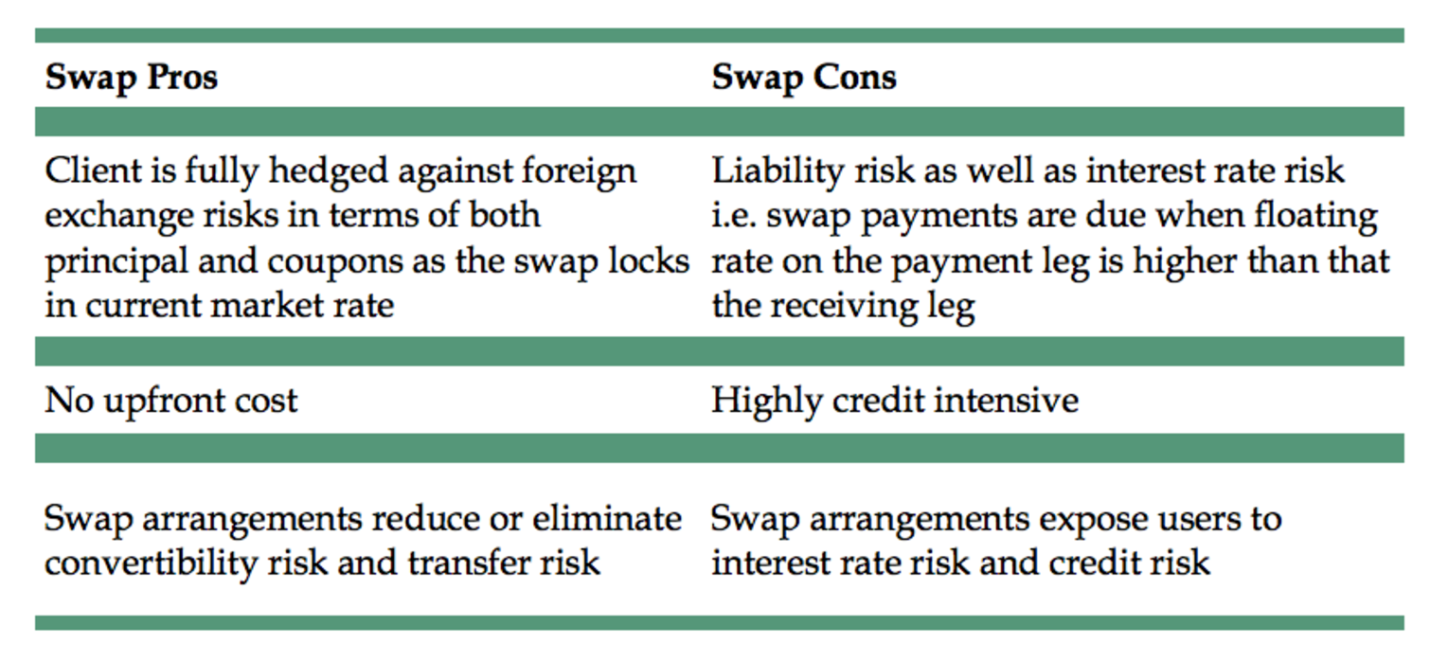

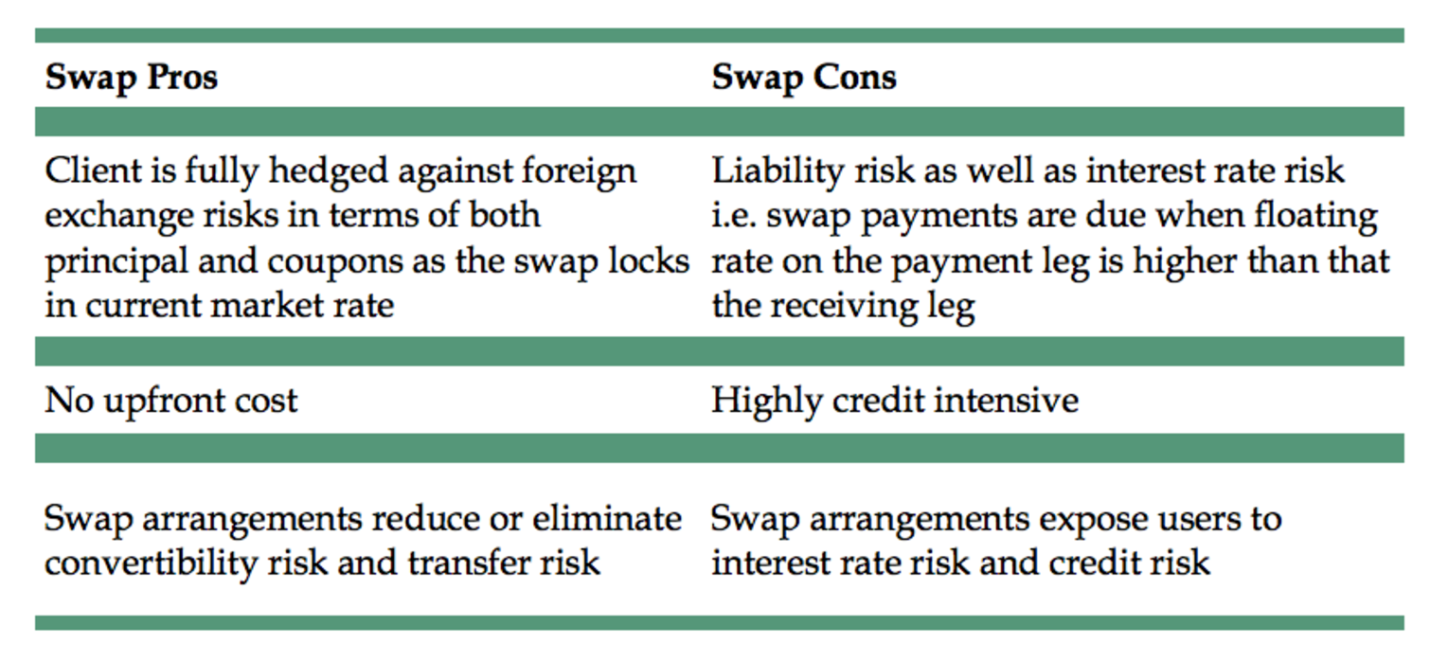

- Purpose: To hedge exposure to exchange-rate risk, to speculate on the direction of a currency, or to reduce the cost of borrowing in a foreign currency.

- The parties involved in currency swaps are usually financial institutions, trading on their own or on behalf of a non-financial corporation.

https://indianexpress.com/article/explained/explained-significance-of-the-200-million-currency-swap-bangladesh-has-approved-for-sri-lanka-7333158/