Description

Disclaimer: Copyright infringement not intended.

Context:

- Morgan Stanley has cut India’s GDP growth estimate by 50 basis points to 7.9 per cent and raised the retail (CPI) inflation forecast to 6 per cent.

- It also expects the current account deficit to widen to a 10-year high of 3 per cent of GDP in FY23.

Current Account Deficit:

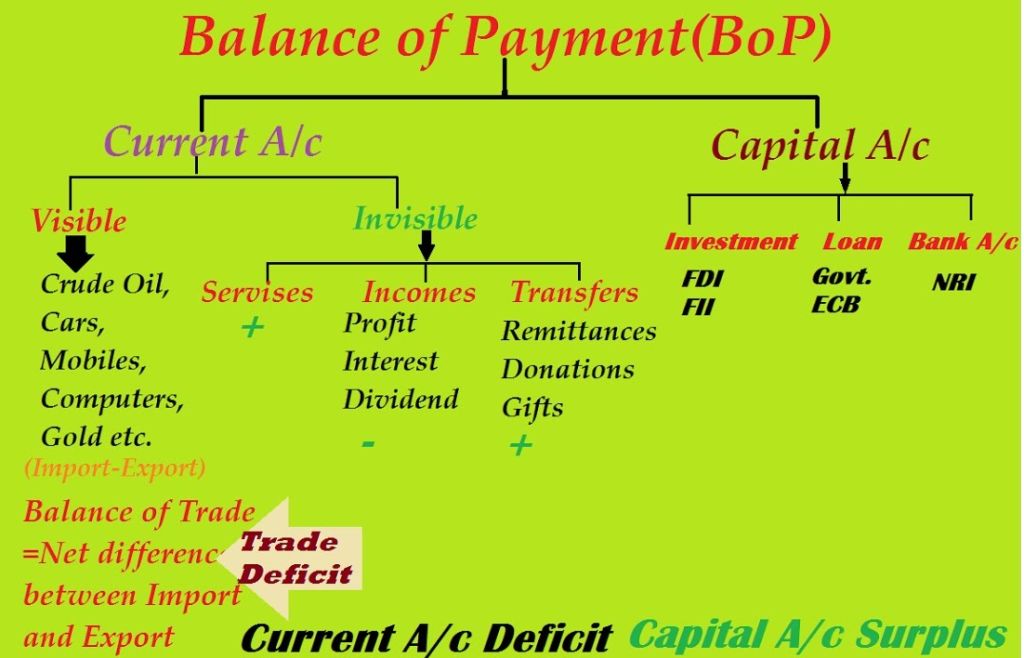

- Current Account Deficit or CAD is the shortfall between the money flowing in on exports, and the money flowing out on imports.

- Current Account Deficit (or Surplus) measures the gap between the money received into and sent out of the country on the trade of goods and services and also the transfer of money from domestically-owned factors of production abroad.

Calculating Current Account Deficit:

- The current account constitutes net income, interest and dividends and transfers such as foreign aid, remittances, donations among others. Although these components make up only a small percentage of the total current account.

|

The current account represents a country’s foreign transactions and, like the capital account, is a component of a country’s balance of payments (BOP).

|

- Current Account Deficit is measured as a percentage of GDP.

- Trade gap = Exports – Imports

- Current Account = Trade gap + Net current transfers + Net income abroad

- A country with rising CAD shows that it has become uncompetitive, and investors are not willing to invest there. They may withdraw their investments.

NOTE: CAD vs Trade Deficit

- The terms current account deficit and trade deficit are often used interchangeably, but they have substantially different meanings.

Current Account Deficit is slightly different from Balance of Trade, which measures only the gap in earnings and expenditure on exports and imports of just goods and services. Whereas, the current account also factors in the payments from domestic capital deployed overseas. For example, rental income from an Indian owning a house in the UK would be computed in Current Account, but not in Balance of Trade.

- A nation has a trade deficit when it spends more on imports than it earns on exports.

- A nation's current account deficit is a broader measure. The trade deficit is almost always the largest component of the current account deficit but it includes other numbers such as foreign aid and international investment.

- It is, in fact, possible for a nation to have a current account deficit when it does not have a trade deficit, but that is highly unusual.

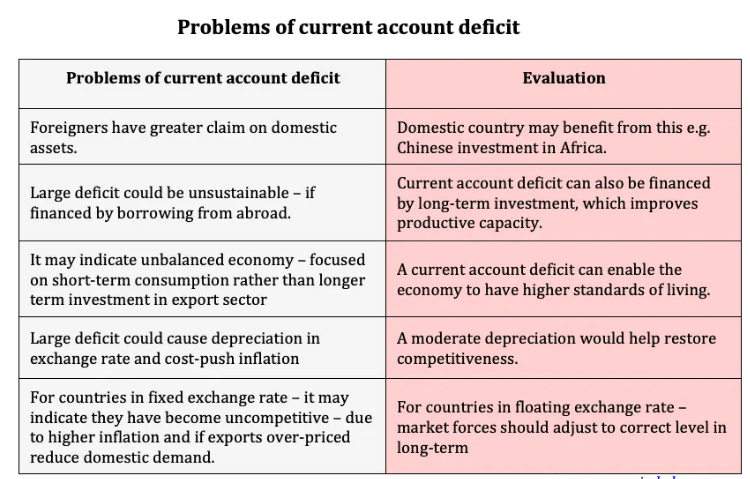

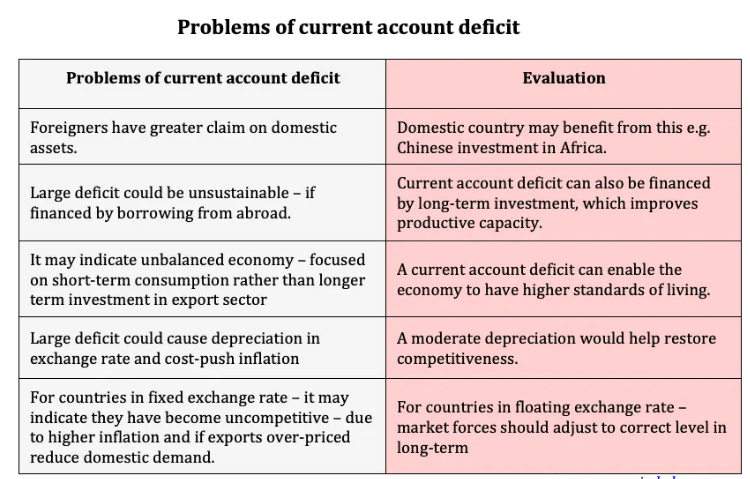

Is Current Account Deficit always a negative indicator?

- Current Account Deficit may be a positive or negative indicator for an economy depending upon why it is running a deficit.

- Foreign capital is seen to have been used to finance investments in many economies. Current Account Deficit may help a debtor nation in the short-term, but it may worry in the long-term as investors begin raising concerns over adequate return on their investments.

A current account deficit is not necessarily harmful:

- A current account deficit could occur during a period of inward investment (surplus on financial account).

- This inward investment can create jobs and investment. E.g. the US ran a current account deficit for a long time as it borrowed to invest in its economy. This enabled higher growth and so it was able to pay its debts back and countries had confidence in lending the US money.

- With a floating exchange rate, a large current account deficit should cause a devaluation which will help automatically reduce the level of the deficit.

- A current account deficit may just indicate a strong economy, which is growing rapidly. For example, the rise in deficit on UK primary incomes (2015-16) is a reflection that investment in the UK was giving a good return to foreign investors.

Further Evaluation:

- It depends on the size of the current account deficit as a % of GDP. For example, a deficit of over 5% would be cause for greater concern.

- It depends on how one is financing the current account deficit. If a country is borrowing from abroad to finance consumption, this is damaging in the long-term. If it is financing the current account deficit through attracting long-term capital investment, this could have positive benefits.

- It depends on the country in question. For example, the US probably has less reason to be concerned about a current account deficit. The US can attract a lot of capital flows to buy dollar securities. However, a developing economy like India may be more vulnerable to a current account deficit. This is because investors may be quicker to fear an economic downturn and remove their capital.

Dealing with Current Account Deficit?

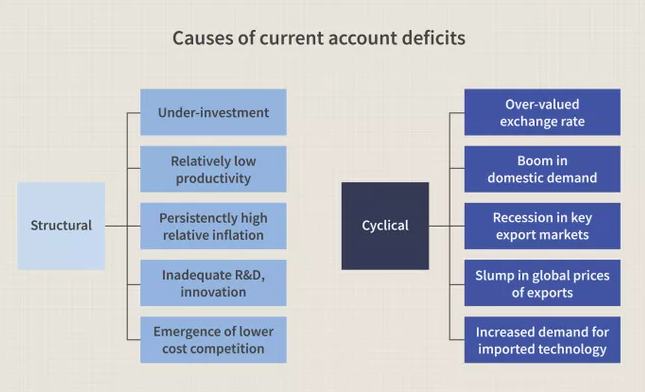

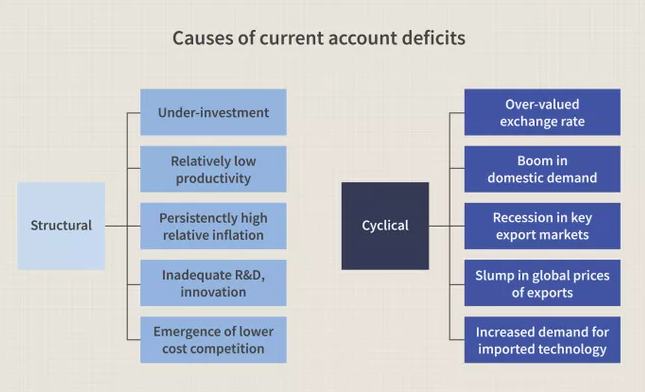

- CAD exists due to a host of factors including existing exchange rate, consumer spending level, capital inflow, inflation level, and prevailing interest rate.

- For the Current Account Deficit in India, crude oil and gold imports are the primary reasons behind high CAD.

- The Current Account Deficit could be reduced by boosting exports and curbing non-essential imports such as gold, mobiles, and electronics.

- Currency hedging and bringing easier rules for manufacturing entities to raise foreign funds could also help.

- The government and RBI could also look to review debt investment limits for FPIs, among other measures.

Recent Findings of Morgan and Stanley:

- In the wake of continued geopolitical tensions (Ukraine Russia-War), the surge in oil prices is likely to be sustained, which would lead to deterioration in the current account deficit from a higher oil import bill.

- The risk would stem from a further sustained rise in oil prices, leading to quick deterioration in macro stability and currency volatility.

- Analysis shows that a 10 per cent rise in oil prices would widen India’s current account deficit by 30-35 bps of GDP.

- Further, the balance of payments could be in deficit of approximately 0.5-1 per cent of GDP because capital flows are likely to be lower than the current account deficit.

Suggestions made:

- The extent of vulnerability to funding risks will be cushioned by the large forex reserves, which along with forward book stand at $681 billion.

- Morgan Stanley expects policy normalization with a reverse repo rate hike. However, if the RBI were to delay its normalization process, the risk of disruptive policy rate hikes would rise.

- There is less room for fiscal policy stimulus to support growth given high deficit and debt levels.

- A possibility of a modest fuel tax cut and reliance on the national rural employment program could be an automatic stabilizer.

Important links:

https://www.iasgyan.in/blogs/key-economic-concepts-back-to-basics

https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

https://www.iasgyan.in/daily-current-affairs/monetary-policy

https://www.iasgyan.in/blogs/budget-basics-key-financial-terms-you-need-to-know

https://indianexpress.com/article/business/economy/current-account-deficit-likely-to-hit-10-year-high-7814251/