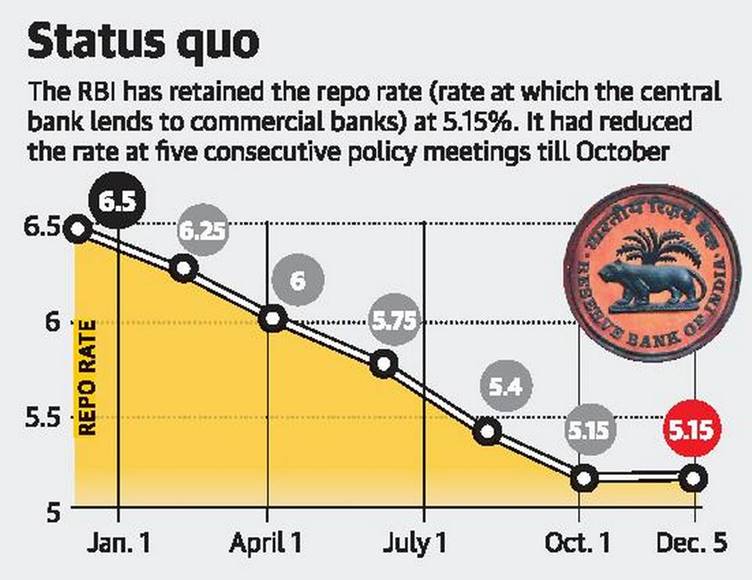

In a surprise, RBI keeps interest rate unchanged

- Kept the policy interest rate unchanged at 5.15%.

- All six members of the monetary policy committee voted for keeping the rate unchanged.

- Maintained an accommodative stance as long as it is necessary to revive growth.

- There is space for further monetary policy action.

- RBI is waiting for further clarity on the inflation front and the steps that the government might take in the Budget to prop up growth.

- Expects banks to cut lending rates further in response to the earlier 135 bps rate cut.

- Raised inflation forecast to 5.1-4.7% for the second half of 2019-20 and 4.0-3.8% for the first half of 2020-21.

- Growth forecast was revised downward sharply — from 6.1% projected in the October policy, to 5%.

Repo rate:

- It is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

- Repo Rate is set by the RBI for lending short-term money to banks. Reverse Repo Rate is actually the opposite of Repo Rate. The RBI borrows money at this rate from the banks for the short term. In other words, the banks park their excess funds with the central bank at this rate, often, for one day. The banks earn an interest rate on government securities purchased from the RBI for the given period. The Repo Rate always stands higher than the Reverse Repo Rate.

Monetary policy committee:

- The Monetary Policy Committee of India is responsible for fixing the benchmark interest rate in India. The meetings of the Monetary Policy Committee are held at least 4 times a year and it publishes its decisions after each such meeting.

- The committee comprises six members - three officials of the Reserve Bank of India and three external members nominated by the Government of India. They need to observe a "silent period" seven days before and after the rate decision for "utmost confidentiality". The Governor of Reserve Bank of India is the chairperson ex officio of the committee. Decisions are taken by majority with the Governor having the casting vote in case of a tie.

- The current mandate of the committee is to maintain 4% annual inflation until 31 March 2021 with an upper tolerance of 6% and a lower tolerance of 2%.

The country’s foreign exchange reserves crossed the $450-billion mark for the first time ever on the back of strong inflows, which enabled the central bank to buy dollars from the market.

Foreign exchange reserves include foreign banknotes, foreign bank deposits, foreign treasury bills, and short and long-term foreign government securities, as well as gold reserves, special drawing rights (SDRs), and International Monetary Fund (IMF) reserve positions.

- At $451.7 billion, the country’s import cover is now over 11 months.

- Import Cover measures the number of months of imports that can be covered with foreign exchange reserves available with the central bank of the country.

- Will give the central bank the firepower to act against any sharp depreciation of the rupee.

- Net foreign direct investment rose to $20.9 billion in the first half of 2019-20 from $17 billion a year ago.

- RBI intervenes in the foreign exchange market to curb volatility and does not target a particular level of exchange rate.

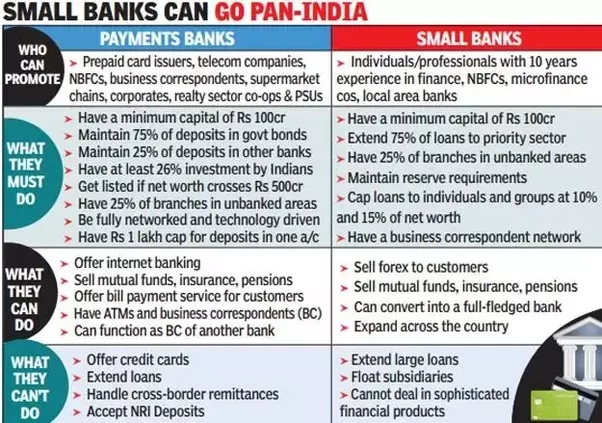

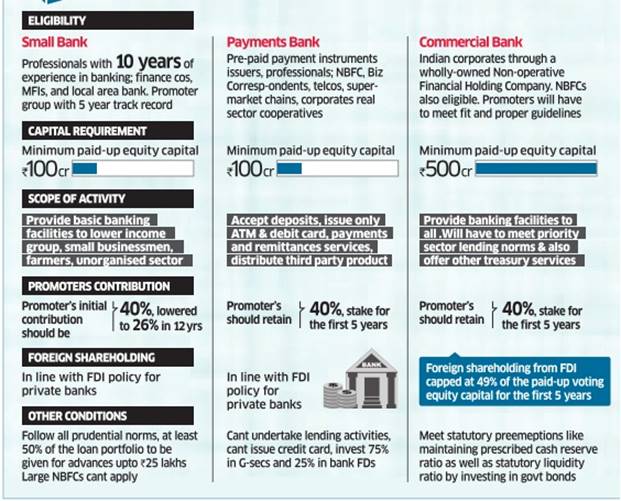

Payments banks willing to convert themselves into small finance banks (SFBs) can apply for such a licence only after five years of operations says the Reserve Bank of India (RBI). Minimum capital for setting up an SFB has been mandated at rs.200 crores.

- Primary (urban) co-operative banks (UCBs), which wish to become SFBs, the initial requirement of net worth will be rs.100 crores.

- Decided to bring UCBs with assets of rs.500 crores and above, under the reporting framework of the Central Repository of Information on Large Credits (CRILC).

- Intermediaries should proactively identify and remove child sexual abuse material, rape/gang-rape imagery.

- Proactively remove contents promoting terrorism without compromising accuracy or privacy using technology-based tools and mechanism.

- Information Technology (IT) Act, 2000, has provisions for removal of objectionable online content.

- Social media platforms are intermediaries as defined in the Act.

- It empowers the government to block any information generated, transmitted, received, stored or hosted in any computer resource in the interest of sovereignty and integrity of India, defence of India, security of the state, friendly relations with foreign states or public order or for preventing incitement to the commission of any cognisable offence relating to above.

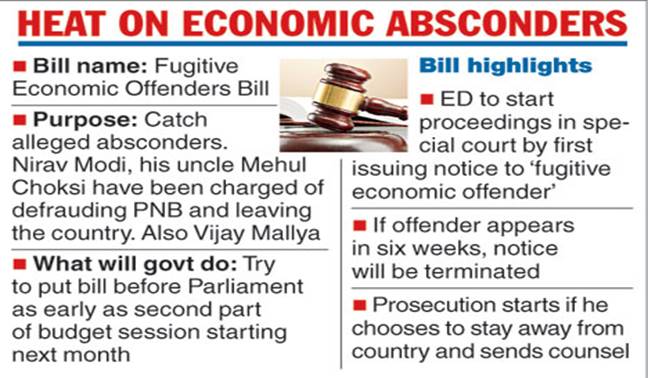

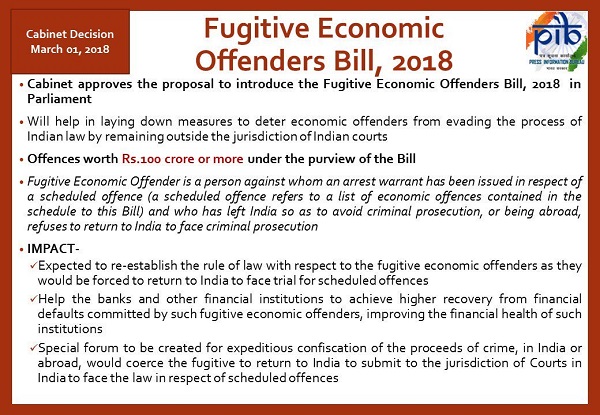

A special Prevention of Money Laundering Act court declared diamond trader Nirav Modi, an accused in the Punjab National Bank scam case, a fugitive economic offender.

- Nirav Modi is the second person to be declared a fugitive economic offender after Vijay Mallaya.

- The court will now begin the proceedings to confiscate his assets.

- It would help in the extradition proceedings pending before a United Kingdom court.

The order in Chidambaram case restates fundamental principles on granting bail.

- Bail remains the norm and its refusal the exception.

- The Supreme Court has now formally disapproved of courts using purported material contained in sealed cover to record one-sided findings.

- If a person is likely to hinder the trial by fleeing from justice.

- Chances of tampering with evidence.

- Chances of influencing witnesses.

- Gravity of the offence may be an additional consideration.

Reference: https://www.thehindu.com/todays-paper/tp-opinion/bail-basics/article30200306.ece

- The Union Cabinet approved a proposal to extend reservations for Scheduled Castes and Scheduled Tribes in the Lok Sabha and State Assemblies for 10 years.

- A question mark prevailed over whether it has extended reservations for two seats in the Lok Sabha for the Anglo-Indian community.

- Provisions for reservations for SCs/STs and Anglo- Indians are extended under Article 334 (a) and (b) of the Constitution.

- Two members of the Anglo Indian community have been nominated in the Lok Sabha since the adoption of the Constitution, under article 334(b).

- Details of the Bill would be clear when it is tabled in Parliament in the ongoing session.

Reference: https://www.thehindu.com/news/national/end-of-reservations-for-anglo-indians/article30170149.ece

The Global Climate Risk Index has been published by environmental think-tank German watch.

- Worsening heatwaves are taking a heavier toll on rich as well as poor countries.

- It has rated Japan as the most-affected country in 2018.

- Japan and Germany were hit hard by heatwaves and drought that year, as was India — in fifth position, which suffered water shortages, crop failures and worst flooding.

- Impact of heatwaves on African countries may be under-represented due to a lack of data.

- Powerful storms also left a trail of destruction in 2018, with the Philippines second in the climate risk index due to large losses when it was battered by top-strength Typhoon Mangkhut.

India’s first attempt to domestically legislate on the topic, the Personal Data Protection (PDP) Bill, 2019, has been approved by the Cabinet and is slated to be placed in Parliament this winter session.

- Data usually refers to information about your messages, social media posts, online transactions, and browser searches.

- It has become an important source of profits.

- Companies, governments, and political parties find it valuable because they can use it to find the most convincing ways to advertise online.

- Much of the future’s economy and law enforcement will be predicated on the regulation of data, introducing issues of national sovereignty.

- Data is stored in a physical space similar to a file cabinet of documents, and transported across country borders in underwater cables.

- Data is collected and handled by entities called data fiduciaries.

- While the fiduciary controls how and why data is processed, the processing itself may be by a third party, the data processor.

- The physical attributes of data — where data is stored, where it is sent, where it is turned into something useful — are called data flows.

- The Bill trifurcates personal data. The umbrella group is all personal data — data from which an individual can be identified.

- Some types of personal data are considered sensitive personal data (SPD), which the Bill defines as financial, health, sexual orientation, biometric, genetic, transgender status, caste, religious belief and more.

- Another is critical data, which is determined by government for national security purposes.

- It requires individual consent for data transfer abroad.

- The bill still requires sensitive personal data to be stored only in India.

- It can be processed abroad only under certain conditions including approval of a Data Protection Agency (DPA).

- The final category of critical personal data must be stored and processed in India.

- The bill mandates fiduciaries to give the government any non-personal data when demanded.

- The bill also requires social media companies, which are deemed significant data fiduciaries based on factors such as volume and sensitivity of data as well as their turnover, to develop their own user verification mechanism.

- The bill includes exemptions for processing data without an individual’s consent for “reasonable purposes” including security of the state, detection of any unlawful activity or fraud, whistleblowing, medical emergencies, credit scoring, operation of search engines and processing of publicly available data.

- The Bill calls for the creation of an independent regulator DPA, which will oversee assessments and audits and definition making.

- Each company will have a Data Protection Officer (DPO) who will liaison with the DPA for auditing, grievance redressal, recording maintenance and more.

- It also grants individuals the right to data portability, and the ability to access and transfer one’s own data.

- It legislates on the right to be forgotten.

- Will help law-enforcement access data for investigations and enforcement.

- Proponents highlight security against foreign attacks and surveillance, harkening notions of data sovereignty.

- Many domestic-born technology companies, which store most of their data exclusively in India, support localisation.

- Reliance Jio has strongly argued that data regulation for privacy and security will have little teeth without localisation, calling upon models in China and Russia.

- Increase the ability of the Indian government to tax Internet giants.

- Security and government access are not achieved by localisation. Even if the data is stored in the country, the encryption keys may still be out of reach of national agencies.

- Many are concerned with a fractured Internet (or a “splinternet”), where the domino effect of protectionist policy will lead to other countries following suit.

- It hampers to the values of a globalised, competitive internet marketplace, where costs and speeds determine information flows rather than nationalistic borders.

- Protectionism may backfire on India’s own young start-ups that are attempting global growth.

© 2025 iasgyan. All right reserved