After a heated debate, RS clears Citizenship Bill

The Rajya Sabha has passed the contentious Citizenship (Amendment) Bill (CAB), 2019. The Bill amends the Citizenship Act, 1955, and for the first time, will grant citizenship on the basis of religion to non-Muslim communities from Afghanistan, Bangladesh and Pakistan; that entered India on or before December 31, 2014.

- The Bill seeks to amend the Citizenship Act, 1955, by wanting to grant citizenship to illegal non-Muslims (Hindus, Sikhs, Buddhists, Jains, Parsis, and Christians) from Bangladesh, Pakistan, and Afghanistan, who came to India on or before December 31, 2014.

- The Bill proposes that all such migrants will be eligible for citizenship if they came to India before December 31, 2014.

- All pending legal cases pertaining to citizenship-related matters against them will stand abated.

- The Bill says the six non-Muslim communities “shall not be treated as illegal migrants” for violating provisions of the Passport Act, 1920, or the Foreigners Act, 1946.

- The Bill reduces the mandatory requirement of continuous stay in India from 12 years to five years for “many persons of Indian origin including persons belonging to the minority community from the neighbouring countries”.

- The Bill says the amendments will not apply to the tribal areas of Assam, Meghalaya, Mizoram, and Tripura, which are included in the Sixth Schedule of the Constitution and Arunachal Pradesh, Mizoram and Nagaland that are protected by the Inner Line Permit (ILP).

India’s Polar Satellite Launch Vehicle (PSLV) marked its ‘Golden Jubilee’ launch by injecting India has advanced radar imaging satellite RISAT-2BR1 and nine other customer satellites from Japan, Italy, Israel and the U.S. into their intended orbits.

- Initially, the PSLV had a carrying capacity of 850 kg, and over the years, it has been enhanced to 1.9 tonnes.

- The PSLV has failed only twice — the maiden flight of the PSLV D1 in September 1993 and the PSLV C-39 in August 2017.

- RISAT-2BR1 will be used for agriculture, forestry, disaster management support and national security.

- The PSLV had helped take payloads into almost all the orbits in space including Geo-Stationary Transfer Orbit (GTO), the Moon, Mars and would soon be launching a mission to the Sun.

- While it had taken ISRO’s 26 years, to achieve 50 launches, the next 50 would likely be done in the coming five years.

- Vikram Sarabhai Space Centre (VSSC) is ISRO’s lead agency for launch vehicles.

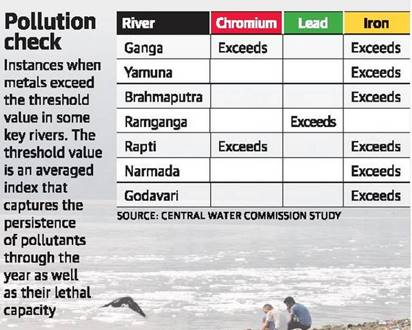

- Two-thirds of the water quality stations spanning India’s major rivers showed contamination by one or more heavy metals, exceeding safe limits set by the Bureau of Indian Standards.

- Samples from only one-third of water quality stations were safe.

- Iron emerged as the most common contaminant with 156 of the sampled sites registering levels of the metal above safe limits.

- None of the sites registered arsenic levels above the safe limit.

- The other major contaminants found in the samples were lead, nickel, chromium, cadmium and copper.

- The study spanned 67 rivers in 20 river basins.

- Lead, cadmium, nickel, chromium and copper contamination were more common in non-monsoon periods while iron, lead, chromium and copper exceeded ‘tolerance limits’ in monsoon periods most of the time.

- Arsenic and zinc are the two toxic metals whose concentration was always obtained within the limits throughout the study period.

- Samples were collected in three different seasons: pre-monsoon, monsoon and post-monsoon.

- Not all rivers were equally sampled. Several rivers have only been sampled at a single site whereas others such as the Ganga, the Yamuna and the Godavari were sampled at multiple sites.

- The presence of metals in drinking water is to some extent unavoidable and certain metals, in trace amounts, are required for good health. However, when present above safe limits, they are associated with a range of disorders.

- Long-term exposure to such heavy metals may result in slowly progressing physical, muscular, and neurological degenerative processes that mimic Alzheimer’s disease, Parkinson’s disease, muscular dystrophy and multiple sclerosis.

- Mining, milling, plating and surface finishing industries that discharge a variety of toxic metals into the environment.

- The Bill provides for the establishment of an Authority to develop and regulate the financial services market in the International Financial Services Centres in India.

- The unified authority would act as a single window of regulation. Currently, the banking, capital markets and insurance sectors in IFSC are regulated by multiple regulators.

- The Bill seeks to amend 14 Acts, including the SEBI Act, the IRDA Act and the PFRDA Act.

- All the laws of the land, including the Prevention of Money Laundering Act, would apply and would be audited by the CVC and the CAG.

- Tax holiday is given only for 10 years in the IFSC.

- Among the other functions of the Authority are the regulation of any other financial products, financial services, or financial institutions in an IFSC, which may be notified by the central government; and to recommend to the central government any other financial products, financial services, or financial institutions, which may be permitted in an IFSC.

- Dynamic nature of business in the IFSCs.

- Financial services and products in IFSCs would require focussed and dedicated regulatory interventions.

- Need to provide a world-class regulatory environment to financial market participants.

- Essential from an ease of doing business perspective.

- Will provide the much-needed impetus to further the development of IFSC in India in sync with the global best practices.

- It will consist of nine members, appointed by the central government.

- They will include, apart from the chairperson of the authority, a member each from the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority of India (IRDAI), and the Pension Fund Regulatory and Development Authority (PFRDA); and two members from the Ministry of Finance.

- All members of the IFSC Authority will have a term of three years, subject to reappointment.

The Union Cabinet has approved the proposal to make amendments in the Insolvency and Bankruptcy Code 2016, through the Insolvency and Bankruptcy Code (Second Amendment) Bill, 2019.

- Ring-fence successful resolution applicants from criminal proceedings with regard to offences committed by previous promoters of a company.

- It aims to remove certain difficulties being faced during the insolvency resolution process to realise the objects of the code and to further ease the doing of business.

- The amendments aim to remove bottlenecks, streamline the corporate insolvency resolution process (CIRP), and protect the last mile funding in order to boost investment in financially distressed sectors.

- The eight Central Labour Acts, namely Employees' Compensation Act, 1923; Employees State Insurance Act, 1948, Employees Provident Funds and Miscellaneous Provisions Act, 1952; Maternity Benefit Act, 1961; Payment of Gratuity Act, 1972; Cine Workers Welfare Fund Act, 1981; Building and Other Construction Workers Cess Act, 1996 and Unorganised Workers Social Security Act, 2008, are to be subsumed under the new law.

- It will give the option for the reduction of Provident Fund contribution by employees in some sectors from 12% to 10%.

- The reduction will not apply to employers and has been done solely to increase the take-home pay of employees.

- The Bill also proposes to set up a social security fund using the funds available under corporate social responsibility, to provide welfare benefits such as pensions and death and disability benefits.

- Voters backing Bougainville’s independence from Papua New Guinea have won a landslide referendum victory — a major step toward the troubled isles becoming the world’s newest nation.

- Chairman of the Bougainville Referendum Commission declared that around 98% of the voters had backed independence with just 2% supporting the option of remaining a part of Papua New Guinea with more autonomy.

The Union Cabinet has given its approval to the proposal of the Ministry of Road Transport and Highways authorizing the National Highways Authority of India (NHAI) to set up an Infrastructure Investment Trust(s) (InvIT) as per InvIT guidelines issued by SEBI.

- Will allow monetization of completed national highways that have a toll collection track record of at least one year.

- NHAI's InvIT will be a Trust established by NHAI under the Indian Trust Act, 1882 and Securities and Exchange Board of India (Infrastructure Investment Trusts) Regulations, 2014.

InvIT as an instrument provides greater flexibility to investors and is expected to create the following opportunities:

- Generation of specialized O&M Concessionaires.

- Attract patient capital (for say 20-30 years) to the Indian highway market, as these investors are averse to construction risk and are interested in investment in assets, which provide long-term stable returns.

- Retail domestic savings and corpus of special institutions (such as mutual funds, PFRDA, etc.) to be invested in infrastructure sector through InvIT.

- Partial Credit Guarantee Scheme” is to be offered by the Government of India (Gol) to Public Sector Banks (PSBs) for purchasing high-rated pooled assets from financially sound Non-Banking Financial Companies (NBFCs)/Housing Finance Companies (HFCs).

- This proposal will allow public sector banks (PSBs) to buy pooled assets from financially sound entities.

- It will help address NBFCs/HFCs resolve their temporary liquidity or cash flow mismatch issues, and enable them to continue contributing to credit creation and providing last mile lending to borrowers.

- The scheme will not cover the NBFCs that were in stress before the IL&FS crisis.

Department of Defence Production deals with matters such as defence production and indigenisation of imported equipment.

- Innovations for Defence Excellence (iDEX) framework: It aims to achieve self-reliance and to foster innovation and technology development in Defence and Aerospace Sector by engaging Industries including MSMEs, start-ups, individual innovators, R&D institutes and academia.

- Launched a program termed as “Technology Development Fund (TDF)” for meeting the requirements of Tri-Services, Defence Production and DRDO.

- Make-II’ procedure has been simplified to encourage wider participation of Indian industry, with impetus for MSME/Start-ups and timely induction of equipment into Indian Armed Forces.

Under Start-up India Initiative, recognized start-ups have been exempted under several sections of IT Act.

- The Fund of Funds for Start-ups (FFS) was approved by the Cabinet and established by the Department for Promotion of Industry and Internal Trade (DPIIT) in June 2016 with a corpus of Rs 10,000 crores.

- This was done to provide a much-needed boost to the Indian start-up ecosystem and enable access to domestic capital.

- The Fund of Funds does not directly invest in start-ups but provides capital to SEBI-registered Alternate Investment Funds (AIFs), known as daughter funds, who in turn invest money in growing Indian start-ups through equity and equity-linked instruments.

- Small Industries Development Bank of India (SIDBI) has been given the mandate of managing this Fund through selection of suitable daughter funds and overseeing the disbursal of committed capital.

© 2025 iasgyan. All right reserved