NDA's course correction: Sitharaman announces multiple changes to boost growth

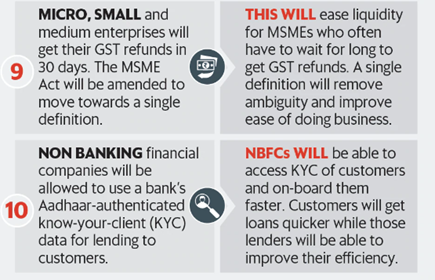

Finance minister Nirmala Sitharaman announced a slew of measures to stoke demand, including a rejig of its spending programme by front-loading it, addressing supply-side bottlenecks and easing bank credit rules, even as she promised to end “tax terrorism" that affect Indian economy badly.

Changes Proposed:

The government has withdrawn the additional surcharge on capital gains, providing major relief to foreign portfolio investors (FPI).

Additionally, Finance minister also said to make Depository receipt scheme 2014 to operational. And, SEBI has relaxed the compliance for FPI by simplifying their registration.

- It will boost the sentiments of investors.

- It will see reversal of foreign money into indian markets.

- It will push the economy ahead of the festive season.

- It will help in rupee appreciation.

- Resumption of the Depository receipt scheme will allow increased access to foreign funds through ADR (American Depository receipt) and GDR (global depository receipt).

- It will make government loose about 1400 crore as envisaged in the budget.

- Reversal of policy within a month shows policy uncertainty which is most critical for investment.

- Government is focusing on FPI which is of short-term nature while focus has to be on FDI which brings investment, jobs.

foreign portfolio investment is the entry of funds into a country where foreigners deposit money in a country's bank or make purchases in the country’s stock and bond markets, sometimes for speculation.

- Not having managerial control in the company.

- It is of short-term in nature.

- Volatility in FPI movement brings high volatility in rupee exchange rate.

- It affects export –import of country.

The FM’s assurances indicate direct tax administration will be closely monitored by the government. The minister said a new centralized computer system has been set up for issuing income tax orders, notices and summons with a unique document identification number(DIN) effective 1 October.

- Businessman will not face any harassment from the tax official.

- A new system is being placed to make officials accountable for their communication with assesse.

- Government will respect the wealth creators.

- Direct tax administration will be closely monitored by the government.

- Government will shift away from prosecution to monetary penalty for minor offences under the Companies Act.

- It will issue faster approvals to make life easier for businesses.

- Government will remain responsive and the reform process will continue.

- Unless a notice or document carries a DIN, it need not be taken seriously by the assesse at all.

- Pre-filling and faceless scrutiny of income tax returns.

- Simplification of goods and services tax return forms.

- Quicker tax refunds.

- Self-certification of start-ups.

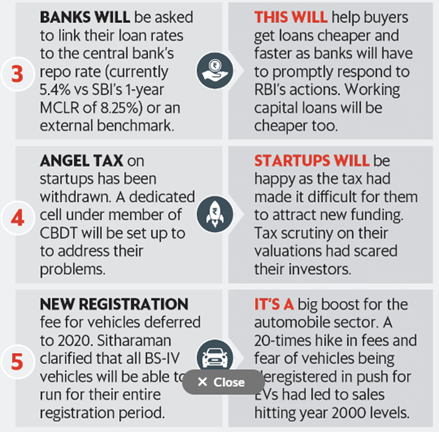

Government announced slew of measures to attack the slowdown in the auto industry. It has already led to loss of thousand jobs.

- Mandating government agencies to replace old vehicles.

- Increasing depreciation on new vehicles for commercial fleet service providers.

- Urging bank to make automobile loans cheaper.

- Increase credit availability to NBFC.

- Assured buyers that vehicles compliant with Bharat IV emission norms purchased before March 31,2020 will be able to run for the entire registration period.

- Government is also working on a scrappage policy.

- Infusion of Rs 70,000 crore into Banks will provide more credit to NBFC.

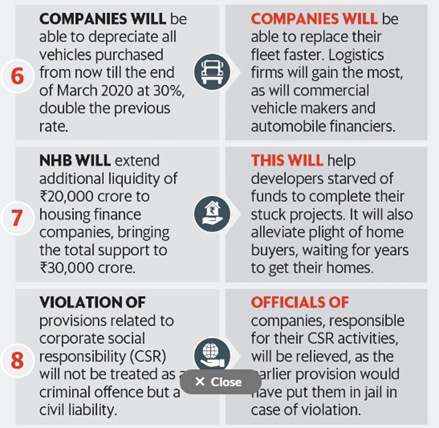

Defaults on corporate social responsibility (CSR) obligations will not be treated as a criminal offence.

- It will be treated as civil offense.

- Government will review the sanctions under Companies Act.

According to the law, every company with a net worth of ₹500 crore or more, or sale of ₹1,000 crore or more, or net profit of ₹5 crore or more, in a fiscal year are required to spend at least 2% of their average net profit of the last three fiscal years on corporate social responsibility activities.

It includes initiatives that would have social, economic and environmental impact, or a way to give back to the society.

- The Companies (Amendment) Act, 2019, says that any unspent annual funds pertaining to corporate social responsibility should be transferred to a specified government fund within six months of the fiscal year.

- In case of ongoing corporate social responsibility projects, businesses have three years to utilize the funds allocated in a given year.

- The law proposes penal provisions that may include fine, imprisonment or both.

Indentured servitude from India started in 1834 and lasted up till 1922, despite having been officially banned in 1917 by British India’s Imperial Legislative Council after pressure from freedom fighters like Mahatma Gandhi.

- Prohibition of slavery in British, French and Dutch colonies.

- Creation of the new form of bonded servitude and euphemistically term it ‘indentured labour’.

- Indentured labor needed to run the Sugar and rubber plantations in British Colonies.

- Continuous expansion of British Empire needed new labor, indentured labor was created to fulfill this demand.

- India had surplus labor population and were ready to serve.

- Plantation owners were accustomed to the mentality of coerced labour. Indentured labor came without any types of labor control thus fulfilled plantation owners conditions.

- Indian agriculture had ruined and workers had no option but to become indentured labor.

- Widows migrated to escape the social stigma associated with them in Indian society.

- Many urban women who were single and employed chose to travel for a fresh start.

- Most labors were shown unrealistic pictures of conditions and lured as a good business deal.

- Indentured labor was mostly hired from the worst affected regions of Jharkhand, Bihar, Uttar Pradesh, Tamil Nadu and Andhra Pradesh became the central point of hiring.

- British hardly had welfare of the migrants in mind while encouraging them to join it.

- There was an agreement to return them in 10 years but very few returned back. For every 100 male, 40 female accompanied to maintain a skewed sex ratio. It ensured initiation of family life in the colony.

- Their signatures or thumb – prints were undertaken. They couldn’t understand the agreement form due to poor literacy among them.

- The system subjected poor, vulnerable Indians to long-term abuse and exploitation.

- The journey by sea was long and traumatic, with travel taking approximately 160 days to reach the Caribbean colonies.

- Travelers were loaded onto cargo cargo ships that were not meant to carry passengers.

- There were cramped quarters and little space on the ship.

- Sanitation was poor and there was little access to food and medication.

- Those who died on board were simply thrown off the ships into the sea.

- The migrants also faced physical and sexual abuse at the hands of the European ship captains.

© 2025 iasgyan. All right reserved