Description

Disclaimer: Copyright infringement not intended.

Context

- In April 2024, the consumer price index for cereals was 8.63% higher than that in April 2023.

- However, the inflation in the price of roti (a staple food item made from wheat) may not have significantly hurt a majority of poor and lower middle-class Indians due to the government's flagship food security scheme.

- This scheme provides 5 kg of rice or wheat, free of cost every month, to some 813.5 million persons.

Impact on Roti Prices

- Government Food Security Scheme: The scheme has cushioned the impact of cereal price inflation on poor and lower middle-class families by providing essential grains at no cost.

- Beneficiaries: Approximately 813.5 million individuals benefit from this scheme.

- Mitigation of Inflation Impact: Despite an 8.63% increase in cereal prices, the availability of free rice and wheat has lessened the financial burden on low-income households.

Inflation in Pulses

- Pulses Inflation: The annual retail inflation for pulses was 16.84% in April 2024, nearly twice that for cereals.

- Significance: Pulses are a critical source of protein and other nutrients for Indian households.

- Public Distribution System (PDS): Unlike cereals, pulses are not widely distributed through the PDS, forcing consumers to purchase them at market prices.

Retail Prices of Pulses

- Chana (Chickpea): The average all-India modal price was Rs 85 per kg on May 23, up from Rs 70 a year ago.

- Arhar/Tur (Pigeon Pea): The price increased from Rs 120 to Rs 160 per kg.

- Urad (Black Gram): The price rose from Rs 110 to Rs 120 per kg.

- Moong (Green Gram): The price also increased from Rs 110 to Rs 120 per kg.

- Masoor (Red Lentil): The price slightly decreased from Rs 95 to Rs 90 per kg.

Implications for Low-Income Households

- Increased Burden: The significant rise in prices of commonly consumed pulses has likely put additional financial pressure on low-income households.

- Limited Access: Due to the lack of inclusion in the PDS, families must purchase pulses at higher market rates, exacerbating the impact of inflation.

- Nutritional Concerns: Given that pulses are a major protein source, the increased prices may affect the dietary intake and nutrition of poor and lower middle-class families.

Reasons for Rising Dal Prices

El Niño-Induced Patchy Monsoon and Winter Rain

- Weather Impact: The primary cause of the surge in dal prices is the El Niño-induced irregular monsoon and insufficient winter rains.

- Production Decline: These weather conditions led to a reduction in domestic pulses production:

- 2021-22: 27.30 million tonnes (mt)

- 2022-23: 26.06 mt

- 2023-24: 23.44 mt

Specific Pulses Affected

- Chana (Chickpea):

- Production dropped from 13.54 mt in 2021-22 to 12.27 mt in 2022-23, and further to 12.16 mt in 2023-24.

- Trade sources estimate this year's production to be even lower, at less than 10 mt.

- Arhar/Tur (Pigeon Pea):

- Production fell from 4.22 mt in 2021-22 to 3.31 mt in 2022-23, and slightly increased to 3.34 mt in 2023-24.

- Trade sources project this year’s output to be below 3 mt.

Regional Production Issues

- Affected States: The most significant production shortfalls occurred in Karnataka, Maharashtra, Andhra Pradesh, and Telangana.

- Reasons: Farmers in these states planted less area due to irregular and deficient rainfall.

Market Prices

- Current Trading Prices:

- Chana: Averaging Rs 6,500 per quintal in Latur, Maharashtra.

- Arhar/Tur: Averaging Rs 12,000 per quintal in Kalaburagi, Karnataka.

- Minimum Support Prices (MSP):

- Chana MSP: Rs 5,440 per quintal.

- Arhar/Tur MSP: Rs 7,000 per quintal.

- Harvest Season Prices:

- Chana: Ranged from Rs 5,700 to Rs 5,800 per quintal during March-April.

- Arhar/Tur: Ranged from Rs 9,500 to Rs 10,300 per quintal during January-February.

Surge in Imports

Increase in Pulses Imports

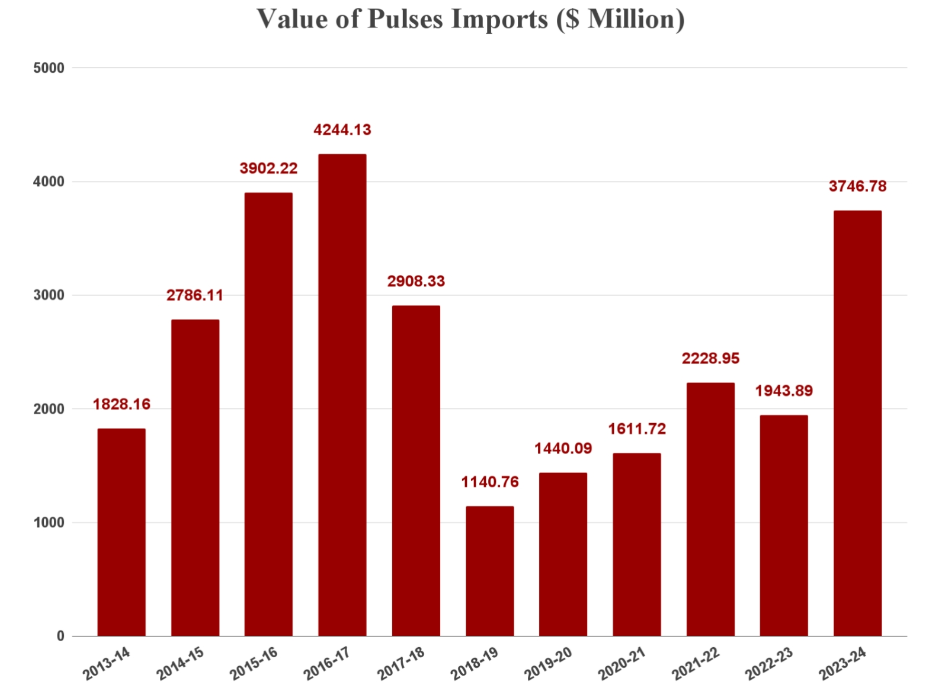

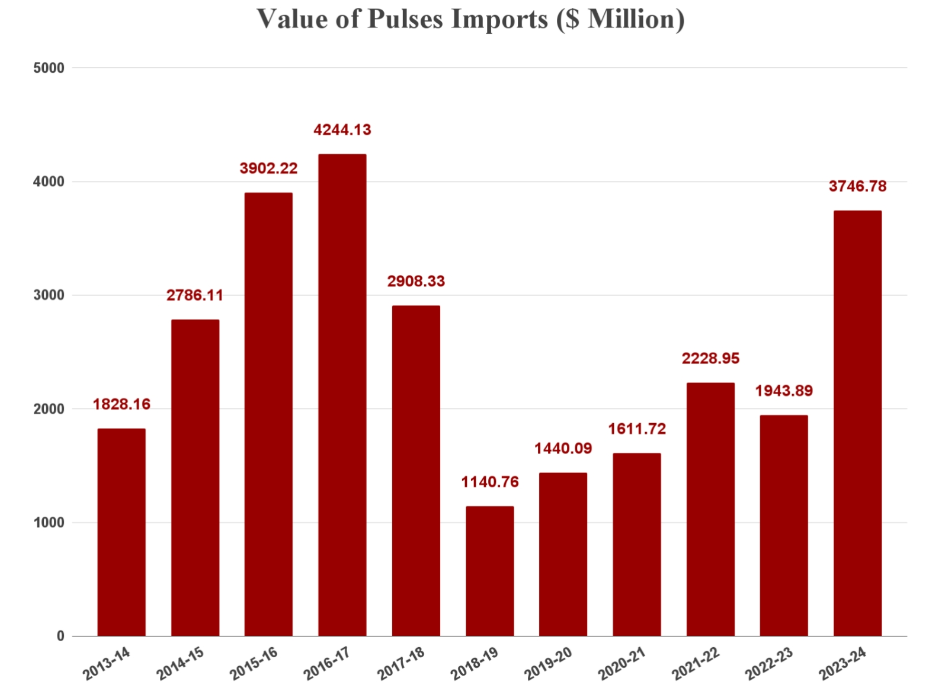

- Record High Imports: In the fiscal year 2023-24 (April-March), India's pulses imports reached a value of $3.75 billion, the highest since 2015-16 and 2016-17, when imports were valued at $3.90 billion and $4.24 billion respectively.

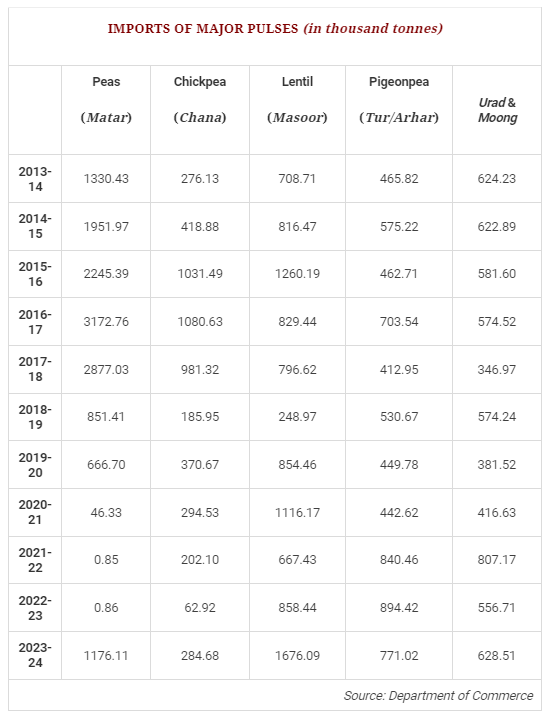

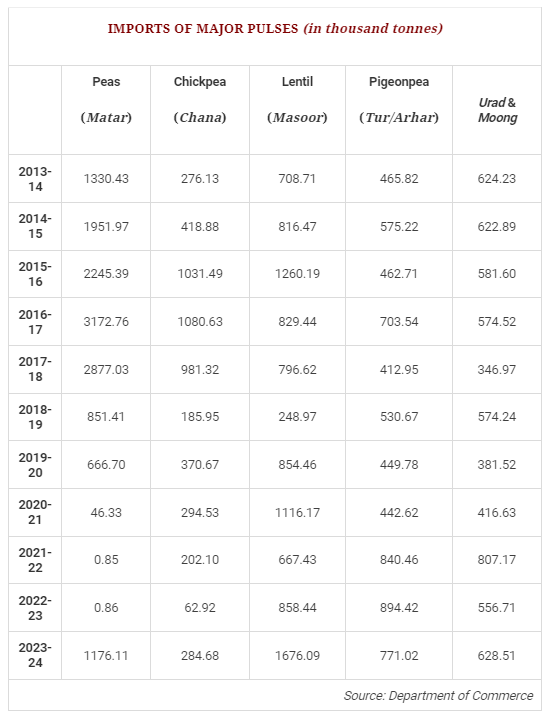

- Import Quantities: Major pulses imports totaled 4.54 million tonnes (mt) in 2023-24, significantly higher than 2.37 mt and 2.52 mt in the preceding two fiscal years.

- Historical Comparison: While substantial, these figures remain below the all-time highs of 5.58 mt, 6.36 mt, and 5.41 mt recorded in 2015-16, 2016-17, and 2017-18 respectively.

Reversal of Self-Sufficiency

- Previous Self-Sufficiency: From 2015-16 to 2021-22, India achieved relative self-sufficiency in pulses, with domestic production rising from 16.32 mt to 27.30 mt.

- Government Policies: This increase was driven by several policy measures:

- MSP-Based Procurement: Minimum Support Price (MSP) procurement incentivized farmers to grow pulses.

- Import Duties: The imposition of duties significantly reduced imports, particularly of yellow/white peas (matar) and chana, by 2022-23.

Agricultural Innovations

- Short-Duration Varieties: The development of short-duration chana and moong varieties further boosted domestic production.

- Chana and Moong Cultivation: These varieties can be cultivated with minimal irrigation, utilizing residual soil moisture from previous crops.

- Multiple Crops: The introduction of 50-75 day moong varieties enabled farmers to plant up to four crops a year—kharif (post-monsoon), rabi (winter), spring, and summer.

Inflation, El Niño, and Elections

Government Measures to Tackle Inflation

- Removal of Tariffs and Quantitative Restrictions (QRs):

- Arhar/Tur and Urad & Moong: On May 15, 2021, the Narendra Modi government lifted the annual QRs of 0.2 mt on arhar/tur and 0.3 mt on urad & moong imports, along with a 10% basic customs duty.

- Masoor (Lentils): On July 26, 2021, the import duty on masoor was reduced from 10% to nil.

- Yellow/White Peas: Previously subject to a 0.1 mt yearly QR, a 50% duty, and a minimum price of Rs 200/kg, all restrictions were removed on December 8, 2023.

- Desi (Small-Sized) Chana: The 60% import duty was abolished on May 3, 2024.

- Moong: The import restriction on moong was reinstated on February 11, 2022.

Impact of Policy Changes

- Increased Imports: The relaxation of tariffs and QRs led to a significant rise in pulse imports.

- Masoor: Imports from Australia and Canada reached a record 1.7 mt in 2023-24.

- Yellow/White Peas: Imports surged to 1.2 mt from virtually nothing, with supplies coming from Canada, Russia, and Turkey.

- Chana: Imports increased despite the duty abolition only occurring recently, with major sources being Tanzania, Sudan, and Australia.

Flat or Declining Imports

- Arhar/Tur: Imports from Mozambique, Tanzania, Malawi, and Myanmar remained flat or declined.

- Urad: Imports, mainly from Myanmar, also showed little change or a decrease.

Electoral and Climatic Pressures

- El Niño Effect: The weather-induced production shortfall necessitated increased imports to stabilize domestic supply and prices.

- Electoral Considerations: With elections approaching, the government was motivated to check rising dal prices to avoid public discontent.

Closing Remarks

Dependence on the Southwest Monsoon

- Monsoon Influence: Future dal inflation will be significantly influenced by the performance of the southwest monsoon.

- Climate Predictions: Global climate models indicate that El Niño may transition to a “neutral” phase next month and possibly to La Niña — which typically brings good rainfall to the Indian subcontinent — by the second half of the monsoon season (June-September).

Domestic Supply Challenges

- Chana Procurement: Government agencies have procured minimal quantities from this year’s chana crop, in stark contrast to the 2.13 mt procured in 2023 and 2.11 mt in 2022.

- Supply Shortfall: The weak domestic supply position, coupled with monsoon uncertainties, suggests that higher imports will be necessary to meet demand.

Government Actions and Import Policies

- Duty-Free Import Permissions: The government has allowed duty-free imports of arhar/tur, urad, masoor, and desi chana until March 31, 2025.

- Extension for Peas: The duty-free import permission for yellow/white peas, currently valid until October 31, 2024, may need to be extended.

Import Trends and Substitutions

- Cheaper Substitutes:

- Yellow/White Peas: These are being imported at Rs 40-41/kg and serve as a cheaper alternative to chana.

- Masoor Dal: This is increasingly being used as a substitute for arhar/tur in dishes like sambar in many restaurants and canteens.

- Import Sources and Likely Increases:

- Higher Imports Expected: Imports of yellow/white peas and masoor, primarily from Canada, Australia, and Russia, are likely to increase more than those of arhar/tur and urad from East Africa and Myanmar.

Conclusion

- The outlook for dal inflation is closely tied to the upcoming southwest monsoon season.

- While there is hope for improved rainfall due to potential La Niña conditions, the current precarious domestic supply situation necessitates continued reliance on imports.

- The government has already taken steps to facilitate these imports, extending duty-free permissions for several key pulses.

- Additionally, the shift towards cheaper substitutes like yellow/white peas and masoor dal is expected to continue, helping to mitigate the impact of inflation on consumers.

- Ensuring stable prices and adequate supply will require careful monitoring of both domestic production and global import trends in the months ahead.

|

PRACTICE QUESTION

Q. Discuss the importance of achieving self-sufficiency in India's dal and cereal sectors. Highlight the challenges and propose policy measures for enhancing domestic production and ensuring food security.

|

SOURCE: THE INDIAN EXPRESS