Disclaimer: Copyright infringement not intended.

Context

Debt Instruments

Types of Debt Instruments

Debentures

Debentures are not backed by any security. They are issued by the company to raise medium and long-term funds. They form part of the company’s capital structure, and reflect on the balance sheet but are not clubbed with the share capital.

In a nutshell, Debentures are a certificate of agreement of loans given under the stamp of the company, undertaking that the debenture holder will get a fixed return (on the basis of the fixed interest rates) and the principal amount whenever the debenture matures. It is generally a long-term debt instrument commonly used by governments and large companies to obtain funds. As debentures are not backed by any security, it carries an advantage by not putting any burden of the asset on the issuer and thereby allowing subsequent financing.

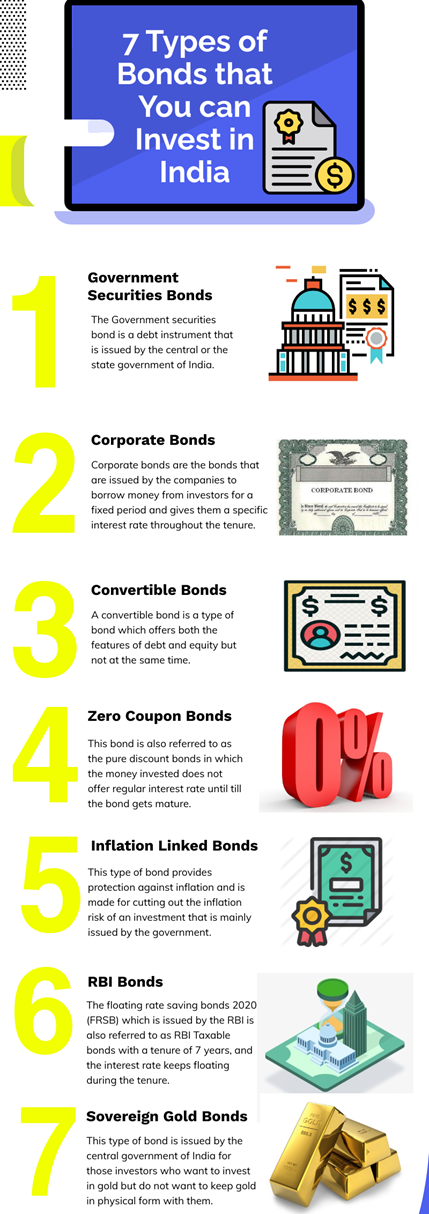

Bonds

Bonds on the other hands are issued generally by the government, central bank or large companies are backed by a security. Bonds also ensure payment of fixed interest rates to the lenders of the money. On maturity of the bond, the principal amount is paid back. Bonds essentially work the way loans do.

In a nutshell, A bond is an IOU in which the investor agrees to lend money to a company or government in exchange for a predetermined interest rate. They are generally issued by large companies, central bank and government. When a company wants to expand, it can borrow money by issuing bonds at different rates and then selling them to the public. As bonds ensure payment of fixed interest rates along with the principal amount to the lenders, it can be said that they work the way loans do. There are various types of bonds, having different features and characteristics. For example, Government bonds, Institutional bonds, Corporate Bonds, and Municipal Bonds.

[An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt.]

Must Read: https://www.iasgyan.in/blogs/bond-yield

Mortgage

A mortgage is a loan against a residential property. It is secured by an associated property. In a case of failure of payment, the property can be seized and sold to recover the loaned amount.

In a nutshell,

A mortgage is a loan against a residential property that is secured by the collateral of specified real estate property. The borrower is obliged to pay back with a predetermined set of payments, in which failure to do so can lead to seizing of the property and selling it off to recover the loaned amount. The most well-known mortgages are a 30-year fixed and a 15-year fixed. They can be as short as five years and as long as 40 years. However, stretching payments over more years reduces the monthly amount to be paid but also increases the amount of interest to pay.

Fixed deposits

Fixed deposits also known as term deposits or FDs are money deposited in a bank for a specific time, earning a fixed rate of interest. The interest on the money deposited is paid by the banks. Due to its nature of high liquidity, a depositor can make a premature withdrawal or break the FD by paying a penalty. By doing so, the depositor will be given 1% less interest on withdrawal. Fixed Deposits offer fixed and guaranteed returns. They are flexible in nature as their duration of maturity ranges from 1 month to 10 years. It also gives the ease to raise a loan against it, and also one can even invest small amounts in an FD. However, a few drawbacks of FDs are that returns are lower as compared to other investment options like share and mutual funds, and the interest does not cover the rising inflation.

Government Securities (G-Secs)

They are the supreme securities issued by the Reserve Bank of India, on behalf of the Government of India and in lieu of the market borrowing program of the Central Government. G-Secs are issued at a face value with no default risk since they carry a sovereign guarantee. Due to its high liquidity, it can be sold by investors in the secondary market. G-Secs can also be redeemed at its face value on maturity with no tax deducted at source. The maturity of these securities ranges from 2-30 years.

Types of G-Secs

Treasury bills (T-bills)

Treasury bills or T-bills are issued only by the central government of India. They are short-term money market instruments, which means that their maturity period is less than 1 year. Treasury bills are currently issued with three different maturity periods: 91 days, 182 days, and 364 days.

Most financial instruments pay you an interest on your investment. The Treasury bill, on the other hand, is what is commonly known as zero coupon securities. These securities do not pay you any interest on your investment. However, they’re issued at a discount and are redeemed at face value on the date of maturity. For instance, a 182-day T-bill with a face value of Rs. 100 may be issued at Rs. 96, with a discount of Rs. 4, and redeemed at the face value of Rs. 100.

Cash Management Bills (CMBs)

Cash Management Bills (CMBs) are relatively new to the Indian financial market. They were only introduced in the year 2010 by the government of India and the Reserve Bank of India. CMBs are also zero-coupon securities and are very similar to Treasury bills. However, the maturity period is the one major point of difference between the two types of government securities. Cash Management Bills (CMBs) are issued for maturity periods less than 91 days, making them an ultra-short-term investment option. CMBs are strategically used by the government of India to meet any temporary cash flow requirements. From the investor’s point of view, Cash Management Bills can be used to meet short-term goals.

Dated G-Secs

Dated G-Secs are also among the different types of government securities in India. Unlike T-bills and CMBs, G-Secs are long-term money market instruments that offer a wide range of tenures, starting from 5 years and going all the way up to 40 years. These instruments come with either a fixed or a floating interest rate, also known as the coupon rate. The coupon rate is applied on the face value of your investment and is paid to you on a half-yearly basis as interest.

There are around 9 different types of dated G-Secs currently issued by the government of India. These are listed below.

– Fixed-Rate Bonds

– Floating Rate Bonds

– Capital Indexed Bonds

– Inflation-Indexed Bonds

– Bonds with Call/Put Options

– Special Securities

– STRIPS

– Sovereign Gold Bonds

– 75% Savings (Taxable) Bonds, 2018

State Development Loans (SDLs)

As the name implies, SDLs are issued only by the state governments of India to fund their activities and to satisfy their budgetary needs. These types of government securities are very similar to dated G-Secs. They support the same repayment methods and come with a wide range of investment tenures. The only difference between dated G-Secs and SDLs is that the former is issued only by the central government, while the latter is issued solely by the state governments of India.

Conclusion

The public or private investors can use the debt market instruments to get fixed and high returns, depending upon the instruments' features, tenure, liquidity, and flexibility. On the contrary, large business corporations, governments, banks, and other financial institutions can use these debt instruments for the expansion of their activities and also reach their short-term and long-term goals.

© 2025 iasgyan. All right reserved