Description

Disclaimer: Copyright infringement not intended.

Context

- Hit by Covid, small & micro units wait for Rs 8.7 lakh crore in pending dues.

Must Read

MSME Sector: https://www.iasgyan.in/daily-current-affairs/msme-sector-21

About

- MSMEs have long been facing a problem of delayed realization of their bills and receivables, particularly from large corporate buyers and government organizations, leading to financial hardships and liquidity constraints—a key reason for many of them turning into non-performing assets (NPAs), affecting their sustainability.

Stats

- Delayed payments, as percentage of sales, has seen a sharp spike in MSME Sector.

- It has been- from 46.16 per cent in 2020 to 65.73 per cent in 2021 for the “micro” segment and from 28.85 per cent to 31.10 per cent for “small” units, according to a report by the Bengaluru-based Global Alliance for Mass Entrepreneurship shared with the Union MSME Ministry.

- However, the rise in delayed payments as a percentage of sales has been much lower for “medium” segment units, up from 24.02 per cent in 2020 to 25.20 per cent in 2021.

.

Pandemic and MSME

- MSMEs were severely impacted during the pandemic.

- A Crisil report showed that more than a quarter of India’s MSMEs lost market share of over 3 per cent due to the pandemic.

- A NeoGrowth survey reveals that 97 per cent of the MSMEs faced difficulty in their credit scores due to reduced cash flows.

Delay in payments

- Delayed payments — from customers in the private sector, government departments and public sector undertakings — are an impediment to the revival of smaller units.

- A majority of India’s MSMEs, payments being delayed and the associated uncertainty is the norm rather than an exception. The buyers realize goods and services, but routinely delay payments.

- Delayed payments are a critical issue not only affecting MSMEs growth but disrupting the supply chains and denting the economy.

Mitigation of delayed payments in India

Laws and Regulations

- India has a history of having legal and regulatory safeguards to protect MSMEs from delayed payments.

- The Interest of Delayed Payments (IDP) to Small Scale and Ancillary Industrial Undertakings Act, 1993 was the first legal measure to ensure timely payments by mandating buyers to pay interest to MSME if payments were due for more than 30 days. This was replaced by the MSME Development Act, 2006, which was similar to the IDP Act, 1993 apart from changes to the interest rates and the number of days in which payments should be made. The threshold for making payments was increased to 45 days.

Limitations

- The laws, however, have limited success in curbing the problem because of weak enforceability. The legal process is lengthy and costly besides straining the buyer-supplier relationship which is detrimental to repeat business.

- The supplier enterprises’ therefore have often shown preference for other recourse such as availing short-term borrowings, accepting discounted payments or having a mix of buyers with both short and longer payment terms to ensure sufficient working capital.

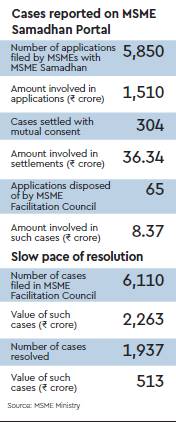

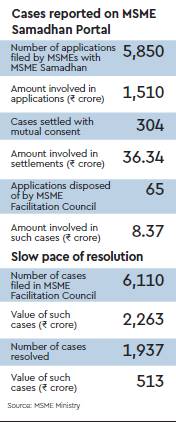

- Samadhaan is a platform introduced by the government for MSMEs to raise disputes over the non-payment of dues. When compared to delayed payments estimates of Rs. 8.7 lakh crores, it indicates the limitations of legal remedies.

Market Solutions

- Market solutions such as working capital loans, trade credit insurance, and invoice discounting.

- India has a number of market solutions to ease the burden of delayed payments such as Trade Receivables Discount System (TReDS) and SIDBI-NSE Trade Receivable E-discounting Engine (NTREES), which MSMEs could use to securitize their receivables, thus easing the working capital crunch due to delayed payments.

- But solutions such as working capital loans and trade credit insurance have seen limited uptake due to the low penetration of formal finance in the MSME sector.

Limitation of TReDS

- It requires corporate buyers to accept the factoring units which underline an invoice or a bill of exchange before it can be discounted. Prior acceptance of bill for payment on due date was not granted by buyers in a majority of cases;

- The buyers’ bank may not agree to honour the payment obligation on due date by debiting the buyers account;

- Very few MSME suppliers could avail the facility of TReDS due to lengthy process involved;

- Eligibility criteria to set up and operate TReDS requires minimum of paid-up voting capital of `100 crore which would restrict entry of financiers into the system;

- TReDS does not address the problem of delayed payments by buyers to MSMEs with interest for delayed payments. Under TReDS, discounting and financing charges will have to be borne by MSME suppliers.

Comparison with other countries around the World

Laws and Regulation

- In the US, the Prompt Payment Act is limited to government contractors only, the EU's Late Payment Directive covered all commercial transactions, and Japan protects subcontractors that supply to both corporations and the government.

- These laws typically define the maximum number of days within which suppliers need to be paid after delivering goods and services and generally penalise delays. By doing so, these laws are intended to ensure sufficient liquidity to small businesses, and provide compensation and legal recourse to enterprises if their payments get delayed.

- The laws, however, have limited success in curbing the problem because of weak enforceability.

Market Solutions

- Market solutions such as working capital loans, trade credit insurance, and invoice discounting are used as a mitigation measure to ensure sufficient liquidity for enterprises to run. These solutions are most prevalent in countries such as Taiwan and South Korea.

- Taiwan and South Korea have the highest financial coverage of SMEs among all major economies, with the majority of the total borrowings extended by formal financial institutions are to SMEs.

Note:

The market solutions have limited impact in countries where formal financial institutions are unwilling to serve smaller businesses. Some of these solutions also require the active participation of the buyer, such as in invoice discounting where buyers need to accept the invoices before they can be discounted. In countries with a weak prompt payment culture, the efficacy of these solutions remains low and questionable.

Way forward for MSMEs in India

Proper implementation of (MSMED) Act 2006):

- One of the main objectives of the Act is to make provisions for ensuring prompt and smooth flow of funds to MSMEs and help them sustain growth.

- As per the section 15 of the act, once MSMEs supply goods or services to clients, the procurer is obliged to release pay funds on or before the agreed date or within a period of 45 days.

Interest for delays

- MSMEs supplying to various corporate and other buyers should be able to get their bills realized on due dates as per agreed terms.

- In cases of delays, buyers should bear interest for such delays, thereby transferring the burden of interest payment on the discounting of such bills for the period of delay to buyers.

List Defaulters

- The Reserve Bank of India (RBI) should list the names of companies who fail to settle dues to MSMEs within the deadline on its website.

- Double interest rates for defaulters: Besides this, if procurement agencies fail to make payment within the stipulated time, they should be made to pay interest at double the existing lending rate.

Role of NBFCs

- RBI should permit setting up of NBFCs specifically for setting up a mechanism of interest payment for delay.

- This would enable MSME players with an e-platform to discount bills and finance their receivables, along with the provision to transfer interest liability on delayed payments to buyers.

The above alternative mechanism will help in the resolution of a two-pronged problem—that of realisation of their bills and receivables, and the issue of delayed payments faced by the MSME sector without disturbing the relationship between MSMEs and their buyers.

Automated portal for transparency

- The Government should set up an automated portal where SMEs provide details of customers they supply to.

- In case of payment defaults, the Government can send automated reminders to defaulting establishments.

- Also, an IT-based mechanism can be created for redressing grievances and collecting feedback without disclosing the identity of the complainant.

Moral appeal and Prompt Payment Culture

- Appeals to larger buyers to honour their obligation to pay on time are routinely made by governments, trade associations, and political leaders. While they are not legally binding, they potentially create persuasive pressure on defaulters in the ecosystem where brand reputation affects business outcomes.

- An example of such a measure is the Prompt Payments Code (PPC) in the UK in 2008 to ensure a good payment culture in the country. Businesses can commit to the code, through which they agree to pay their suppliers on time, provide guidance to suppliers on payment procedure and encourage other actors in their supply chain to commit to good payment practices.

- India is yet to have an equivalent to the Prompt Payments Code in the UK.

- The need of the hour is creation of a prompt payments culture through the Prompt Payment Pledge as part of the ongoing campaign against Delayed Payments.

Final Thought

- To conclude, from the experiences of other countries, no single solution has been successful in dealing with delayed payments, but a combination of these solutions can address delayed payments and create an environment for MSMEs to flourish and grow.

https://indianexpress.com/article/business/companies/covid-small-micro-units-wait-for-pending-dues-8049395/

1.png)