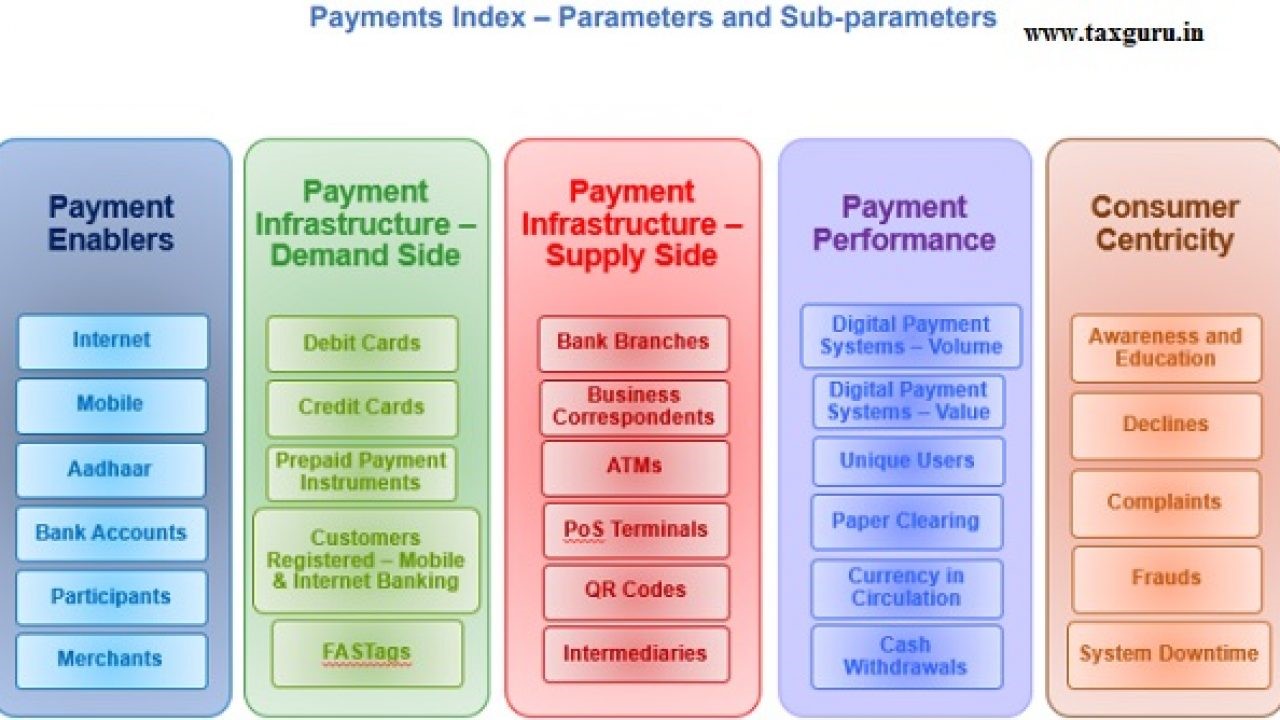

Context: The Reserve Bank of India (RBI) has constructed a composite Digital Payments Index (DPI) to capture the extent of digitisation of payments across the country.

© 2025 iasgyan. All right reserved