Description

Disclaimer: Copyright infringement not intended.

Context

- Direct Tax collections up to 8th September, 2022 show that gross collections are at Rs. 6.48 lakh crore, which is 35.46% higher than the gross collections for the corresponding period of last year.

What is a Direct Tax?

- Direct taxes, usuallylevied on a person’s income and wealth, are paid directly by people or an organization to the Government.

- The person or the organization in question cannot transfer this type of tax to another person or entity for payment. Some of the examples of direct tax include income tax and wealth tax.

Types of Direct Taxes in India

- The various types of direct taxes levied on the citizens by the Government of India are discussed as follows:

Corporate Tax

- Under the Indian Income Tax Act, 1961, both Indian as well as foreign organizations are liable to pay taxes to the government.

- The corporate tax is levied on the profit of domestic firms that are different from the shareholders.

- Also, foreign corporations whose profits appear or are deemed to emerge in India are also liable to pay taxes to the Government of India.

- The income of a company, be it in the form of dividends, interest and royalties, is taxable. Corporate tax also includes the following :

Minimum Alternative Tax (MAT): The MAT is imposed by the Government on Zero Tax companies. The accounts of these companies are made according to the Companies Act.

|

Minimum Alternate Tax is applied when the taxable income calculated according to the I-T Act provisions is found to be less than 15.5 per cent (plus surcharge and cess as applicable) of the book profit under the Companies Act, 2013.

For example, a company with Rs 100 crore book profit is required to pay a minimum tax of Rs 15 crore (assuming 15 per cent MAT rate). If its normal tax liability after claiming deductions is Rs 10 crore (less than MAT), it is required to pay the remainder Rs 5 crore as MAT and use MAT credit equivalent to Rs 5 crore to pay tax in the future.

In September 2019, the government reduced the MAT tax rate from 18.5 per cent to 15 per cent while also slashing the corporation tax rate to 22 per cent from 30 per cent. MAT is levied on book profit, unlike normal corporation tax, which is levied on taxable profit.

Book profits refer to the profit earned by the business entity from its operations and activities and is calculated by deducting all the business expenses incurred within a financial year from all the sales revenue and other income generated from the selling of goods & services within that same financial year.

Taxable income is the base income upon which tax is levied. It includes some or all items of income and is reduced by expenses and other deductions.

|

Fringe Benefits Tax (FBT): Fringe benefit tax (FBT) was a form of tax that companies paid in lieu of benefits they offered their employees in addition to the compensation paid to them (examples, gym, drivers and maids). It was included by the Finance Act 2005 with effect from April 1, 2006.

Dividend Distribution Tax (DDT): An amount that is declared, distributed or paid as a dividend to the shareholders by a domestic company is taxed under the Dividend Distribution Tax. It is applicable to domestic companies only; foreign companies are exempted from this tax rule.

Securities Transaction Tax (STT): The SST is imposed on the income which the companies get through taxable securities transactions. This tax is free of any surcharge. It is similar to tax collected at source (TCS). STT is a direct tax levied on every purchase and sale of securities that are listed on the recognized stock exchanges in India.

2) Wealth Tax

- The wealth tax is imposed on property owners. It does not matter if the property is generating an income or not.

- If owning a property, one is liable to pay wealth tax yearly to the Government of India on the basis of the current market value of the property.

- Not everything is taxable under the wealth tax law.

- The working assets are exempted from the wealth tax law. Some of the examples of working assets are as follows:

- Gold Deposit Bonds

- Stock Holdings

- Commercial Complex Properties

- House property (rented for more than 300 days yearly)

- House property owned for business or professional requirement

- House property held for business or profession

3) Capital Gains Tax

- The capital assets of an individual refer to anything owned for personal use or to make an investment.

- For businesses, the capital asset is anything that can be used for more than a yearand is not intended to be sold or liquidated during the course of business operation.

- Machinery, cars, homes, shares, bonds, art, businesses and farms are some of the examples of capital assets.

- The capital gains tax is imposed on the income derived from the sale of investments or assets.

- On the basis of the holding period, capital tax is categorized under short-term gains and long-term gains. The formula to calculate the capital gains is:

Capital Gains = Sale Value – Purchase Value

- Only those capital assets are liable to short-term gain, which are sold within 3 years of acquisition.

- The exception to this rule is securities. The capital assets sold after being held for more than 3 years fall under long-term gains

Benefits of Direct Tax

The direct taxation has its share of benefits. Some of them are listed as follows:

Economic

- The direct tax such as the income tax is collected annually and is mostly deducted at the source.

- For example, the income tax is deducted from an employee’s salary every month.

- This saves a great amount of administrative costsas here the employer acts as the tax collector.

- This system makes direct tax more economical than other types of taxes where a lot of administrative costs are involved.

Productive

- The direct taxes are also very productive. The revenue generated from direct tax is directly proportional to the changes in the national wealth of the country.

- In simple words, the increase in a country’s population and/or prosperity will consequently increase the returns on direct tax.

Certain

- In case of direct tax, a taxpayer is certain about the amount of tax to be paid.

- In addition, the tax authorities can also precisely estimate the revenue they can expect from the direct tax.

- There is no ambiguity in the tax amountas it is decided before the tax submission date.

- This certainty on the tax amount from both the sides helps in eliminating corruption from the tax collection system.

Equitable

- The direct taxes are imposed on the basis of a taxpayer’s income.

- The taxpayers with high income need to pay more taxes compared to the taxpayers with lesser income. In other words, the rich pay more taxes than the poor.

- This is, however, applicable to all the sections of the society.

- People belonging to similar economic conditions are taxed under the same rate.

- The equitable trait of the direct tax serves the purpose of equality and justice across all sections of the population.

Progressive

- The direct taxes play an important role in reducing the gap of financial inequalities across the country.

- These taxes are progressive as the government imposes tax on people according to their income.

- The money collected from these taxes helps implement policies and rules for the uplift of the poor in the society, helping achieve the aim of social and economic equality.

Anti-inflationary

- Direct taxes can be used as an anti-inflationary tool to stabilize the price level in the market.

- It can be used to control the use and demand of products.

- The increase in demand of the product and services during inflation can be decreased by increasing the direct tax.

- Doing this will force people at large to spend less money to purchase the products and services, thus, reducing their demand and consequently the inflation rate.

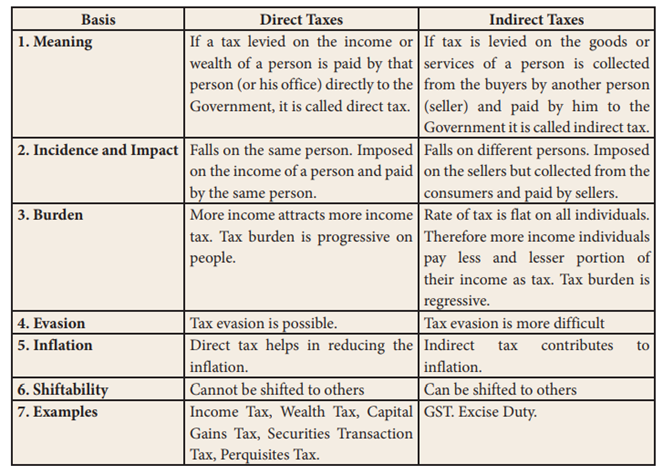

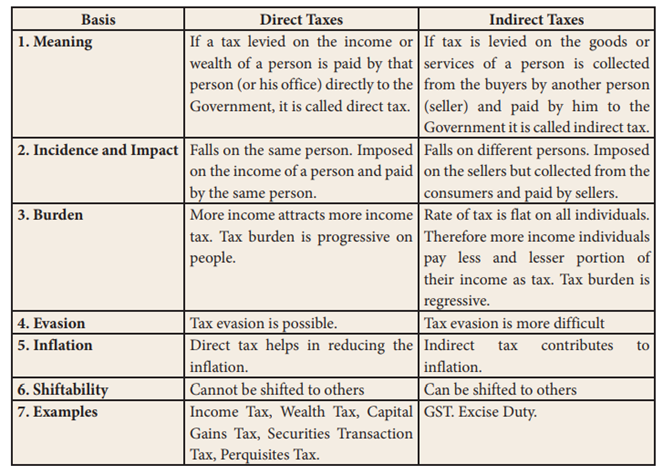

Direct vs Indirect Tax: Key Differences

https://www.livemint.com/news/india/at-rs13-63-trillion-direct-tax-mop-up-exceeds-revised-budget-target-11647525355061.html