Description

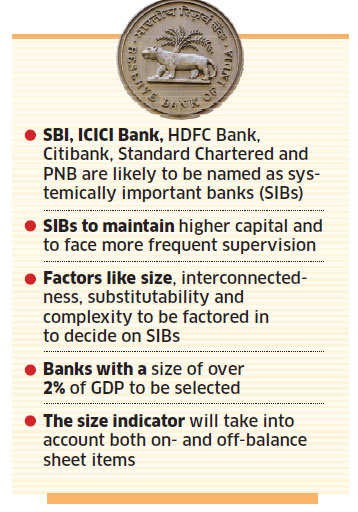

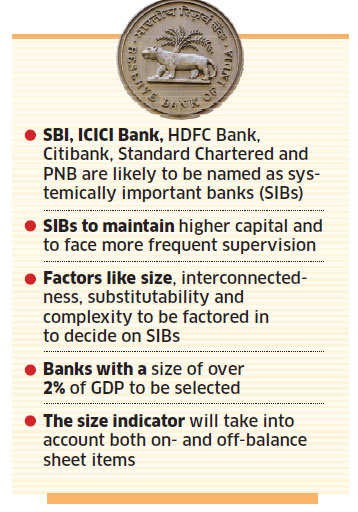

Context: The Reserve Bank of India (RBI) has retained State Bank of India, ICICI Bank and HDFC Bank as domestic systemically important banks (D-SIBs) or banks that are considered as “too big to fail”.

D-SIB framework

- The D-SIB framework requires the Reserve Bank to disclose the names of banks designated as D-SIBs starting from 2015 and place these banks in appropriate buckets depending upon their systemic importance scores (SISs).

- “Based on the bucket in which a D-SIB is placed, an additional common equity requirement has to be applied to it.

- Too big to fail is a phrase used to describe a bank or company that’s so entwined in the economy that its failure would be catastrophic.

- In case a foreign bank having branch presence in India is a global systemically important bank (G-SIB), it has to maintain additional CET1 capital surcharge in India as applicable to it as a G-SIB, proportionate to its risk weighted assets (RWAs) in India — additional CET1 buffer prescribed by the home regulator multiplied by India RWA as per consolidated global group books divided by total consolidated global group RWA.

D-SIB

- Some banks become systemically important due to their size, cross-jurisdictional activities, complexity and lack of substitute and interconnection.

- Banks whose assets exceed 2% of GDP are considered part of this group.

- Such a bank fail, could lead to disruption of essential services they provide to the banking system and the overall economy.

- The too-big-to-fail tag also indicates that in case of distress, the government is expected to support these banks.

- Due to this perception, these banks enjoy certain advantages in funding.

- It also means that these banks have a different set of policy measures regarding systemic risks and moral hazard issues.

- As per the framework, from 2015, every August, the central bank has to disclose names of banks designated as D-SIB.

- It classifies the banks under five buckets depending on order of importance. ICICI Bank and HDFC Bank are in bucket one while SBI falls in bucket three.

- Based on the bucket in which a D-SIB is, an additional common equity requirement applies.

- Banks in bucket one need to maintain a 0.15% incremental tier-I capital from April 2018.

- Banks in bucket three have to maintain an additional 0.45%.

- With bucket three being higher than bucket one, SBI has a higher additional requirement than ICICI Bank and HDFC Bank.

- All the banks under D-SIB are required to maintain higher share of risk-weighted assets as tier-I equity.

- According to the central bank, the additional capital requirement for these banks started in April 2016 in a phased manner and will be fully effective from April 2019.

- The concept of D-SIB emerged after the global financial crisis.

- Whether your bank is in the D-SIB list or not, your fixed deposits are insured up to Rs5 lakh under the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- This means, in case of default, DICGC will pay you up to Rs5 lakh. Also, so far, there hasn’t been an incident where the government has not rescued depositors during a crisis in commercial banks.

- The government has also come to the rescue of large co-operative banks.

https://indianexpress.com/article/business/banking-and-finance/too-big-to-fail-list-sbi-icici-bank-hdfc-bank-remain-7153597/