Description

Disclaimer: Copyright infringement not intended.

Context

- The Reserve Bank of India (RBI) announced its decision to transfer a record surplus of Rs 2.11 trillion to the government for FY24, exceeding the Centre’s anticipated dividends, despite raising the contingent buffer to 6.5%.

- This surpasses the previous year's surplus of Rs 87,416 crore and reflects the impact of the New Economic Capital Framework (ECF) recommended by the Bimal Jalan Committee, which established guidelines for determining surplus transfers to the government.

MUST READ ARTICLE:

RBI’S SURPLUS TRANSFER TO GOVERNMENT: https://www.iasgyan.in/daily-current-affairs/rbis-surplus-transfer

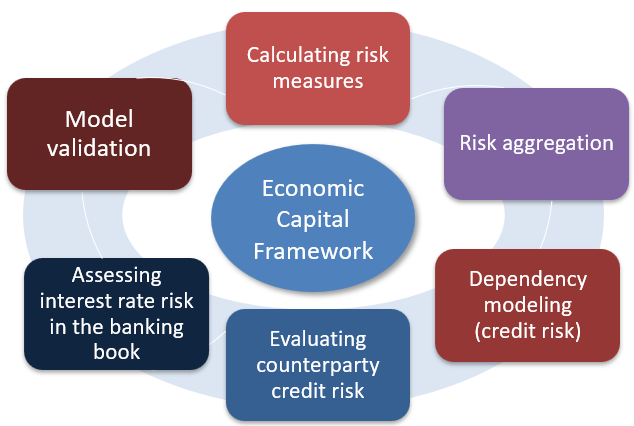

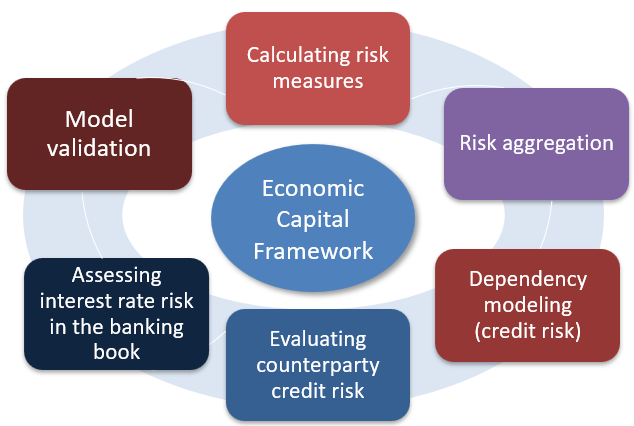

Economic Capital Framework

- The Economic Capital Framework is a safety net for the Reserve Bank of India (RBI).

- It's a smart plan that helps the RBI figure out how much money it needs to keep safe to handle different kinds of risks.

These risks could be things like:

- Credit risk (the risk of default on loans and investments),

- Operational risk (the risk of losses due to internal processes, systems, or external events), and

- Interest rate risk (the risk of losses due to changes in interest rates).

- The framework also decides how much extra money the RBI can share with the government after dealing with these risks.

- RBI ensures that an adequate surplus is available for transfer to the government, as mandated by the RBI Act, 1934.

Why is it Important?

- After the Big Financial Crisis in 2008, it was realized how important it is for central banks like the RBI to have a strong plan in place.

- This plan helps them manage risks and keep the economy stable.

- Unlike banks, central banks like the RBI are tasked with maintaining monetary and fiscal stability.

What Happened in 2015?

- In 2015, the RBI came up with a draft plan to make its economic capital framework stronger.

- The idea was to be ready for risks, especially those related to changes in foreign currency values.

- By having enough money set aside, the RBI can do its job without needing help from the government during tough times. It also wanted to be prepared for risks that could affect the country's financial stability.

Learning from Other Countries

- In England, they have a similar plan for their central bank. They make sure the bank has enough money to handle tough situations.

- If the bank makes more money than it needs for these situations, it shares the extra with the government.

- This way, everyone stays prepared for financial challenges, and the government also gets some extra funds when things are going well.

Revision of ECF

- The former ECF was devised during the 2014-15 fiscal year and commenced operations in 2015-16.

- In 2018, the RBI established an Expert Committee chaired by Dr. Bimal Jalan to evaluate the economic capital framework in order to propose an appropriate surplus distribution policy.

- On August 26, 2019, the RBI adopted a revised ECF based on the recommendations of the Bimal Jalan Committee, with provisions for periodic review every five years.

Key Recommendations:

- Fiscal Year Alignment: Coordinate the RBI's financial year with the government's fiscal year to enhance consistency in projections and publications.

- Periodic Review: Conduct regular reviews of the Economic Capital framework every five years.

- Interim Dividend: Authorize the RBI to issue interim dividends to the government only in exceptional circumstances, a practice initiated in the 2016-17 fiscal year.

- Contingency Fund Range: Keep the Contingency Fund (CF) within a range of 6.5% to 5.5% of the economic capital.

Acceptance of Recommendations:

- The RBI Central Board endorsed the recommendations of the Jalan Committee, particularly supporting a 5.5% Contingency Fund.

- This decision underscores the importance of maintaining equilibrium between realized equity, revaluation reserves, and risk provisioning to bolster the RBI's resilience against potential economic adversities.

|

PRACTICE QUESTION

Q. What do you understand by the term Economic Capital Framework (ECF)? Evaluate its importance in managing risks and maintaining financial stability, citing recent RBI actions regarding surplus transfers to the government.

|

SOURCE: BUSINESS STANDARD