Description

GS PAPER III: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Context: The Supreme Court upheld a government move to allow lenders initiate insolvency proceedings against personal guarantors, who are usually promoters of big business houses, along with the stressed corporate entities for whom they gave guarantee.

Key highlights of the judgment:

- The apex court said there was an “intrinsic connection” between personal guarantors and their corporate debtors.

- It was this “intimate” connection that made the government recognise personal guarantors as a “separate species” under the IBC.

- It would facilitate the Committee of Creditors to frame realistic plans, keeping in mind the prospect of realising some part of the creditors’ dues from personal guarantors.

- The court further corrected a misunderstanding that approval of a resolution plan in respect of corporate debtors would also extinguish the liability of the personal guarantor.

- This move would result in maximising the value of assets and promoting entrepreneurship, which is one of the main purposes of the Code.

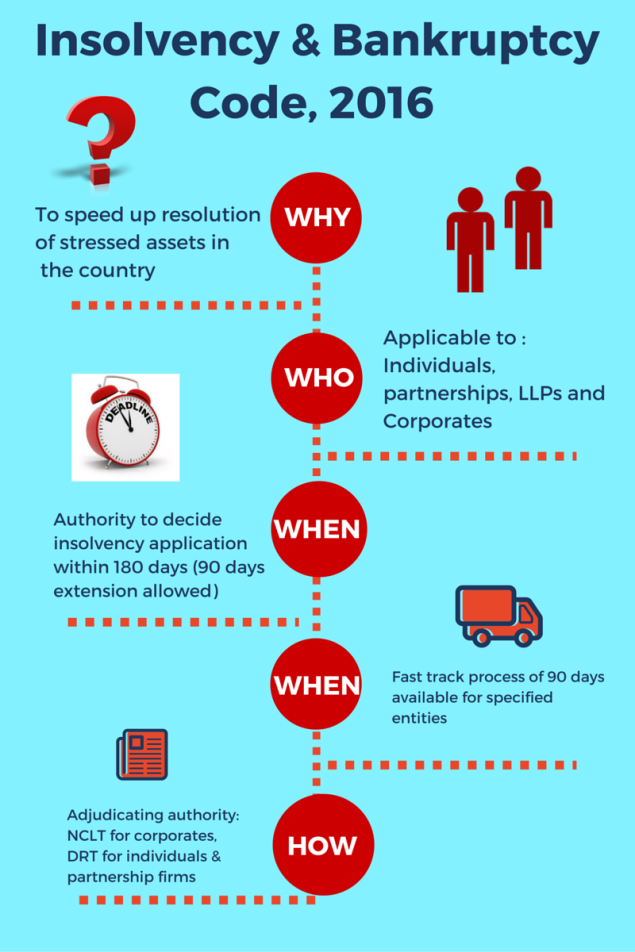

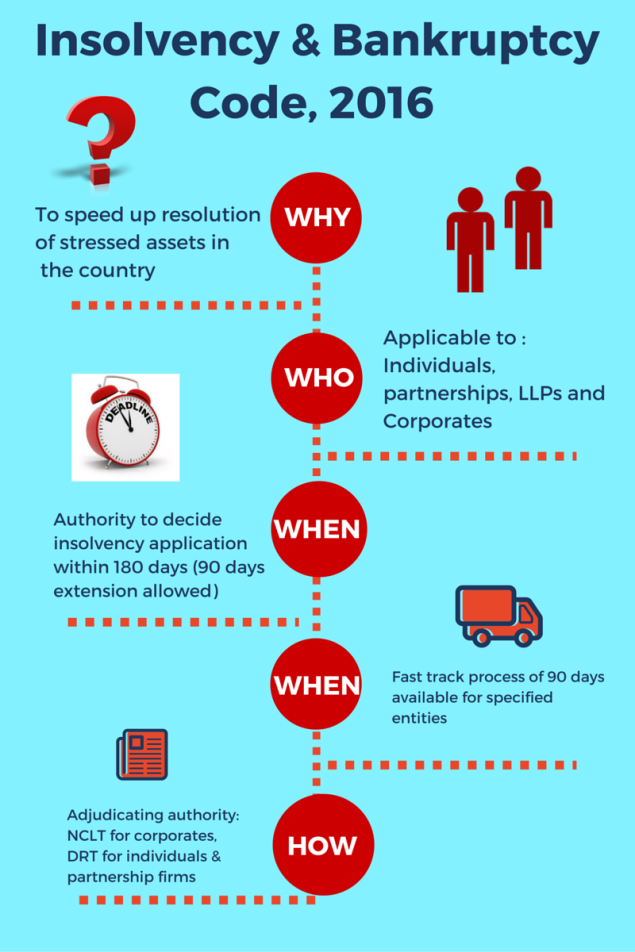

What is Insolvency and Bankruptcy Code (IBC) 2016?

- It was implemented through an act of Parliament and got Presidential assent in 2016.

- Centre introduced the IBC in 2016 to resolve claims involving insolvent companies.

- The bankruptcy code is a one stop solution for resolving insolvencies, which previously was a long process that did not offer an economically viable arrangement.

- Aim: The code aims to protect the interests of small investors and make the process of doing business less cumbersome. IBC was intended to tackle the bad loan problems that were affecting the banking system.

How it works?

- IBC applies to companies, partnerships and individuals.

- The IBC process has changed the debtor-creditor relationship. It provides for a time-bound process to resolve insolvency.

- When a default in repayment occurs, creditors gain control over debtor’s assets and must take decisions to resolve insolvency.

- Under IBC, debtor and creditor both can start 'recovery' proceedings against each other.

- Companies have to complete the entire insolvency exercise within 180 days under IBC.

The deadline may be extended if the creditors do not raise objections on the extension.

- For smaller companies, including startups with an annual turnover of Rs 1 crore, the whole exercise of insolvency must be completed in 90 days and the deadline can be extended by 45 days. If debt resolution doesn't happen the company goes for liquidation.

Who regulates the IBC proceedings?

- Insolvency and Bankruptcy Board of India has been appointed as a regulator and it can oversee these proceedings.

- IBBI has 10 members; from Finance Ministry and Law Ministry the Reserve Bank of India.

Who facilitates the insolvency resolution?

- A licensed professional administer the resolution process, manage the assets of the debtor, and provide information for creditors to assist them in decision making.

Who adjudicates over the proceedings?

- The proceedings of the resolution process will be adjudicated by the National Companies Law Tribunal (NCLT), for companies and the Debt Recovery Tribunal (DRT) for individuals.

- The courts approve initiating the resolution process, appointing the insolvency professional and giving nod to the final decision of creditors.

- The Insolvency and Bankruptcy Board regulates insolvency professionals, insolvency professional agencies and information utilities set up under the Code.

What does the committee of creditors do?

- A committee consisting of the financial creditors who lent money to the debtor is formed by the insolvency professional.

- The creditors' committee decides the future of the outstanding debt owed to them.

- They may choose to revive the debt owed to them by changing the repayment schedule or selling the assets of the debtor to get their dues back.

- If a decision is not taken in 180 days, the debtor’s assets go into liquidation.

What happens under liquidation?

- If the debtor goes into liquidation, an insolvency professional administers the liquidation process.

- Proceeds from the sale of the debtor’s assets are distributed in the following order of order:

- First insolvency resolution costs, including the remuneration to the insolvency professional,

- second secured creditors, whose loans are backed by collateral and

- third dues to workers, other employees,

- forth unsecured creditors.

Major Issues with IBC 2016?

- Lack of operational NCLT benches that leads to low approval rate of resolution plans . Most of these remain non-operational or partly operational due lack of proper infrastructure or adequate support staff.

- Crossing time limits: Undoubtedly, the IBC has been effective to a great extent so far, however, compliance to timelines remains an issue. The earlier envisaged timeframe of 180 days (+90 days extension) was increased to 330 days for resolving issues. Despite the extension, resolution plans continue to cross the deadline.

- Resolution has become complex: The process also involves a number of stakeholders, which further makes resolution complex and time-consuming. Such anomalies affect the valuation profession and its credibility.

- Another challenge is that the sole authority lies with the committee of creditors to control the RPs, without any guidelines.

Way Forward:

- The need of the hour is to enhance institutional capacity of the NCLT benches and bring in more transparency in the selection of RPs.

- Information utilities (IUs) should help to collect, collate and disseminate financial information to facilitate insolvency resolution in time bound manner.

- IBC created an Insolvency and Bankruptcy Fund that can be used to enhance the operational capacity of NCLT by creating proper infrastructure or training support staff.

Conclusion:

- The IBC is a crucial structural reform, which if implemented effectively and in a timebound manner can produce major gains for the corporate sector and the economy as a whole.

- After all, it played an indisputable role in improving India’s Ease of Doing Business (EODB) ranking from 130 in 2016 to 63 in 2020.

https://www.thehindu.com/news/national/sc-upholds-centres-notification-permitting-banks-to-proceed-against-personal-guarantors-under-ibc/article34612708.ece