Description

GS PAPER II: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

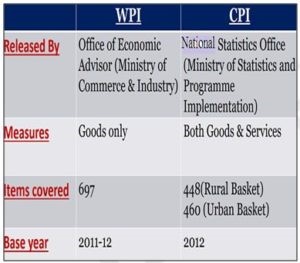

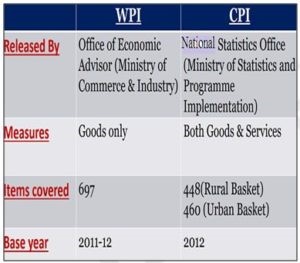

Context: The Office of Economic Adviser, Department for Promotion of Industry and Internal Trade has released index numbers of Wholesale Price in India for the month of April, 2021 (Provisional) and for the month of February, 2021 (Final).

- In April, 2021 (over April, 2020), the annual rate of inflation (YoY), based on monthly WPI, stood at 49% (Provisional).

- The annual rate of inflation in April 2021 is high primarily because of rise in prices of crude petroleum, mineral oils viz petrol, diesel etc, and manufactured products as compared to the corresponding month of the previous year.

What is WPI?

- It is used to measures inflation from Wholesale point of view.

- While retail inflation looks at the price at which the consumer buys the product, WPI is measured based on prices at the wholesale level.

- There are two layers between the wholesale price and retail price, one is the additional cost of transportation from the wholesale to the point of sale, and the other is the retail mark-up.

- During the lockdown, for instance, it was more difficult to transport goods, and that additional cost got added to individual prices.

- Another difference between the two indices is that the wholesale market is only for goods. So WPI does not include services, whereas the retail price index does.

- The pricing norms of wholesale and retail are also different.

- Certain items on WPI, such as fuel, are also closely linked to international prices, creating a gap between the figures on this index and the CPI.

- While CPI is the most relevant index for the consumer as it shows the increase in their actual outgo, it is not a completely accurate cost of living indicator since it focuses on certain goods and services more than others.

- The net effect of inflation is that the value of your money decreases over time, so make sure to align and diversify your investments so that you can inflation-proof your corpus.

Consumer Price Index

- Inflation can be described as the general rise in the price of goods and services in an economy over time.

- It’s calculated by tracking the increase in prices of essentials.

- The primary index that tracks the change in retail prices of essential goods and services consumed by Indian households is the Consumer Price Index or CPI.

- The index assigns different weights to various goods and services in the basket and tracks the movement of their prices.

- It also tracks the price movement of the entire basket on a pan-India level to calculate the overall inflation figure or CPI inflation.

- CPI is not the cost of living index, and is, therefore, not an accurate reflection of consumer spending.

- The weightage of food in the CPI is close to 50%, but most households don’t spend nearly that much of their overall expenditure on food.

- What we spend more on are services such as education, health care and transportation, where inflation levels are much higher.

https://pib.gov.in/PressReleasePage.aspx?PRID=1719264