Disclaimer: Copyright infringement not intended.

Context

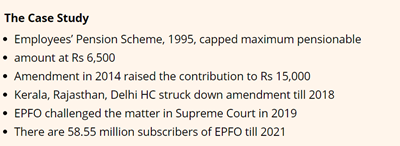

- In a crucial judgment, the Supreme Court held the provisions of the Employees Pension (Amendment) Scheme 2014 to be legal and valid.

Note: High Courts of Kerala, Rajasthan, and Delhi, had quashed the EPS Amendment of 2014 earlier.

- However, the Supreme Court has invalidated certain provisions of the scheme.

EPF

- EPF is the main scheme under the Employees' Provident Funds and Miscellaneous Act, of 1952. The employee and employer each contribute 12% of the employee's basic salary and dearness allowance towards EPF. Currently, the rate of interest on EPF deposits is 8.10% p.a.

EPFO (Employee Provident Fund Organization)

- The Employees' Provident Fund Organisation (EPFO) is a non-constitutional body that promotes employees to save funds for retirement. The organization is governed by the Ministry of Labour and Employment, Government of India, and was launched in 1951.

- The schemes offered by the organization cover Indian workers and international workers (from countries with whom the EPFO has signed bilateral agreements).

Schemes Offered Under the EPFO

- Employees' Provident Funds Scheme 1952 (EPF)

- Employees' Pension Scheme 1995 (EPS)

- Employees' Deposit Linked Insurance Scheme 1976 (EDLI)

PF Contribution

The employer's contribution is divided into the below-mentioned categories:

|

Category

|

Percentage of contribution (%)

|

|

Employees Provident Fund

|

3.67

|

|

Employees' Pension Scheme (EPS)

|

8.33

|

|

Employee's Deposit Link Insurance Scheme (EDLIS)

|

0.50

|

|

EPF Admin Charges

|

1.10

|

|

EDLIS Admin Charges

|

0.01

|

It is mandatory for the employee and the employer to make an EPF contribution. Each makes a 12% contribution of the employees' dearness allowance and basic salary towards EPF. Given below are the details of the employees' and employers' contributions towards EPF.

- Employee's contribution towards EPF - 12% of the employee's salary is deducted by the employer every month for a contribution towards EPF. The entire contribution goes towards the EPF account.

- Employer's contribution towards EPF - The employer also contributes 12% of the employee's salary towards EPF.

EPF Eligibility

- It is mandatory for salaried employees with an income of less than Rs.15,000 per month to register for an EPF account.

- As per law, it is mandatory for organizations to register for the EPF scheme if they have more than 20 employees working for them.

- Organisations with less than 20 employees can also join the EPF scheme voluntarily.

- Employees who earn more than Rs.15,000 can also register for an EPF account; however, they must get approval from the Assistant PF Commissioner.

- The whole of India (except the states of Jammu and Kashmir) can benefit from the provisions of the EPF scheme.

EPS - Employee Pension Scheme

- The Employee's Pension Scheme (EPS) was introduced in the year 1995 with the main aim of helping employees in the organized sector. All employees who are eligible for the Employees Provident Fund (EPF) scheme will also be eligible for EPS.

About EPS

- The Employees' Provident Fund Organisation (EPFO) administers the system, which assures that employees receive a pension after they reach the age of 58. The scheme's benefits are available to both existing and new EPF members.

- Both the employee and the employer contribute 12% of the employee's basic salary and Dearness Allowance (DA) to the EPF. While the employee's entire part goes to EPF, the employer's contribution goes to EPS at a rate of 8.33 percent. After the employee retires, the plan provides a steady stream of income.

Eligibility to avail of EPS benefits

- Must be a member of the EPFO.

- Must have attained the age of 50 years for an early pension and 58 years for a regular pension.

- In case one defers the pension for 2 years (until you reach the age of 60 years), she will be eligible to receive the pension at an additional rate of 4% per year.

- Must have completed at least 10 years of service.

Features of the EPS scheme

The main features of the EPS scheme are mentioned below:

- Since EPS is sponsored by the Indian Government, the returns are guaranteed and there are no risks to investing in the scheme. The amount that will be returned will be fixed and no changes will be made.

- Employees earning a base salary plus DA of Rs.15,000 or less are required to enroll in the scheme.

- One can withdraw the EPS once one attains the age of 50 years. However, the amount received will be at a reduced rate of interest.

- If the widower/widow remarries, the children will be classified as orphans and would receive the additional pension amount.

- Employees who are enrolled in the EPF scheme will automatically be enrolled in the EPS scheme.

- The minimum monthly pension amount that the individual will receive is Rs.1,000.

- In case the widow/widower is receiving the EPS amount, they will continue to receive the amount until his/her death. After that, the children will receive the pension amount until they attain the age of 25 years.

- In case the child is physically challenged, they will receive the pension amount until his/her death.

Contribution towards EPS

- The employer and employee contribute 12% of the employee's basic salary and DA towards the EPF scheme. The 12% contribution made by the employer is split in the below-mentioned ways:

- EPF Contribution: 3.67%

- EPS Contribution: 8.33%

- Apart from the above-mentioned contributions, the Government of India contributes 1.16% as well. Employees are not eligible to contribute to the scheme.

2014 EPS Amendments

- The EPS amendment of August 22, 2014, had raised the pensionable salary cap to Rs 15,000 a month from Rs 6,500 a month and allowed only existing members (as on September 1, 2014) along with their employers exercise the option to contribute 8.33 percent on their actual salaries (if it exceeded the cap) towards the pension fund. This was extendable by another six months at the discretion of the Regional Provident Fund Commissioner.

- It, however, excluded new members who earned above Rs 15,000 and joined after September 2014 from the scheme completely.

- The amendment also required such members (with actual salaries over Rs 15,000 a month) to contribute an additional 1.16 percent of their salary exceeding Rs 15,000 a month towards the pension fund.

- Those existing members who did not exercise the option within the stipulated period or extended period, were deemed to have not opted for contribution over the pensionable salary cap and the extra contributions already made to the pension fund were to be diverted to the Provident Fund account of the member, along with interest.

- Only a negligible percentage of EPFO members – with salaries higher than the Rs 15,000 a month pensionable salary cap – had opted for contributions based on their actual salaries.

Resistance by States

- High Courts of Kerala, Rajasthan, and Delhi, had quashed the EPS Amendment of 2014.

- The Kerala High Court in 2018 had, while setting aside the 2014 amendments to the scheme, allowed paying pension in proportion to the salary above the threshold limit of ₹15,000 per month. EPFO challenged the matter in SC.

Details of SC’s Verdict

2014 Amendments valid

- SC observed that the 2014 amendments to the EPS will apply to establishments exempt and not exempt.

Opportunity to join EPFO extended

- In a relief to several employees, the Court held that employees who have not exercised the option to join the Employees Pension Scheme must be given a further chance of 4 months to do so.

Use of Article 142 to extend Cut-Off Date

- The Court said that the employees, who were entitled to join the pension scheme but could not do so as they did not exercise the option within the cut-off date, should be given an additional opportunity. SC said that this is because there existed a lack of clarity regarding the cut-off date given by the High Court judgments. The Court exercised its powers under Article 142 of the Constitution to extend the cut-off date.

Struck Down Requirement

- The Court further held as invalid the condition in the 2014 scheme that the employees are required to make a further contribution at the rate of 1.16% on the salary exceeding Rs.15,000/-.

- The Court held this condition to make additional contributions on the salary exceeding the threshold limit to be ultra vires the EPF Act 1952.

Agreement with R.C. Gupta v. Regional Provident Fund Commissioner Judgement

What is Article 142?

- Article 142 of the Constitution deals with the Supreme Court's power to exercise its jurisdiction and pass an order for doing complete justice in any cause or matter pending before it. It provides the apex court with a special and extraordinary power and is meant to provide justice to litigants who have suffered traversed illegality or injustice in course of legal proceedings.

What are the important instances where the Supreme Court has invoked its plenary powers under Article 142?

Manohar Lal Sharma v. Principal Secretary

- The Supreme Court can deal with exceptional circumstances interfering with the larger interest of the public to fabricate trust in the rule of law.

Babri Masjid Case

- The article was used in the Ram Janmabhoomi-Babri Masjid land dispute case and was instrumental in the handover of the disputed land to a trust to be formed by the union government.

A.R. Antulay v. R.S. Nayak

- The Supreme Court held that any discretion which is given by the court should not be arbitrary or in any way be inconsistent with provisions of any statute laid down.

Union Carbide Corporation v. Union of India

- The Supreme Court invoked its plenary powers in the Union Carbide vs Union Govt case and intervened to provide compensation to victims of the deadly Bhopal Gas Tragedy.

Other significant instances

- SC has also used powers vested in it by Article 142 to justify divorce due to the breakdown of marriage in the Munish Kakkar vs Nidhi Kakkar case.

- To reduce drunk driving, it invoked the Article to order a ban on the sale of alcohol within a distance of 500 meters of national or state highways.

- SC has even used Article 142 to order a probe into the 2013 IPL match-fixing controversy.

Need for rational justification

- Critics have claimed that the Article gives courts and judges immense power. But while the Article itself does not have any inherent "safety valve" that can ensure its correct and just usage, it is intended to be used only in cases that cannot or have not been tackled efficiently with existing legal and policy provisions of the nation.

- Over the years, the judiciary has relied heavily on the provision as a tool for judicial activism and judicial innovation. According to academics like, Ninad Laud, it has become a new source of substantive power. In the 2021 paper, 'Rationalising 'Complete Justice' Under Section 142, Laud focuses on the two ways the SC uses Article 142 - to grant relief and to fill what it perceives as gaps in the legislative setup of the country. Through the analysis, the paper posits the obligation of courts to provide "rational justification for its directions aimed at doing “complete justice",".

Significance of Article 142

- While the makers of the Constitution of India ensured the separation of powers of the legislative, executive, and judiciary, Article 142 was envisaged to allow the Supreme Court the opportunity to provide 'complete justice' to even those who may have been wrongly sentenced or denied justice due to the intricacies or inefficacies of the legal justice system.

- It was rightly believed that a disadvantaged judiciary could be the cause for many not being able to get justice or achieve their rights. With Article 142, the Supreme Court has been likened to an entity of 'Natural Law' which theoretically prevails over laws of the land. The article was meant to empower the apex court to deliver justice in exceptional cases without being hindered by legal or bureaucratic red tape.

https://www.thehindu.com/news/national/all-employees-can-opt-for-epfo-pension-scheme-supreme-court/article66095455.ece