Description

GS PAPER II: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Context: In a move that is expected to help curb tax evasion, Goods and Services Tax (GST) authorities will now be able to track real-time data of commercial vehicle (CV) movement on highways by integration of the e-way bill (EWB) system with FASTag and RFID.

Integration of e-way bill, RFID and FASTag

- From January 1, 2021, RFID/FASTag has been integrated with the e-way bill system and a transporter is required to have a radio-frequency identification (RFID) tag in his vehicle and details of the e-way bill generated for goods being carried by the vehicles are uploaded into the RFID system.

- When a vehicle passes the RFID tag reader on the highway, the details fed into the device get uploaded on the government portal.

- The information is later used by revenue authorities to validate the supplies made by a GST registered person.

Benefits of this new system:

- Tax officers can now access

- reports about vehicles that have passed the selected tolls without e-way bills in the past few minutes.

- details of vehicles carrying critical commodities specific to the state that have passed the selected toll.

- details of any suspicious vehicles and vehicles of e-way bills generated by suspicious taxpayer GST identification numbers (GSTINs) that have passed the selected toll on a near real-time basis.

- These will make the vigilance activity more effective.

- Officers of the audit and enforcement wing can use these reports to identify fraudulent transactions like bill trading, recycling of e-way bills.

- It will allow live vigilance for e-way bill compliances by businesses and help prevent revenue leakage by real-time identification of cases of recycling of e-way bills or non-generation of e-way bills.

e-way bills:

- Under the indirect tax regime, e-way bills have been made mandatory for inter-state transportation of goods valued over Rs 50,000 from April 2018, with exemption to precious item such as gold.

- The top five sectors where maximum e-way bills were generated are textiles, electrical machinery, machinery and mechanical appliances, iron and steel, and automobiles.

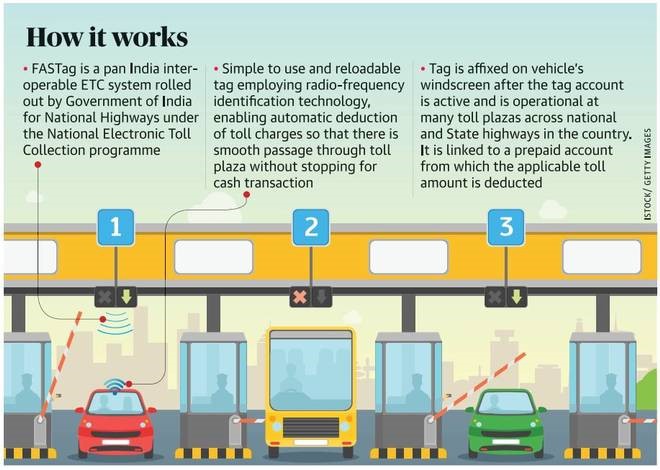

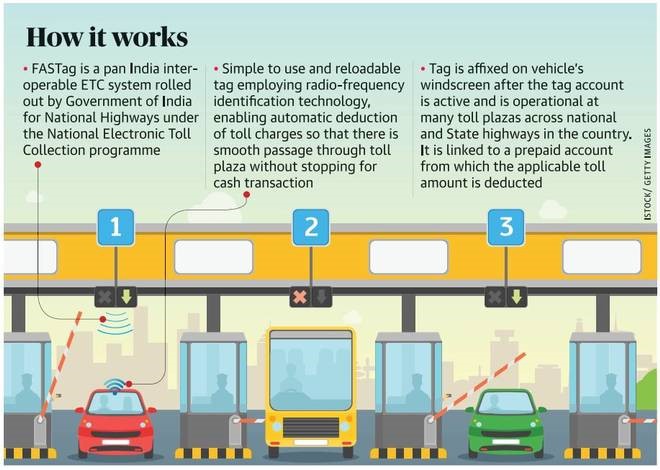

What is FASTag?

- FASTag is an easy-to-use, reloadable tag that is affixed on your vehicle's windscreen.

- It enables automatic deduction of toll charges, so one can pass through toll plazas without stopping to pay the fees manually.

- FASTag is linked to a prepaid account from which the applicable toll amounts are deducted.

- The tag makes use of Radio-Frequency Identification (RFID) technology to ensure that the relevant charges are automatically deducted from your prepaid account.

- A FASTag is valid for five years, and can be recharged as and when required.

Under a new “One Nation One FASTag” scheme, the NHAI is trying to get states on board so that one tag can be used seamlessly across highways, irrespective of whether it is the state or the Centre that owns/manages it.

https://indianexpress.com/article/explained/e-way-bill-integration-with-fastag-rfid-how-vehicle-tracking-could-curb-tax-evasion-7326369/