Description

Copyright infringement not intended

Picture Courtesy: https://www.fatf-gafi.org/en/publications/Fatfgeneral/outcomes-fatf-plenary-february-2023.html

Context: The Financial Action Task Force (FATF) finalized modifications to its assessment methodology, particularly concerning the protection of non-profit organizations (NPOs) from potential abuse for terrorist financing.

Details

- The Financial Action Task Force (FATF) is an intergovernmental organization that sets international standards for combating money laundering, terrorist financing, and other threats to the integrity of the international financial system.

- The recent modifications to its assessment methodology, as discussed in the plenary, primarily focus on addressing terrorist financing risks related to non-profit organizations (NPOs).

Changes to Assessment Methodology:

- The FATF has finalized modifications to its assessment methodology to align with the revisions made to its standards for the protection of non-profit organizations (NPOs) from potential abuse for terrorist financing. These changes are crucial in preparing for the next round of mutual evaluations.

Protection of Non-Profit Organizations (NPOs)

- The modifications emphasize the obligation to apply risk-based measures to protect NPOs that are particularly vulnerable to potential terrorist financing abuse. The goal is to prevent unintended consequences resulting from the incorrect application of FATF requirements.

Recommendation 8

- In October 2023, the FATF made changes to Recommendation 8, which aims to safeguard NPOs from potential terrorist financing abuse through the effective implementation of risk-based measures.

- Best practices were also updated to guide countries, the non-profit sector, and financial institutions in taking relevant steps without unduly disrupting legitimate NPO activities.

Understanding Degrees of Terrorist Financing Risk

- The draft suggests that countries should develop an understanding of the varying degrees of terrorist financing risk posed to NPOs. It recommends considering different levels of mitigating measures based on the assessed risk. Countries are urged to be mindful of the potential impact of measures on legitimate NPO activities and apply them as needed to address the assessed terrorist financing risks.

Risk-Based Approach

- The draft emphasizes a risk-based approach, suggesting that countries should have focused, proportionate, and risk-based measures to address terrorist financing risks. This aligns with the broader global effort to adopt risk-based approaches in regulatory frameworks.

|

Other Outcomes of the Plenary

Besides addressing NPO-related issues, the FATF plenary resulted in new risk-based guidance for implementing Recommendation 25 on beneficial ownership and transparency of legal arrangements. Additionally, the identification of jurisdictions with materially important virtual asset activity was emphasized to assist in implementing FATF requirements in the context of evolving financial technologies.

|

|

FATF Plenary Outcomes Summary

|

|

Outcome

|

Description

|

Significance

|

|

Changes to NPO Assessment Methodology

|

Emphasizes risk-based approach to assessing terrorist financing (TF) risk for NPOs.

Encourages proportionate measures based on identified risk.

Aims to avoid hindering legitimate NPO activities.

|

Balances security needs by protecting NPOs' ability to operate freely and provide essential services.

|

|

Revision of Recommendation 8

|

Updated in October 2023 to guide countries on applying proportional measures based on NPO-specific TF risks.

Focuses on preventing excessive restrictions and protecting legitimate NPO operations.

|

Addresses concerns raised about potential harm to NPOs due to overly restrictive measures.

|

|

New Guidance for Recommendation 25

|

Provides guidance on implementing Recommendation 25, which focuses on beneficial ownership and transparency of legal structures.

Aims to combat money laundering and terrorist financing facilitated by such structures.

|

Strengthens efforts to prevent the misuse of legal structures for financial crimes.

|

|

Identification of Jurisdictions with Significant Virtual Asset Activity

|

Identifies jurisdictions with high levels of virtual asset activity.

Targets these jurisdictions for specific support in implementing FATF's standards to prevent abuse of virtual assets for financial crimes.

|

Focuses resources to combat emerging financial crime risks associated with virtual assets.

|

Financial Action Task Force (FATF)

- The Financial Action Task Force (FATF) is an intergovernmental organization established in 1989 by the G7 countries. Initially focused on combating money laundering, its mandate was expanded in 2001 to include the prevention of terrorism financing.

- The primary objectives of FATF include setting standards and promoting the effective implementation of legal, regulatory, and operational measures to combat money laundering, terrorist financing, and related threats to the global financial system.

FATF Recommendations

- The organization sets international standards on Money Laundering and Special Recommendations on Terrorism Financing. These recommendations cover principles for action, allowing countries flexibility in implementation. They are intended to be implemented at the national level through legislation and other legally binding measures.

- Recommendations cover various aspects, including implementing international conventions, criminalizing money laundering, establishing financial intelligence units, and fostering international cooperation.

- In 2012, FATF codified its recommendations into one document, including new rules on weapons of mass destruction, corruption, and wire transfers (commonly known as the “travel rule”).

- In 2019, FATF released guidance on a risk-based approach for virtual assets and virtual asset service providers, emphasizing anti-money laundering and countering the financing of terrorism obligations.

Compliance Mechanism

- FATF uses a methodology for assessing compliance with its recommendations, evaluating technical compliance and effectiveness. The compliance mechanism includes criteria for assessing whether countries meet FATF standards in their legal and financial systems, criminal justice systems, and preventive measures by specified businesses and institutions.

- Non-profit organizations are under scrutiny, especially when associated with "suspect communities" or operating in conflict zones.

Black or Greylisting of Non-Compliant Nations

- FATF issues a list of "Non-Cooperative Countries or Territories," commonly known as the FATF Blacklist. In 2000, 15 jurisdictions were listed, motivating changes in those countries. As of December 2022, countries on the blacklist include Iran, Myanmar, and North Korea. There is also a "greylist" of jurisdictions under increased monitoring.

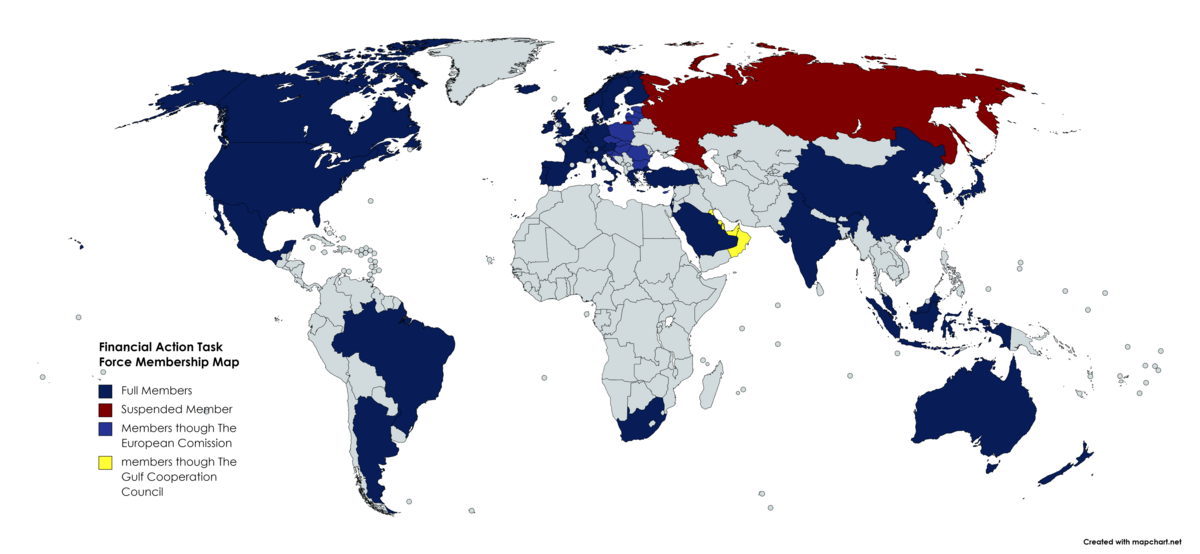

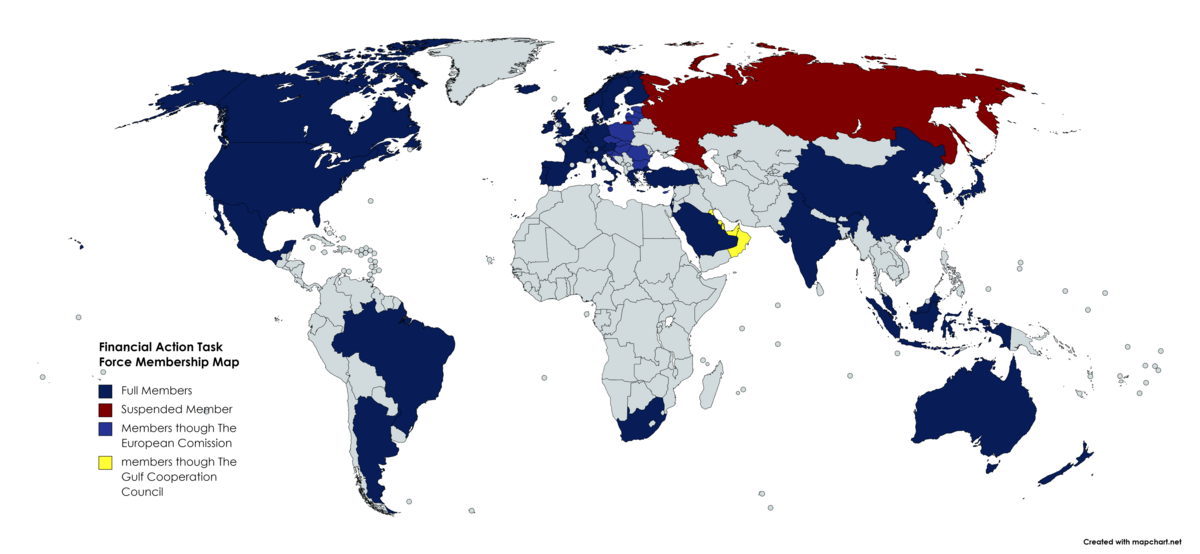

Members and Affiliate Organizations

- As of 2023, FATF has 38 full member jurisdictions and two regional organizations. It collaborates with international and regional organizations closely. Countries are subjected to evaluations by FATF to ensure compliance with its standards and regulations.

Conclusion

- FATF plays a crucial role in setting global standards to combat money laundering, terrorist financing, and related threats. Its recommendations and evaluations influence international efforts to maintain the integrity of the financial system and prevent illicit activities. The organization's focus on compliance, transparency, and cooperation reflects its commitment to global financial security.

|

PRACTICE QUESTION

Q. The Financial Action Task Force (FATF) sets global standards, but countries have varying legal and political systems. How can the FATF balance the need for robust global standards with respect for national sovereignty and diverse legal frameworks? Can a "one-size-fits-all" approach be truly effective in such a diverse environment?

|