Description

Copyright infringement not intended

Context: With the approval of the Finance Bill 2023 by both Houses of Parliament, the government completed its 2023–2024 budget exercise.

Finance Bill

- The Finance Bill, which is a component of the Indian Union Budget, outlines all the legal changes necessary to implement the proposed changes to taxation made by the finance minister. The Finance Bill, as a Money Bill, must be approved by the Lok Sabha, the lower house of the Parliament, before it can become the Finance Act.

- The Finance Bill is a Money Bill in which the government proposes new taxes, makes changes to the existing tax system, or makes suggestions for the continuation of the current tax system for a specific amount of time after the Parliament initially authorised it.

Characteristics of the Finance Bill

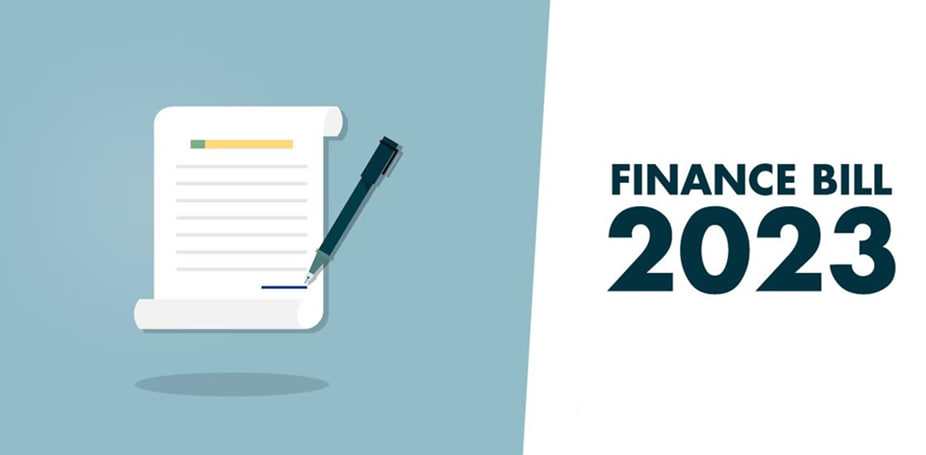

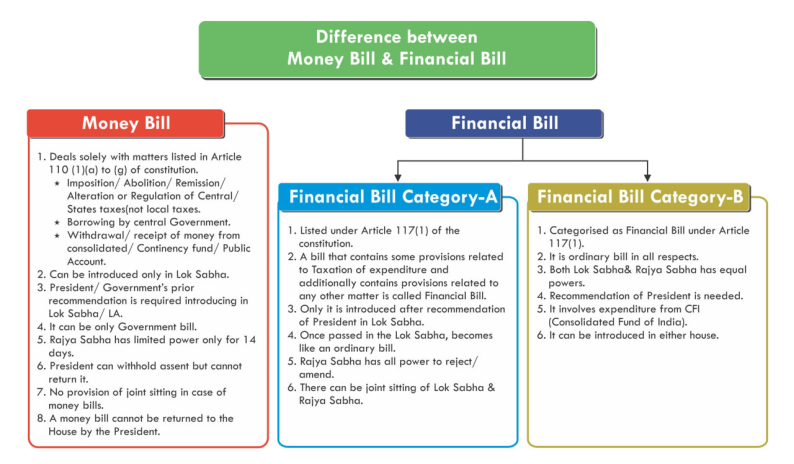

- Finance Bills are divided into three categories: the Money Bill, Finance Bill Category I, and Finance Bill Category II.

- Money Bills include elements that deal with regulation or borrowing, changes to national or state tax rules, the withdrawal of funds from a contingency or consolidated fund, etc.

- Both types of finance bills include clauses that deal with taxes, spending, and other issues.

- A Money Bill will always be a Finance Bill. However, a Finance Bill need not necessarily be a Money Bill.

- Only those financial bills are money bills which contain exclusively those matters which are mentioned in Article 110 of the Constitution. These are also certified by the Speaker of Lok Sabha as money bills.

- A money bill cannot be returned by the president for any reason.

- The Finance Bill must be enacted (passed by the Parliament and assented to by the president) within 75 days of introduction.

- The Finance Act legalises the income side of the budget and completes the process of the enactment of the budget.

.jpeg)

More about Money Bill

- The definition of money bills is covered in Article 110 of the Constitution. A bill is declared to be a money bill, according to the law, if it contains "only" provisions addressing all or any of the following:

- The levying, repealing, waiving, modifying, or regulating of any tax.

- Regulating the Union government's borrowing capacity.

- The custody of the Consolidated Fund of India or the India Contingency Fund, the deposit or withdrawal of funds into or from any such fund.

- The withdrawal of funds from India's Consolidated Fund.

- The declaration of any expense charged to the Consolidated Fund of India or the raising of any such expense's amount.

- The receipt of funds on behalf of the Consolidated Fund of India or the public account of India, the holding or release of such funds, or the audit of the Union's or a state's accounts.

- The Speaker of the Lok Sabha has the last say in any disputes over whether a bill qualifies as a money bill or not. No court, the House of Representatives, or even the president has the authority to overrule his judgement in this case.

- On the president's recommendation, a money bill can only be introduced in the Lok Sabha. Each of these bills is thought of as a government bill, and only a minister can present them.

- After the Lok Sabha approves a money bill, the Rajya Sabha receives the bill for consideration.

- The Rajya Sabha has limited powers concerning a money bill:

- It cannot reject or amend a money bill.

- It can only make recommendations.

- It must return the bill to the Lok Sabha within 14 days, whether with or without recommendations.

- Lok Sabha has more powers than Rajya Sabha concerning a money bill. Lok Sabha can either accept or reject all or any of the recommendations of the Rajya Sabha.

- Case 1: If the Lok Sabha accepts any recommendation, the bill is then deemed to have been passed by both Houses in the modified form.

- Case 2: If the Lok Sabha does not accept any recommendation, the bill is then deemed to have passed by both Houses in the form originally passed by the Lok Sabha without any change.

- Case 3: If the Rajya Sabha does not return the bill to the Lok Sabha within 14 days, the bill is deemed to have been passed by both Houses in the form originally passed by the Lok Sabha.

- When a money bill is sent to the President, he has two options: he may approve the bill or refuse to, but he cannot send it back to the Houses for further consideration. A money bill is often approved by the president as it is presented in the Parliament with his prior approval.

More about Financial Bills

- Financial bills are those bills that deal with fiscal matters, that is, revenue or expenditure.

- Financial bills are of three kinds:

- Money bills–Article 110

- Financial bills (I)–Article 117 (1)

- Financial bills (II)–Article 117 (3)

- This classification implies that money bills are simply a species of financial bills. Therefore all money bills are financial bills but all financial bills are not money bills.

- Only those financial bills are money bills which contain exclusively those matters which are mentioned in Article 110 of the Constitution. These are also certified by the Speaker of Lok Sabha as money bills.

Financial Bills (I)

- A financial bill (I) is a bill that contains the matters mentioned in Article 110, and also other matters of general legislation.

- A financial bill (I) is similar to a money bill in two respects;

- Both of them can be introduced only in the Lok Sabha and not in the Rajya Sabha.

- Both of them can be introduced only at the recommendation of the president.

- In all other respects, a financial bill (I) is governed by the same legislative procedure applicable to an ordinary bill. Hence, it can be either rejected or amended by the Rajya Sabha.

- In case of a disagreement between the two Houses over such a bill, the president can summon a joint sitting of the two Houses to resolve the deadlock.

- When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration in the Houses.

Financial Bills (II)

- A financial bill (II) contains provisions involving expenditure from the Consolidated Fund of India but does not include any of the matters mentioned in Article 110.

- It is treated as an ordinary bill in all respects. The only special feature of this bill is that it cannot be passed by either House of Parliament unless the President has recommended to that House the consideration of the bill.

- Financial bill (II) can be introduced in either House of Parliament and a recommendation of the President is not necessary for its introduction. The recommendation of the President is not required at the introduction stage but is required at the consideration stage.

- It can be either rejected or amended by either House of Parliament. In case of a disagreement between the two Houses over such a bill, the President can summon a joint sitting of the two Houses to resolve the deadlock.

- When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration in the Houses.

Union Budget for 2023-24

https://www.iasgyan.in/daily-current-affairs/union-budget-for-2023-24

|

PRACTICE QUESTION

Q. Q. Consider the following Statement;

1. A Money Bill will always be a Finance Bill. However, a Finance Bill need not necessarily be a Money Bill.

2. The Finance Bill must be enacted within 75 days of the Introduction.

3. The Speaker’s decision over the classification of the Money bill can be challenged before the court.

Which of the following Statement is/are correct?

(A) 1 and 2 only

(B) 2 and 3 only

(C) 1 and 3 only

(D) 1, 2 and 3

Answer: A

Explanation:

Statement 1 is correct: A Money Bill will always be a Finance Bill. However, a Finance Bill need not necessarily be a Money Bill.

Statement 2 is correct: The Finance Bill must be enacted (passed by the Parliament and assented to by the president) within 75 days of Introduction.

Statement 3 is incorrect: The Speaker of the Lok Sabha has the last say in any disputes over whether a bill qualifies as a money bill or not. No court, the House of Representatives, or even the president has the authority to overrule his judgment in this case.

|

https://epaper.thehindu.com/ccidist-ws/th/th_delhi/issues/30317/OPS/GSDB1RI84.1.png?cropFromPage=true