Description

Copyright infringement is not intended

Context: The United Arab Emirates (UAE) has become the latest addition to the grey list put out by the Financial Action Task Force, a global financial crime watchdog.

Implications of this move:

- The country’s inclusion may reduce its attractiveness as an investment hub for foreign inflows into India and raise the level of scrutiny by India’s financial regulators.

- The UAE has become a popular destination for seeking tax avoidance and is facing greater scrutiny amid global efforts to counter Russia’s invasion of Ukraine.

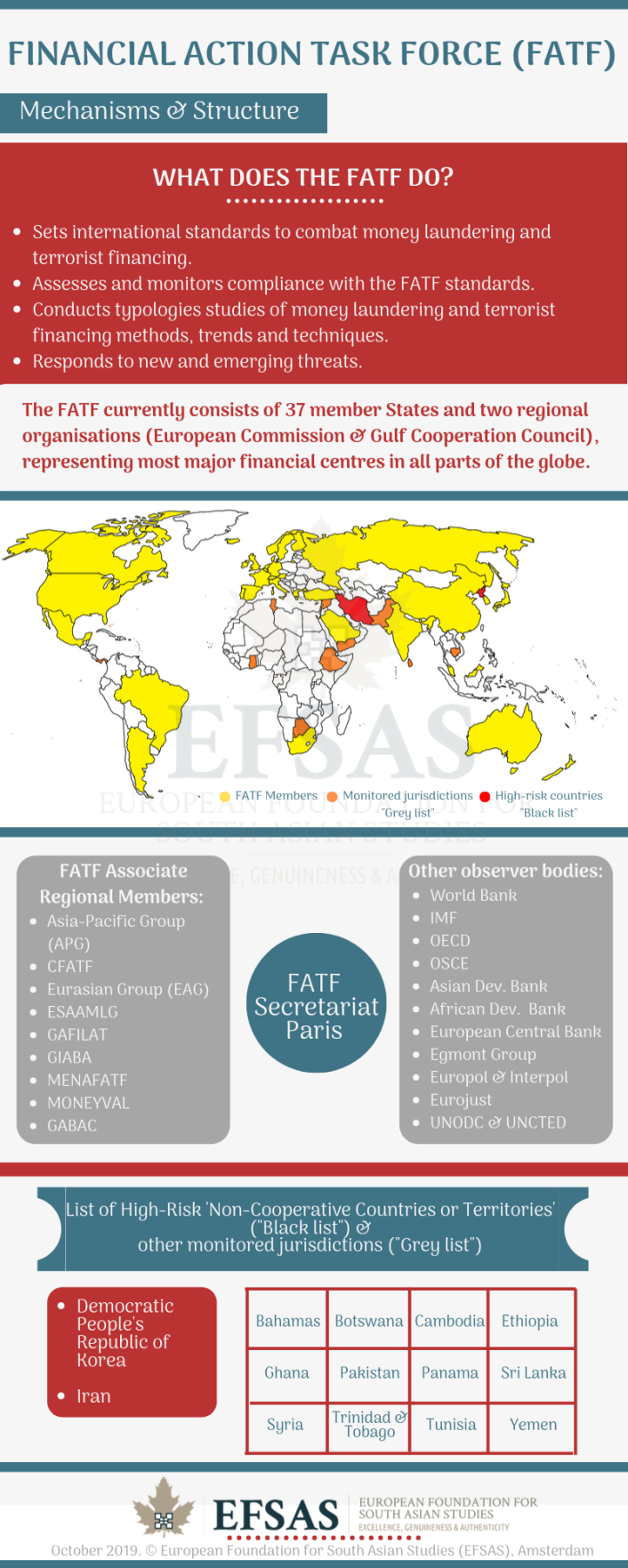

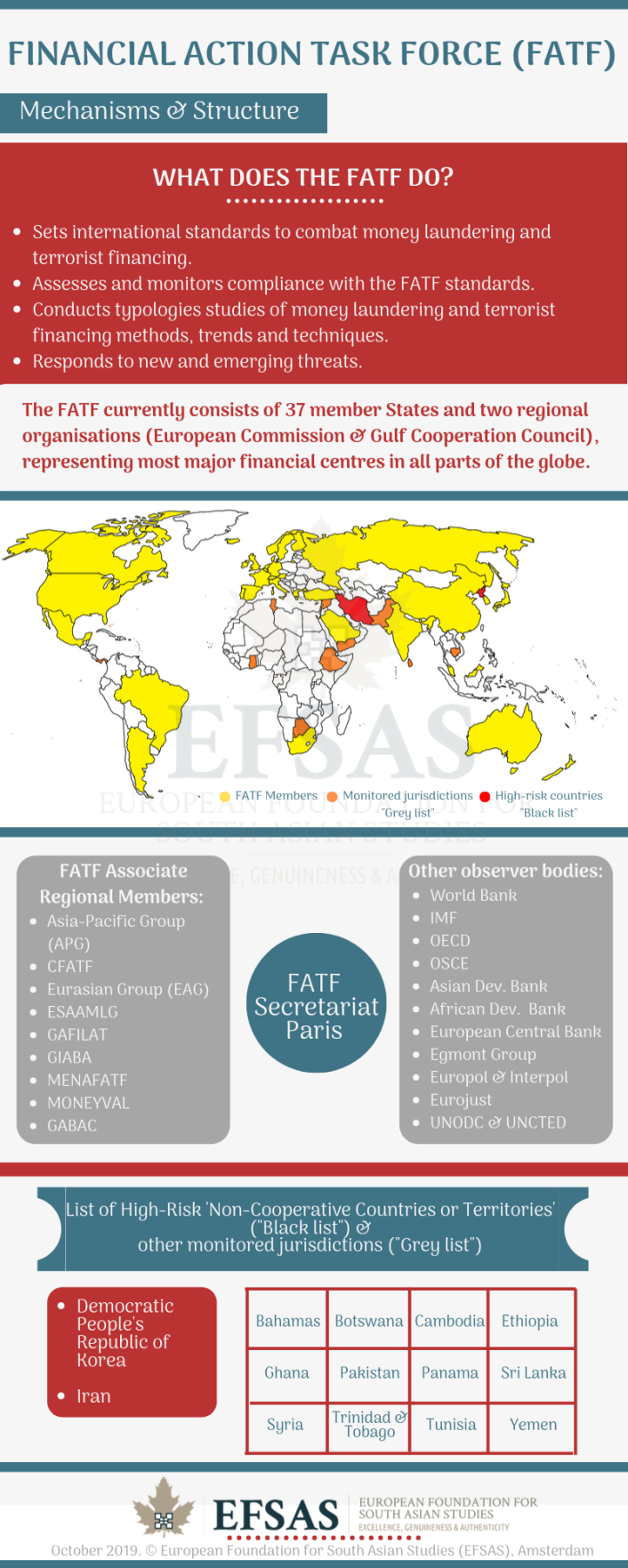

What is FATF?

- The FATF is an inter-governmental body that is now in its 30th year, working to “set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system”.

- The FATF holds three Plenary meetings in the course of each of its 12-month rotating presidencies.

- It currently has 39 members, including two regional organisations — the European Commission and the Gulf Cooperation Council.

- India is a member of the FATF consultations and its Asia Pacific Group.

What is ‘Grey List’ and ‘Black list”?

- The FATF “greylist” refers to countries that are under “monitored jurisdictions”.

- “Blacklist” refers to those facing a “call to action” or severe banking strictures, sanctions and difficulties in accessing loans.

How does it Affect that country?

Greylisting affects the country in several ways:

- On getting greylisted the country’s rating gets downgraded by global bodies and thus this impacts the bond market of the country.

- The economy starts shrinking due to a lack of investment opportunities and this takes a toll on the financial needs of the country.

- The borrowing capacity of the country gets affected due to severing ties with other bodies like the UN, IMF, etc.

- The trade opportunity with other countries also suffers a blow and other countries look over grey listed countries with a lot of speculation.

- The country is deemed as a high-risk country which also affects the tourism sector.

- There comes the problem of enhanced economic pressures like degrading currency value, trade deficit, and rise in inflation.

Advantages and Disadvantages of Grey List:

Advantages of Grey List:

- FATF involvement may help a country tied up in illegal activities come back to form and shape.

- Greylist is more of a warning to prevent a country from coming to blacklist where the regulations and penalties are more severe.

- Greylisting may help a country revive its lost economy and amend its mistakes.

Disadvantages of Grey List:

- It hampers the economy of a country in a negative manner where other countries start looking at the greylisted country as a risky nation for investment.

- Grey listed countries find it difficult to obtain additional financing from global bodies like the IMF and other borrowers.

- They suffer international boycott from other countries.

Conclusion:

- Greylisting can be considered as a warning and a remedial phase where countries are given a chance to amend their mistakes and strategic deficiencies before FATF declares a country under its blacklist where the punishment and penalties are more severe.

- To avoid such listing a country must adopt ethical practices and should not get involved in terror financing and money laundering activities.

https://www.business-standard.com/article/economy-policy/investments-via-uae-to-face-more-scrutiny-after-fatf-grey-list-inclusion-122030700038_1.html

https://www.thehindu.com/news/national/tamil-nadu/thousands-of-crimson-rose-butterflies-fly-across-ocean-from-india-towards-sri-lanka/article65055049.ece