Disclaimer: Copyright infringement not intended.

Context

Fiscal Deficit

Definition

Description

|

A country’s fiscal balance is measured by its government’s revenue vis-a-vis its expenditure in a given financial year. Fiscal deficit, the condition when the expenditure of the government exceeds its revenue in a year, is the difference between the two. Fiscal deficit is calculated both in absolute terms and as a percentage of the country’s gross domestic product (GDP). The fiscal deficit of a country is calculated as a percentage of its GDP or simply as the total money spent by the government in excess of its income. In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall. |

What are components of the fiscal deficit calculation?

The fiscal deficit calculations are based on two components — income and expenditure.

Formula for Fiscal Deficit

Or

Or

Or

|

Government Revenue Receipts |

Government Capital Receipts |

Government Expenditure |

|

Corporation Tax Income Tax Custom Duties Union Excise Duties GST and taxes of Union territories |

Interest Receipts Dividends and Profits External Grants Other non-tax revenues Receipts of union territories |

Revenue Expenditure Capital Expenditure Interest Payments Grants-in-aid for creation of capital assets

|

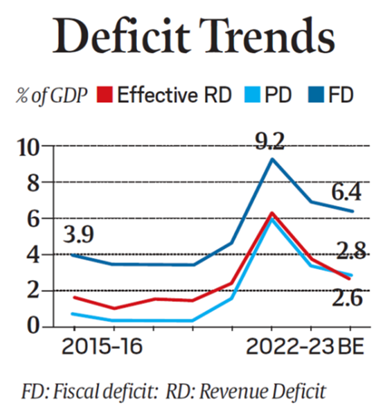

Trend of Fiscal Deficit in India (as % of GDP)

How is fiscal deficit balanced out?

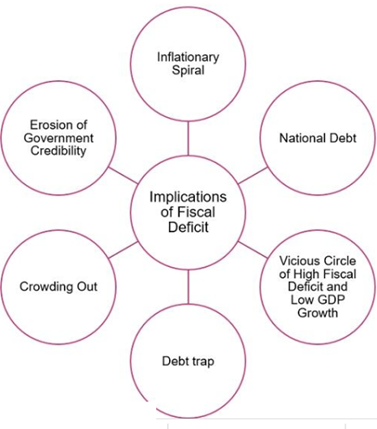

Implications of Fiscal Deficit

Inflationary Spiral: Borrowing from RBI, increases the supply of money in the economy, which increases the general price level. A prolonged increase in the general price level results in an inflationary spiral, i.e. borrowing from RBI > Increase in money supply > Increase in prices > Inflationary Spiral.

National Debt: Fiscal Deficit gives birth to the national debt. It hampers GDP growth, as a large portion of the national income is spent on repaying past debts.

Vicious Circle of High Fiscal Deficit and Low GDP Growth: When there is a high fiscal deficit constantly, it gives rise to a situation in which GDP growth remains low due to high fiscal deficit and the fiscal deficit remains high due to low GDP growth.

Debt trap: Borrowing leads to two main problems, with respect to the repayment of loan and payment of interest, because the payment of interest again increases the revenue deficit. And more borrowing will be required to finance interest payments which results in a debt trap.

Crowding Out: Crowding Out Effect is an outcome of Fiscal Deficit. It refers to a condition when high government borrowings because of high fiscal deficit, decreases the availability of funds for private investors. This reduces overall investment in the economy.

Erosion of Government Credibility: High fiscal deficit destroys the credibility of the government in both domestic and international markets. This lowers down the government’s credit rating, and the foreign investors will begin withdrawing money that they have invested in the domestic economy. As a result of which GDP is reduced.

FRBM Act

Key features of the FRBM Act

As per the requirements of the Act, Centre needs to limit fiscal deficit to 3 per cent of the country's gross domestic product (GDP) by March 31, 2021. While, government's debt should be restricted to 40 per cent of GDP by 2024-25.

The FRBM Act also allows invoking of an escape clause in situations of calamity and national security. In such situations, the government can deviate from its annual fiscal deficit target.

N K Singh Committee's recommendations on Fiscal Deficit

Targets: The committee suggested using debt as the primary target for fiscal policy and that the target must be achieved by 2023.

Fiscal Council: The committee proposed to create an autonomous Fiscal Council with a chairperson and two members appointed by the Centre (not employees of the government at the time of appointment)

Deviations: The committee suggested that the grounds for the government to deviate from the FRBM Act targets should be clearly specified

Borrowings: According to the suggestions of the committee, the government must not borrow from the RBI, except when the Centre has to meet a temporary shortfall in receipts RBI subscribes to government securities to finance any deviations RBI purchases government securities from the secondary market

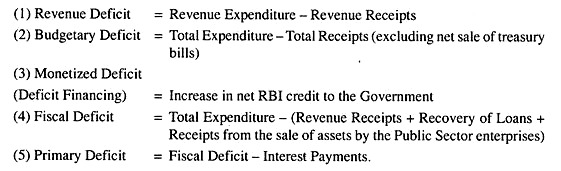

Some Key Differences

© 2025 iasgyan. All right reserved